Are you feeling overwhelmed by your debt and unsure of how to tackle it? A partial debt payment agreement can be a great option to help you manage your financial obligations in a more manageable way. This approach allows for a structured plan that can ease your burden while still working towards a resolution. If you want to learn more about how to create a partial debt payment agreement, keep reading!

Creditor and debtor information

A partial debt payment agreement is a legally binding document outlining the terms between a creditor (the lender or service provider owed money) and a debtor (the individual or entity responsible for the debt). The agreement typically includes essential details such as the creditor's name and contact information, including address and phone number, alongside the debtor's name, address, and identification number if applicable. The agreed-upon amount for partial payment is specified, alongside the remaining balance. Additionally, it may detail the payment schedule, including due dates and accepted payment methods, and outline consequences for missed payments. The document may also need signatures from both parties, ensuring acknowledgment and acceptance of the terms outlined within the agreement.

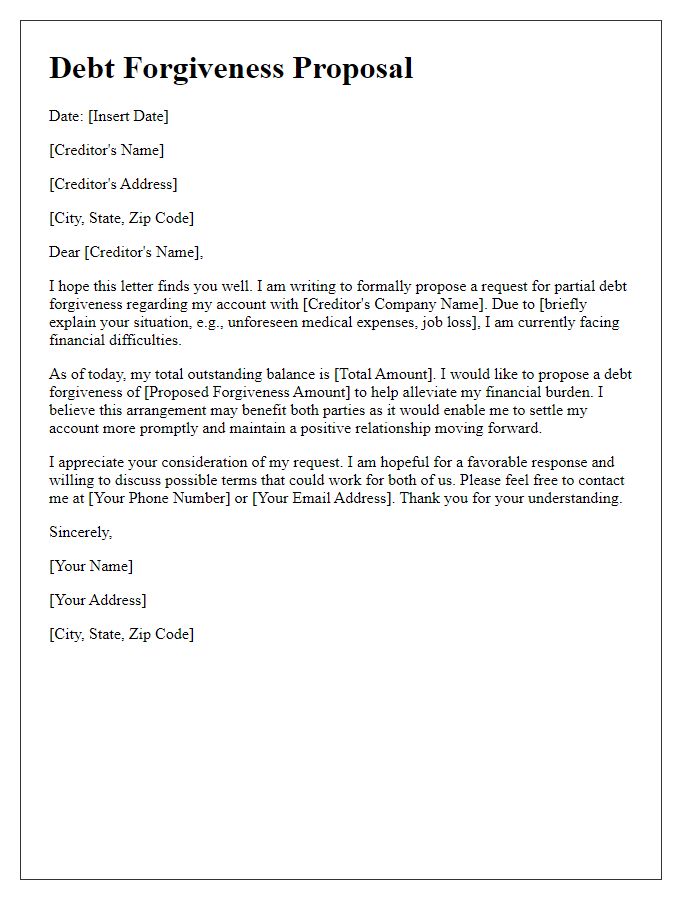

Amount owed and payment terms

A partial debt payment agreement outlines the terms under which a debtor agrees to pay a portion of the total debt owed to a creditor. The agreement specifies the total amount owed, such as $10,000, and details the negotiated payment amount, for instance, $4,000, that will be paid immediately, with the remaining balance scheduled for payment over the following six months. The payment schedule may include specific dates, such as monthly installments of $1,000, and may set conditions on the remaining balance, which could incur interest or require updates on the debtor's financial status. Notably, the agreement often reinforces the importance of both parties' signatures to formalize the commitment, ensuring legal and financial accountability.

