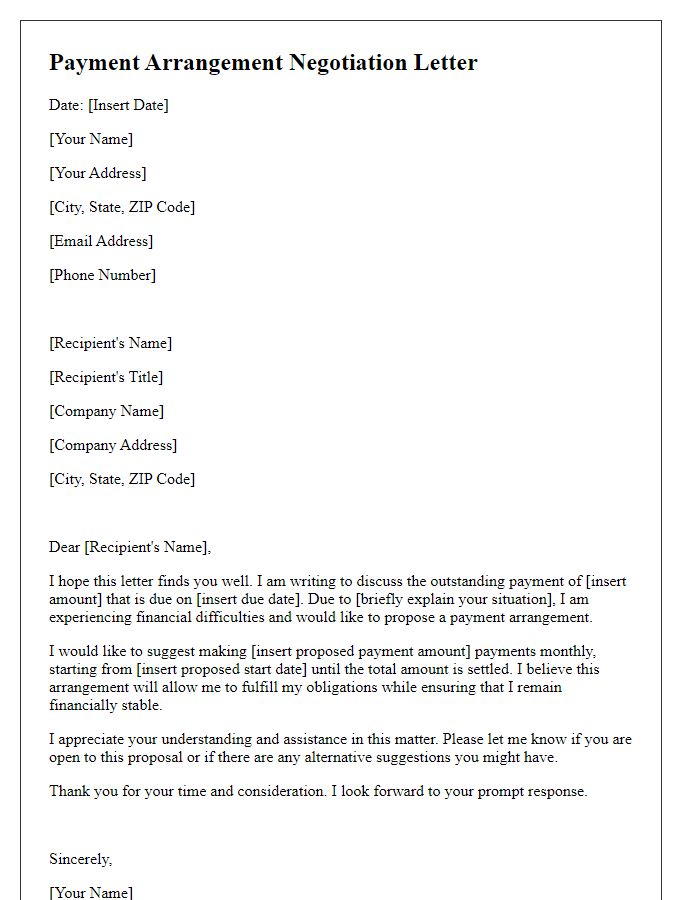

Are you struggling to manage your payments? You're not aloneâmany people face financial challenges that can make it difficult to keep up with bills. That's why crafting a thoughtful payment arrangement offer can be a game changer for both parties involved. If you want to learn how to create an effective letter that encourages open communication and showcases your willingness to find a solution, keep reading!

