Are you a veteran looking to unlock the benefits of a loan designed just for you? Understanding the specific advantages and opportunities available can make a world of difference when navigating the home-buying process. With programs tailored to support those who have served, it's essential to know your rights and options. Join us as we explore veteran loan benefits in detail, and discover how they can help you achieve your homeownership dreams!

Personal Information Section

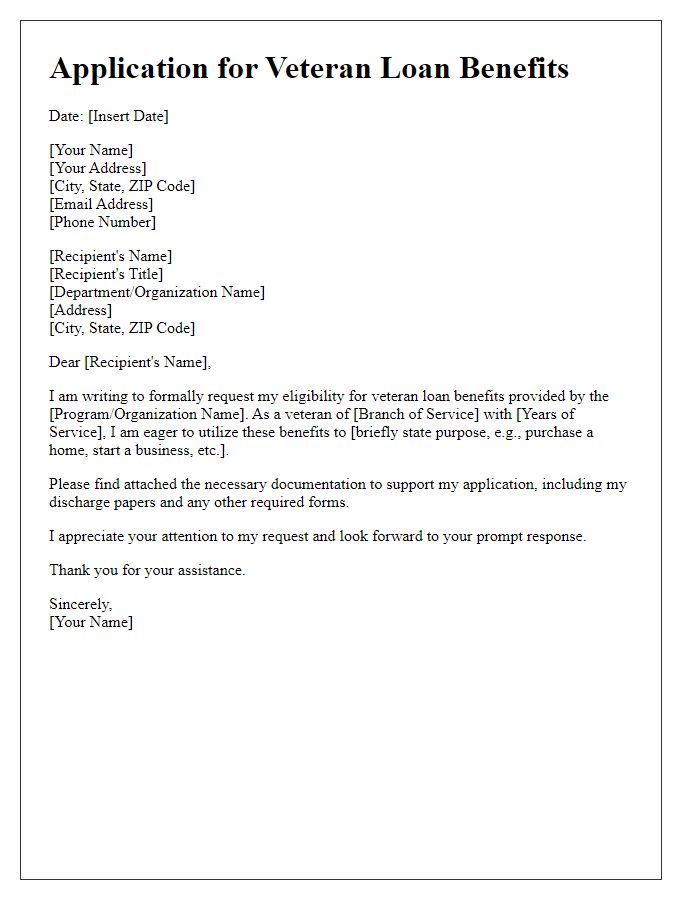

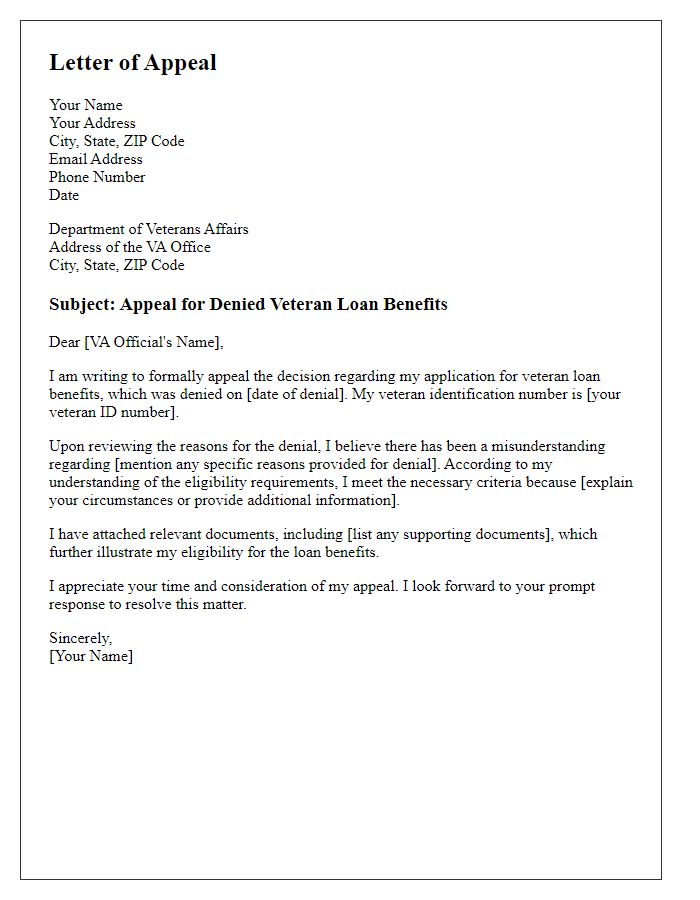

Veterans possess access to a variety of loan benefits, such as the VA Home Loan program, designed to facilitate home ownership opportunities. Eligibility criteria include service duration, honorably discharged status, and specific service branches recognized by the Department of Veterans Affairs. The application process requires vital personal information, including full name, social security number, and current mailing address, ensuring the accurate assessment of benefits based on individual service records. Furthermore, documentation of income and employment history may be necessary to establish financial reliability. This information becomes crucial during the verification process, reaffirming the veteran's entitlement to utilize these significant financial advantages.

Eligibility Verification

Veteran loan benefits offer crucial financial support to military personnel, including veterans and active service members. This program, managed by the Department of Veterans Affairs (VA), includes options such as the VA Home Loan, which provides assistance in purchasing homes without the need for private mortgage insurance (PMI). Eligibility criteria include length of service, discharge status, and service-related disabilities. Specific documentation is often required to verify eligibility, such as the Certificate of Eligibility (COE), DD Form 214, and other personal identification material. Understanding these requirements is essential for ensuring access to the significant benefits designed to assist veterans in achieving homeownership and financial stability.

Loan Benefit Details

