Are you feeling overwhelmed by a debt dispute and unsure of how to address it? Navigating financial disputes can be a daunting experience, but having the right tools can make all the difference. In this article, we'll explore an effective letter template you can use when your debt is under investigation, helping you communicate clearly and assertively. So, grab a cup of coffee and let's dive in to find the best way to tackle your financial concerns!

Debtor's Personal Information

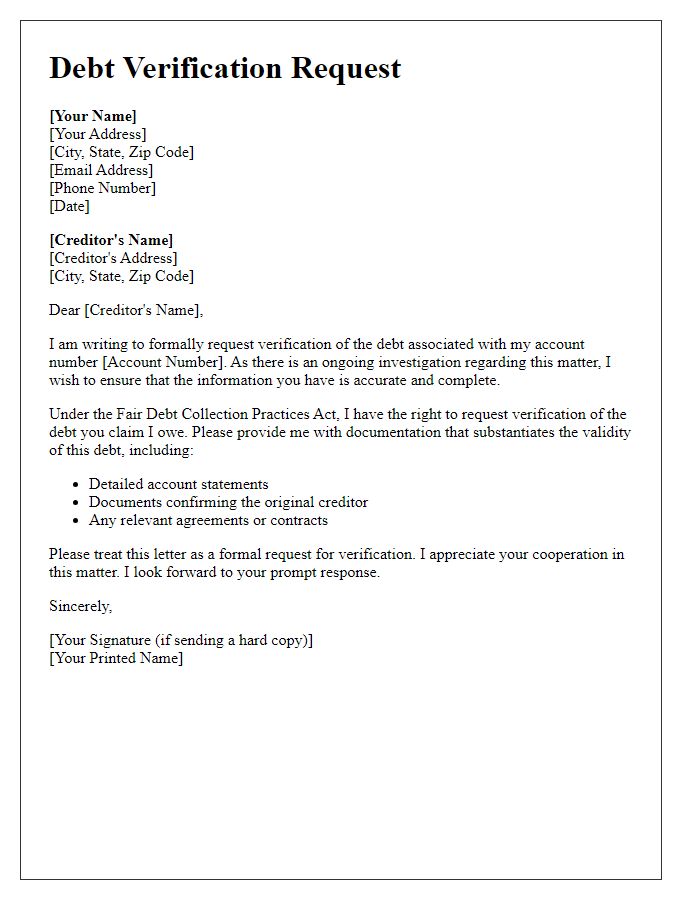

Submitting a debt dispute under investigation requires precise identification of the debtor's personal information. Essential details include the full name of the debtor (individuals' names), social security number (typically a nine-digit number used in the United States for identification), and contact information (address including city and state, phone number, and email). Additionally, it's vital to state the account number associated with the disputed debt (unique identifier provided by the creditor), the name of the creditor or collection agency (entities involved in the collection process), and any relevant dates (such as the date when the debt was last active or the date of the dispute). Accurate and complete personal information is crucial for the prompt and effective resolution of the dispute.

