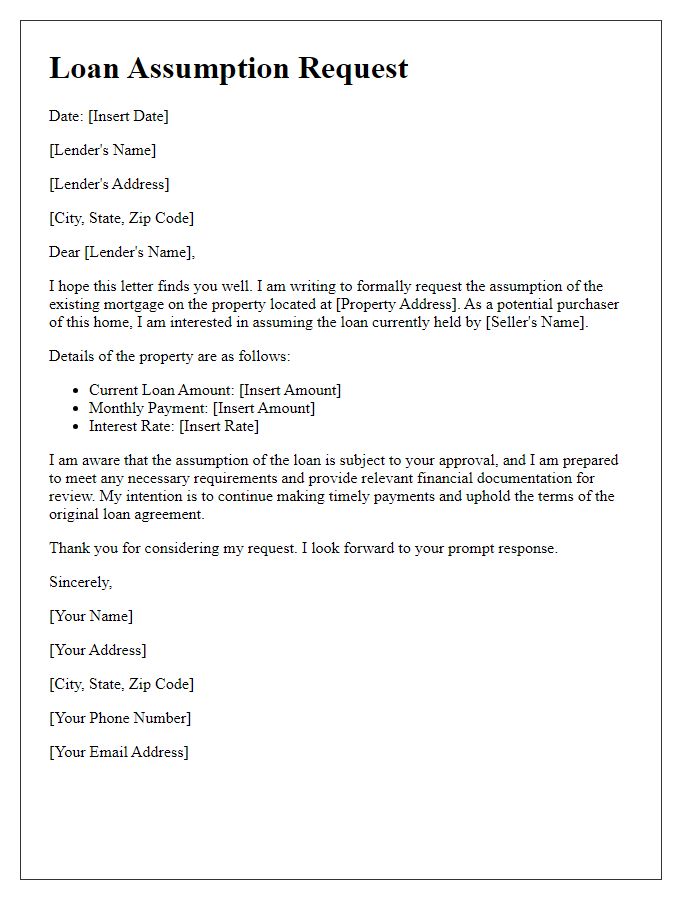

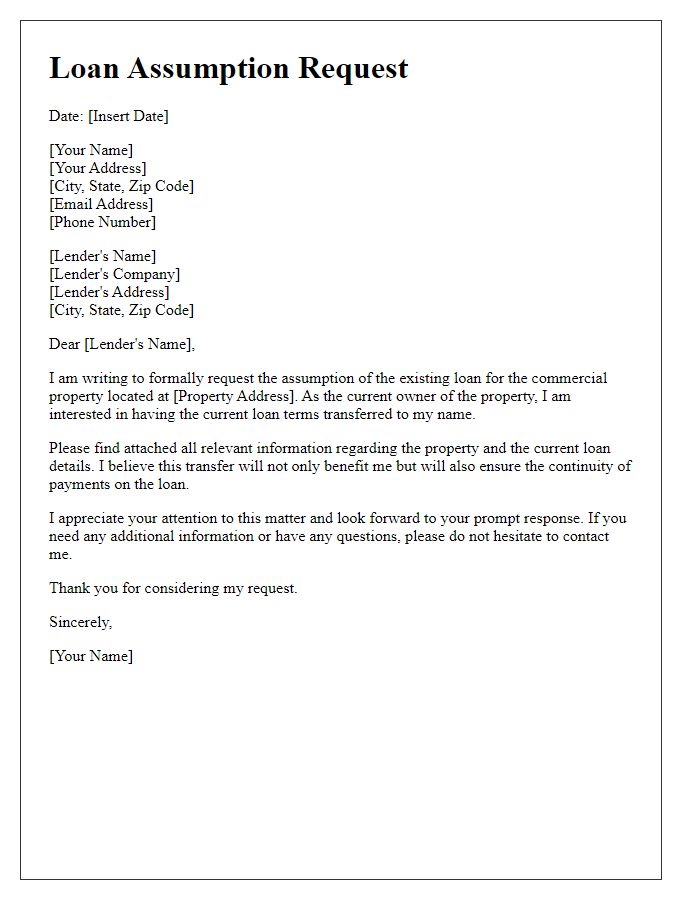

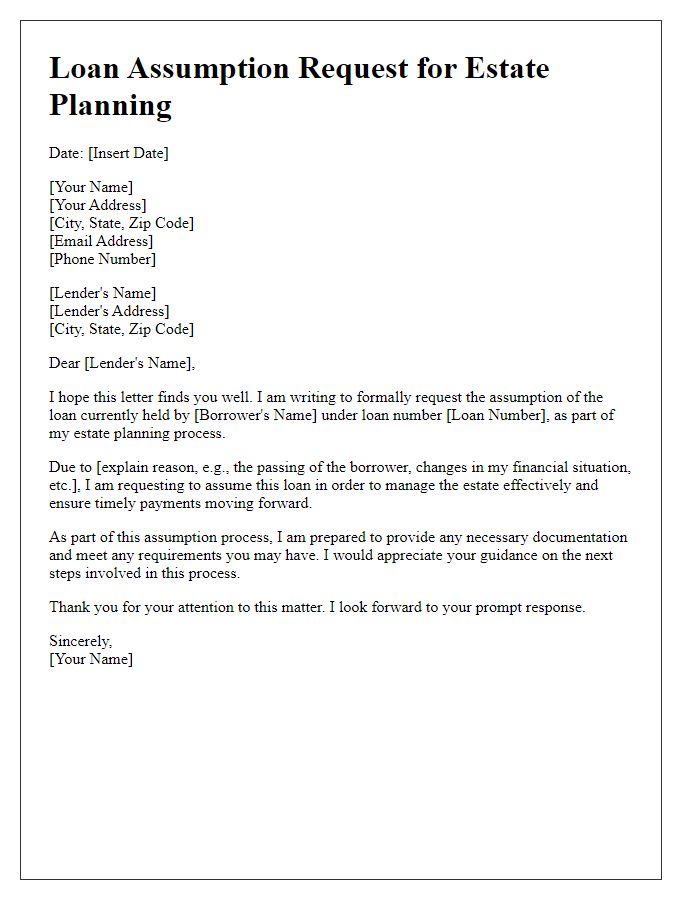

Are you considering taking over a loan and looking for a simple way to communicate your intentions? Writing a loan assumption request letter might seem daunting, but it can be straightforward with the right approach. This letter serves as your formal notice to the lender, expressing your desire to assume the existing loan obligations. Ready to learn how to craft an effective request? Let's dive into the essential components of a compelling loan assumption request letter!