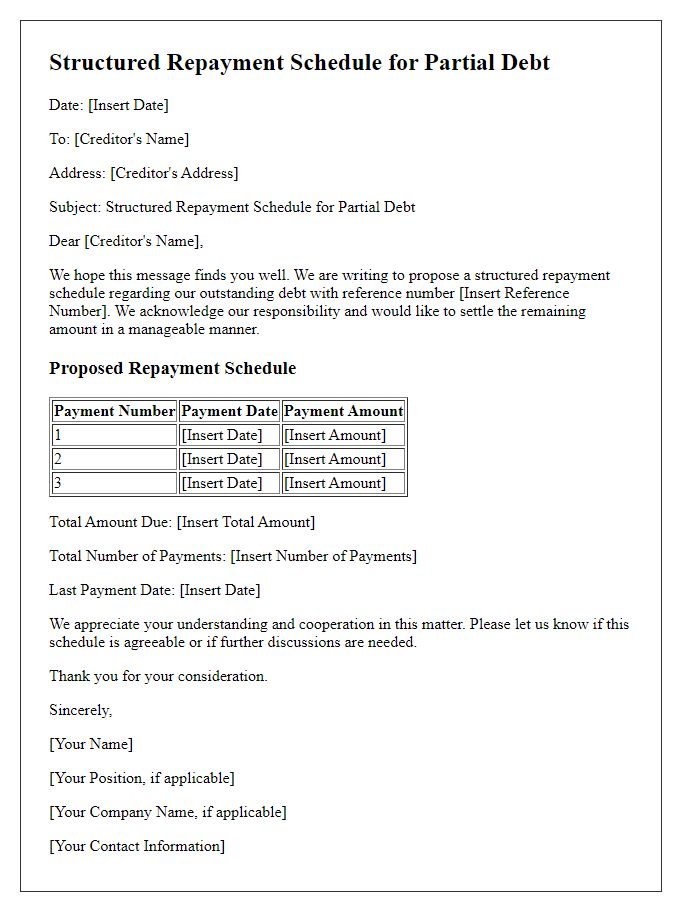

New payment schedule

A partial debt payment agreement can establish a new payment schedule for outstanding debts owed. This agreement typically outlines the total amount owed, the agreed-upon payment amount, and specific due dates for each installment. For example, if a debtor owes $5,000 and agrees to pay $500 monthly, the repayment plan spans ten months. Key elements of the agreement should include the names and contact information of both parties involved, the conditions under which the agreement can be modified, and potential penalties for missed payments. Jurisdiction, often specified as the relevant state or country where the agreement is enforced, is crucial to resolve any disputes regarding this financial arrangement.

Consequences of default

Defaulting on a partial debt payment agreement can lead to significant financial and legal repercussions. Creditors may impose late fees, increasing the total amount owed by substantial percentages, often ranging from 5% to 15% of the overdue balance. Failure to meet payment deadlines can also result in a negative impact on credit scores, which may drop by 100 points or more, affecting future borrowing opportunities. Legal action may be taken by creditors, including filing lawsuits or initiating collections, potentially leading to wage garnishment or liens on property. Additionally, the opportunity for further negotiation or settlement may diminish, resulting in less favorable repayment terms in the future. The original contract may reinstate terms that enable full enforcement of the debt, while escalating collection efforts can increase stress and financial burden.

