In today's world, navigating debt collection can feel overwhelming, but understanding your rights is the first step toward regaining control. A cease and desist letter is a powerful tool that empowers you to halt any unwanted communication from debt collectors. By clearly stating your wishes, you assert your position and can potentially alleviate some stress from the collection process. Ready to learn how to craft an effective cease and desist letter? Let's dive in!

Clear identification of the debtor and creditor

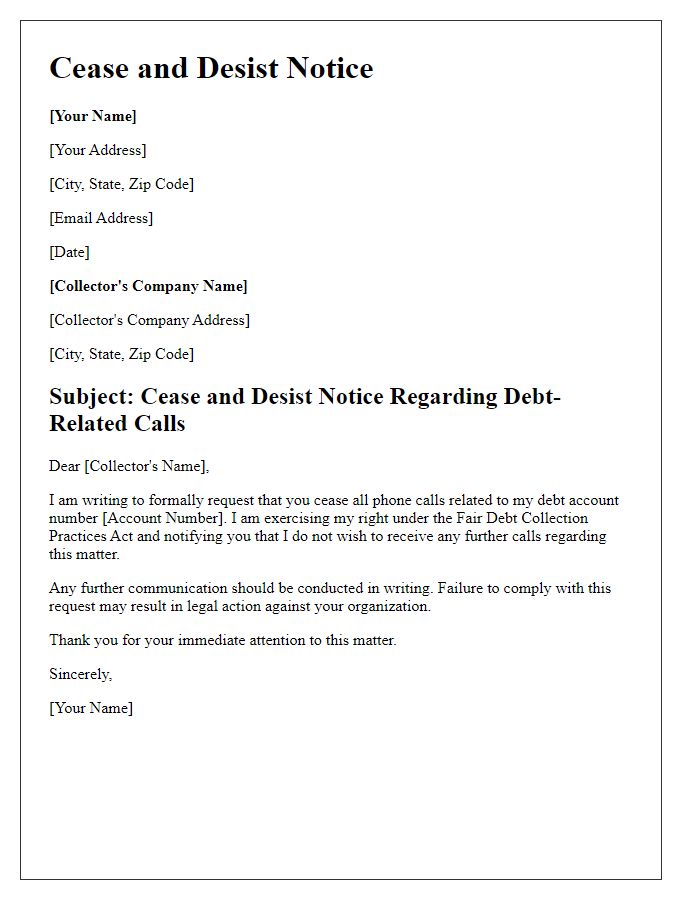

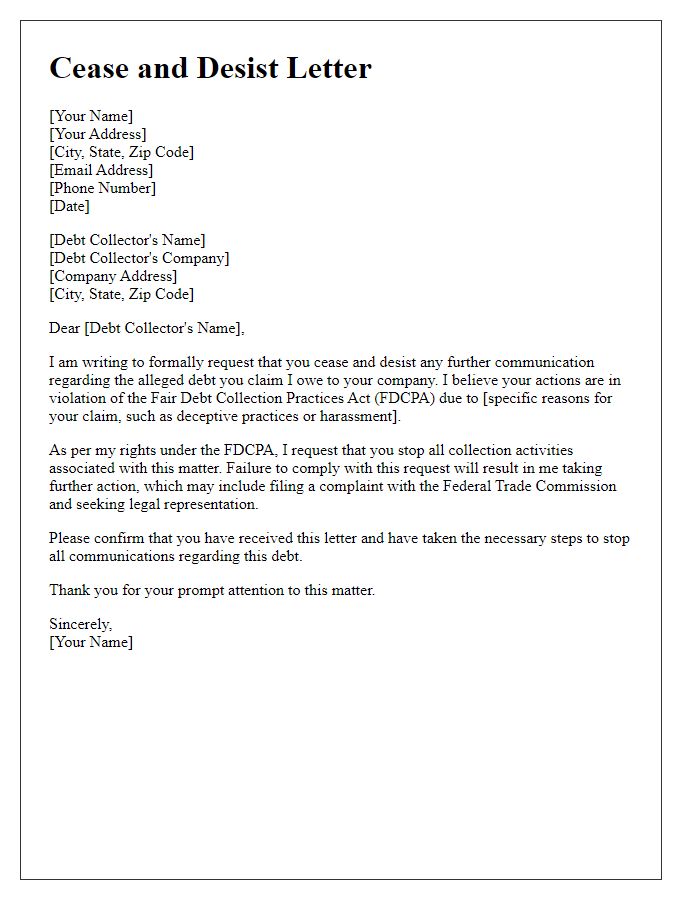

A cease and desist letter regarding debt collection serves as a formal request to cease communication regarding a specific debt. Essential details include identification of the debtor (individual's name, address, account number) and the creditor (lender's name, organization, contact information). The letter typically mentions relevant law codes, such as the Fair Debt Collection Practices Act (FDCPA) in the United States, which protects debtors from abusive collection practices. Including a clear statement of the debtor's request to stop all collection activities is crucial. Additionally, specifying any further actions taken, such as potential litigation, may reinforce the seriousness of the request. Documenting communication history provides context for the severity of the situation, highlighting previous contact and interactions with the creditor or collection agency.

Specific reference to the alleged debt

Cease and desist letters serve as a formal request to halt further communication regarding a specific alleged debt. Such letters may reference the exact amount, date of initial collection attempts, and the original creditor's name. Clear identification of the alleged debt minimizes confusion, as does stating applicable laws, such as the Fair Debt Collection Practices Act (FDCPA) in the United States, which protects consumers against abusive debt collection practices. A cease and desist letter can also specify preferred methods of communication, while emphasizing the consumer's rights in disputing the debt through proper channels. Such communication must be sent via certified mail to ensure receipt, and retaining a copy serves as a record of the consumer's formal request.

Explicit demand to cease contact or collection activities