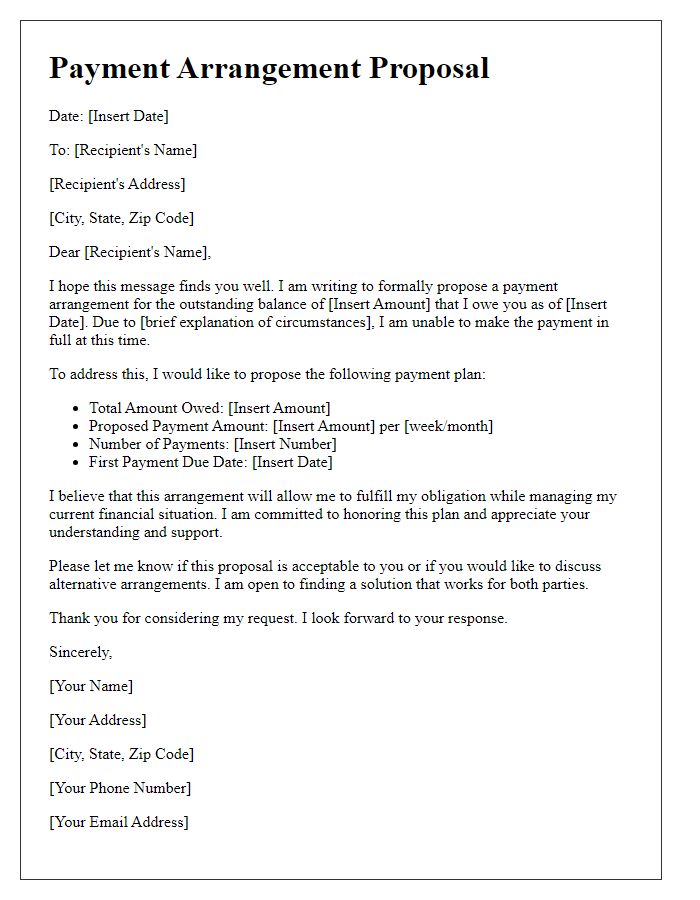

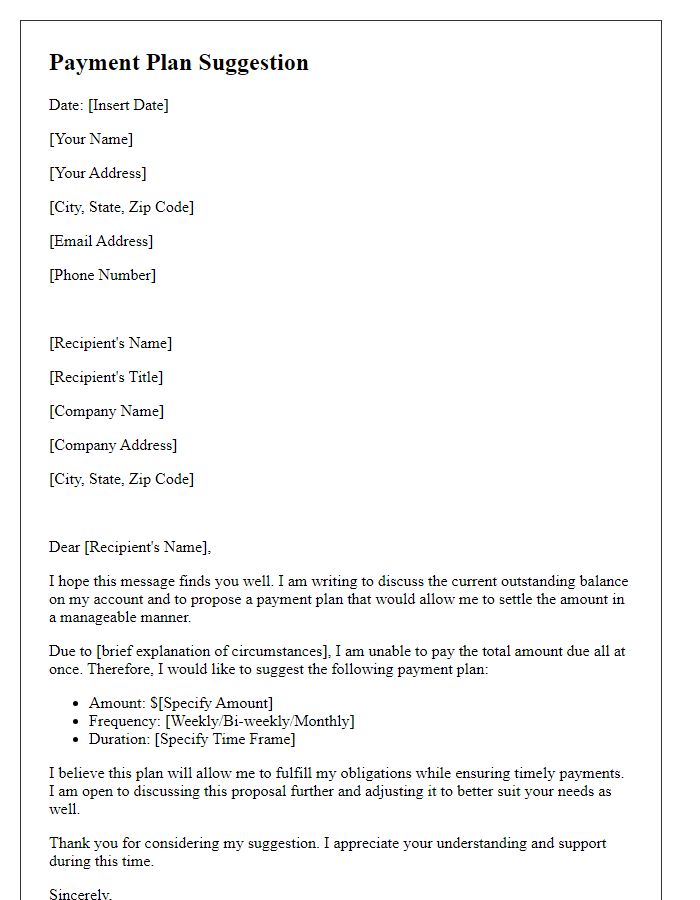

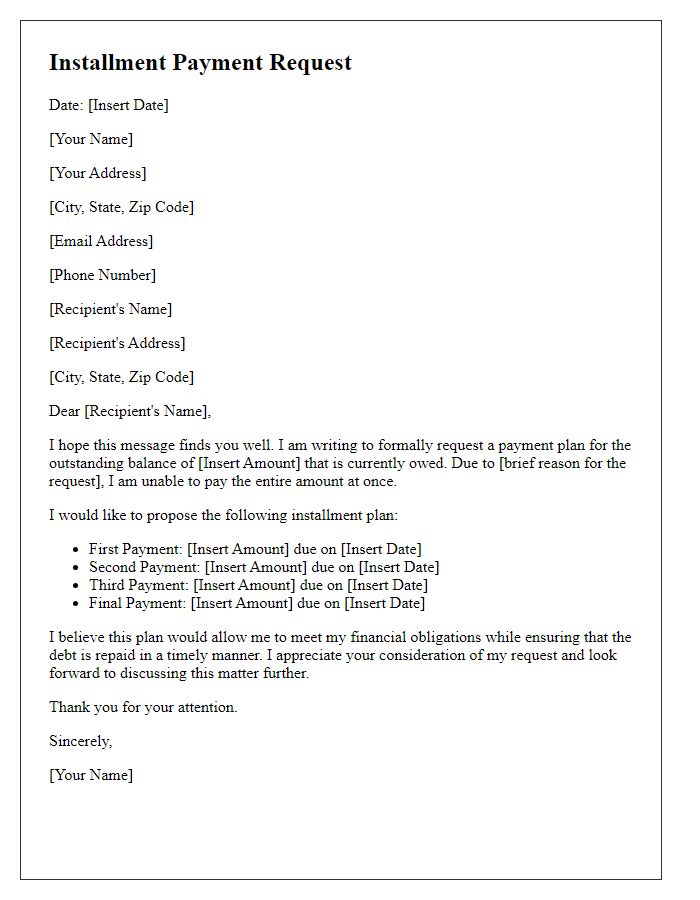

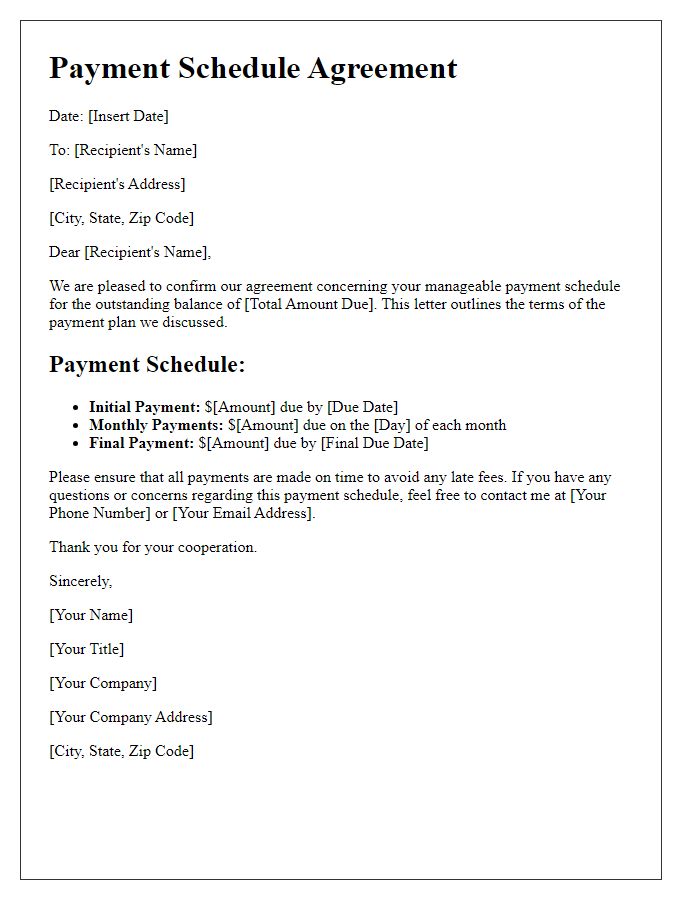

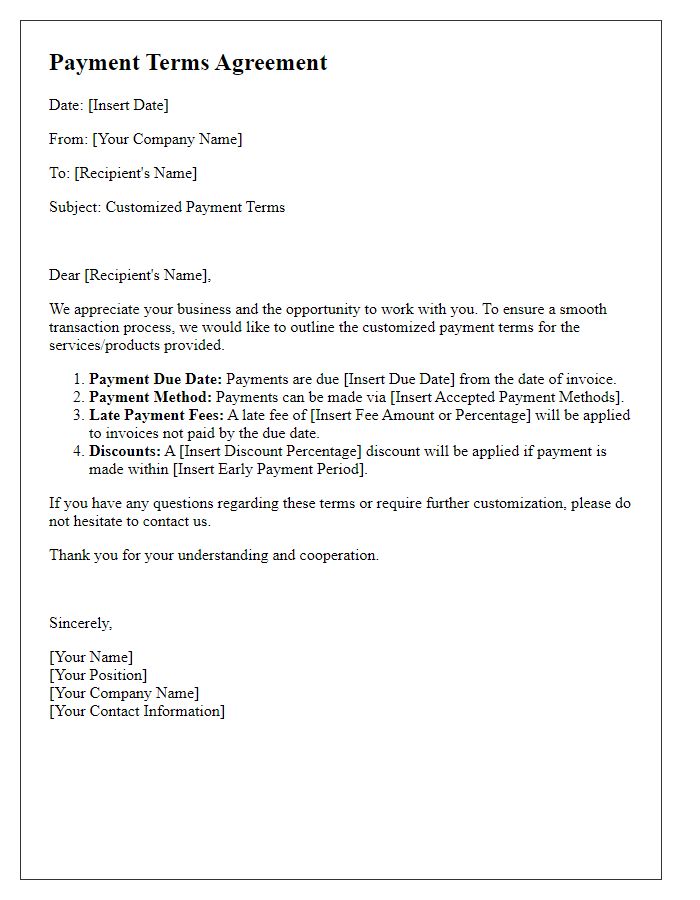

Contact Information

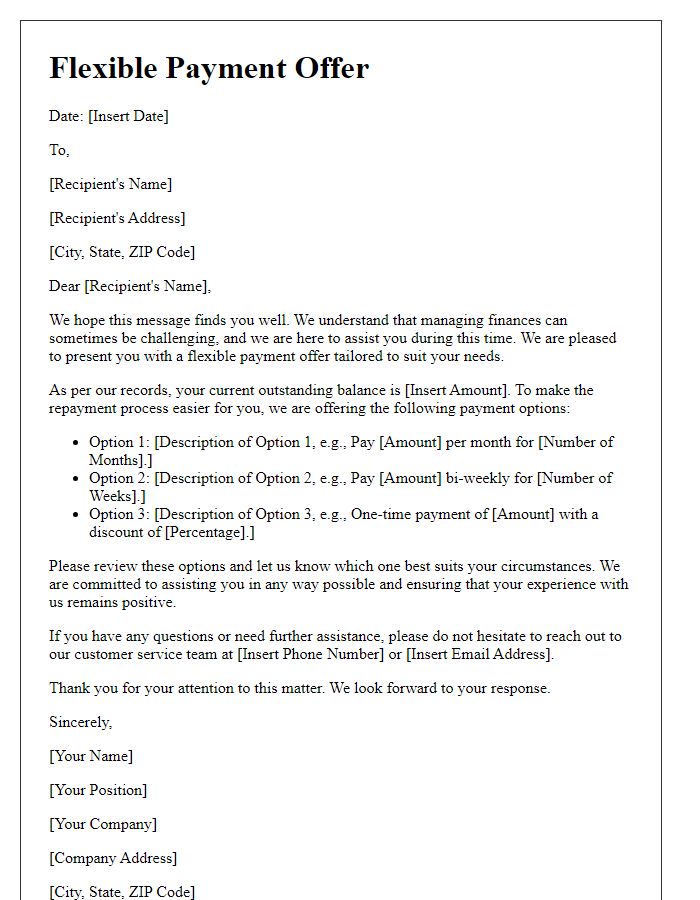

Payment arrangement offers often detail essential information regarding financial agreements. Individuals seeking to propose a payment plan typically include items like contact information, which encompasses the sender's name, physical address (street address, city, state, and ZIP code), and email address. These elements provide a framework for reliable communication. Additionally, the recipient's contact details, including relevant account numbers or identifiers associated with the debt, ensure that both parties can track the agreement effectively. Clarity in such arrangements helps maintain transparency regarding payment amounts, due dates, and any interest or fees that may apply.

