Have you ever found yourself in a situation where you needed to acknowledge a debt but felt overwhelmed by the process? It's not uncommon to experience delays when it comes to financial communication, and navigating these waters can be tricky. In this article, we'll explore a simple yet effective letter template for acknowledging debt delays, making your correspondence clear and professional. So, if you're looking to handle this matter smoothly, keep reading for our expert tips and the template you need!

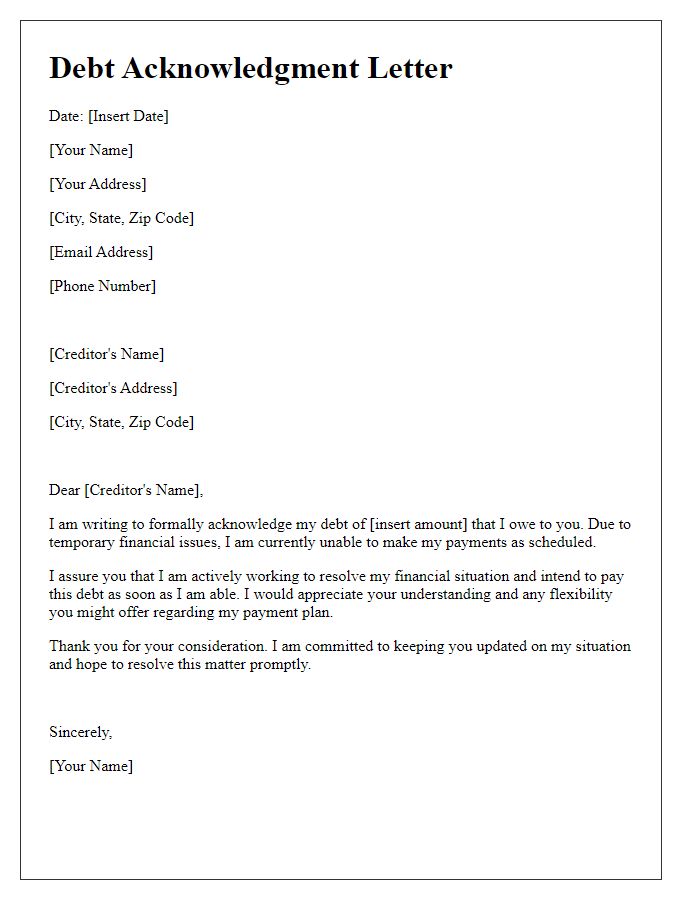

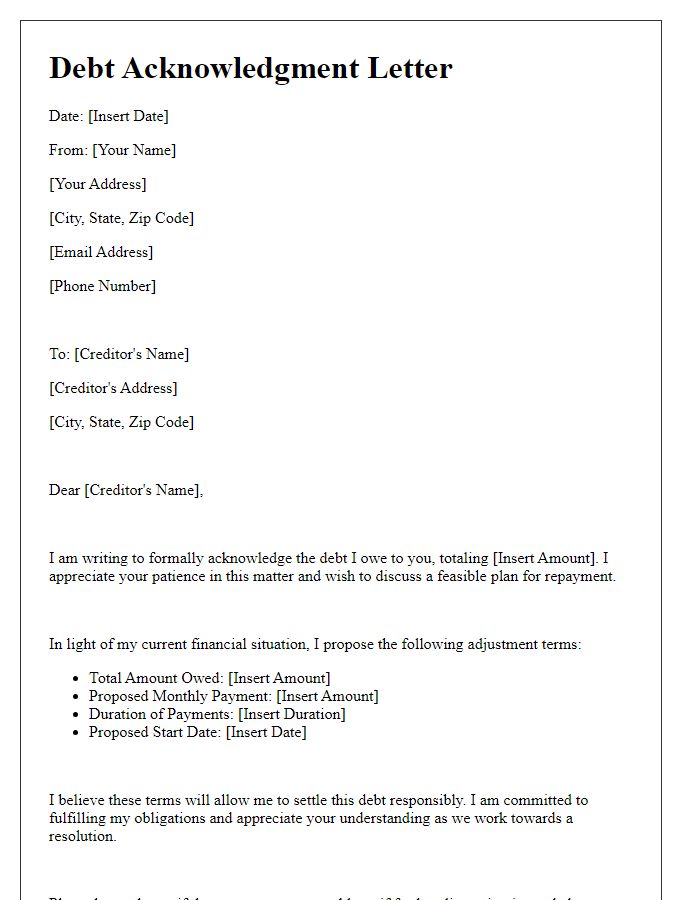

Clear Subject Line

Businesses often face delays in debt acknowledgment, impacting financial relations and cash flow. In financial management, timely communication is crucial. Delays can arise from various factors, including administrative bottlenecks and unforeseen circumstances. Acknowledging these delays is essential for maintaining trust with creditors, ensuring transparency in business dealings. Clear documentation outlining the reasons for the delay can mitigate misunderstandings. Sending notifications through formal channels helps maintain professionalism. It's critical to set new expectations for acknowledgment timelines, reinforcing commitment to resolving outstanding debts efficiently.

