Are you feeling overwhelmed by debt and unsure of where to turn? You're not alone, and there is a path forward that can help you regain control of your finances. In this article, we'll explore a receiver-oriented debt strategy, focusing on practical steps that put you in the driver's seat of your financial future. So, let's dive in and discover the options that await you!

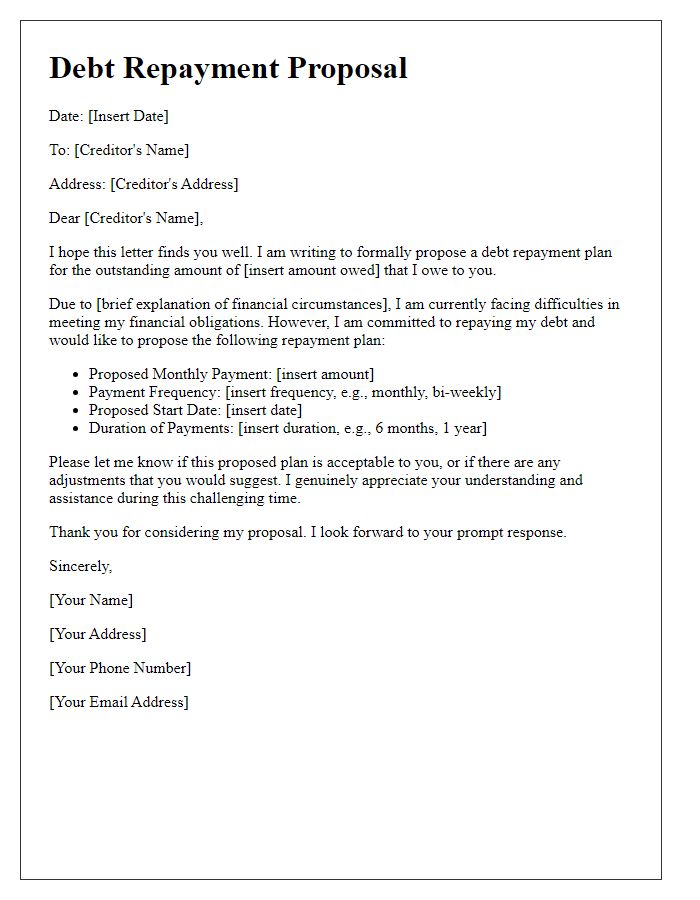

Personalized Salutation

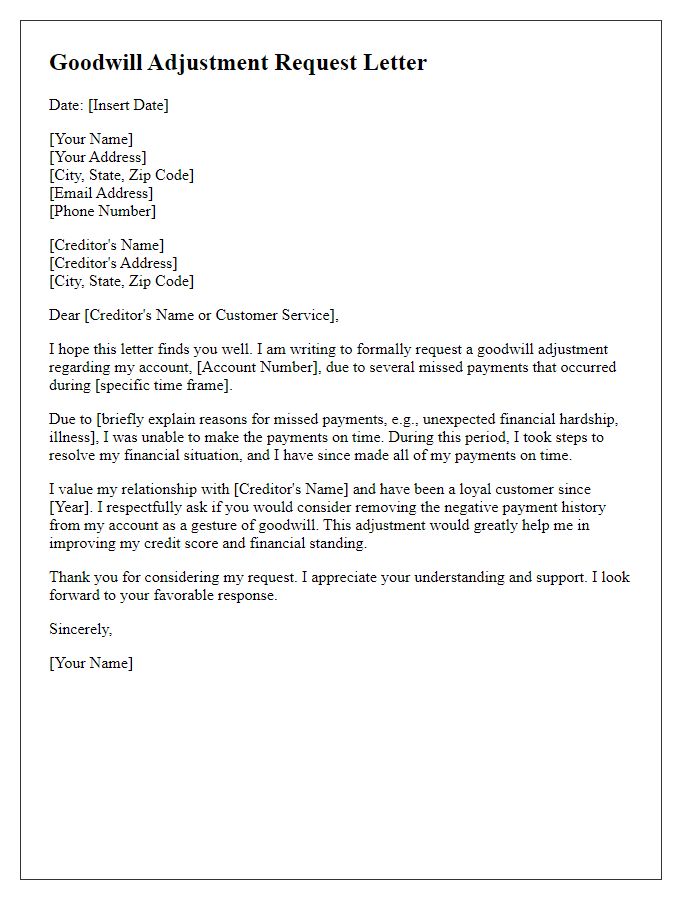

A receiver-oriented debt strategy emphasizes personalized communication to enhance engagement and improve the response rate. A personalized salutation is important, as it establishes a connection between the sender and the recipient. Utilizing the recipient's name, such as "Dear John," or addressing them by title and last name, like "Dear Mr. Smith," creates a sense of recognition. The inclusion of additional details, such as a reference to a previous interaction or mutual contact, can further personalize the approach. This tailored method fosters a positive atmosphere for discussions about outstanding debts, encouraging cooperation and understanding while mitigating potential conflict.

