Are you tired of feeling overwhelmed by your mortgage payments? We understand that life can throw curveballs, and sometimes, financial relief is just a modification away. In this article, we'll walk you through the steps of obtaining a loan modification approval, making the process more manageable and less stressful. So, if you're ready to take control of your financial future, read on to discover how you can secure the support you need.

Borrower's Name and Address

Loan modification approval notifications often include important details. The borrower, typically an individual or family in financial distress, receives confirmation from a lender, such as a bank or mortgage company, regarding changes to their original mortgage terms. The notification outlines adjustments to interest rates, payment schedules, or loan terms that could significantly alleviate the borrower's financial burden, often influenced by government programs like HAMP (Home Affordable Modification Program). This notification, addressed directly to the borrower's home, impacts not only personal finances but also their housing stability, enabling continued homeownership.

Loan Details and Terms

The loan modification approval notification reflects crucial information regarding the alteration of your existing loan agreement, specifically the loan number (e.g., 123456789), original loan amount ($250,000), and the new principal balance ($225,000). The modification introduces a reduced interest rate of 4% from the previous 5%, resulting in an adjusted monthly payment of $1,150 (down from $1,350). The new loan term will span 30 years, effective from the start date of the modification, ensuring affordable payments. Important dates include the effective date of modification (e.g., January 1, 2024), and the payment due date will remain on the first of each month. This adjustment aims to make your financial obligations more manageable while adhering to federal regulations set forth under the Home Affordable Modification Program (HAMP).

Modification Agreement Description

The Loan Modification Agreement outlines the specific changes made to the original loan terms for a borrower, typically due to financial hardship or difficulty in making monthly payments. This agreement may involve alterations to the interest rate, loan duration, and monthly payment amounts, aimed at making the repayment process more manageable for the borrower. Key components of this agreement include the new interest rate, potentially reduced from original figures (e.g., from 5% to 3%) and the modified loan term which may extend the repayment period (such as from 15 years to 30 years), thereby lowering monthly obligations. The agreement is executed at the lender's office, often requiring both the borrower and lender representatives' signatures, ensuring clarity and legal validity. Furthermore, stipulated conditions for ongoing modifications may include timely payment records or potential penalties for missed payments, highlighting the lender's flexibility while maintaining risk management practices.

Payment Schedule and Amounts

Loan modification approval notifications detail essential changes to payment schedules and amounts following loan agreements. The new payment schedule typically outlines a revised monthly payment amount, reflecting adjustments due to interest rate modifications or loan term extensions. For instance, homeowners might see a reduction in their payment from $1,500 to $1,200, providing relief in financial burdens. The notification specifies due dates and any applicable fees or penalties for late payments, ensuring clarity for borrowers. Included is also an outline of the total loan balance remaining, emphasizing the impact of the modification on the overall debt repayment strategy. Clear communication of these changes aims to foster understanding and encourage timely payments.

Contact Information for Further Assistance

Loan modification approval notifications provide critical updates regarding a borrower's financial situation. Often, they detail the acceptance of modified loan terms, including interest rates, payment schedules, and other relevant adjustments aimed at making the loan more manageable for individuals facing economic hardships. Typically, these notifications include essential contact information such as the customer service number (often beginning with a toll-free area code), office hours (notably from 9 AM to 5 PM EST), and a dedicated email address for further inquiries or clarifications. It's vital for borrowers to have access to qualified representatives who can address concerns related to their modified agreements, ensuring a clearer understanding of their updated obligations and rights.

Letter Template For Loan Modification Approval Notification Samples

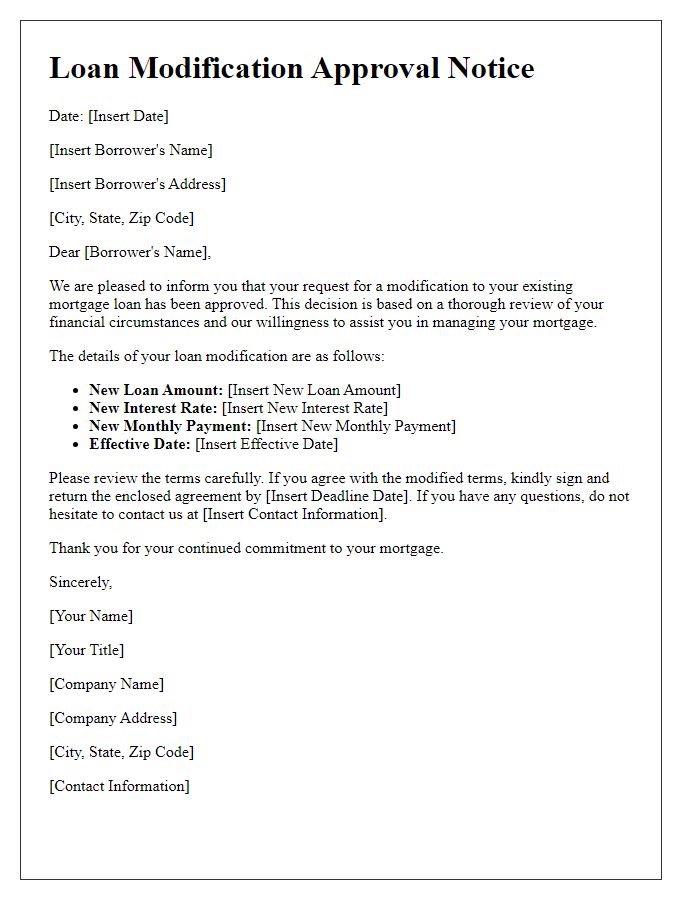

Letter template of loan modification approval notice for mortgage adjustment.