Cease and desist communications are formal requests directed at debt collectors to stop all forms of contact regarding an alleged debt. These letters often include specific details about the debt, such as the account number (which may be assigned by the collection agency), the name of the creditor (the entity that initially lent money), and any relevant dates (like the date the debt became overdue). It is imperative to include a request that the collector acknowledges the cessation of all communication as required by the Fair Debt Collection Practices Act (FDCPA), which outlines the legal protections consumers possess against harassment. Furthermore, asserting that the debt is disputed or requesting verification can add significant weight to the letter. Proper documentation of all correspondence, including return receipts, serves as vital evidence should the situation escalate into a legal dispute.

Reference to legal rights under relevant laws

Cease and desist letters on debt collection assert legal rights against aggressive collection practices. The Fair Debt Collection Practices Act (FDCPA) of 1977 outlines the consumer's rights, providing protection against harassment and misleading tactics used by debt collectors. Legal compliance requires that the debt collector cease communication upon the consumer's request. The letter serves to document the consumer's right to dispute the debt and to receive validation of the claim. It is essential to indicate clear information such as the original creditor's name, the amount owed, and any relevant account identification numbers to ensure clarity. Additionally, state-specific laws may provide further rights, highlighting the importance of local regulations in the consumer's defense.

Contact information for any further legitimate inquiries

A cease and desist letter aimed at stopping debt collection practices should include clear details like the sender's contact information, the reason for the communication, and relevant laws applicable in the jurisdiction. This letter must address specific entities involved, such as debt collection agencies or individual collectors. Providing accurate contact information for legitimate inquiries can facilitate proper and legal communications. Ensure all correspondence adheres to the Fair Debt Collection Practices Act, which safeguards consumers against harassment. Include specific details like account numbers or previous communication dates to substantiate the request effectively, ensuring all claims are well-documented for any future disputes.

