Are you feeling overwhelmed by debt and seeking a way to lighten your financial burden? A waiver of debt agreement might be the solution you need to regain control of your finances. In this letter, we'll guide you through the key components needed to draft a compelling and effective waiver, ensuring that both parties feel reassured and secure. So, let's dive in and explore how to craft the perfect debt waiver letter that could pave the way for your financial freedom!

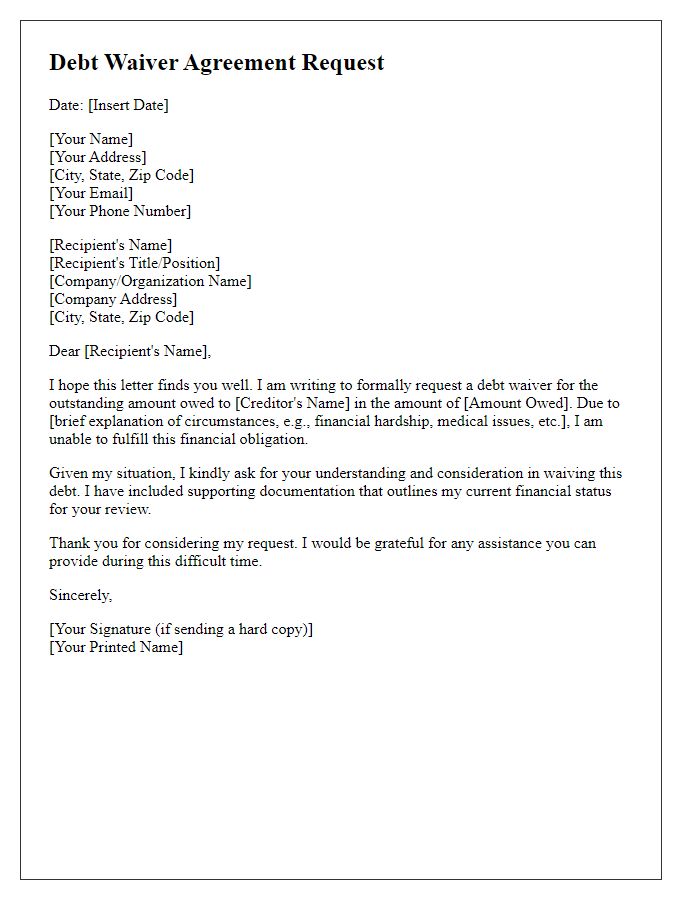

Clear Identification of Parties

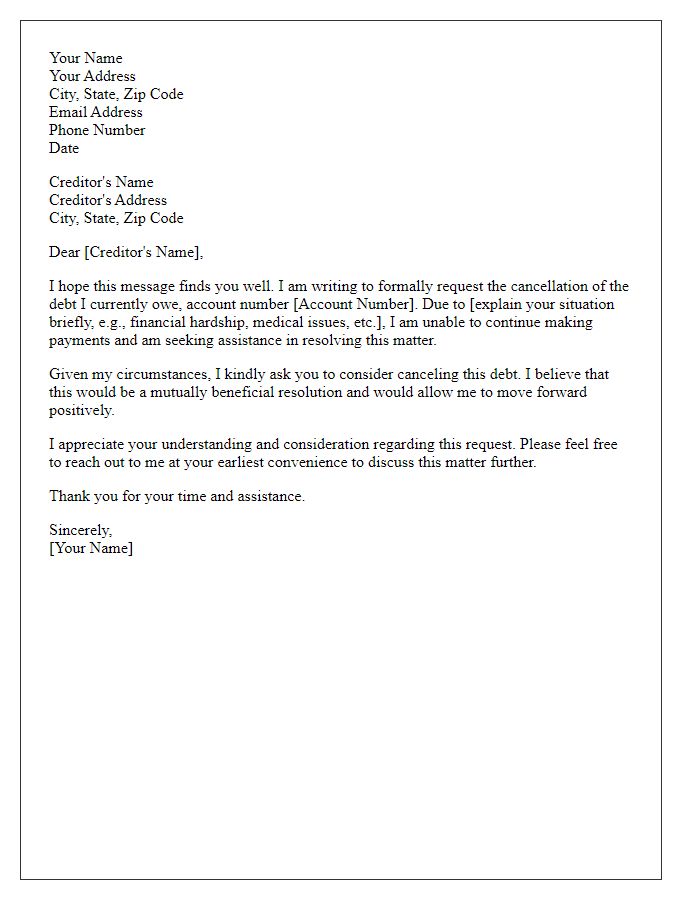

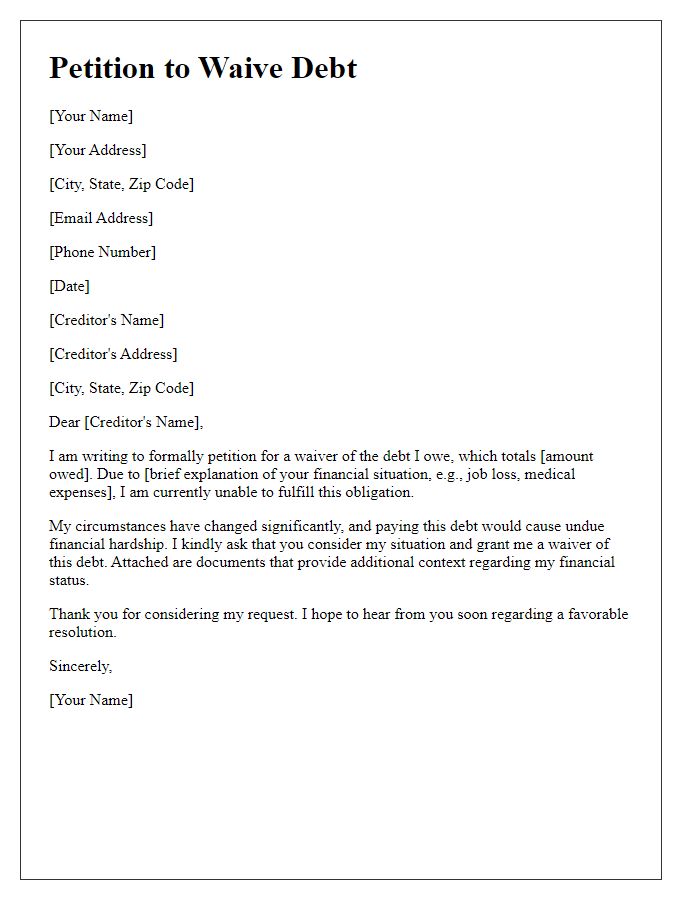

A waiver of debt agreement involves a detailed identification of the parties involved, which is crucial for the enforcement of the agreement in legal contexts. The primary party, the creditor, is typically the individual or entity owed money, such as a bank (e.g., Chase Bank). The secondary party, the debtor, is the individual or entity who owes the debt, for instance, a small business owner. Each party must include pertinent details, such as legal names, addresses (e.g., 123 Main Street, City, State, Zip Code), and identification numbers (e.g., Social Security Number or Employer Identification Number). Clear definitions establish accountability and clarify the rights and obligations of both parties. Additionally, this identification aids in preventing any potential future disputes regarding the identity or status of the parties involved.