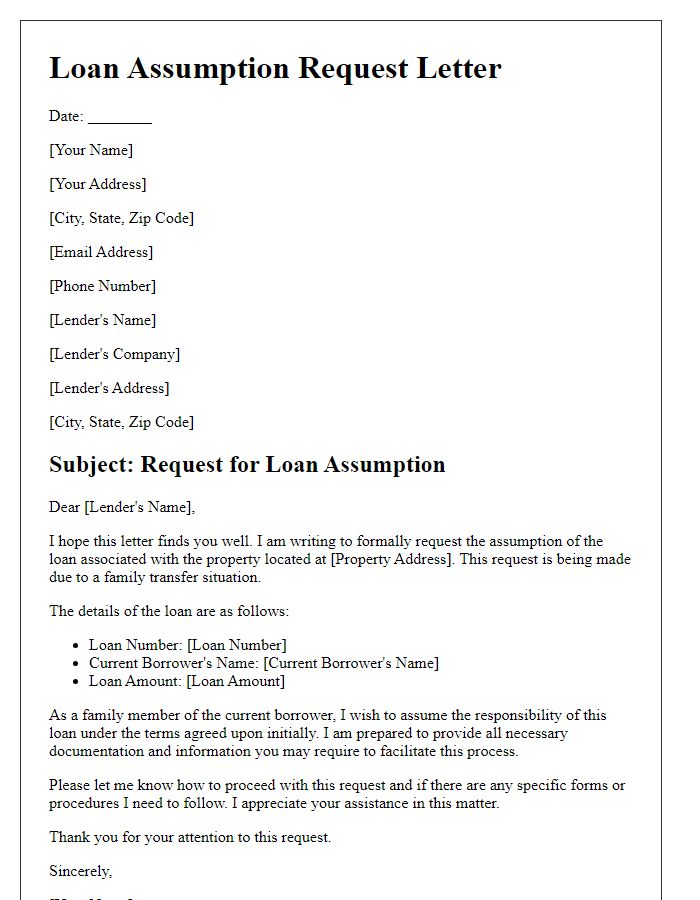

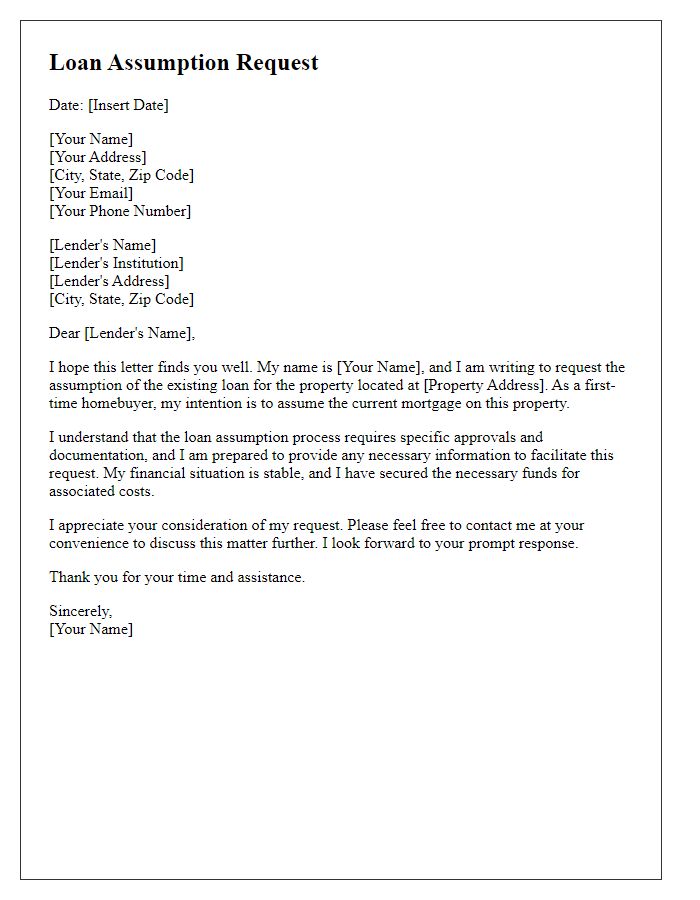

Borrower's personal and contact information.

A loan assumption request requires precise details to ensure proper processing. Include the borrower's full name, such as John Doe, along with the complete mailing address, typically formatted as 123 Main Street, Springfield, IL 62701. Include contact information, like a phone number, for instance, (555) 123-4567, enabling effective communication. An email address, such as johndoe@email.com, facilitates additional coordination. Ensure the borrower's Social Security number (XXX-XX-1234) is included for identification purposes. If applicable, add any co-borrower's information. Being thorough with these personal and contact details accelerates the request process with the loan servicing company.