Letter Template For Cease And Desist Debt Collection Samples

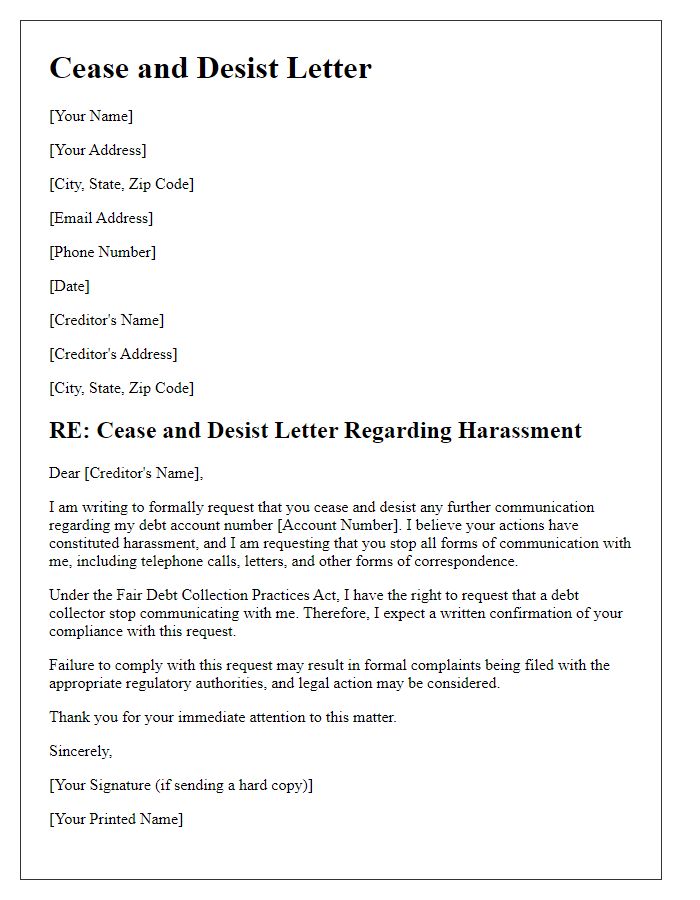

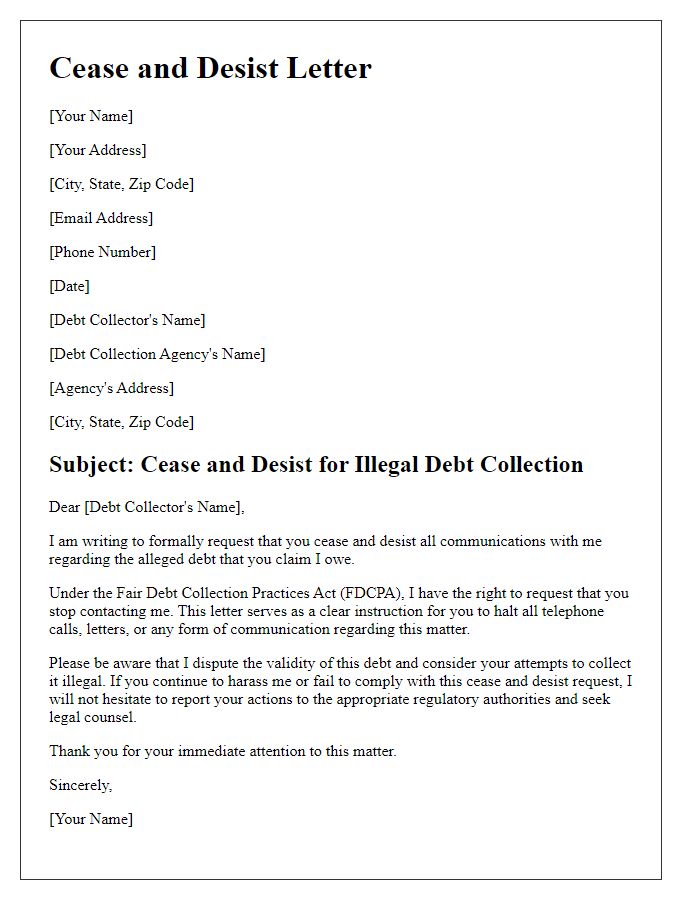

Letter template of cease and desist communication regarding debt harassment.