Detailed Account and Debt Information

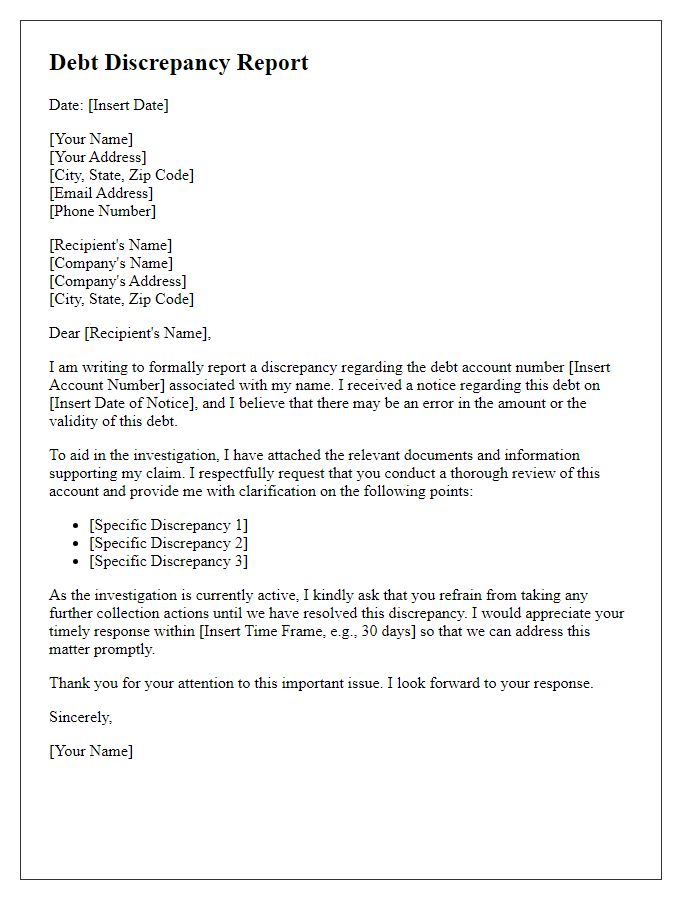

A detailed account dispute regarding potential discrepancies in outstanding debts is crucial for resolving financial matters effectively. The account under investigation, identified by the number 123456789, shows an alleged debt of $2,500 attributed to XYZ Credit Corporation, recorded in April 2023. The entry indicates a missed payment in March 2023; however, the associated bank statements from January 2023 to March 2023 reveal timely payments made on the 15th of each month. The noted address for correspondence, 456 Elm Street, Springfield, is also under review, as recent correspondence was incorrectly sent to a previous residence. This situation raises questions about the accuracy of the reported debt and necessitates a thorough examination of payment history, creditor records, and applicable consumer protection laws, including the Fair Debt Collection Practices Act of 1977, to ensure fair treatment and resolution.

