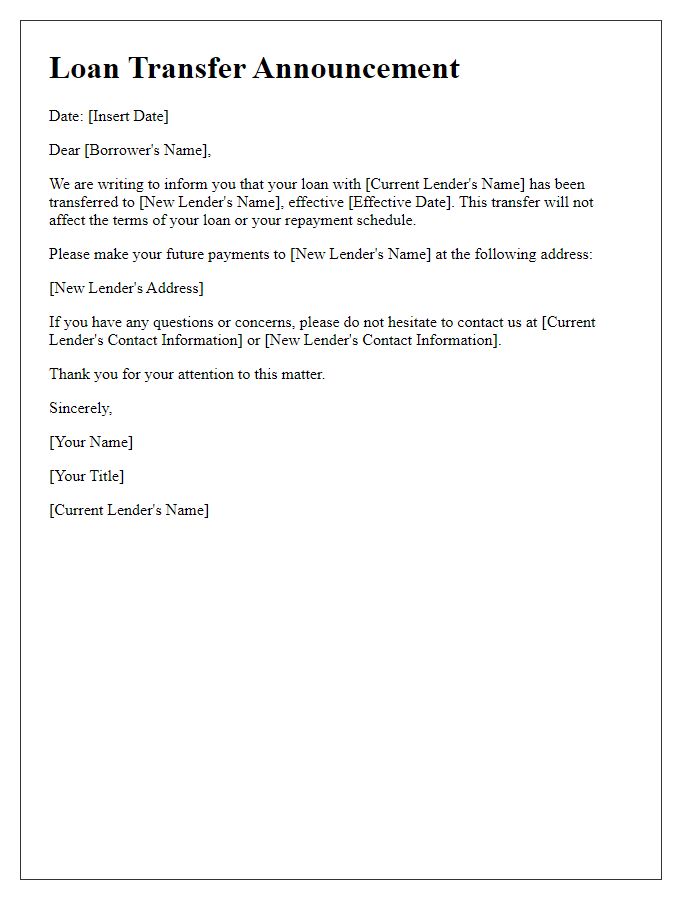

Are you in the process of transferring a loan and feeling a bit overwhelmed by the paperwork? Understanding the ins and outs of loan transfer notifications can make the transition smoother and stress-free. This article will guide you through a straightforward letter template that covers all the necessary details, ensuring that both parties are informed every step of the way. So, let's dive in and explore how to simplify your loan transfer processâread on to discover more!

