Navigating the world of bankruptcy can be daunting, and understanding your rights is crucial. In this article, we'll break down what to include in a bankruptcy notification response letter to ensure your voice is heard. You'll discover key elements that can make a significant difference in your financial future. So, let's dive in and explore how you can effectively communicate during this challenging time!

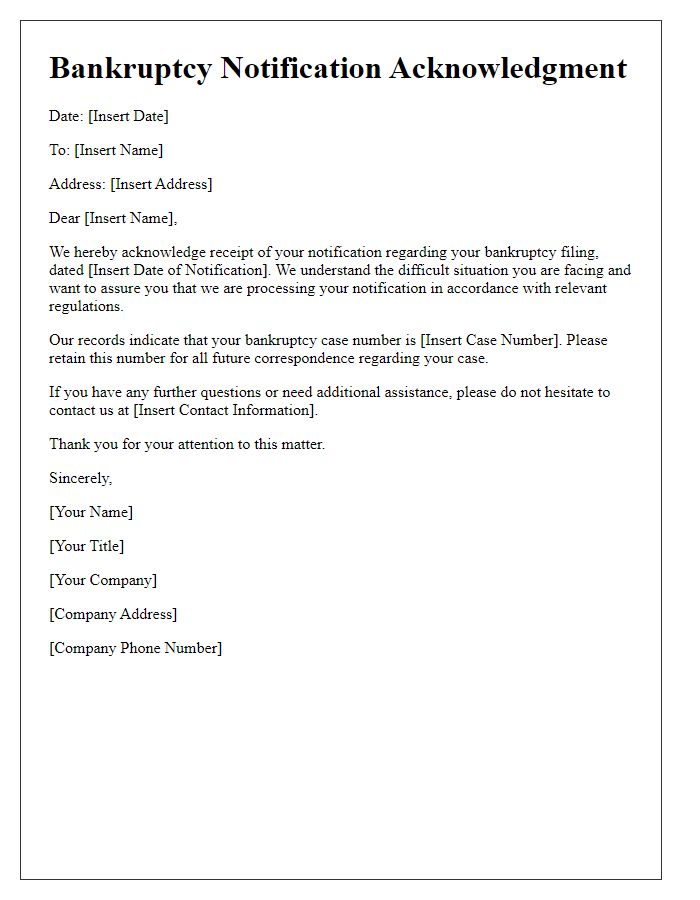

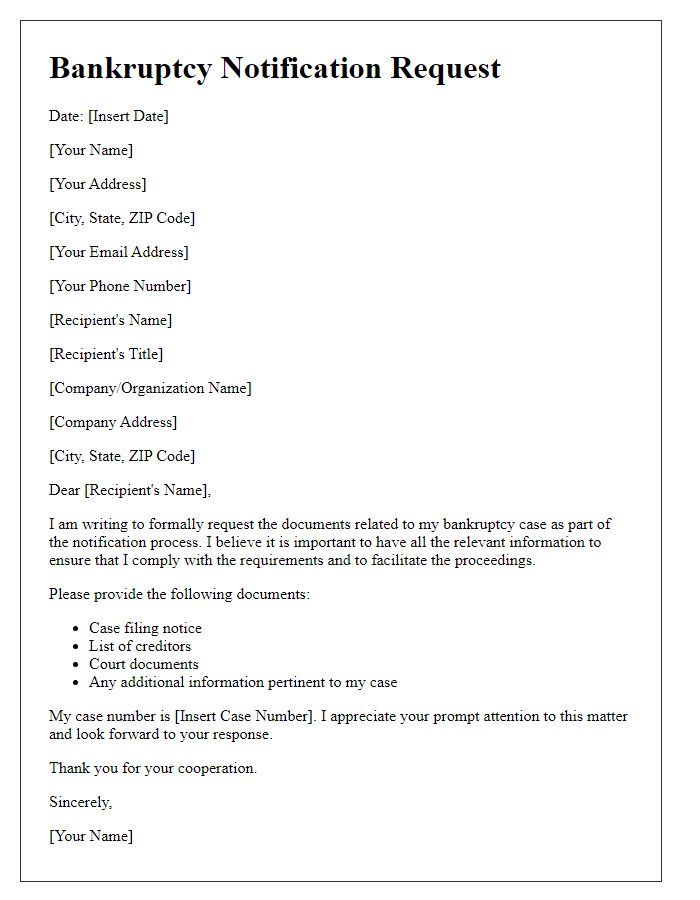

Company Name and Contact Information

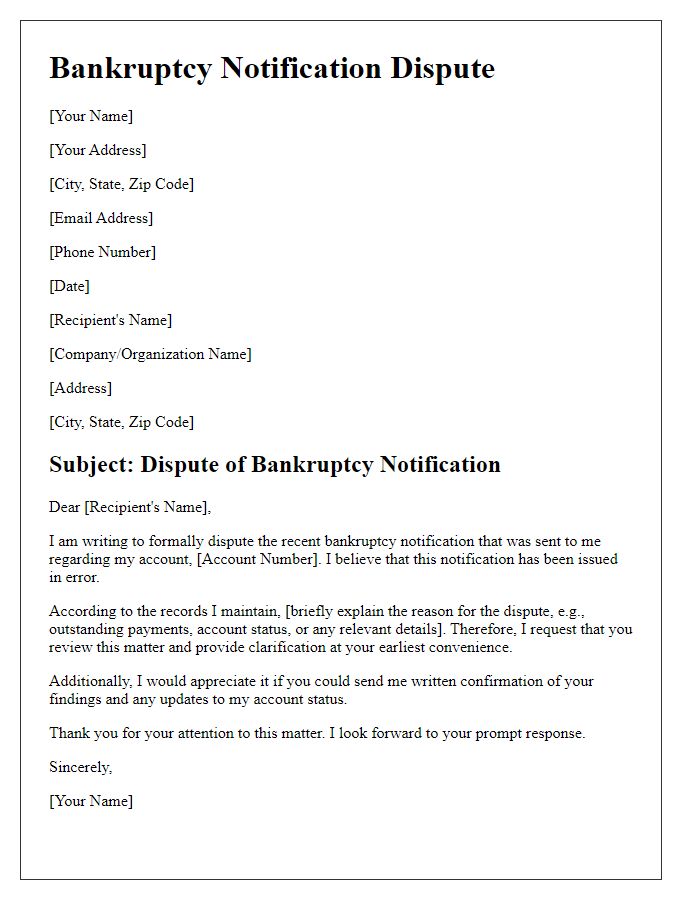

Bankruptcy notifications can significantly impact business operations and financial health. Companies that receive such notices, particularly in the United States, must respond promptly to adhere to legal protocols. Important documents, such as the bankruptcy petition, need meticulous review. The Chapter 11 process, common among corporations, allows for reorganization under court supervision, enabling companies to continue operations. Timely responses can include filing proofs of claim or negotiating payment plans with creditors. Understanding regional bankruptcy laws in specific states like Delaware or California is crucial, as these regions have unique regulations. Proper communication with legal counsel can ensure compliance and protect the company's interests during such critical times.