Account Details

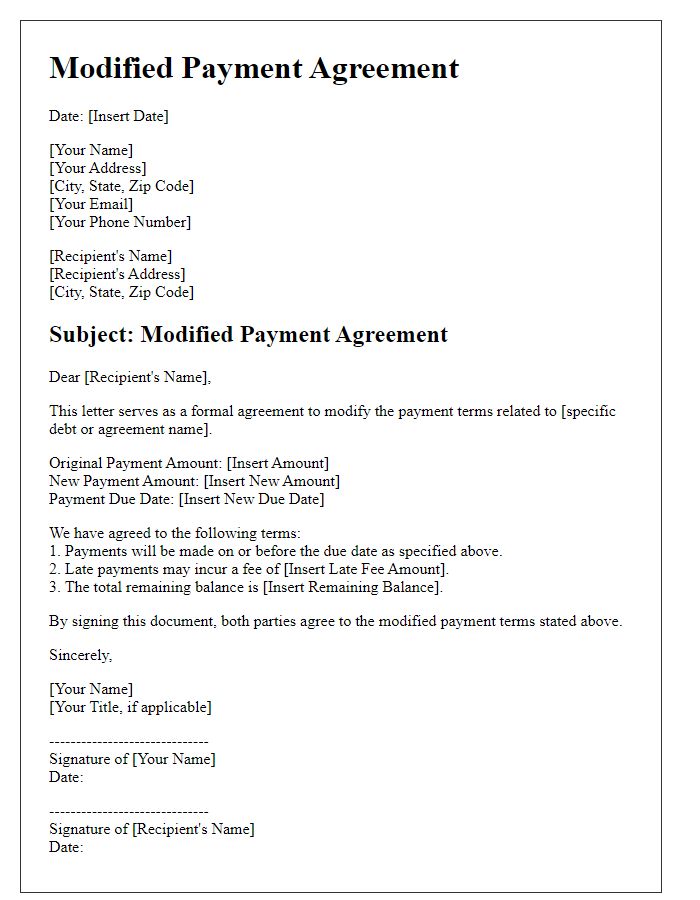

A payment arrangement offer typically includes essential account details such as the account number (a unique identifier linked to the individual or business), the total outstanding balance (the full amount owed), and the proposed monthly payment amount (the suggested portion to be paid regularly), along with the payment due date (indicating when the payment should be made). Additional information may include the contact number for inquiries (allowing for direct communication), the payment method accepted (such as credit card or bank transfer), and the reference number (which helps to correctly apply the payment to the account). Maintaining transparency in these details ensures clarity for both parties involved in the payment arrangement.

Payment Proposal

A payment arrangement offer can help individuals or businesses manage financial obligations effectively. This proposal outlines specific terms regarding scheduled payments to address outstanding debts or invoices. Key details may include total outstanding amount (for instance, $5,000), proposed payment timelines (such as monthly installments over six months), and preferred payment methods (like bank transfers or credit card transactions). Additionally, it is crucial to clarify any potential late fees or penalties associated with missed payments, which can typically range from 1% to 5% of the overdue amount. Establishing a mutual agreement in writing can foster trust between parties, ensuring a clear understanding and commitment to the proposed payment structure.