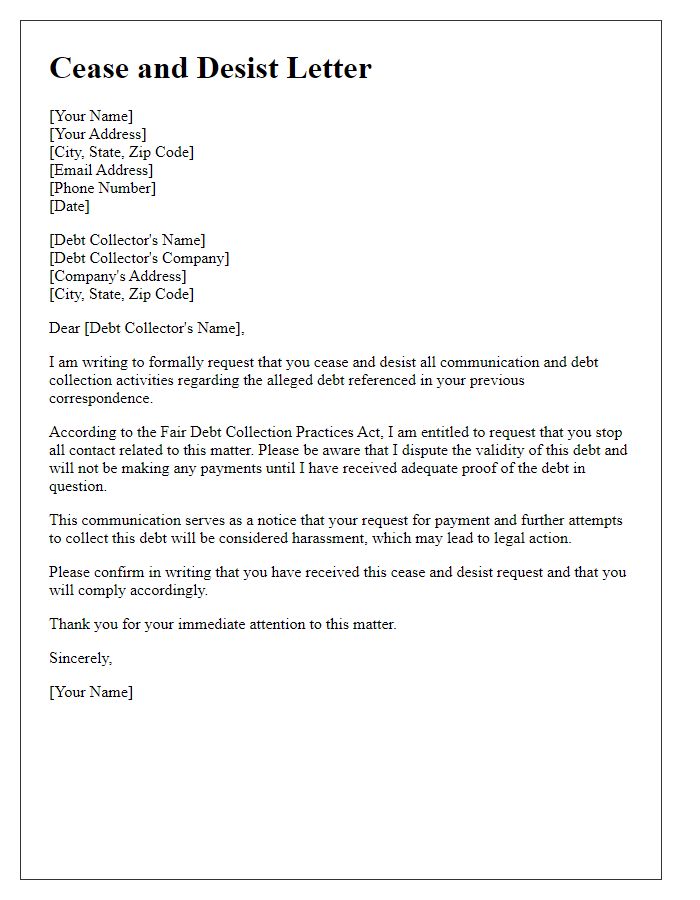

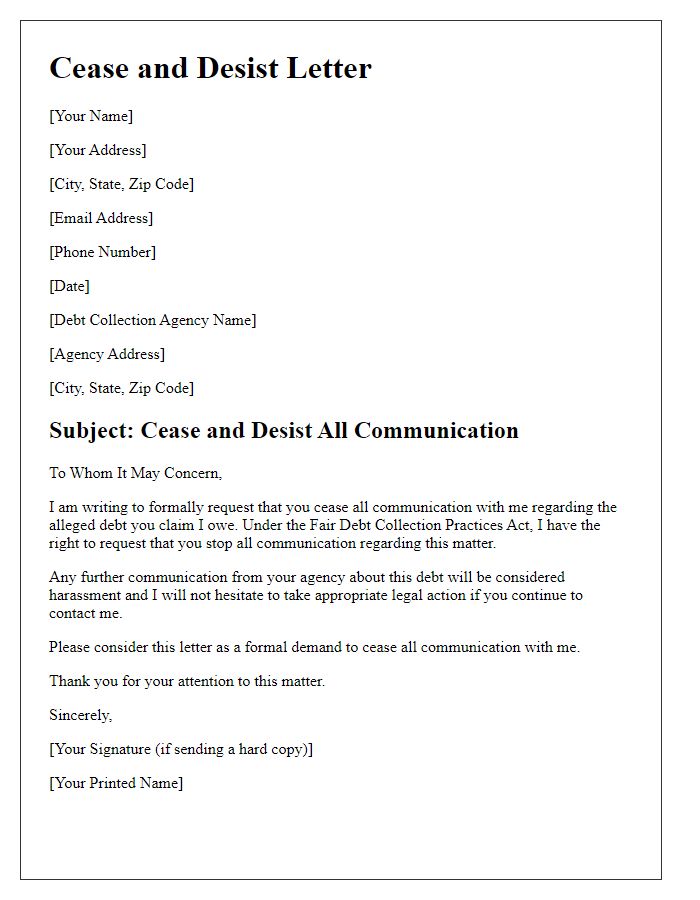

Letter template of immediate cease and desist for unauthorized debt collection.

