Are you feeling overwhelmed by debt and searching for a way out? You're not aloneâmany individuals and families find themselves in similar situations, and that's where our Debt Assistance Program comes in. We aim to provide the support you need to regain financial stability through personalized solutions tailored just for you. Join us as we explore how this program can help lighten your financial burdens and pave the way for a brighter future!

Clarity and precision in language.

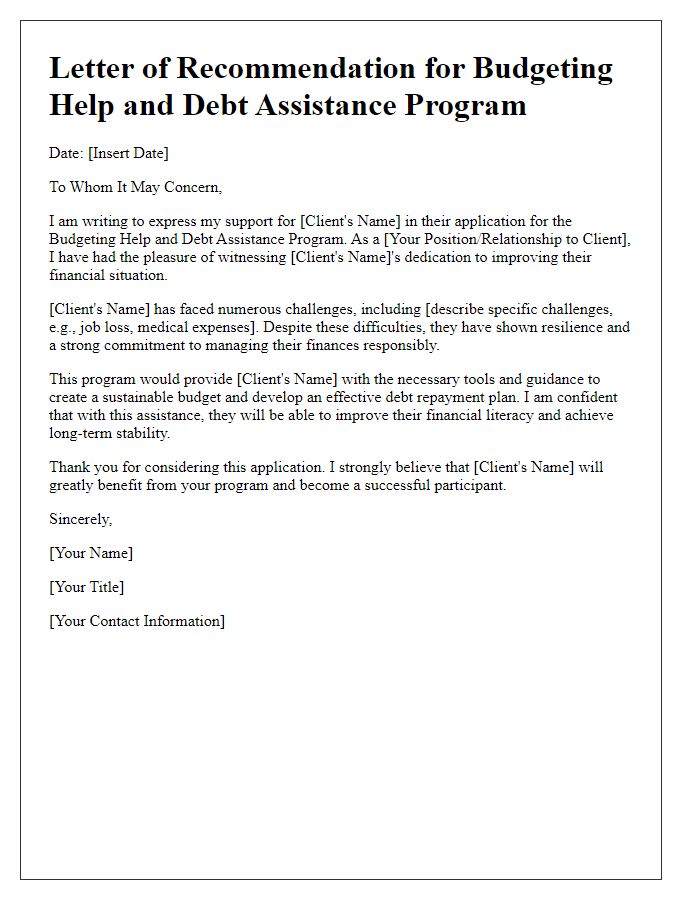

Debt assistance programs, designed for individuals struggling with financial liabilities, provide structured solutions to manage overwhelming debts. These programs often include options such as debt management plans (DMPs), which involve a trained credit counselor negotiating lower interest rates and monthly payments with creditors. Statistics indicate that nearly 30% of U.S. adults reported having credit card debt in 2022, highlighting the need for such assistance. Nationally recognized organizations, like the National Foundation for Credit Counseling (NFCC), offer resources and support for individuals seeking relief. They conduct thorough assessments regarding income, expenses, and outstanding debts to tailor a personalized plan, ensuring clarity and precision in communication throughout the process, crucial for building trust and cooperation between clients and counselors.

Comprehensive details about the program.