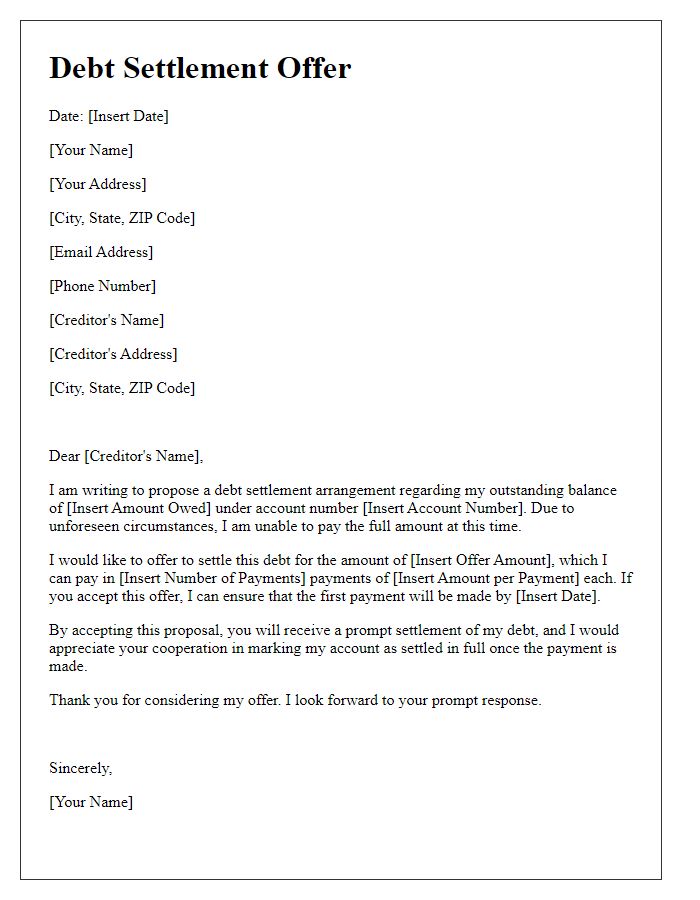

Specific Debt Details

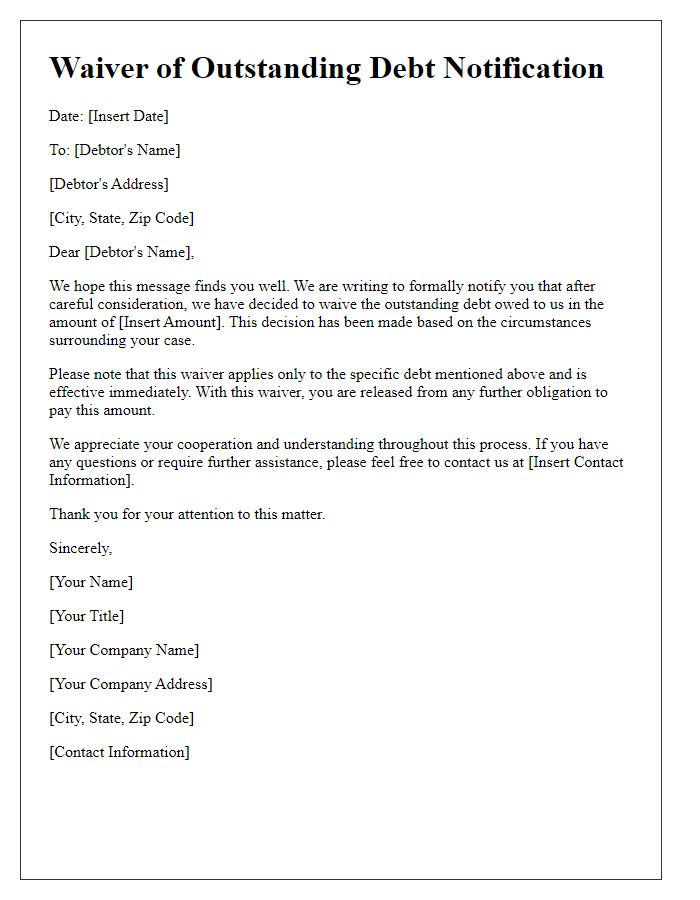

The waiver of debt agreement must contain specific details to ensure clarity and legality. The debtor's name, address, and identification number are essential for identification purposes. The creditor's name, address, and identification details create a clear legal relationship. The specific debt amount, such as $5,000 owed from a personal loan taken on January 10, 2022, should be outlined to avoid ambiguity. Dates regarding the original loan agreement and any previous payment dates provide context. The waiver terms must specify that the creditor relinquishes the right to collect the debt and any related interest, clearly stating that the agreement is effective immediately upon signing. A signature line with date and place for both parties establishes mutual consent and finality of the agreement.