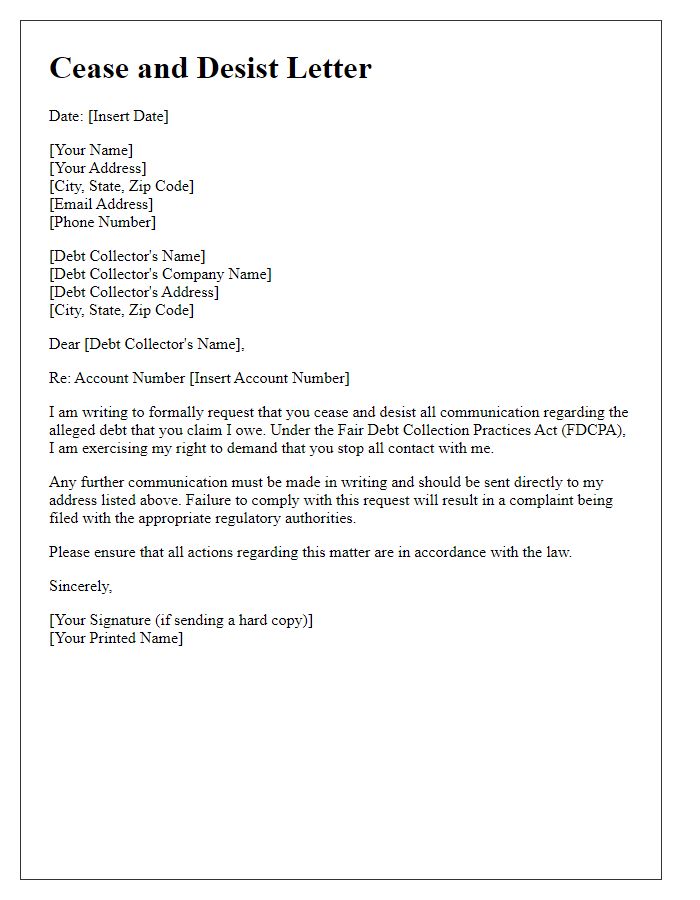

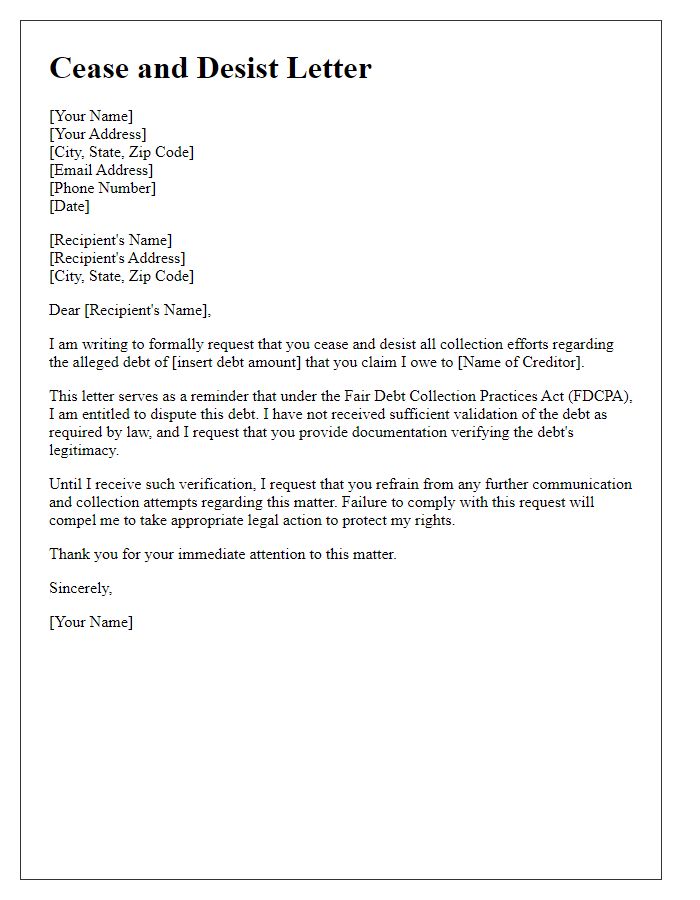

Letter template of cease and desist for third-party debt collection practices.