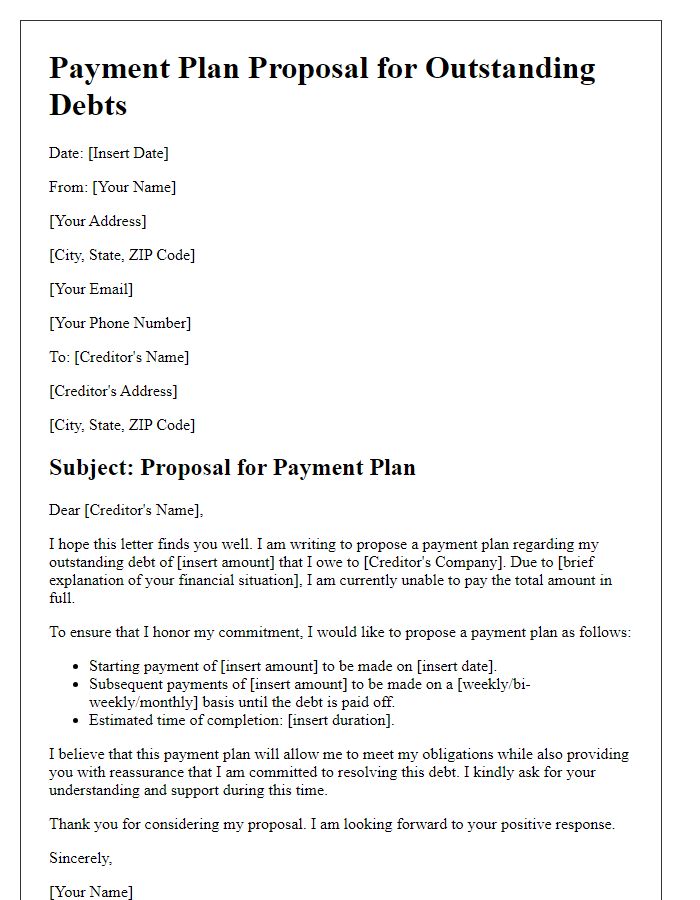

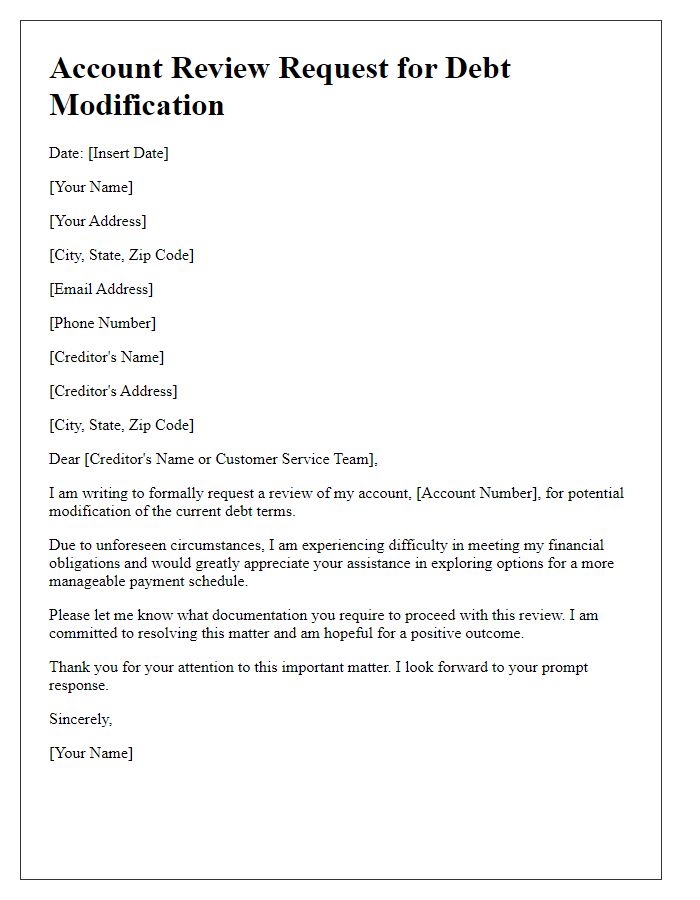

Clear Debt Overview

A comprehensive debt overview outlines an individual's financial obligations, including total amounts owed and specific creditors. This overview typically features categorization by debt type, such as credit card debt, student loans, and medical bills. The total debt amount often ranges in the thousands, with interest rates varying significantly, often between 5% to 25%. Each creditor, including notable entities like American Express and Sallie Mae, may have differing payment structures, influencing monthly budget allocations. An effective debt overview also incorporates due dates for each payment, essential for avoiding late fees and maintaining credit scores, often considered crucial for future financial decisions, such as purchasing a home or securing a loan.