The Veterans Affairs (VA) loan program provides unique opportunities for qualifying veterans to secure home financing without the need for a down payment. Eligibility includes those who have served on active duty for a minimum period, often 90 consecutive days during wartime or 181 days during peacetime. The program offers competitive interest rates, often below the market average, and the absence of private mortgage insurance (PMI) requirements, which can save veterans thousands of dollars. VA loans also cater to adjustable-rate and fixed-rate mortgages, enabling flexibility in loan terms. Additionally, veterans can access funding fee exemptions based on service-related disabilities for further affordability. The maximum loan limit varies by county, often reaching up to $1 million in high-cost areas, ensuring veterans can purchase homes that accommodate their family needs.

Contact Information

Veteran loan benefits significantly enhance homeownership opportunities for military veterans, providing access to financing options without the need for a down payment and with favorable interest rates. The U.S. Department of Veterans Affairs (VA) oversees this program, ensuring eligible veterans can obtain loans through VA-approved lenders. These benefits include loan guarantees that protect lenders against loss, which enables competitive lending terms. Additionally, veterans seeking assistance can find resources and information from organizations such as the National Veterans Affairs office located in Washington, D.C. By capitalizing on these benefits, veterans can secure stable housing and foster a sense of community post-service.

Formal Closing and Signature

The formal closing of a letter serving to notify a veteran about loan benefits should embody respect and professionalism. Common closings include "Sincerely," "Respectfully," or "Best regards." A signature follows the closing, preferably handwritten in ink for authenticity. Including a printed name beneath the signature reinforces clarity. Additionally, providing a title or position, for instance, "Loan Benefits Officer" or "Veterans Affairs Representative," adds credibility and context to the communication, emphasizing the official nature of the message regarding the veterans' loan benefits program.