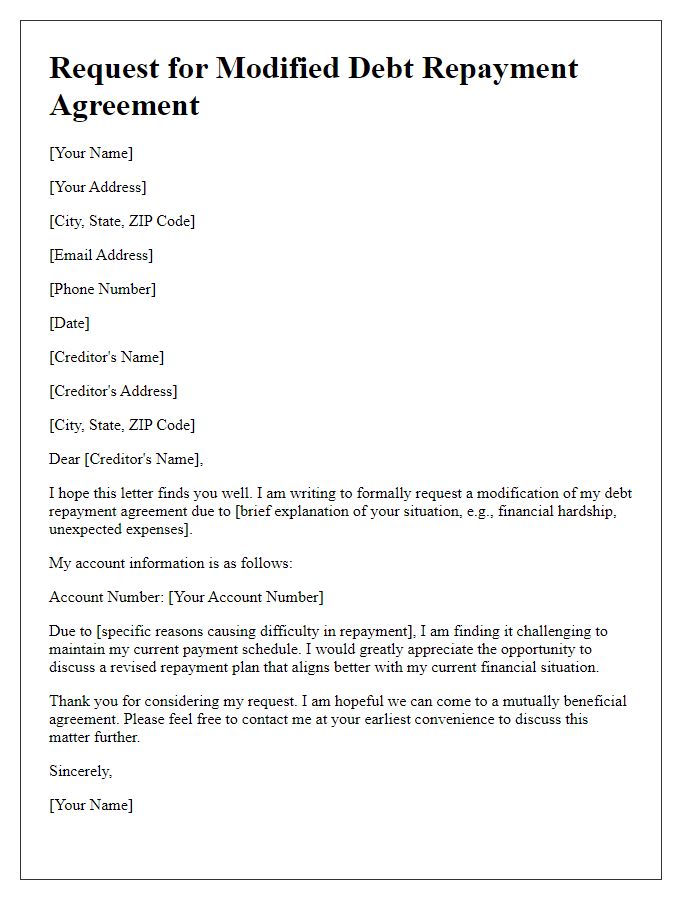

Signature lines and date

A partial debt payment agreement outlines the terms under which a debtor will make partial payments towards their outstanding debt. This document should include details such as the debtor's name, the creditor's name, the total amount of debt, the agreed partial payment amount, and the payment schedule (such as weekly, monthly, or bi-weekly). Additionally, it is essential to include a clause addressing any potential penalties for missed payments or failure to adhere to the agreement. Signature lines for both parties, indicating their consent to the terms, as well as the date the agreement is signed, formalize the document and create a binding commitment to the outlined payment plan.