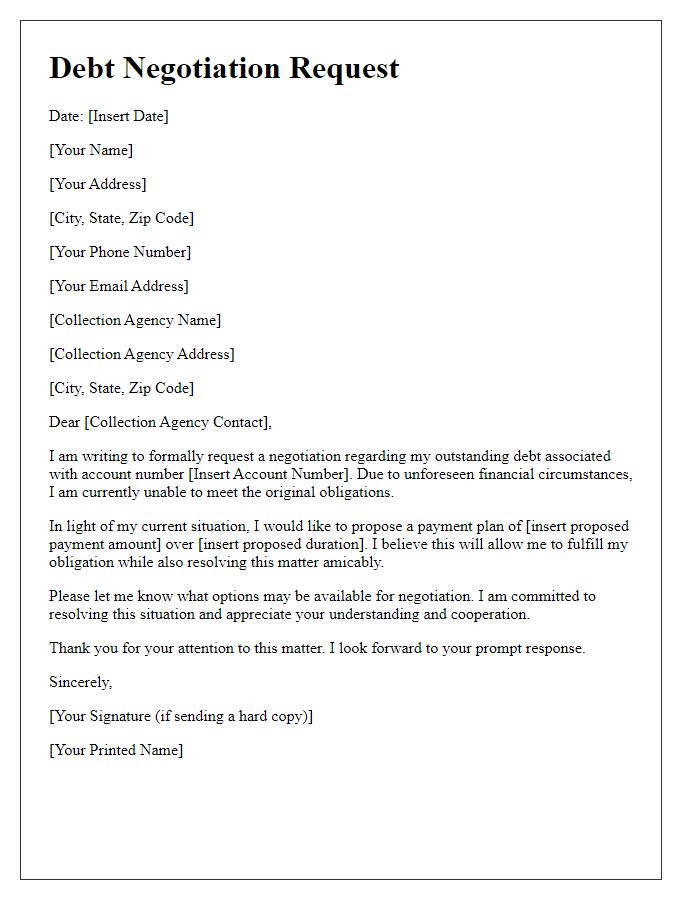

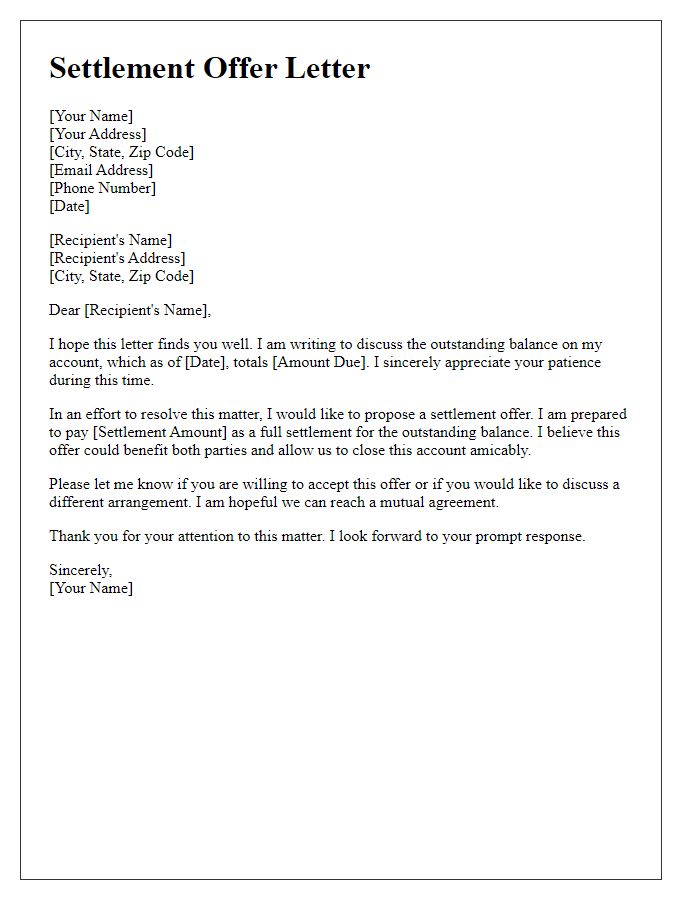

Negotiation Terms

Debt negotiation strategies focus on achieving favorable terms for both parties involved in financial discussions. Key concepts include settlement amounts, which may be a reduced payment, typically 30-60% lower than the original debt. Timeframes for payment plans play a crucial role, with options often ranging from 6 to 24 months. Interest rates may be renegotiated, aiming for significantly lower annual percentages, potentially under 10% for installment agreements. Locations such as local credit unions or mediation centers can provide support, offering guidance and resources for negotiating terms. Understanding the debtor's financial situation, including income levels and expense ratios, is essential for creating realistic repayment plans that address specific needs while protecting creditors' interests.