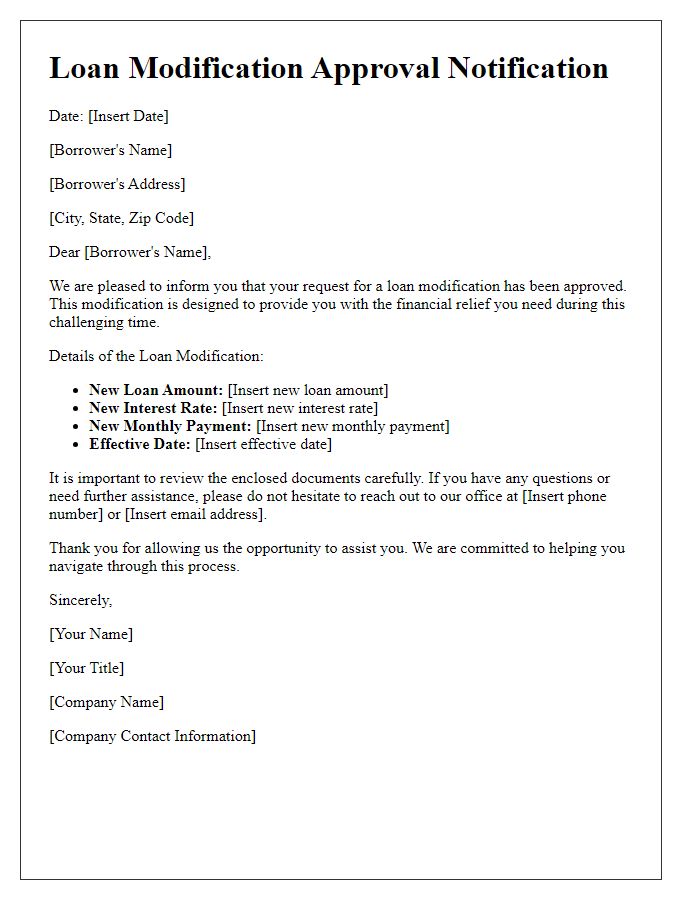

Letter template of loan modification approval communication for financial relief.

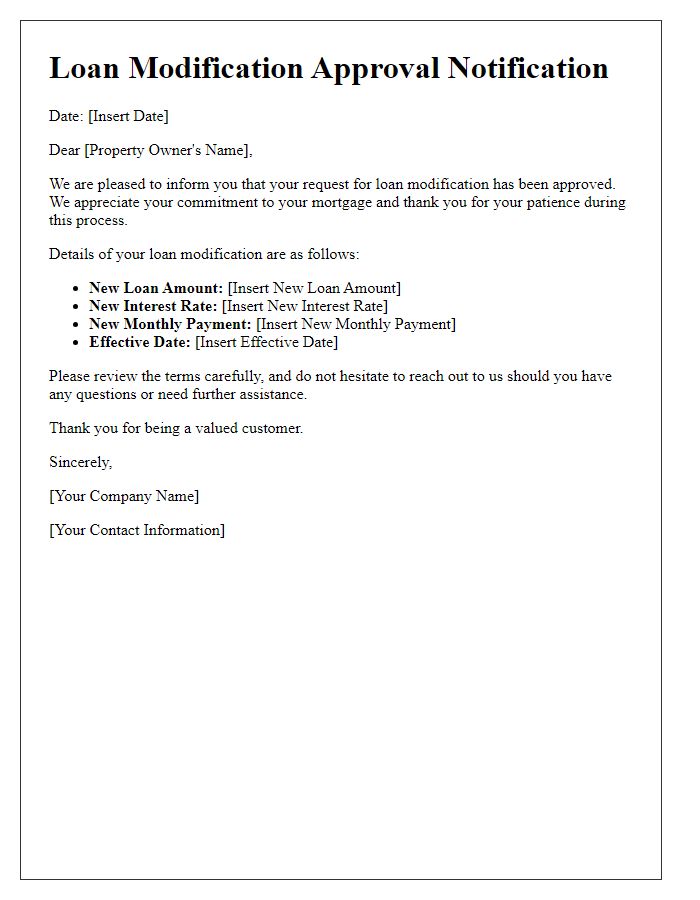

Letter template of loan modification approval announcement for property owners.

Letter template of loan modification approval correspondence for debt restructuring.

Letter template of loan modification approval message for customer service.

Comments