Letter Template For Veteran Loan Benefits Letter Samples

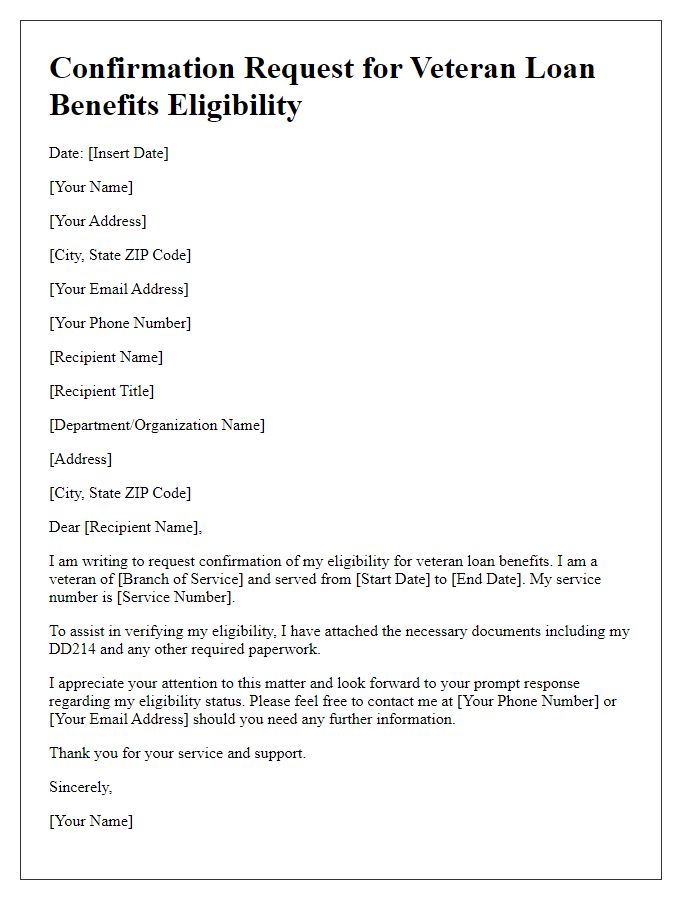

Letter template of confirmation request for veteran loan benefits eligibility

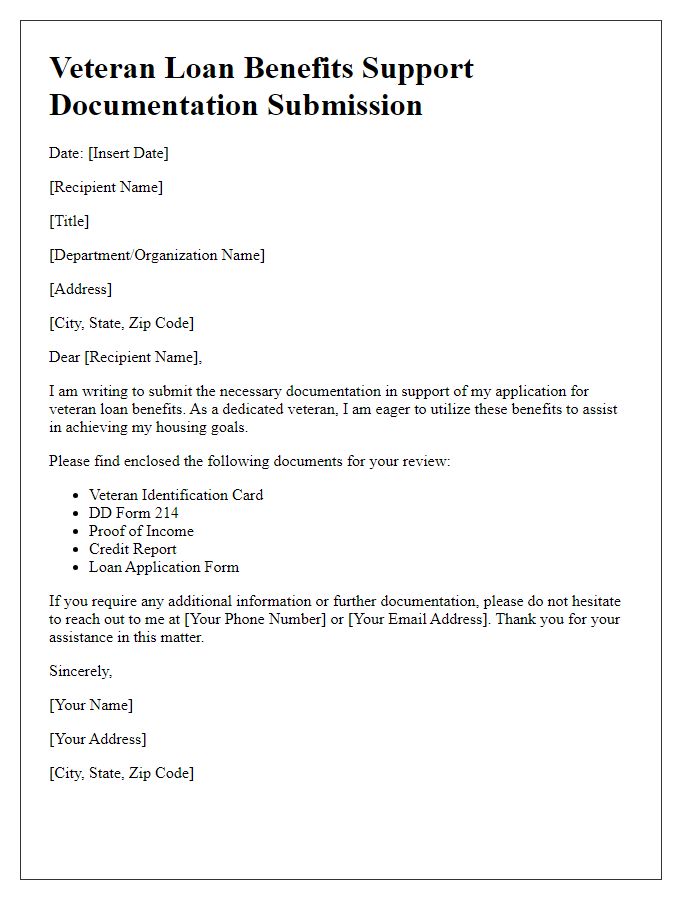

Letter template of support documentation submission for veteran loan benefits

Comments