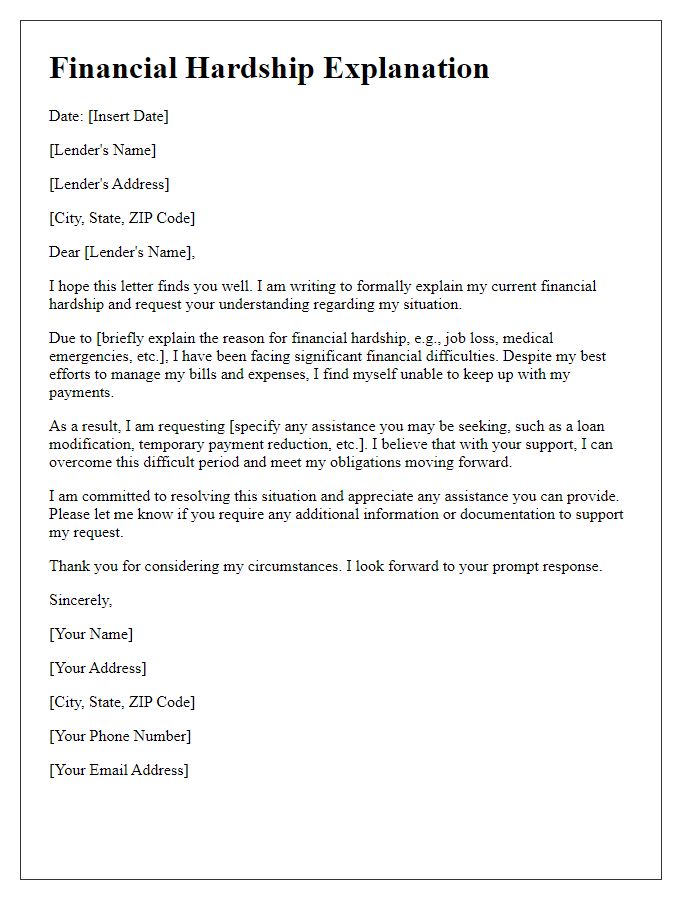

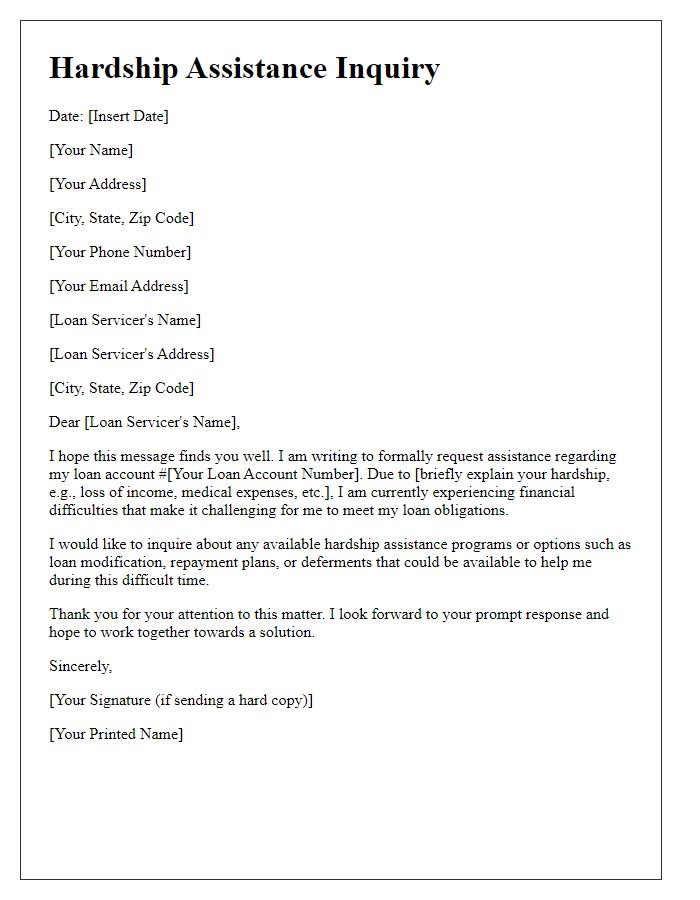

Support Contact Information

A receiver-oriented debt strategy focuses on effective communication and support for individuals managing financial obligations. Essential contact information includes helplines for financial counseling, legal aid organizations, and local government offices offering assistance programs. Providing specific numbers to established non-profit agencies, such as the National Foundation for Credit Counseling (NFCC) at 1-800-388-2227, ensures immediate access to trained financial professionals who can guide individuals through the complexities of debt management. Additionally, local resources may include community banks or credit unions providing financial literacy workshops and one-on-one consultations aimed at improving personal finance management skills. Clear and accessible support enhances the likelihood of successful debt resolution and financial stability.

Positive Tone and Encouragement

Effective debt management strategies can provide individuals with a path toward financial stability and empowerment. Personalized debt repayment plans, such as those recommended by financial advisors, can help prioritize high-interest debt, allowing individuals to focus on settling overdue accounts. Establishing a budget that considers living expenses, such as rent or mortgage payments, can help allocate funds efficiently each month. Furthermore, seeking assistance from reputable nonprofit credit counseling organizations, including the National Foundation for Credit Counseling (NFCC), can provide invaluable resources and guidance tailored to personal financial situations. Individuals can also benefit from the potential relief of exploring debt consolidation options through low-interest loans, which can simplify repayment and lower monthly payments. Celebrating small victories along the journey, such as paying off one debt, reinforces positive behavior and fosters a sense of control over their financial future.

Comments