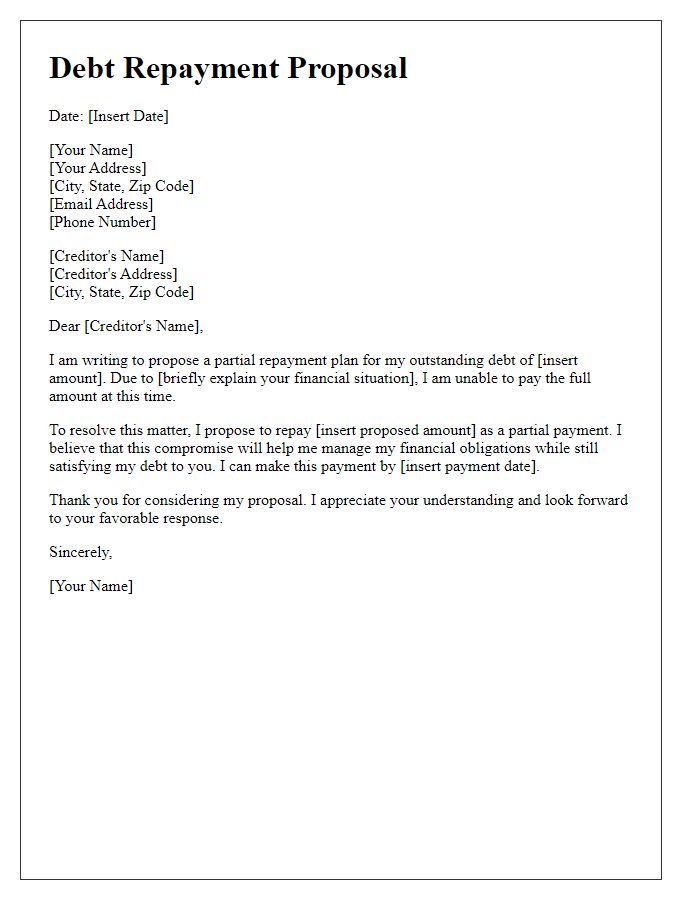

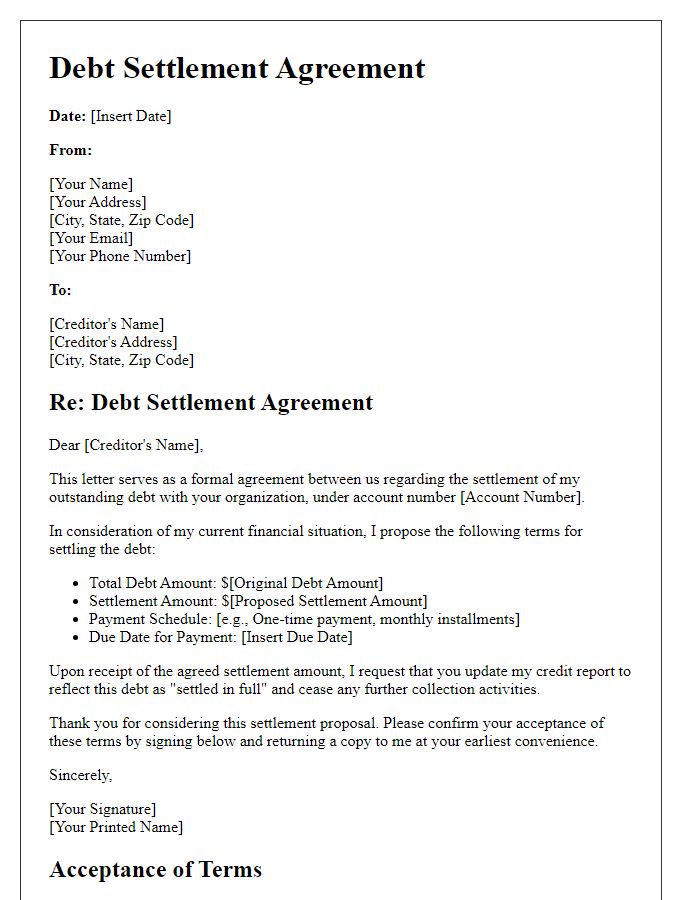

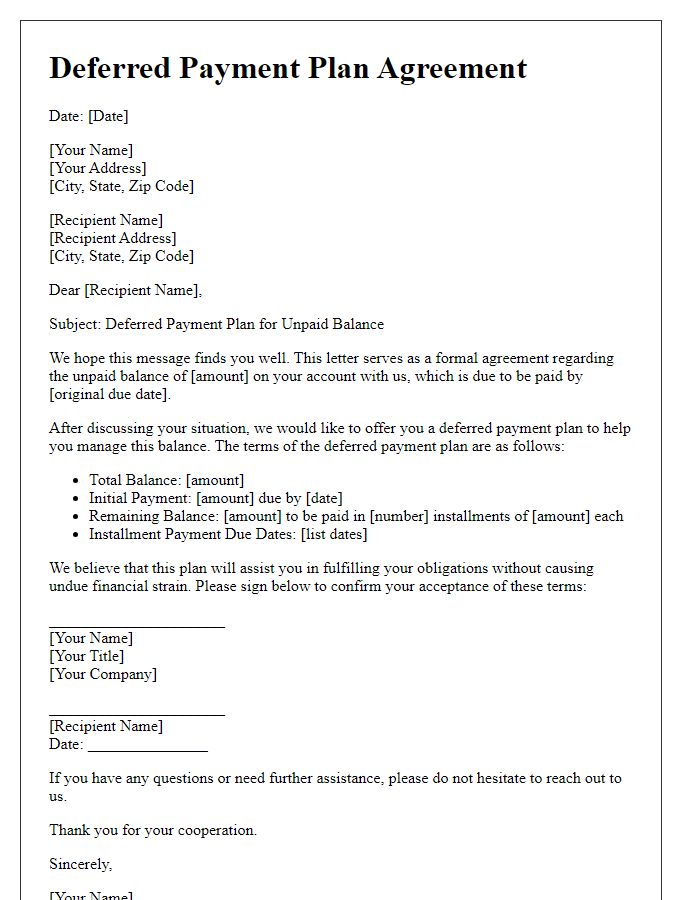

