Are you feeling overwhelmed by multiple debts and high-interest rates? A debt consolidation proposal could be the solution you've been searching for, allowing you to streamline your payments and potentially lower your interest rates. By consolidating your debts into one manageable monthly payment, you can regain control of your financial situation and work towards a debt-free future. Ready to learn more about how a debt consolidation proposal can benefit you? Read on!

Clear Identification of Debtor and Creditor

In a debt consolidation proposal, the clear identification of the debtor (the individual or entity seeking to consolidate debts) and the creditor (the financial institution or party to whom money is owed) is crucial. The debtor must provide their full name, address, Social Security number (or Tax ID for businesses), and contact information to ensure accurate identification. The creditor's details should include the name of the financial institution, address, account number, and the specific type of debt involved (such as credit card debt, personal loans, etc.). This section lays the foundation for the agreement, establishing the parties involved in the debt consolidation process, which allows for transparent communication and effective negotiation. Proper documentation is essential to support the proposal, demonstrating the debtor's financial situation and the intent to manage liabilities effectively.

Comprehensive Financial Overview

Comprehensive financial overviews play a crucial role in debt consolidation proposals, serving as a detailed examination of an individual's financial situation. This overview typically includes critical elements such as total debt amounts, interest rates, monthly payments, and types of debt, like credit card obligations, personal loans, and medical bills. The inclusion of monthly income figures, along with essential living expenses, allows for a clearer understanding of an individual's cash flow and budgeting needs. Additionally, it can outline asset ownership, like home equity and savings accounts, providing insight into potential collateral or resources for repayment options. Understanding these financial dynamics is essential for developing a viable debt consolidation strategy tailored to enhance affordability and improve creditworthiness.

Proposed Terms and Conditions

Debt consolidation proposals offer a strategic approach to managing multiple debts into a single payment plan. Key components include the total debt amount, often thousands of dollars, which needs to be addressed. Interest rates can significantly impact repayments, with average credit card rates hovering around 15% annually. The proposal should outline a clear repayment timeline, typically ranging from three to five years, depending on the total amount and whether unsecured or secured loans are involved. Monthly payments must be specified, emphasizing the benefits of potentially reducing overall monthly expenses by consolidating high-interest debts into one lower interest rate. Furthermore, potential fees associated with the consolidation process, like origination or application fees, must be transparently discussed to prevent unexpected costs. Establishing a communication plan with creditors, located in industries like banking and finance, can also facilitate a smoother approval process and enhance financial stability.

Justification and Supporting Evidence

Debt consolidation can significantly simplify financial management for individuals struggling with multiple debts. By merging several high-interest debts, such as credit card balances averaging 18% APR or personal loans, into a single lower-interest loan (often around 6% to 12% APR), individuals can reduce monthly payments and overall interest costs. Successful debt consolidation can improve credit scores over time, given that credit utilization ratios decrease and late payments diminish. Statistical evidence from financial studies indicates that 70% of people who engage in debt consolidation report improved financial stability and the ability to meet their obligations more effectively. The strategy can be executed through various methods, such as balance transfer credit cards, personal loans from reputable banks, or credit counseling services, providing individuals with tailored solutions suited to their financial situations. Locations with strong financial institutions, such as New York City and San Francisco, often offer diverse opportunities for debt consolidation, enhancing accessibility for those in need.

Contact Information and Follow-up Plan

Debt consolidation offers a strategic approach for managing multiple debts efficiently. Individuals looking to consolidate debts, often ranging in amounts from several thousand to tens of thousands of dollars, can benefit from understanding their total debt liability and monthly payment plans. Local credit counseling agencies, such as those found in major cities like New York or Los Angeles, often provide financial assessments and tailored plans. Establishing a follow-up plan, including regular check-ins (every month or quarterly) with a financial advisor, is essential for tracking progress. This plan may encompass setting measurable goals like a 20% reduction in outstanding balances within six months, enabling borrowers to stay on track towards achieving financial stability.

Letter Template For Debt Consolidation Proposal Samples

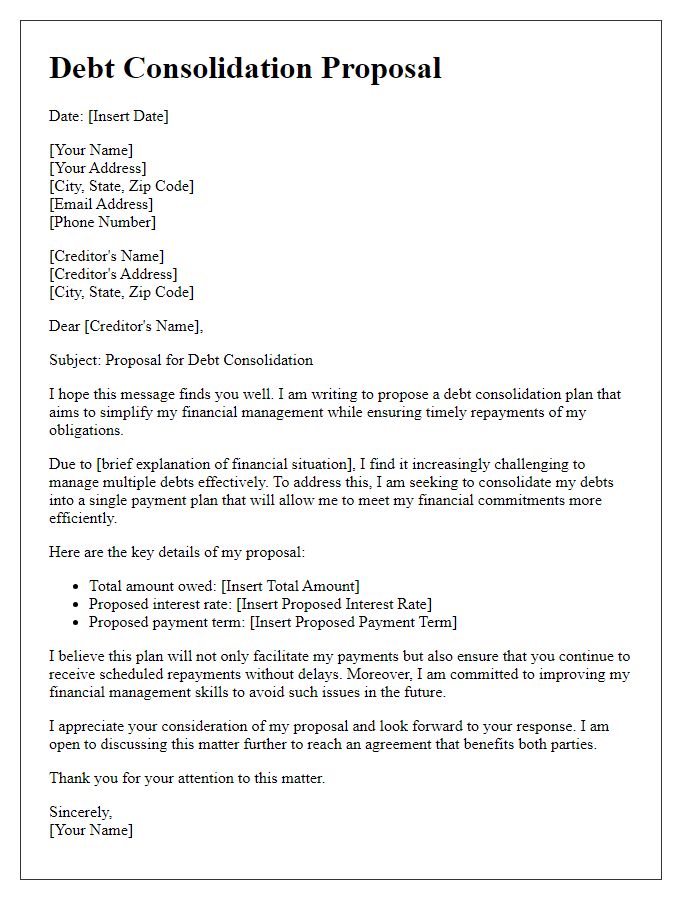

Letter template of debt consolidation proposal for better financial management.