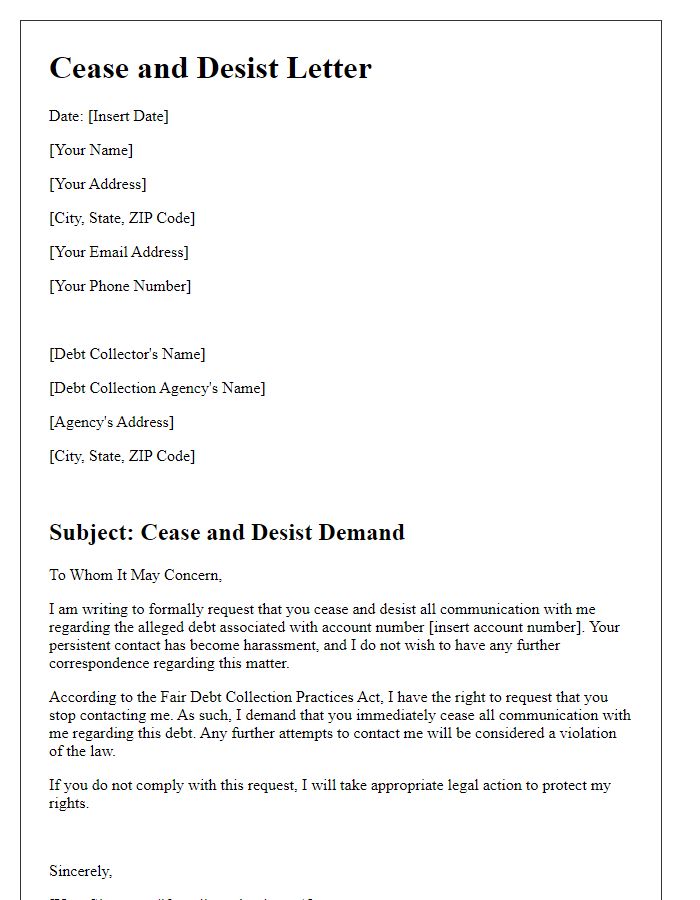

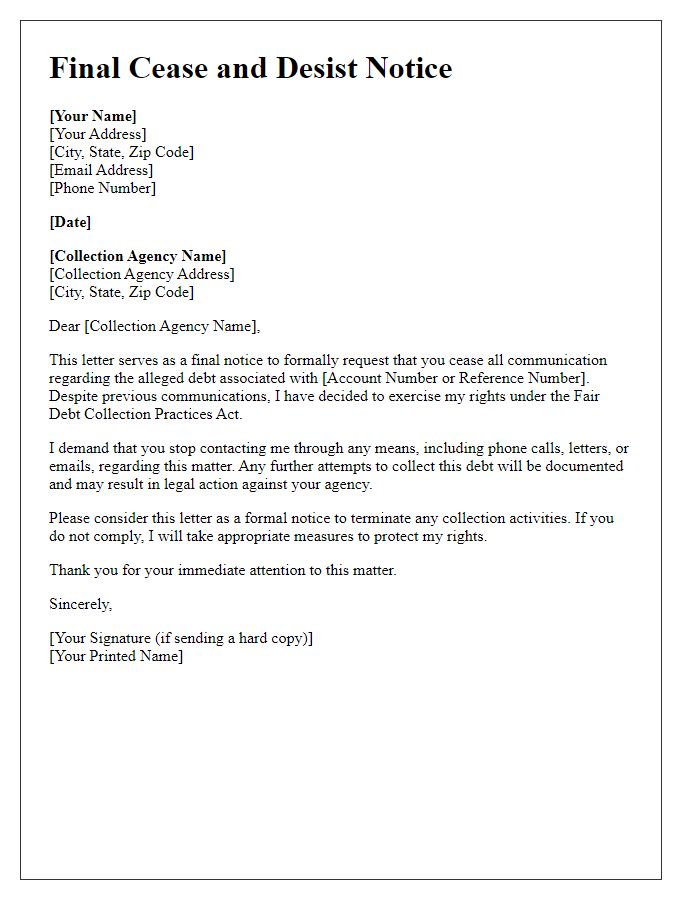

Letter template of cease and desist demand for persistent debt collectors.

Letter template of documented cease and desist for illegal debt collection.

Comments