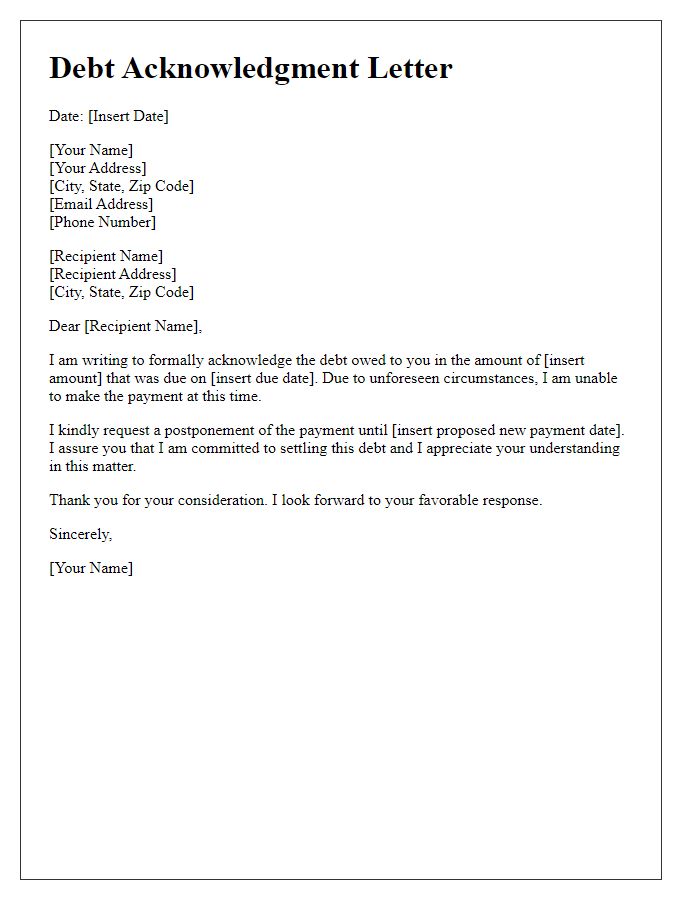

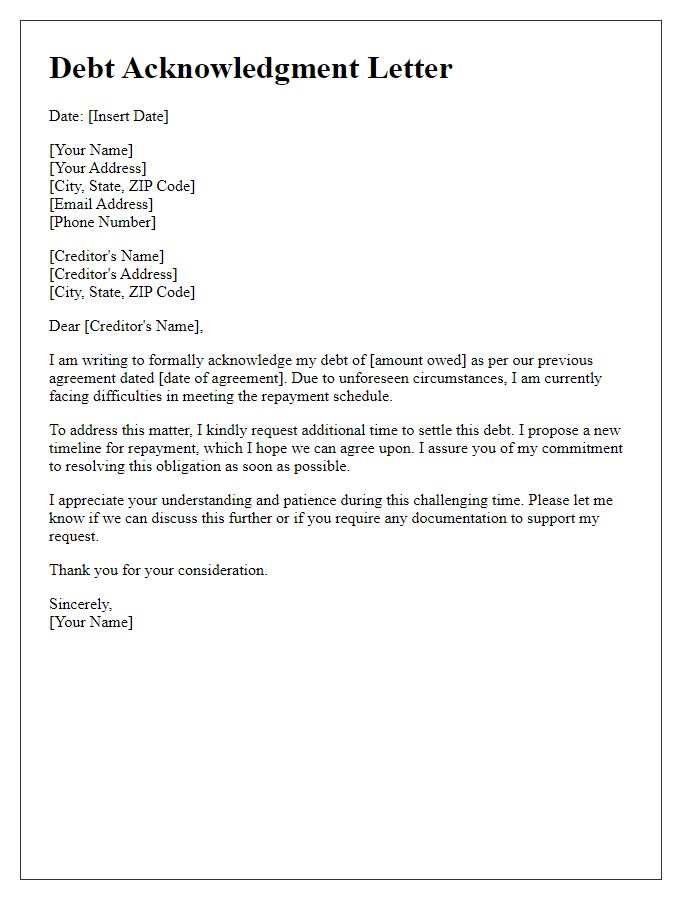

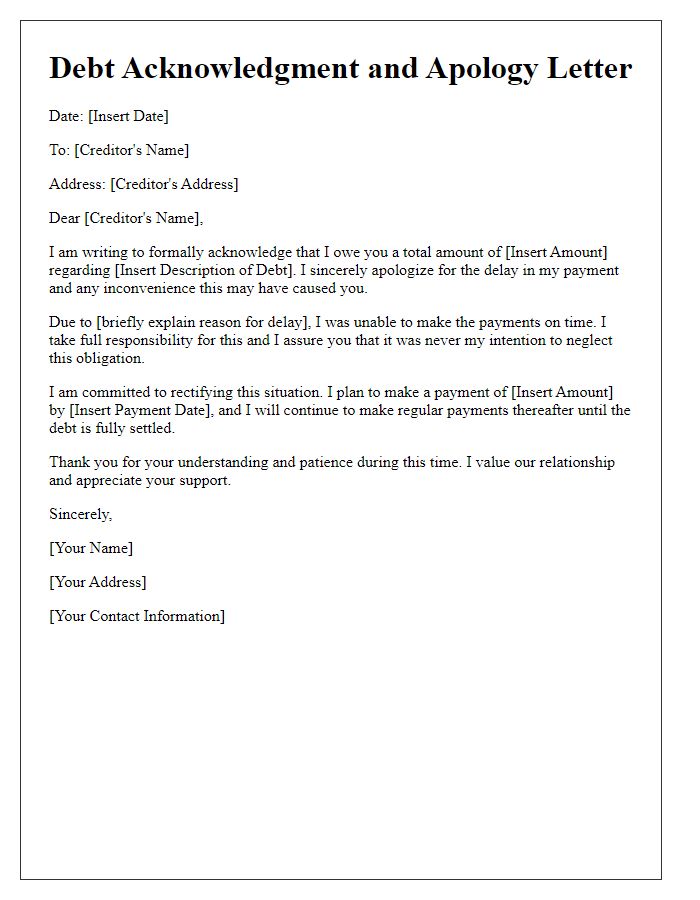

Polite Apology Statement

Delayed debt acknowledgment can create misunderstandings in financial transactions. A formal apology letter serves to clarify intentions. A polite expression of regret indicates awareness of the delay's impact on trust and relationships. Including specific details like the amount owed, payment deadlines, and contributing factors to the delay demonstrates transparency. Mentioning a revised repayment plan or timeline can provide reassurance to the creditor, fostering goodwill. Maintaining a respectful tone throughout the letter is crucial while emphasizing a commitment to resolving the matter efficiently.