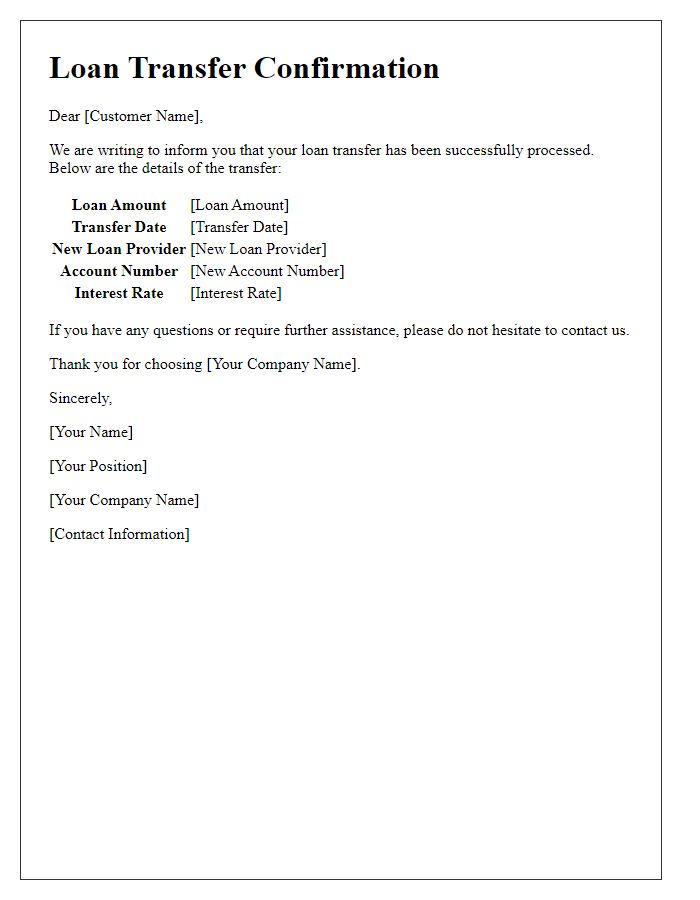

Clear and concise subject line

Clear and concise notification regarding loan transfer can ensure efficient communication with stakeholders. Important details include the loan amount (specific financial figure, e.g., $50,000), the original financial institution's name (reference to Bank of America), and the new lender's entity (such as Wells Fargo). Additionally, the transfer date (like September 15, 2023) and the involved loan account number should be highlighted for clarity. A brief mention of the purpose of the transfer, such as refinancing or consolidation, can provide context to recipients, ensuring they understand the implications and next steps.

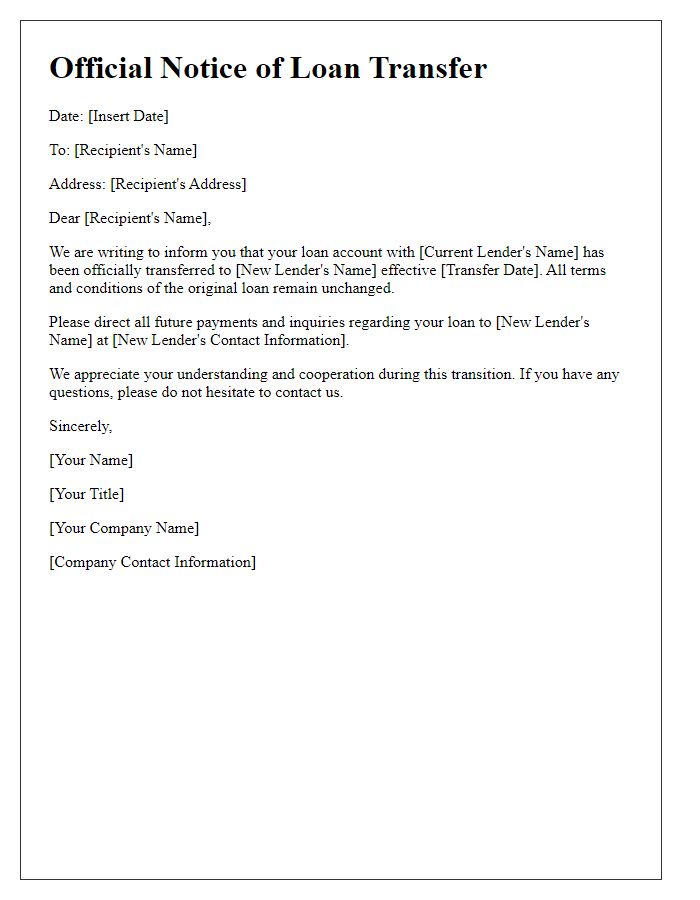

Borrower and lender details

The loan transfer notification outlines essential details regarding the transfer of a financial obligation from one party to another. The Borrower, whose name is John Smith, residing at 123 Main Street, Anytown, USA, holds loan account number 456789123, initially originating from Lender ABC Bank, located at 456 Financial Ave, Capital City, USA. The transfer involves the balance of $25,000, originally dated January 15, 2023, with an interest rate of 4.5% per annum. The new Lender, XYZ Finance, located at 789 Investment Blvd, Wealth City, USA, will assume all rights and responsibilities associated with this loan effective immediately. Notification sent on October 4, 2023, ensures all parties are aware of the transaction and compliance with contractual obligations.

