Are you feeling overwhelmed by your current financial situation? You're not alone; many individuals and families find themselves in need of loss mitigation assistance to navigate tough times. This process can seem daunting, but with the right guidance and resources, you can take meaningful steps towards stabilizing your finances. Let's dive deeper into how to effectively apply for loss mitigation assistance and find the relief you need!

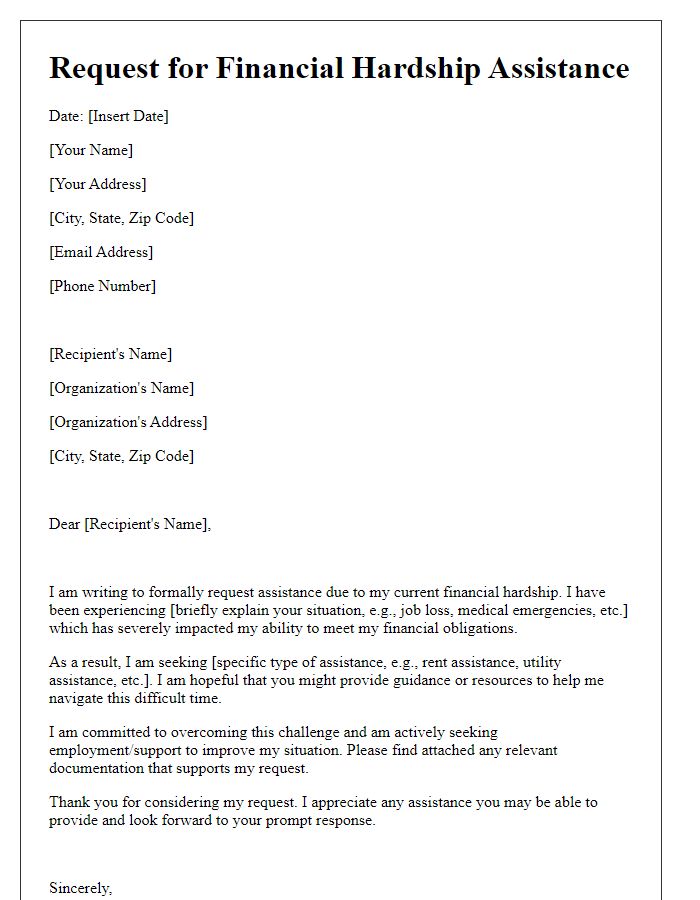

Borrower Information

The borrower information section is crucial in loss mitigation assistance scenarios, containing essential details about the individual seeking help from lenders. Key elements include the borrower's full name, which identifies the individual requesting assistance; the property address, which specifies the location related to the mortgage in question; and the loan number, a unique identifier crucial for tracking the specific account. Other important information includes contact details such as phone number and email address, enabling lenders to reach the borrower efficiently. Employment status and income information can also be pertinent, providing lenders with an understanding of the borrower's financial situation and ability to make future payments. Overall, this section lays the groundwork for any loss mitigation discussion and informs the lender's decision-making process.