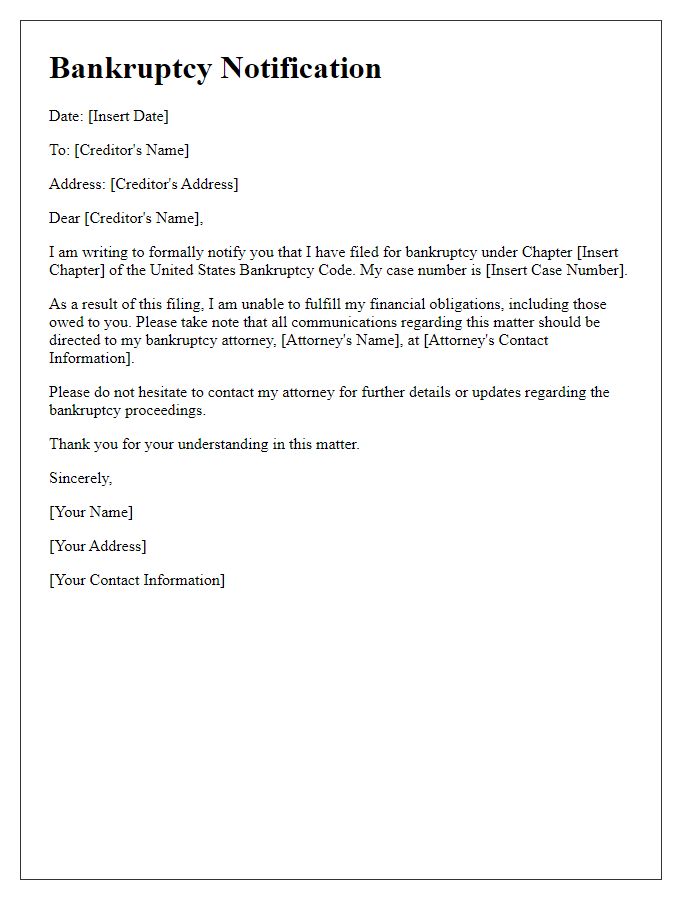

Debtor's Account and Case Number

The bankruptcy notification response requires attention to detail regarding the debtor's financial situation. The debtor's account number (a unique identifier assigned to the individual's case) is crucial for tracking the case's progress within the judicial system. The case number (often a unique alphanumeric code assigned by the court) indicates the legal proceedings concerning the bankruptcy filing under Chapter 7 or Chapter 11. In situations involving consumer financial distress, this response should outline the allegations and confirm the understanding of dischargeable debts, timelines for future court dates, and necessary documentation (such as proof of income or assets). Proper handling of this notification can significantly influence the debt relief process, affecting the debtor's financial recovery trajectory.

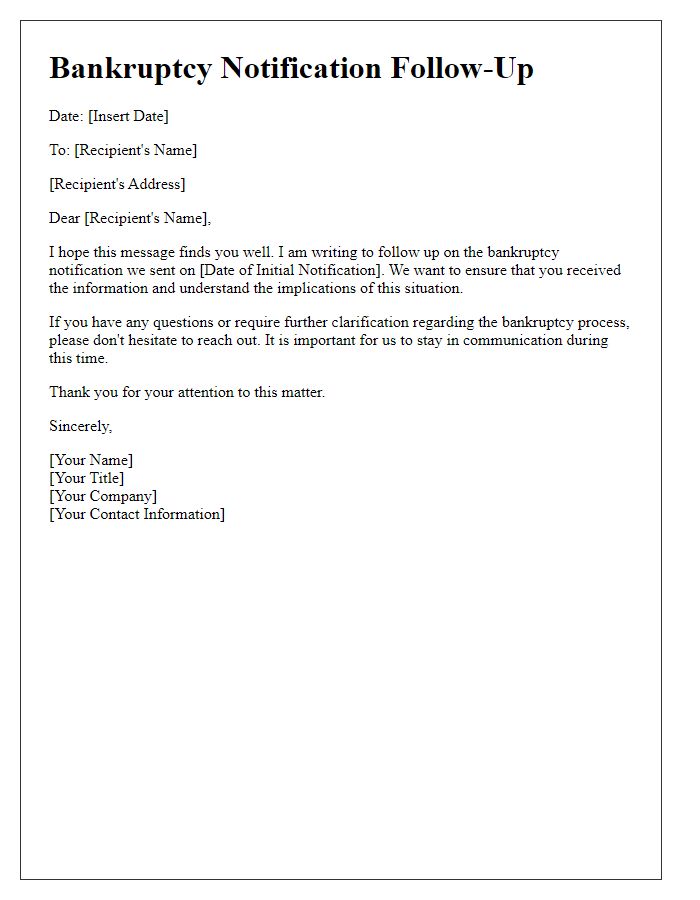

Statement of Bankruptcy Filing Status

A statement of bankruptcy filing status serves as a crucial notification to creditors regarding the legal standing of a debtor's bankruptcy case. The document typically outlines essential details such as the type of bankruptcy filed (Chapter 7 or Chapter 13), the case number, and the court's jurisdiction, often located in a specific district such as the Southern District of New York. The filing date is another significant piece of information, marking the formal commencement of the bankruptcy process. It's also important to specify the debtor's name and address, ensuring clarity in communication. Furthermore, the statement may include deadlines for filing claims or objections, along with a reminder of the automatic stay in effect, which prevents creditors from attempting to collect debts pending the bankruptcy proceedings. This document is pivotal for maintaining transparency during financial restructuring.