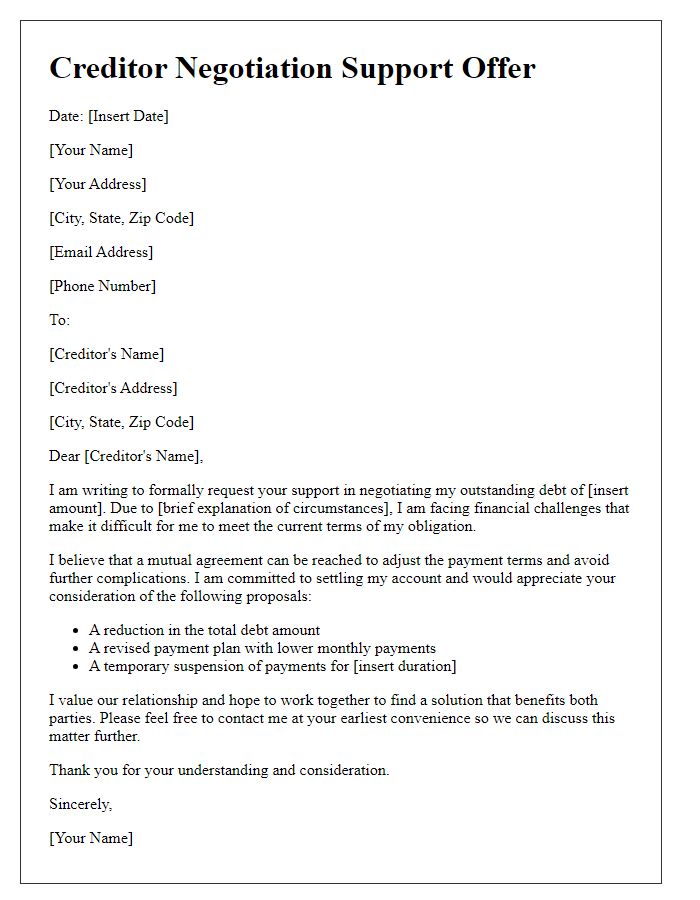

The Debt Assistance Program (DAP) provides a structured approach to help individuals facing financial challenges manage their debts effectively. This initiative, established in 2022, offers personalized consultations aimed at assessing individual financial situations, including outstanding balances, credit scores, and monthly expenditures. Participants receive tailored strategies that may include debt consolidation options, negotiation with creditors, and budgeting techniques to enhance financial literacy and stability. The program is designed to support residents of New York City, providing access to licensed financial counselors who are trained to help navigate complex financial systems. Additionally, DAP offers workshops and resources focused on improving credit scores and preventing future debt issues, ensuring participants gain long-term financial independence and peace of mind.

Eligibility criteria and requirements.

A debt assistance program can significantly alleviate financial burdens for individuals facing overwhelming debt. Eligibility criteria typically include a minimum debt threshold, often around $5,000, and a maximum income limit based on the Federal Poverty Level (FPL), which varies by household size. Participants are usually required to provide documentation such as recent pay stubs, tax returns, and bank statements to verify income and financial status. Additionally, individuals must demonstrate financial hardship, which may involve proof of unemployment, unexpected medical expenses, or other qualifying factors. Programs often require attendance at financial literacy workshops, aimed at equipping participants with skills to manage finances effectively and prevent future debt accumulation.

Step-by-step application instructions.

A comprehensive debt assistance program offers crucial support to individuals struggling with financial burdens. Applicants seeking help must follow detailed application instructions to ensure successful enrollment. First, they must gather necessary documents, including income statements, outstanding bill records, and any previous debt correspondences, which provide a complete financial picture. Next, applicants visit the official program website, often managed by government agencies or non-profit organizations, to access the online application portal. Here, they fill out the required fields, which might include personal information (name, address, social security number) and financial details (monthly income, total debt amount). After completing the application, individuals must review their entries for accuracy, as discrepancies can delay the process. Finally, applicants submit the application and await a notification regarding their eligibility, usually received via email within a few weeks, along with instructions for the next steps, such as potential consultations or financial counseling sessions tailored to their needs.

Contact information for further assistance.

The Debt Assistance Program provides essential support to individuals facing financial challenges. Participants in the program can receive guidance on managing outstanding debts, creating realistic repayment plans, and understanding legal rights in financial matters. Clients can access resources such as financial counseling services and educational workshops designed to improve budgeting skills and increase financial literacy. For further assistance, individuals can contact dedicated support staff via phone at (555) 123-4567 or email at support@debtassist.org. Office hours are Monday to Friday from 9 AM to 5 PM, ensuring assistance is available to those in need.

Comments