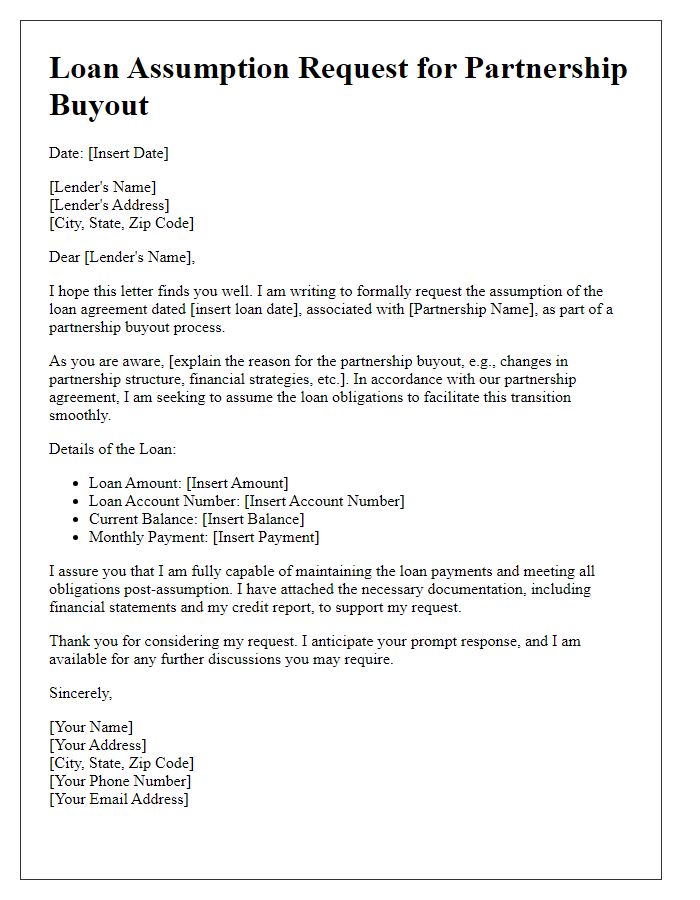

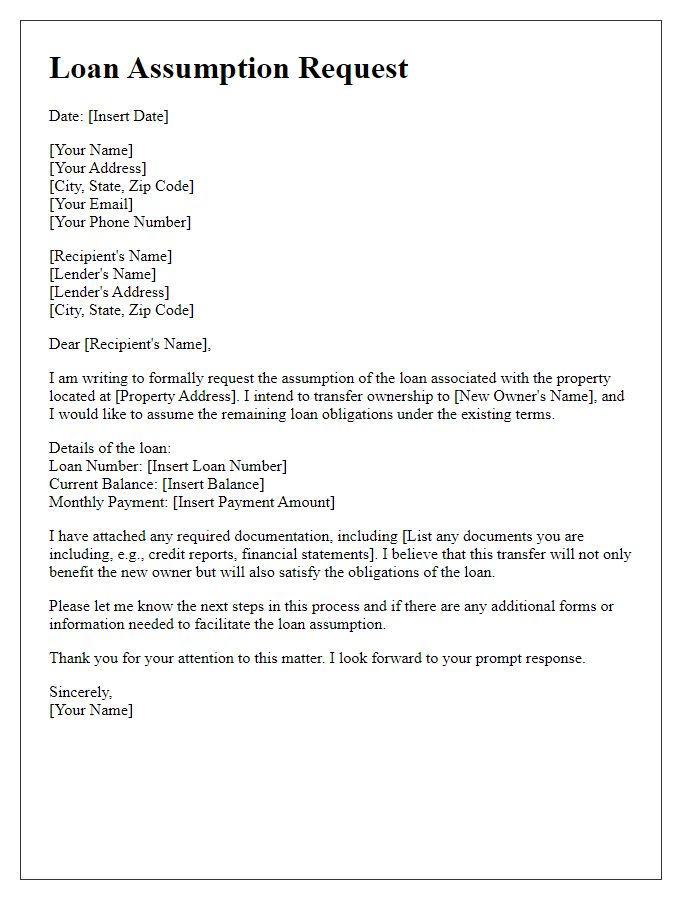

Loan details and account number.

In a loan assumption request, essential details such as loan type, outstanding balance, and account number must be clearly specified. Home mortgages, for instance, may require information such as original loan amounts (often in hundreds of thousands of dollars). Additionally, the account number--typically a unique string of digits (usually 10 to 12 characters)--is vital for identifying the loan in question. It is also important to mention relevant timestamps, such as loan origination date, which impacts potential interest rates and terms. Furthermore, clarifying the parties involved in the assumption, such as the original borrower and the prospective assuming borrower, enhances clarity and ensures proper processing by the financial institution.