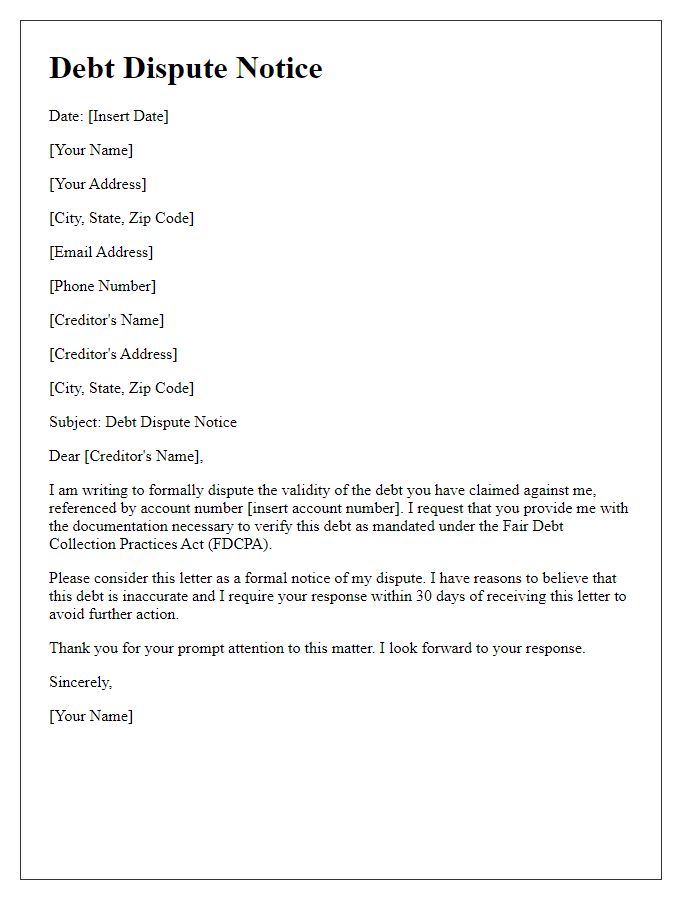

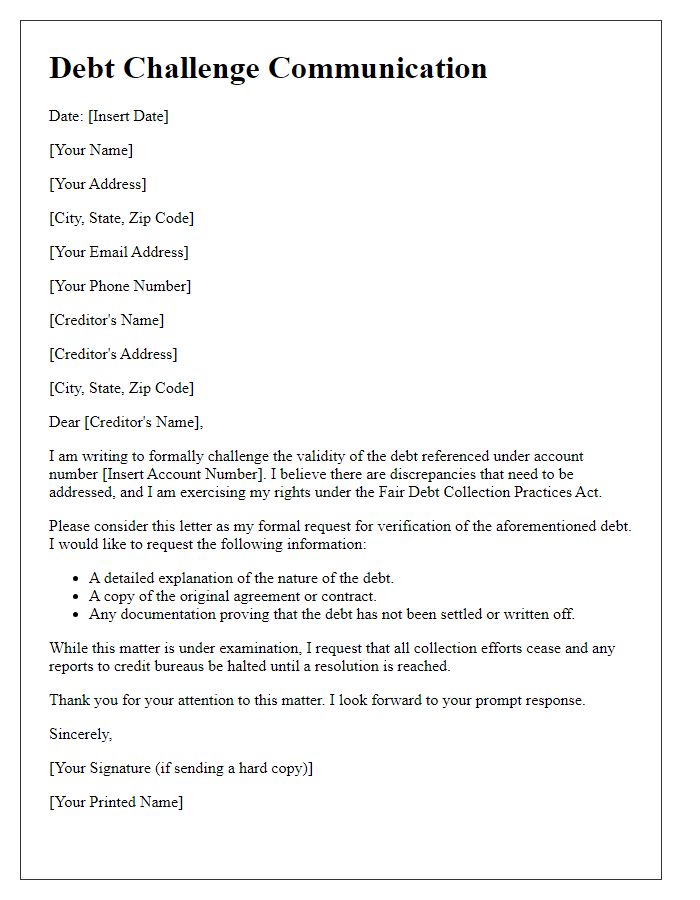

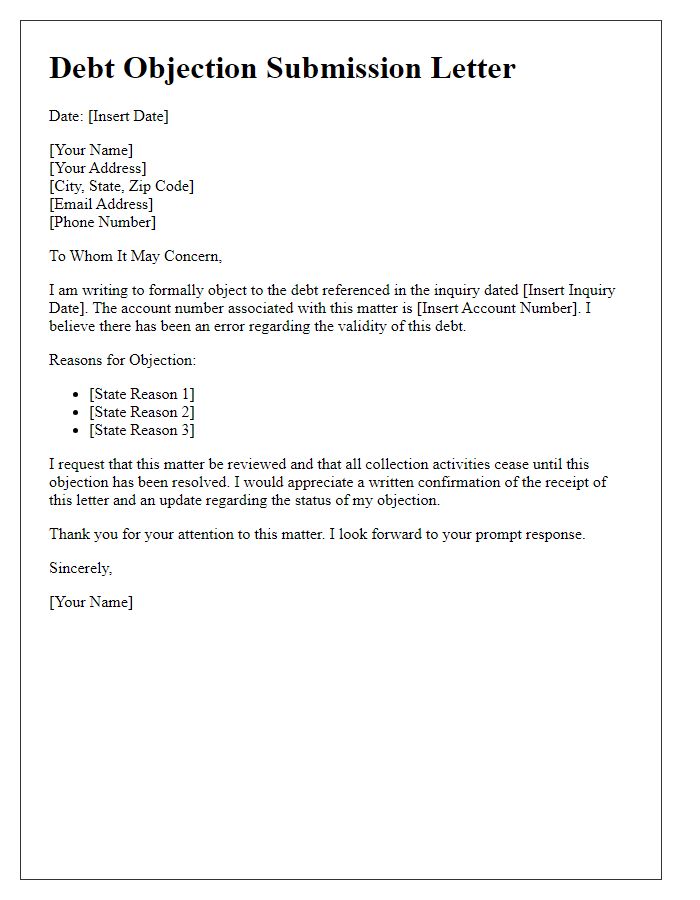

Specific Dispute Reasons

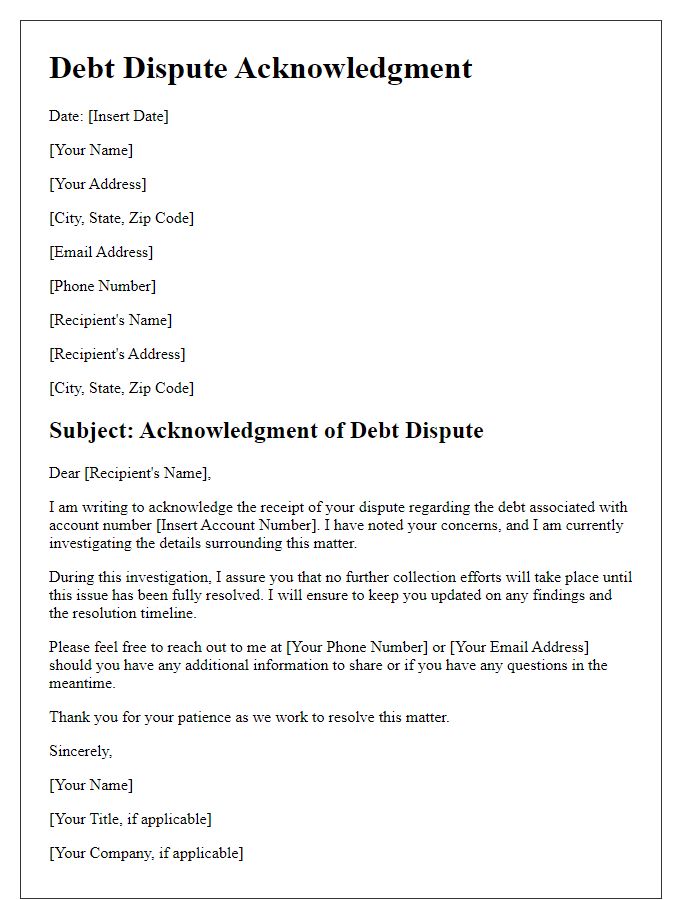

Debt disputes often arise due to inaccuracies in account details, such as erroneous balances, incorrect transaction records, or unrecognized charges. Investigations into disputed debts typically involve verifying the legitimacy of the debt, which may include a thorough review of associated documentation, payment history, and communication logs. Common specific reasons for disputes include identity theft, where a borrower is wrongly held accountable for debts incurred by another person, billing errors that result in inflated balances, or failure to apply payments correctly. Respondents, such as collection agencies or creditors, must adhere to legal frameworks like the Fair Debt Collection Practices Act (FDCPA) to ensure proper handling of disputed accounts. The resolution process could involve formal investigations, possible litigation, and communication with credit reporting agencies to rectify inaccuracies affecting credit scores.