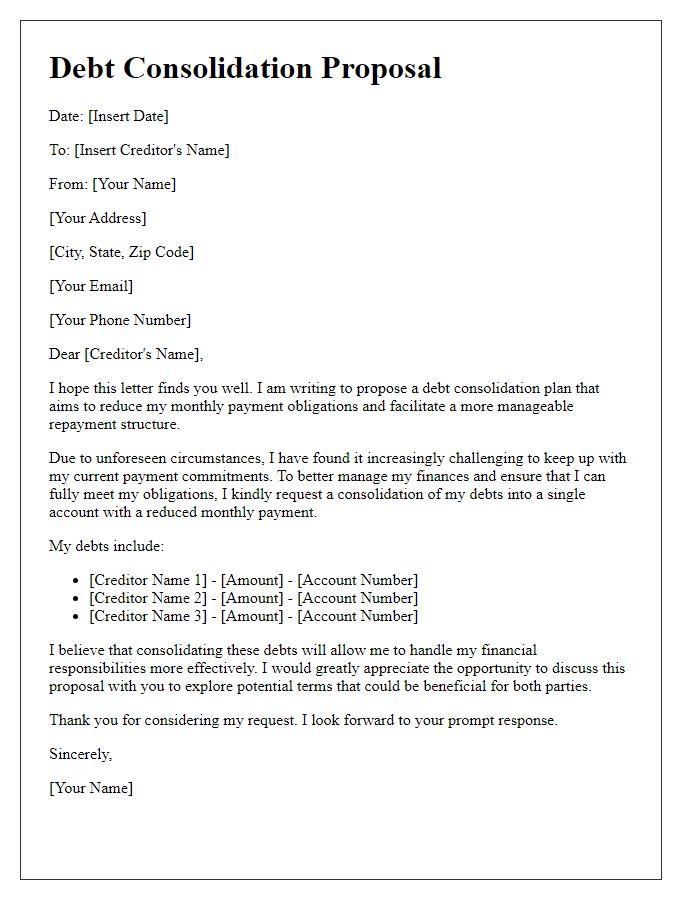

Letter template of debt consolidation proposal to reduce monthly payments.

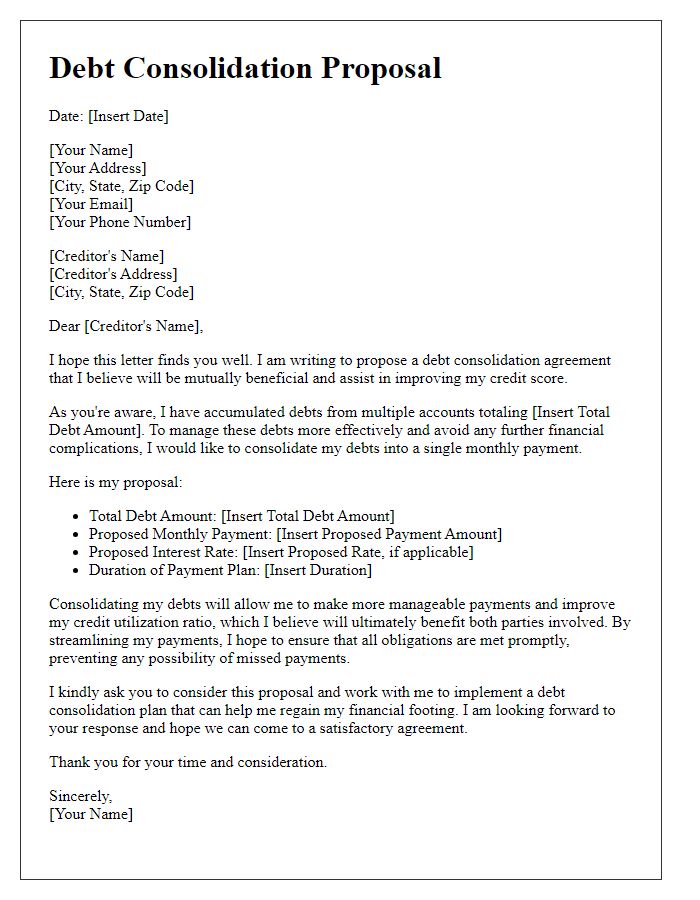

Letter template of debt consolidation proposal aimed at improving credit scores.

Letter template of debt consolidation proposal for simplifying repayment processes.

Letter template of debt consolidation proposal to avoid bankruptcy risks.

Letter template of debt consolidation proposal for creating a fixed payment plan.

Letter template of debt consolidation proposal seeking lower interest rates.

Letter template of debt consolidation proposal for debt relief and financial wellness.

Letter template of debt consolidation proposal to negotiate with creditors.

Comments