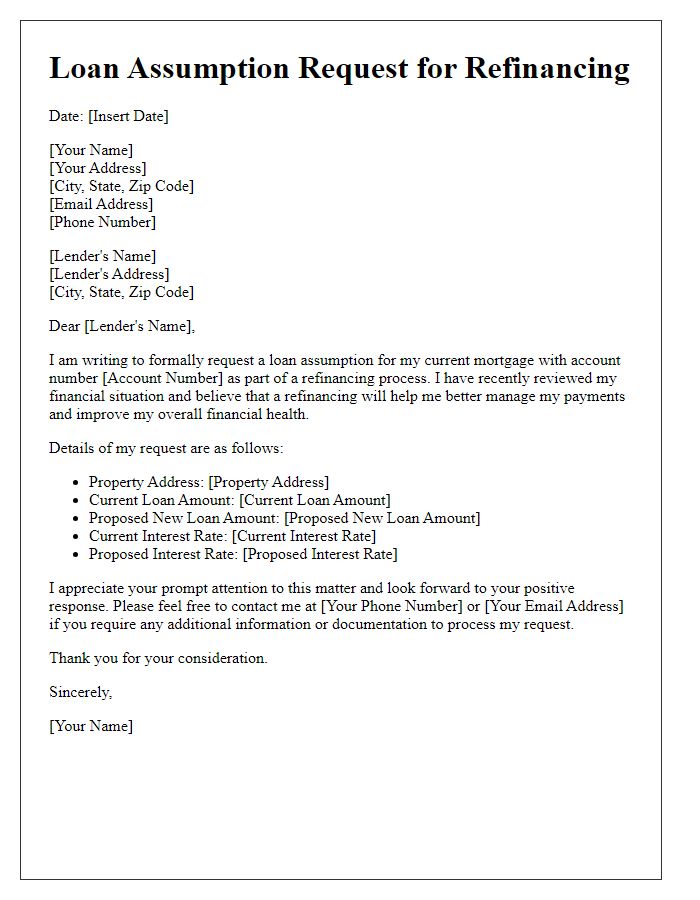

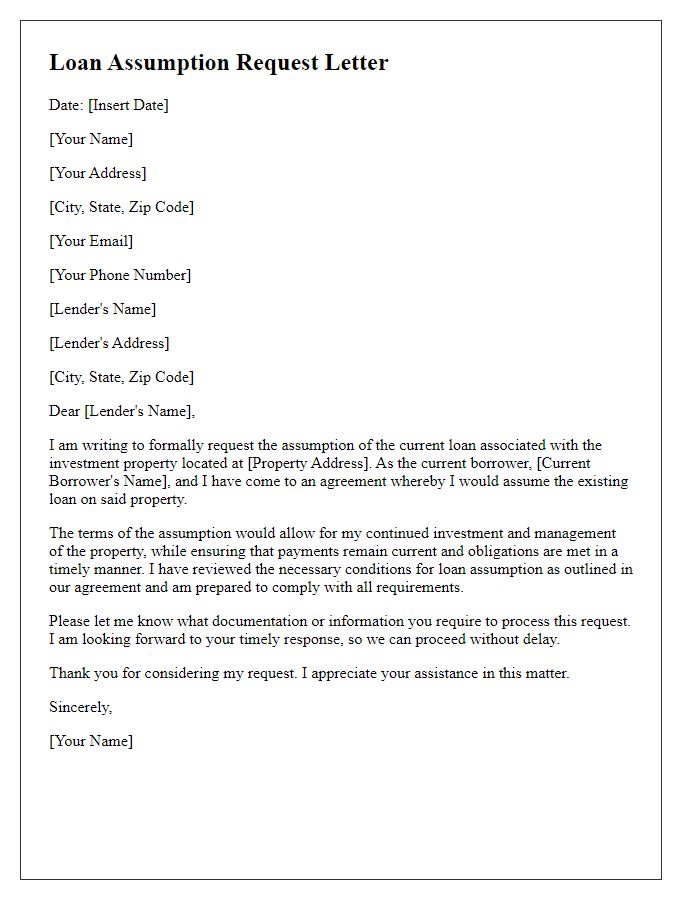

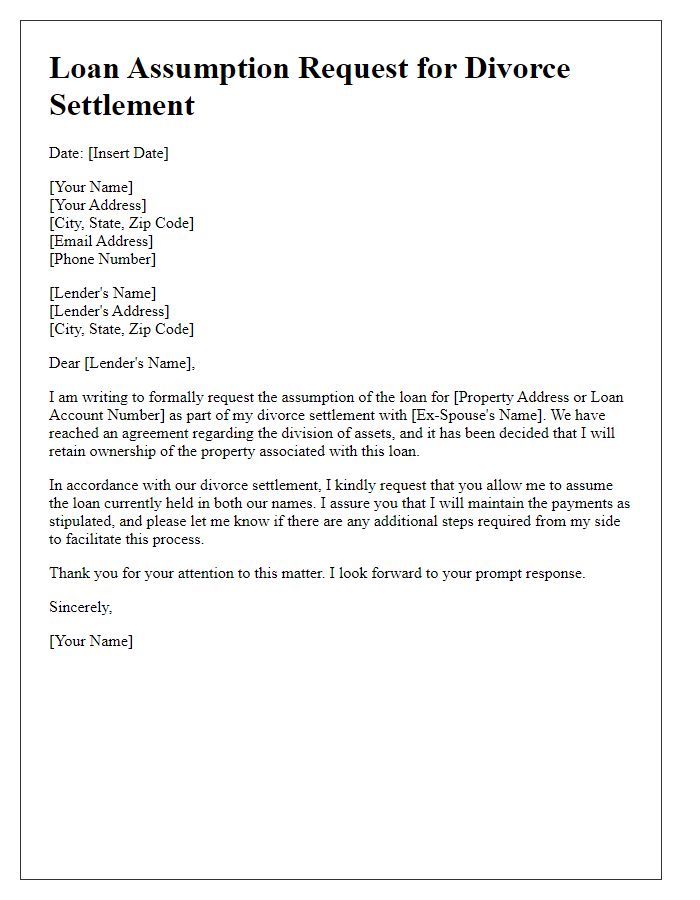

Reason for loan assumption request.

A loan assumption request typically arises when a borrower seeks to transfer their existing mortgage obligation to another party, often due to circumstances like financial hardship or a change in personal situation. In cases like the housing market downturn of 2008, many homeowners faced difficulties maintaining mortgage payments and opted to seek loan assumptions to alleviate financial strain. In a request, it is crucial to outline specific reasons such as the desire for a more manageable financial obligation, the need to facilitate a property sale, or a shared family responsibility in ownership. The objective is to ensure the lender understands the motivation behind the request, which could positively influence the approval process. Detailed documentation, including financial statements and property valuation, may enhance the request's legitimacy and urgency in the eyes of the lender.

Financial information and supporting documents.

A loan assumption request requires comprehensive financial information and supporting documents to substantiate the applicant's capability. Key details include the applicant's credit score, typically ranging from 300 to 850, recent pay stubs covering the last 30 days, and two years of tax returns, indicating income stability and tax obligations. Furthermore, proof of assets, such as bank statements showing sufficient funds for down payments or reserves, must be provided. Supporting documents may include the loan agreement of the existing mortgage, detailing the original terms and current balance, and a letter from the existing lender, affirming the loan's assumability. This documentation ensures a thorough evaluation of the applicant's financial health and the feasibility of taking over the loan obligations.

Statement of intent and commitment to loan terms.

The loan assumption process involves transferring the existing loan obligations from one borrower to another, typically subject to lender approval. Commitment to the loan terms, including interest rates, repayment schedule, and any applicable fees, is crucial for both parties involved. It is essential for the new borrower to express their intention to adhere to the original agreement to ensure a smooth transition and maintain the mortgage's integrity. Completing the necessary documentation, including a formal request for the assumption and the lender's required forms, will initiate the process. In many cases, the new borrower's financial stability and creditworthiness will be evaluated to assess their ability to meet the loan obligations.

Comments