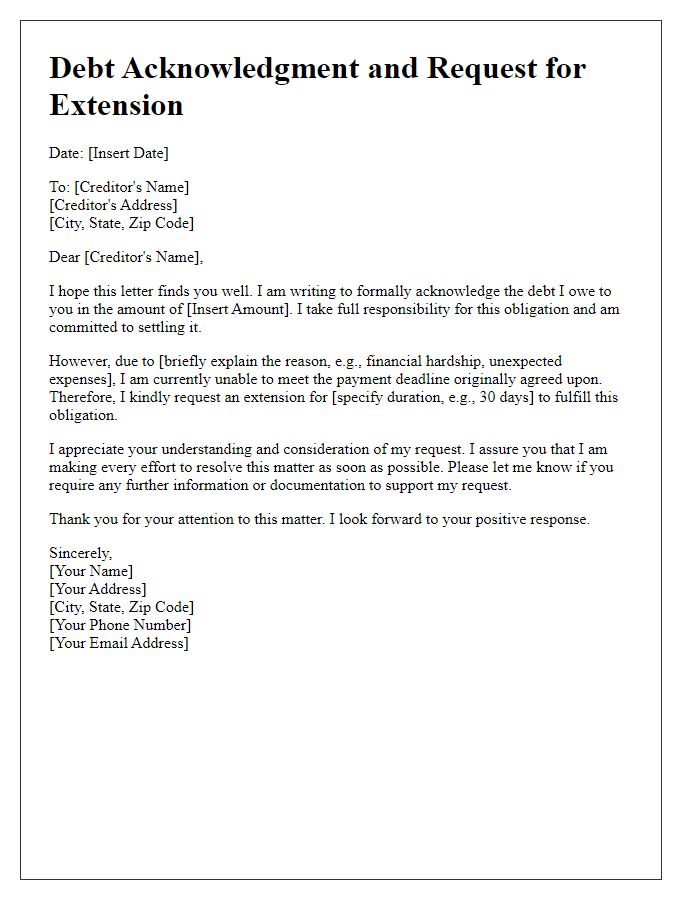

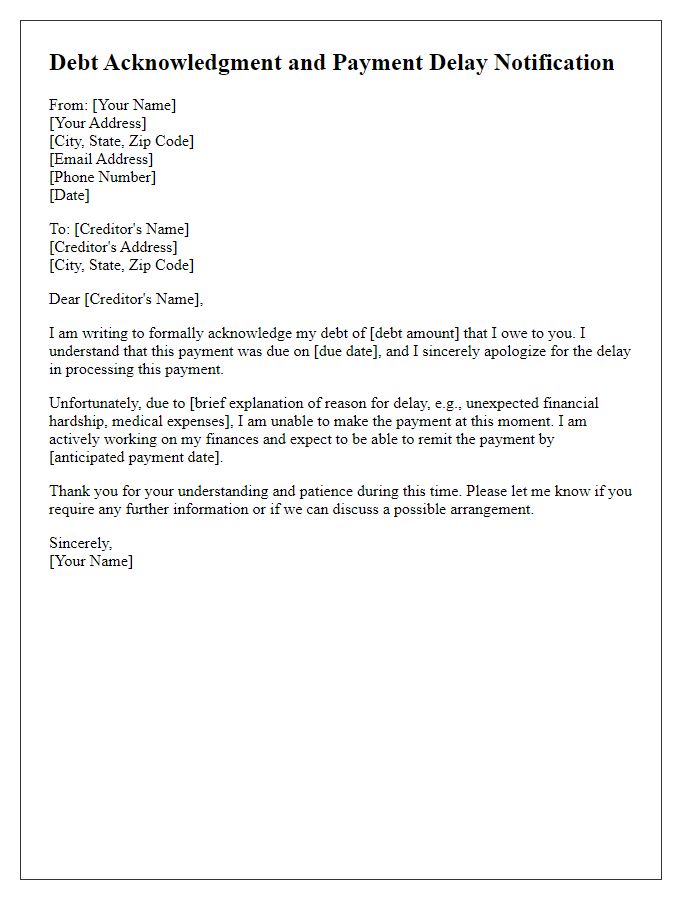

Explanation for Delay

Acknowledging a delay in debt acknowledgment requires clarity and sincerity. Delays may be attributed to various reasons such as administrative oversights, financial complications, or unforeseen circumstances. It is crucial to emphasize the commitment to resolving the debt matter promptly. While specific situations may vary, one example could involve an individual or company facing cash flow issues due to unexpected expenses, like medical emergencies or property repairs, leading to the inability to formalize debt acknowledgment within the expected timeframe. Additionally, international transactions may experience delays due to banking protocols or regulatory requirements. Providing a timeline for when the acknowledgment will be finalized demonstrates accountability and responsibility, ensuring all parties remain informed and engaged throughout the process.