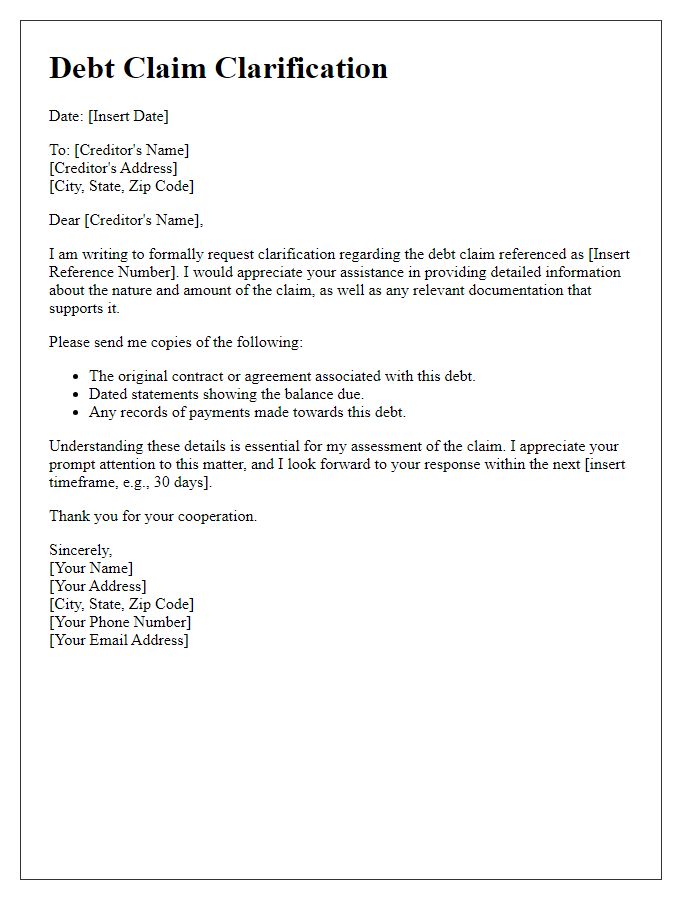

Supporting Documentation and Evidence

Submitting documentation that supports a debt dispute involves presenting relevant evidence, such as account statements, correspondence with creditors, and payment records. These pieces of evidence are crucial for validating claims during investigations into inaccuracies or identity theft. For example, providing details from the Fair Credit Reporting Act, which empowers consumers to challenge erroneous information, can strengthen arguments. Including certified letters from creditors, stamped with postal service tracking, can establish a timeline of communication. Additionally, attaching identity verification documents, like a passport or utility bill, can corroborate personal information and enhance credibility in the dispute resolution process.