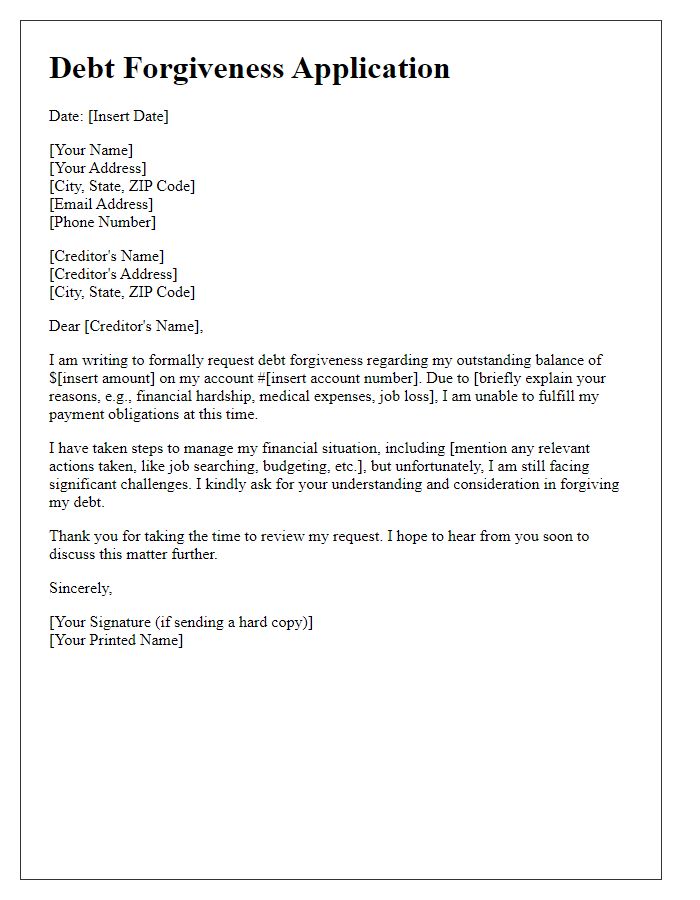

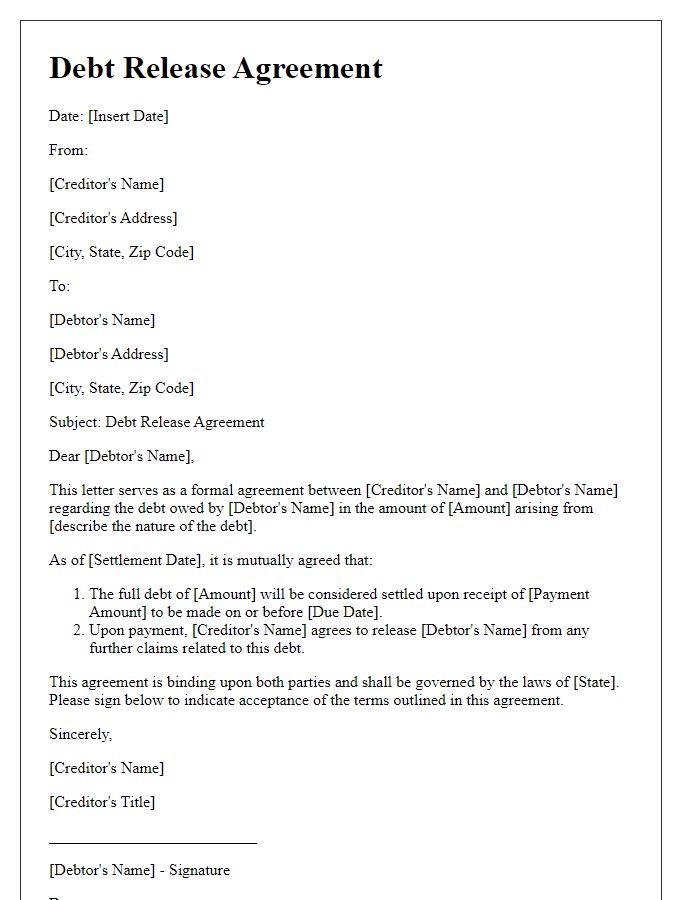

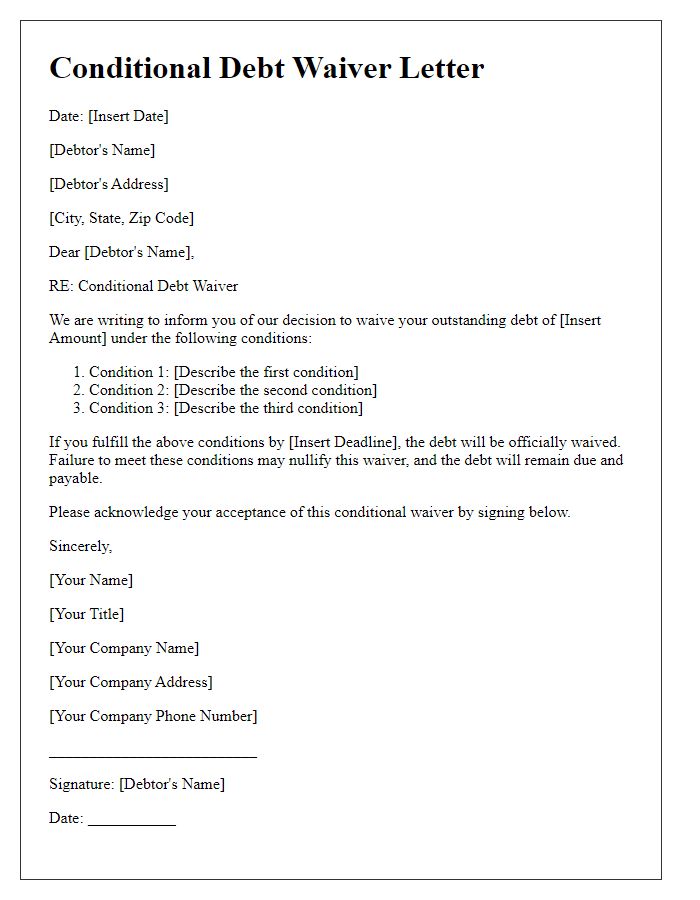

Legal Release Language

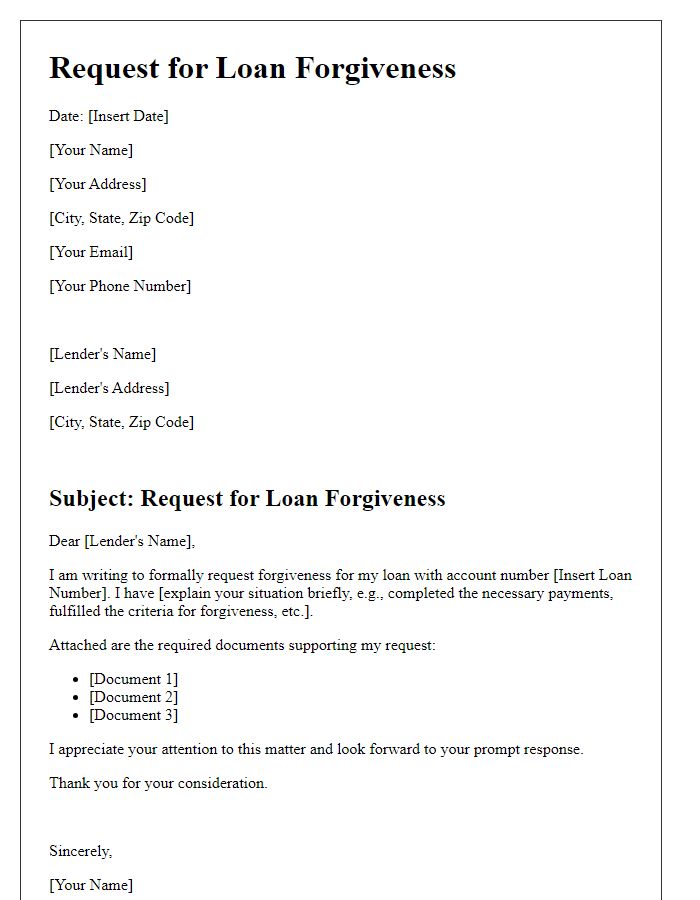

A waiver of debt agreement is a legal document that formally releases a debtor from the obligation to repay a specific amount owed to a creditor. This agreement often includes phrases such as "full and final settlement" and "no further claims" to ensure that the debtor is freed from any future expectations of payment related to the debt. The agreement typically references the original debt's details, including the total amount owed, the account number, and the specific terms under which the waiver is granted. Important legal conditions may outline the effective date of the release and the signatures of both parties involved, ensuring that the release is legally binding. It may also