Justification for Payment Plan

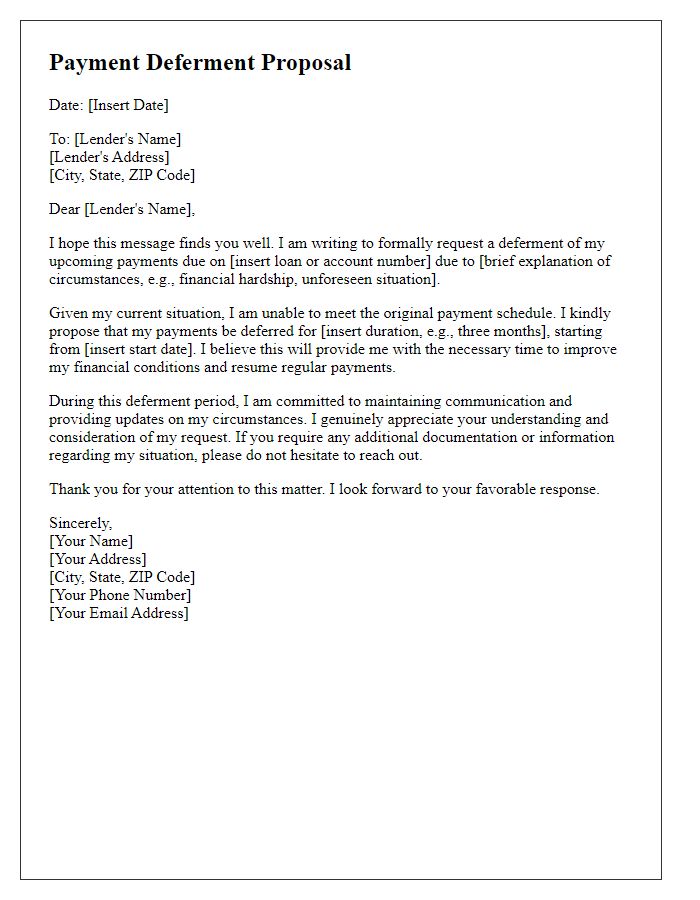

A payment arrangement offer is a structured proposal outlining a feasible plan for settling outstanding debts, often necessitated by financial difficulties. Individuals or businesses may request this to avoid severe consequences like foreclosure, lawsuits, or credit score downgrades. Debt amounts can vary significantly, often exceeding thousands of dollars, depending on the nature of the financial obligation, such as personal loans, medical bills, or credit card debt. A well-justified payment plan typically includes detailed financial disclosures, such as income, expenses, and any other relevant financial obligations, thus allowing creditors to understand the debtor's current economic situation. Effective communication about the rationale behind the payment schedule can foster goodwill, making creditors more amenable to accepting lower monthly payments or extended timelines. Successful arrangements may depend on consistent payments, reinforcing trust in the debtor's commitment to fulfilling obligations over time.

Request for Confirmation and Agreement

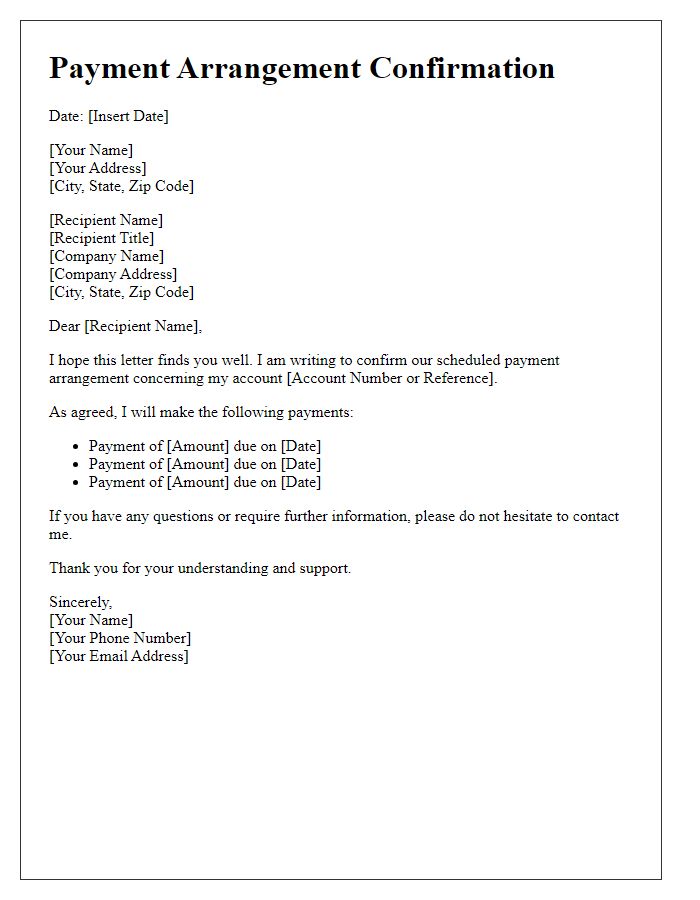

A payment arrangement offer provides a framework for individuals or businesses to manage debts effectively. This proposal typically includes details such as specific amounts, due dates, and payment methods. Clear communication is essential, indicating expectations for timely payments, which fosters trust between the creditor and the debtor. Clarity about potential fees for missed payments enhances transparency. Additionally, including a designated point of contact within the company (such as a financial counselor) can facilitate better management of the arrangement and reinforce support for the debtor. Documenting the agreement in writing ensures both parties acknowledge and consent to the terms, reducing the likelihood of future disputes.

Comments