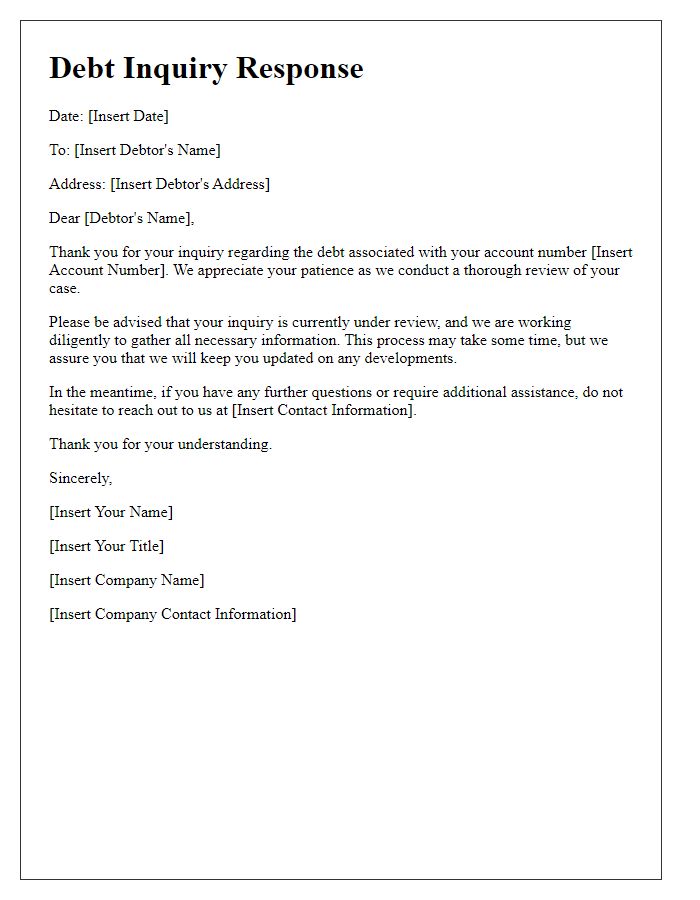

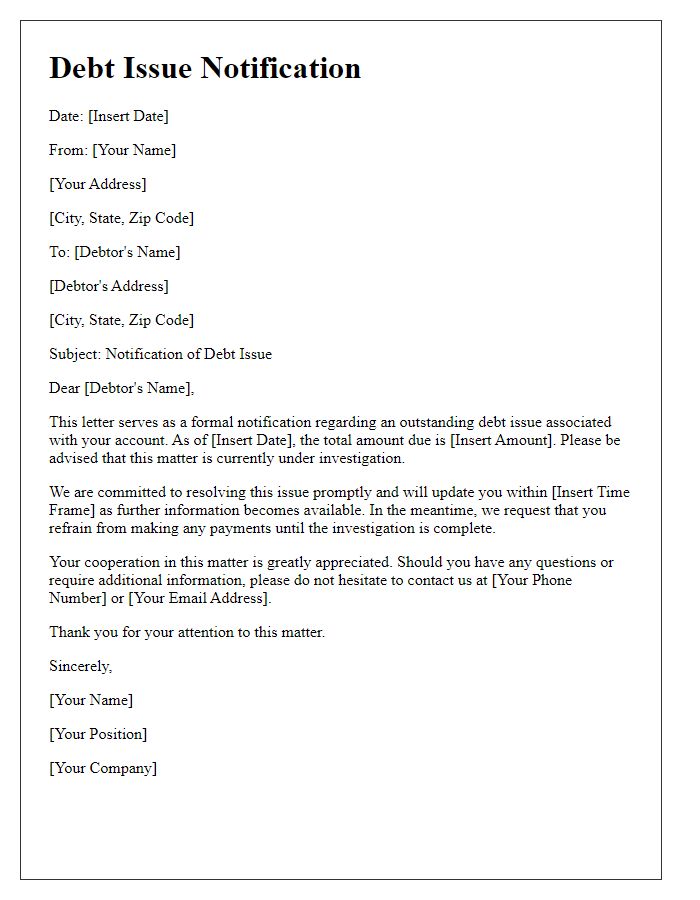

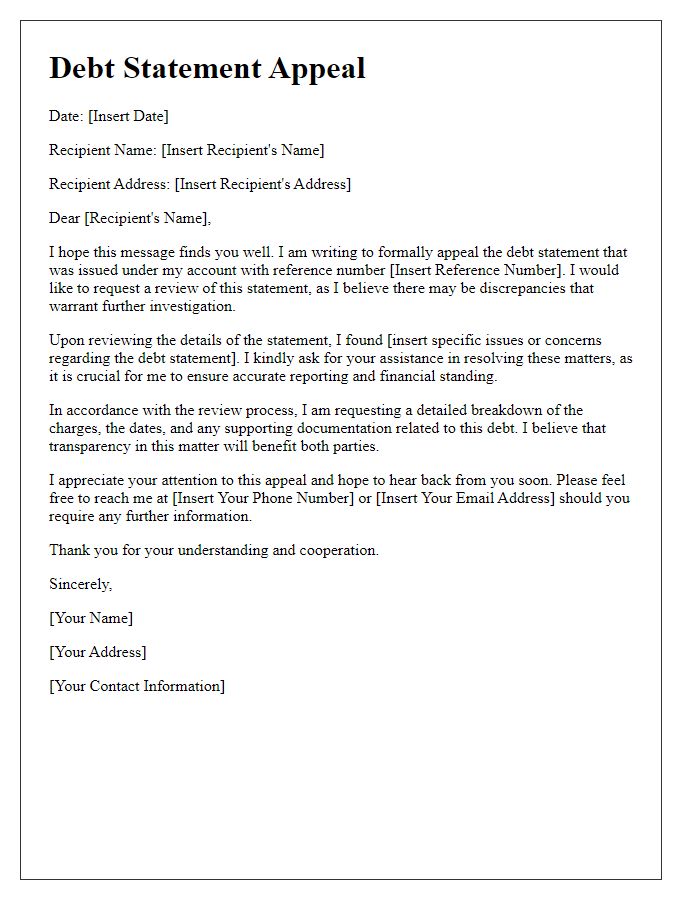

Request for Written Verification and Resolution

Standard procedures in debt collection often require consumers to formally dispute inaccuracies within their accounts. Initiating a request for written verification of a debt, as stated under the Fair Debt Collection Practices Act (FDCPA), is vital for protecting one's rights. Documentation should include relevant details such as the account number, creditor name, and specific amounts owed. It is essential to phrase the dispute clearly, citing any discrepancies like incorrect balances or unrecognized charges. Providing a deadline of 30 days for the collection agency to respond ensures adherence to timelines specified in consumer protection laws. Maintaining copies of all correspondence, including certified mail receipts, serves as crucial evidence should further legal action be necessary.

Letter Template For Debt Dispute Under Investigation Samples

Letter template of debt verification request amidst ongoing investigation

Letter template of debt discrepancy report while investigation is active

Comments