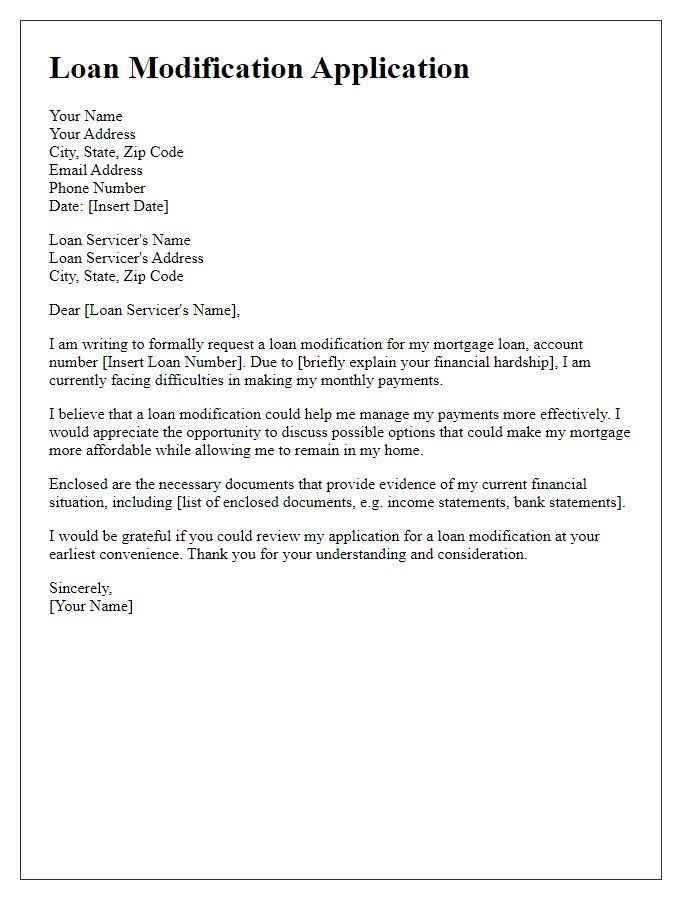

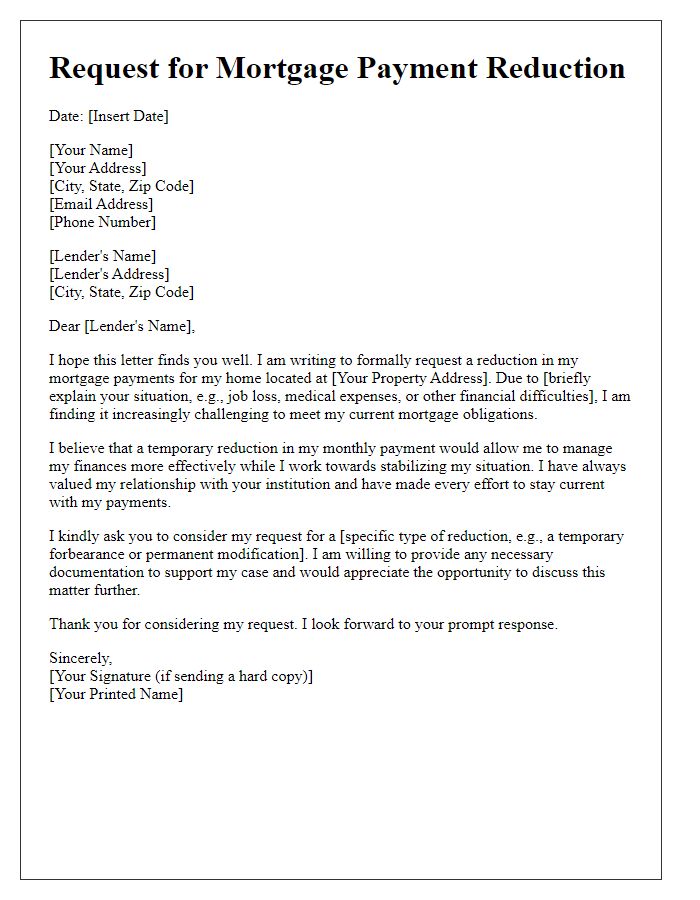

Loan Details

The assistance program for loss mitigation encompasses various loan types, including FHA (Federal Housing Administration) loans and conventional loans, with a primary focus on homeowners facing financial hardships. The loan details specify essential information such as the loan number, original loan amount (often ranging from $100,000 to $500,000), outstanding balance, interest rate, and monthly payment obligations, typically averaging between $1,000 and $2,500. This program is designed to provide options like loan modifications, repayment plans, or forbearance agreements for borrowers struggling to maintain their mortgage payments. Specific eligibility criteria must be met, requiring documentation of income, hardship, and a completed loss mitigation application form.