include a clause that protects the creditor from any subsequent financial claims by the debtor, reinforcing the resolution of the financial obligation.

Governing Law Clause

The Governing Law Clause establishes the jurisdiction and legal framework applicable to the waiver of debt agreement. In this context, the clause specifies the state or country's laws, such as California state law or New York law, that will interpret the agreement and resolve any disputes arising from it. Legal precedents and statutory provisions within that jurisdiction will be applied to enforce the terms of the agreement. Clarity in this clause ensures that all parties understand their rights and responsibilities, facilitating compliance and reducing the likelihood of litigation. This clause can also clarify procedures for dispute resolution, such as mediation or arbitration, further streamlining conflicts should they arise.

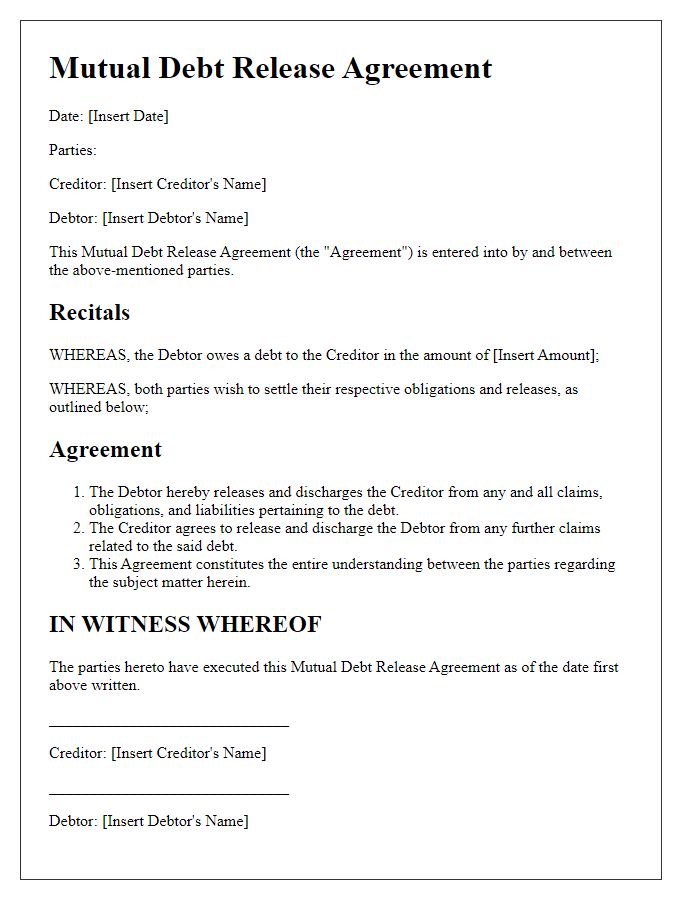

Signature Lines

A waiver of debt agreement is a legal document that relinquishes a person's or entity's right to collect a debt. This document typically includes signature lines for both parties involved in the agreement. The signature line for the creditor, who is releasing the claim to the debt, usually appears first, with space for the creditor's printed name, title, and date of signing. Following this, the debtor's signature line is included, which also requires the debtor's printed name, any relevant title, and date of signing. Additional spaces may exist for witnesses or notaries, depending on the jurisdiction's requirements, ensuring the authenticity of the agreement. Each signature signifies acceptance of the terms outlined in the waiver, solidifying the legal release of the debt obligations.

Comments