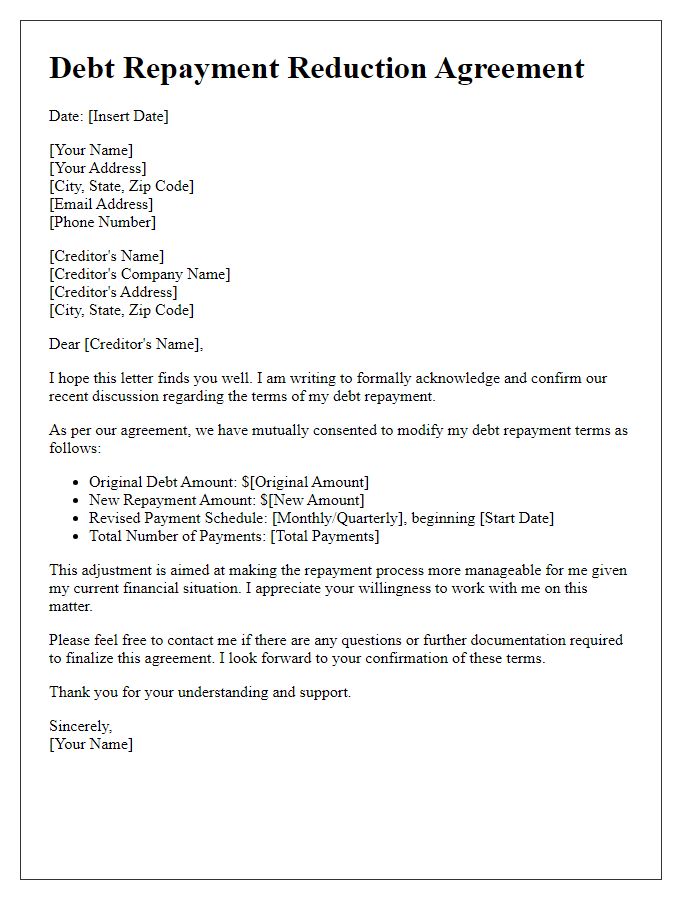

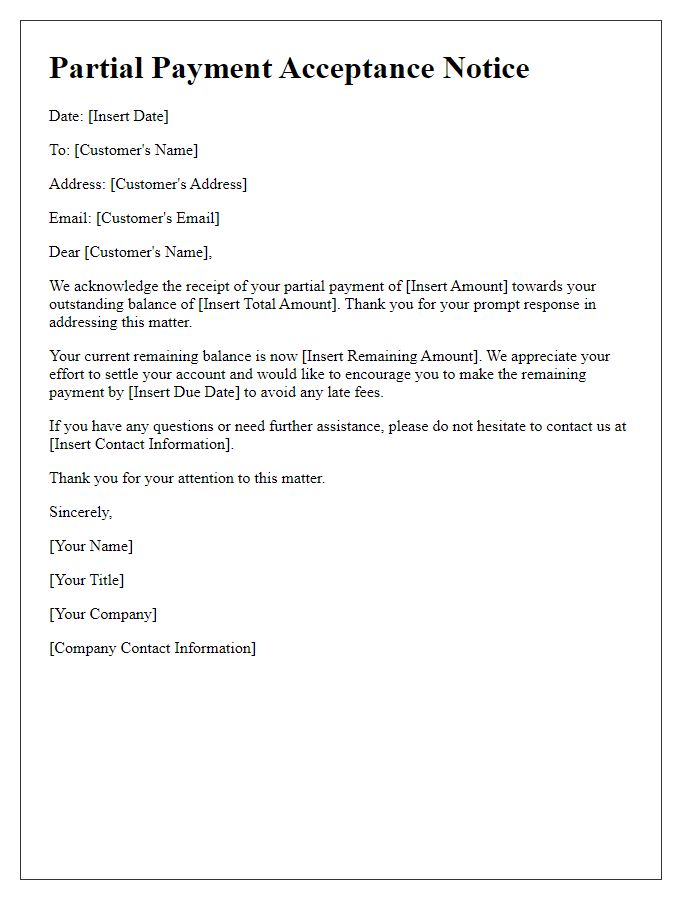

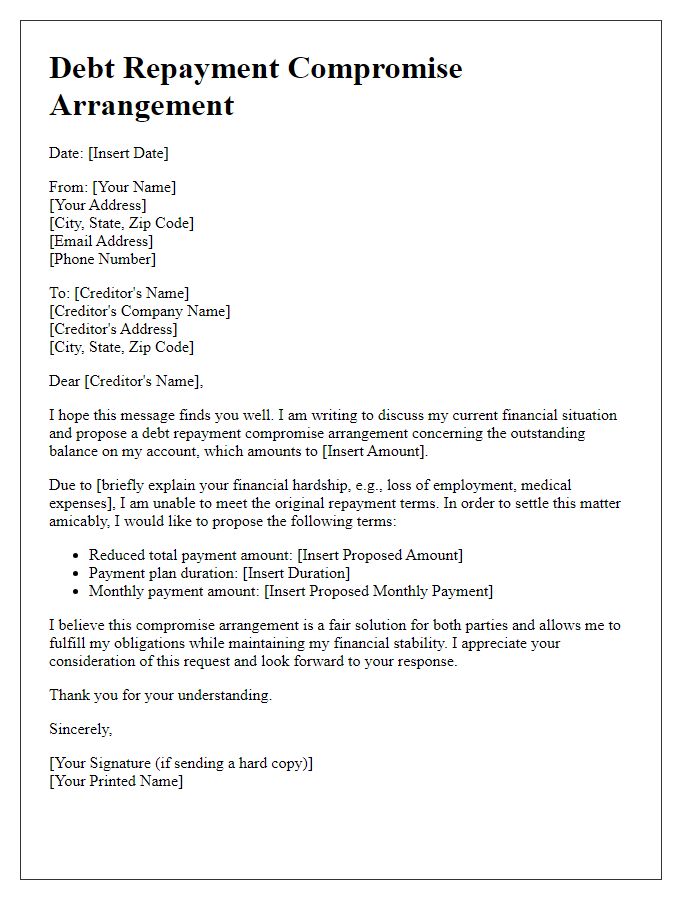

Letter Template For Partial Debt Payment Agreement Samples