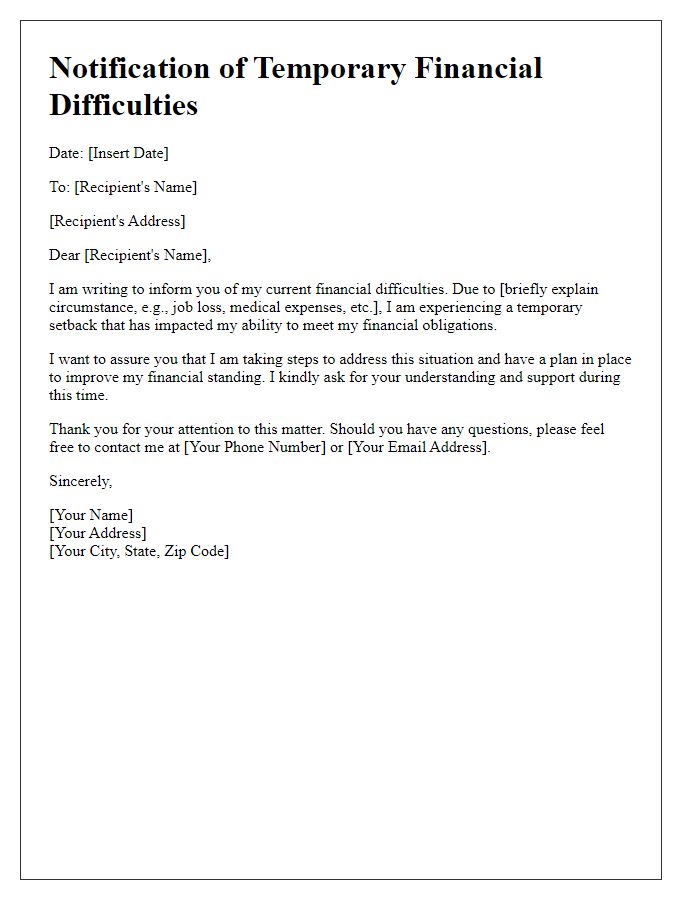

Hardship Explanation

Financial hardship can significantly impact individuals and families, often resulting from unexpected events such as job loss, medical emergencies, or natural disasters. Many households in the United States face difficulties meeting monthly expenses, with studies indicating that nearly 40% of Americans encounter financial strain due to unforeseen circumstances. In places like New Orleans, where Hurricane Katrina left long-lasting economic challenges, residents often seek loss mitigation assistance to cope with mortgage payments. This assistance can provide crucial support, helping families to stabilize their finances and avoid foreclosure. Understanding options available, like loan modification or forbearance, is essential for those navigating these difficult situations. Various agencies, including the Federal Housing Administration (FHA), offer resources, ensuring that families have access to the necessary support during financial crises.

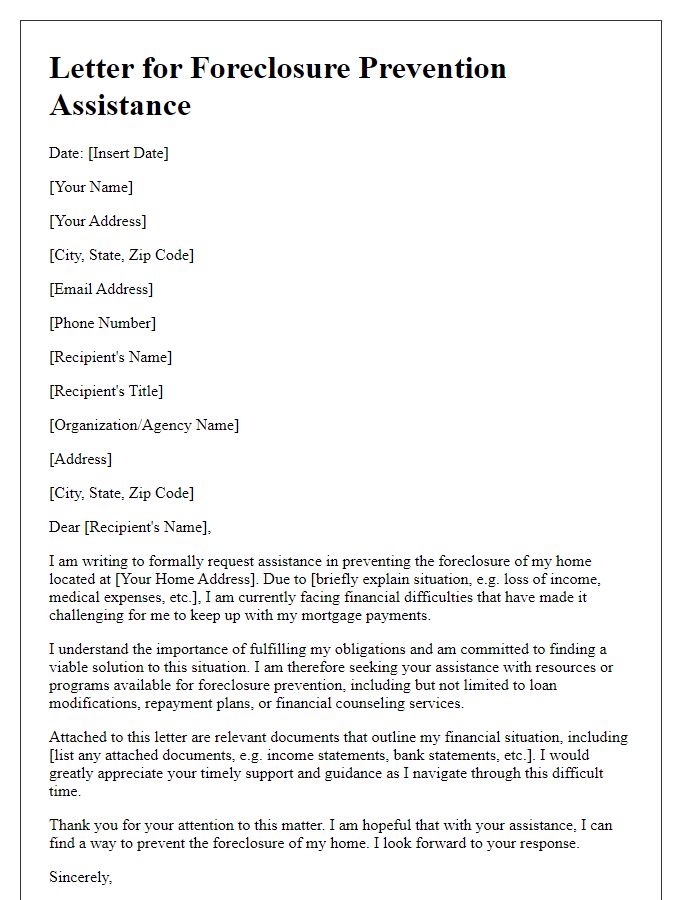

Requested Assistance Type

Loss mitigation assistance typically involves programs and options offered to borrowers struggling to make mortgage payments, primarily aimed at avoiding foreclosure. This assistance can include loan modifications, which adjust the terms of the mortgage to make it more affordable, and forbearance plans, which allow temporary pauses or reductions in payments. Additionally, short sales can be facilitated, allowing homeowners to sell their property for less than the owed mortgage amount with lender approval. Many lenders also provide dedicated customer support teams, trained to help navigate the complex process of loss mitigation. Additionally, resources such as government programs may be available, designed to assist individuals facing financial hardships, particularly during events like economic downturns or natural disasters.