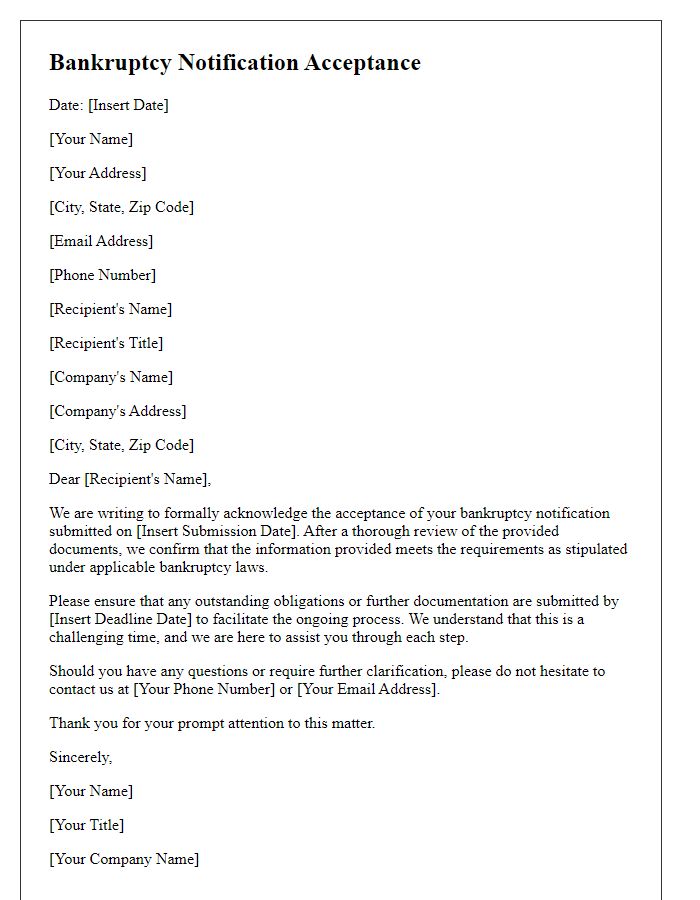

Payment Plan Proposal or Legal Obligations

Bankruptcy notifications often require a careful review of payment plan proposals or legal obligations. The bankruptcy court typically requires documentation outlining debtors' financial situations, including income statements, asset valuations, and a detailed payment plan that adheres to legal requirements outlined in the Bankruptcy Code. A common approach includes submitting a Chapter 13 repayment plan to the bankruptcy trustee, which allows individuals to keep their assets while making payments toward debts over three to five years. Timely responses to notifications are essential, with specific deadlines set by the court (usually within 14 days) for filing objections or confirming repayment plans, ensuring compliance with local rules in jurisdictions like the United States Bankruptcy Court. Legal implications of failing to address these notifications can lead to dismissal of the bankruptcy case, which could severely impact the debtor's financial future and ability to discharge obligations.

Signature and Official Title

In financial distress, bankruptcy notification responses require careful consideration. A signature represents an individual's or organization's formal acknowledgment of receipt or action. An official title specifies the person's role within a company, such as Chief Financial Officer (CFO) or Director of Operations, indicating authority in handling legal and financial matters. A well-structured response ensures clarity in communication with creditors or the court, reinforcing the seriousness of the situation while adhering to legal protocols. Legal documentation, including bankruptcy forms, must be completed accurately to maintain compliance with federal regulations, particularly under Chapter 7 or Chapter 11 frameworks.

Comments