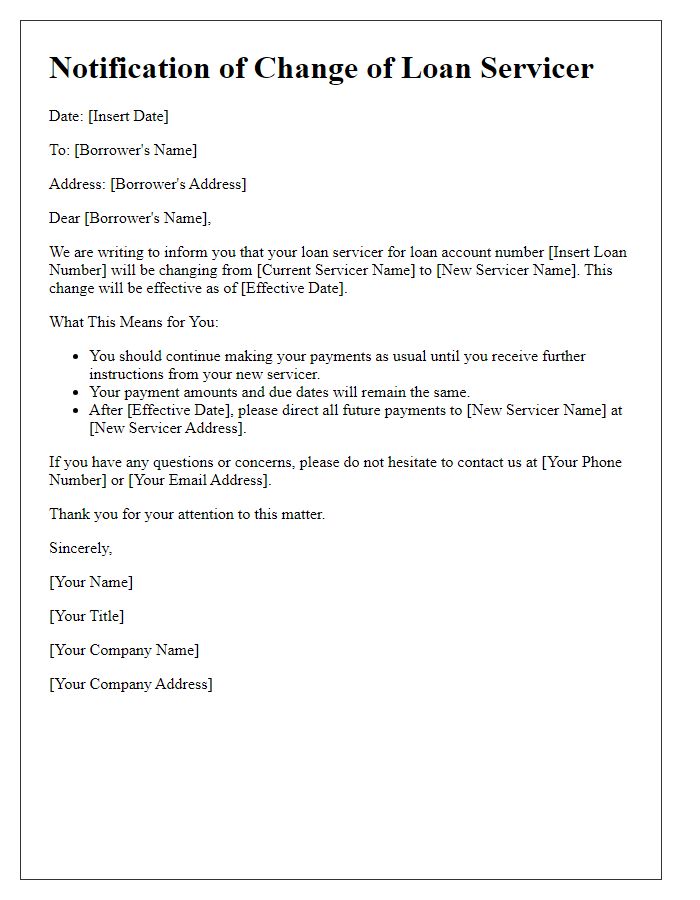

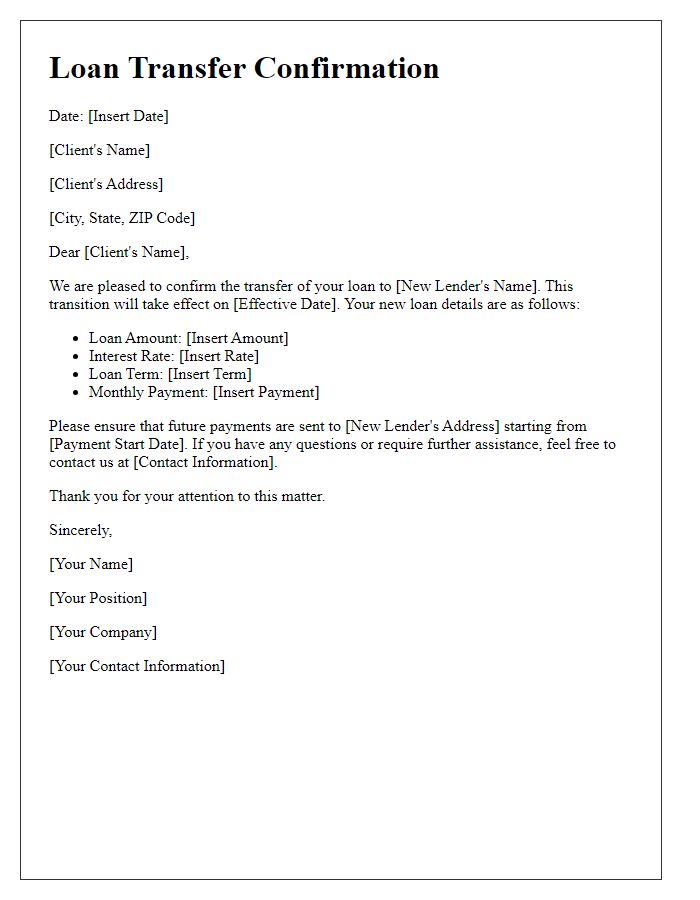

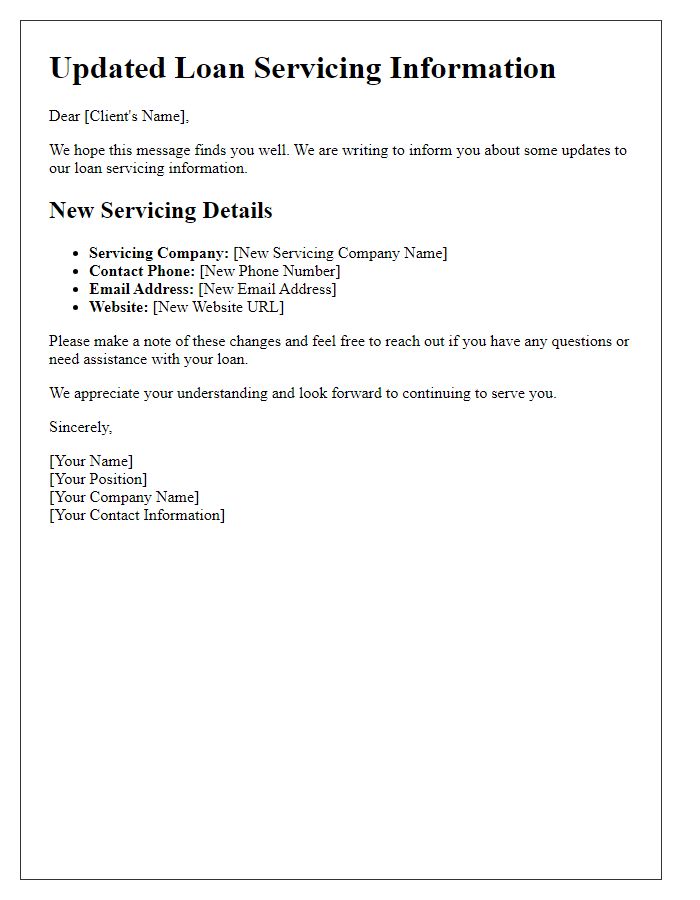

Loan account and transfer specifics

Loan transfer notifications inform borrowers about changes to their loan accounts, including details about new loan servicers and account numbers. Typically, the notification includes the original loan servicer's contact information, the new loan servicer's details, and the specific loan account number associated with the transfer. Important dates, such as the effective transfer date (often the 1st of a month), along with payment instructions, are crucial elements in ensuring a smooth transition. Borrowers should also find information regarding their rights under the Fair Debt Collection Practices Act, as well as reassurances about maintaining previous loan terms, interest rates (fixed or variable), and payment schedules. Timely communication is essential to prevent confusion about ongoing payment obligations and to clarify any changes related to customer service and support.

Updated payment instructions

Loan transfer notifications signify an important change in payment processes for borrowers. Clear communication of updated payment instructions is essential for ensuring timely payments. Updated instructions typically include the new loan servicer's name, contact information, and specific details regarding payment methods such as electronic transfers or checks. Borrowers should note any changes in account numbers and additional guidelines for ensuring payments are credited correctly to the loan balance. Timely adherence to these new instructions prevents delays in processing and potential penalties or fees.

Contact information for inquiries

Loan transfer notifications inform borrowers about the relocation of their loan servicing from one lender to another. To facilitate smooth communication, essential contact information must be provided. Typically, this includes the new loan servicer's name, mailing address, phone number, and email address for inquiries. For example, if a homeowner's mortgage loan is transferred from ABC Bank to XYZ Financial Services, the notification should clearly state XYZ Financial Services' details: 123 Finance Road, Suite 100, Springfield, IL 62701, Phone: (555) 123-4567, Email: support@xyzfinancial.com. Clear instructions on how and when to make payments during the transition period may also be included to avoid confusion.

Comments