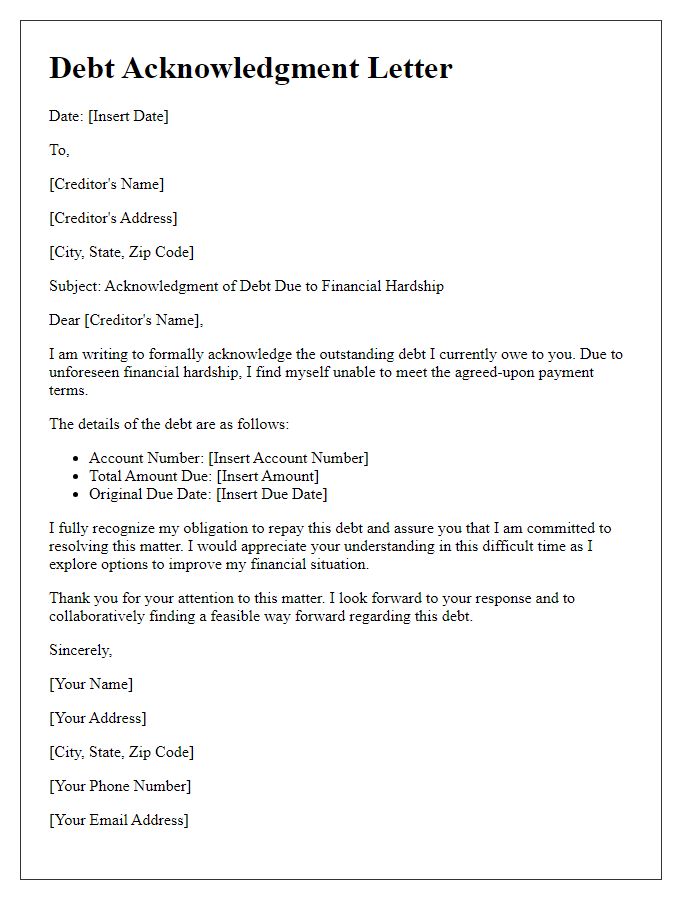

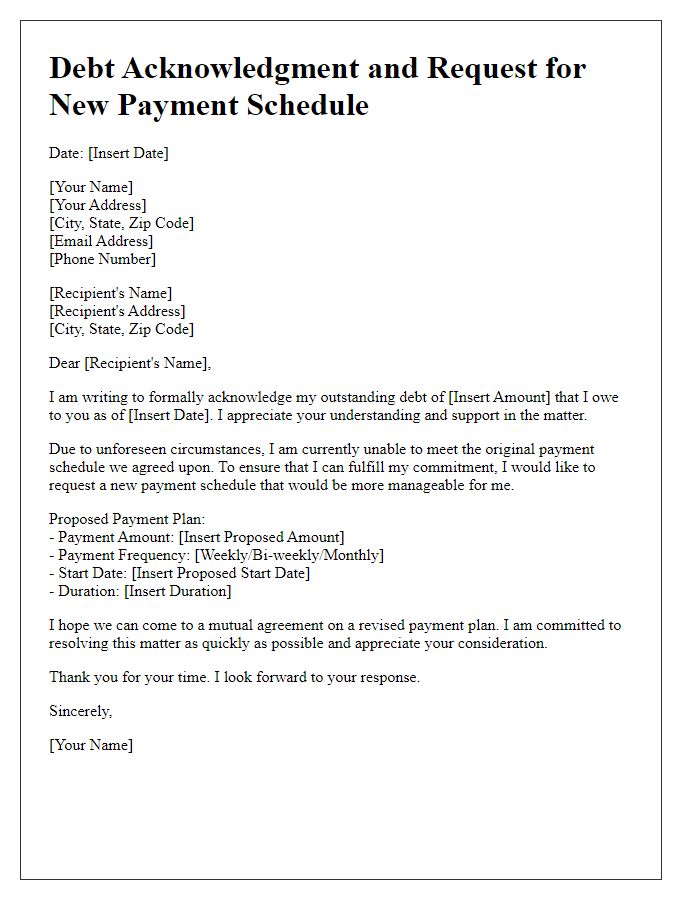

Reassurance of Commitment

A delay in acknowledging debt can raise concerns for creditors regarding repayment intentions. A borrower may reassure lenders by emphasizing commitment to resolving the outstanding amount, despite the setback. Specific scenarios such as recent financial challenges or contractual disputes might serve as context for the delay. Providing a timeline for intended communication updates or payments could enhance credibility. Furthermore, offering alternative solutions, like a structured payment plan, can demonstrate a proactive approach to debt management. Clear communication and transparency throughout the process strengthen trust and reinforce the commitment to fulfilling financial obligations.