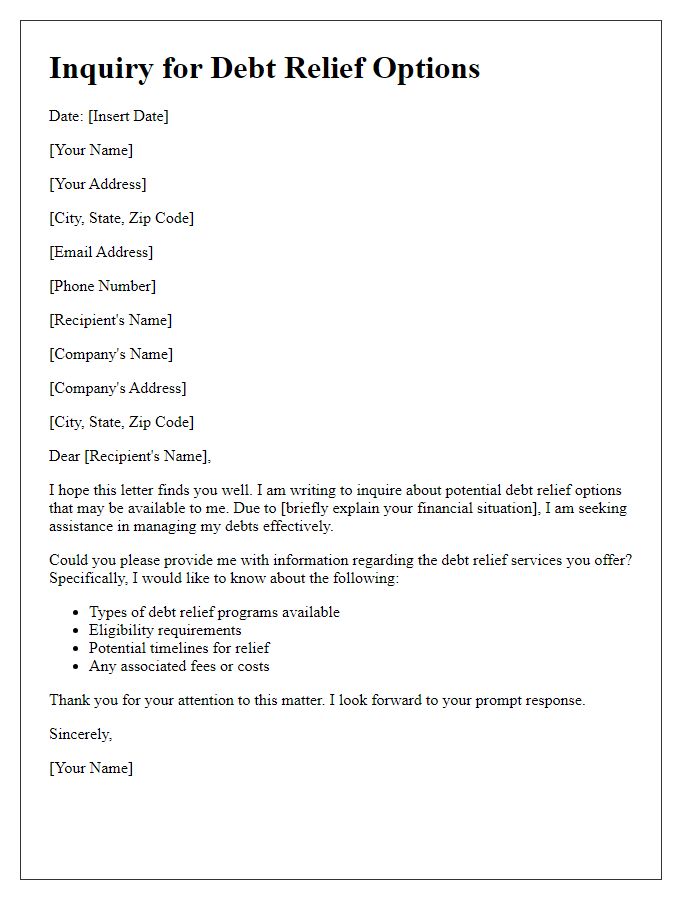

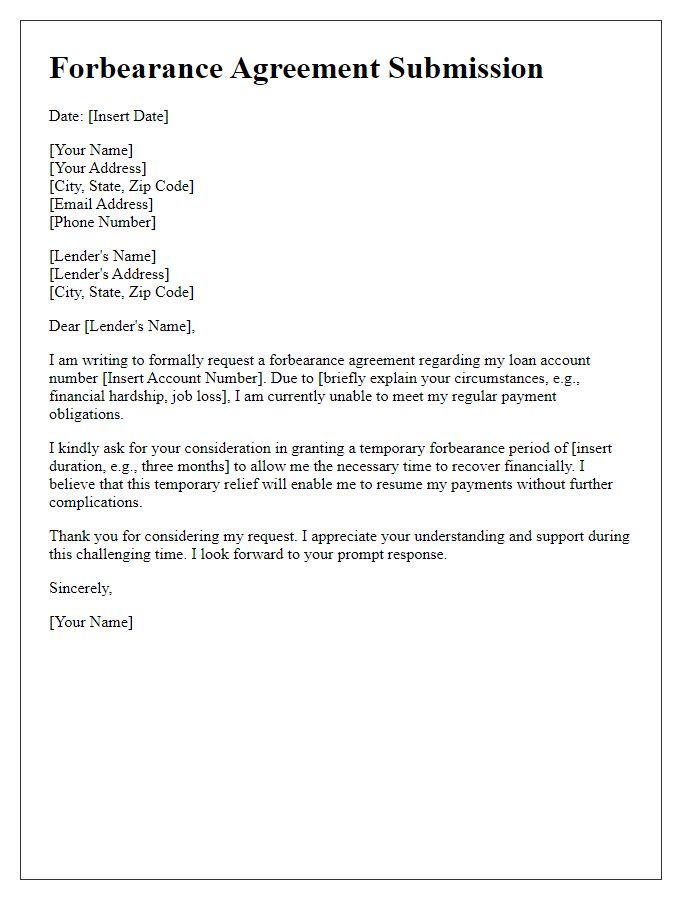

Supporting Documentation

Supporting documentation plays a crucial role in loss mitigation assistance requests significantly impacting the outcomes of financial relief efforts. Key documents include Form 710, a completed Request for Mortgage Assistance (RMA), detailing the borrower's financial situation and hardship. A current pay stub, preferably dated within the last 30 days, provides insight into the borrower's income level, essential for evaluating repayment capacity. A bank statement, typically showing transactions from the past 60 days, can demonstrate overall financial health and cash reserves. Additionally, a hardship letter articulating the reason for seeking assistance--such as job loss, medical emergency, or divorce--helps convey the urgency of the request. This comprehensive documentation layer assists mortgage servicers in assessing eligibility for programs like loan modification, forbearance, or loss mitigation options tailored to prevent foreclosure and promote stability in homeowners' financial situations.

Comments