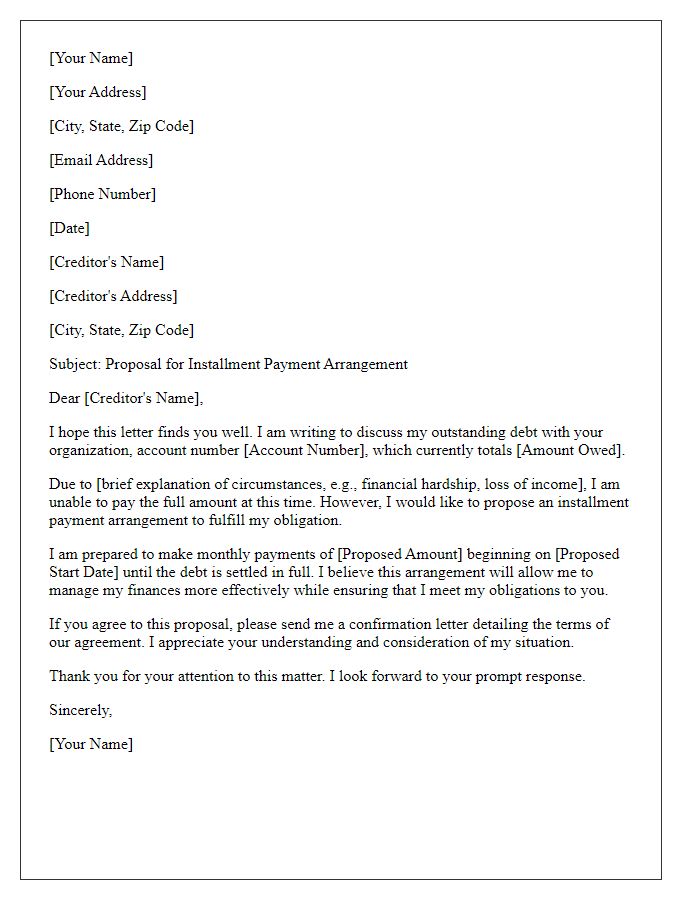

Letter template of installment payment arrangement for outstanding debt.

Comments