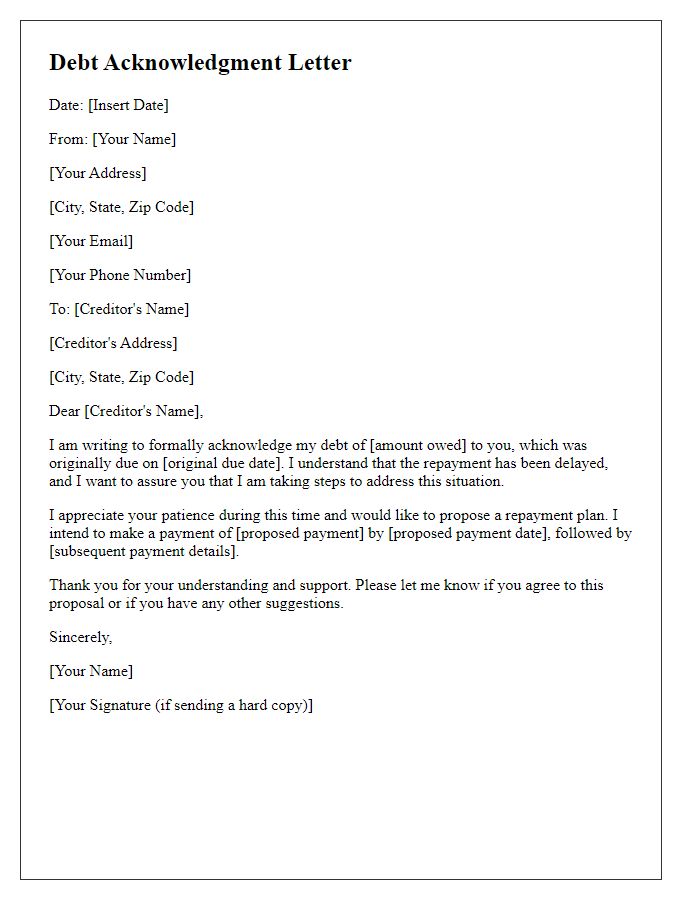

Contact Information for Further Assistance

Debt acknowledgment delays can significantly impact financial planning and credit ratings. Clear communication is essential to managing outstanding obligations. For further assistance regarding debt issues, individuals should reach out to financial advisers or credit counseling services. Local agencies, such as the National Foundation for Credit Counseling, offer resources and support tailored to personal financial situations. Engaging with the lender--often through dedicated customer service lines found on official websites--can provide clarity on payment arrangements. Timely follow-ups, ideally within 30 days, are vital in ensuring that delays do not escalate into larger financial concerns.

Comments