Are you looking to streamline your asset liquidation process? Crafting a clear and concise letter to formally request the liquidation of your assets can make all the difference. In this article, we'll walk you through an effective letter template that ensures you cover all the essential details while maintaining a professional tone. So, let's dive in and explore how to create a compelling asset liquidation request letter!

Identification Information

The asset liquidation request aims to streamline the process of disposing of company assets in an organized manner. Identification details include the company's name, tax identification number, and primary contact information, ensuring compliance with regulatory requirements. Additionally, a comprehensive list of assets for liquidation is necessary, outlining specifications such as asset type (machinery, vehicles, or inventory), identification numbers, estimated current market value, and condition assessments. This structured approach facilitates timely appraisals and aligns with local legal frameworks that govern asset disposal.

Asset Description

Asset liquidation involves the process of selling off assets, typically to raise funds or reduce liabilities. Various assets can be liquidated, including real estate properties, industrial machinery, and electronic equipment. For instance, a commercial building located in downtown New York City (currently valued at approximately $5 million) may require liquidation due to financial distress faced by the owner. Other assets like heavy-duty construction vehicles, such as Caterpillar excavators (valued at $150,000 each), can also be sold to liquidate capital. Moreover, electronic assets, such as outdated computer servers, might be liquidated for recycling or resale, often yielding significantly lower returns due to depreciation.

Reason for Liquidation

Asset liquidation serves multiple purposes, often undertaken when a company, such as Tech Innovations Inc., seeks to convert its physical goods into cash. Common reasons for liquidation include financial distress, market changes, or strategic restructuring. In some cases, companies face insolvency, requiring immediate asset liquidation to satisfy creditors. For example, during economic downturns, companies in the retail sector may liquidate inventory to recover losses and stabilize finances. Additionally, businesses may opt for voluntary liquidation when downgrading operations or focusing on core competencies, as seen with several technology firms during the 2020 market fluctuations due to the COVID-19 pandemic. Furthermore, this process can facilitate an exit strategy for owners, allowing them to cash out and allocate resources to new ventures or projects.

Request for Specific Action

The asset liquidation process involves the strategic sale of company-owned resources to free up capital for operational needs or debt reduction. In financial contexts, liquid assets, such as stocks or bonds, can be converted into cash quickly. The request must clearly identify the assets, such as machinery valued at $50,000 or warehouse inventory worth $100,000. Executors or managers must document the rationale for liquidation, including potential market opportunities in the next quarter or financial obligations due within six months. Regulatory compliance, such as adhering to IRS guidelines for asset sales, is crucial. Specific timelines for liquidation and potential buyers or marketplaces, like online auction platforms or industry-specific brokers, should be considered to maximize financial returns.

Contact and Response Instructions

In an asset liquidation request, clear and detailed contact information is essential for efficient communication and timely responses. Include the name of the requestor, their title, and the organization's name. Specify the address for correspondence, ensuring it includes city, state, and postal code for accurate delivery. Provide multiple methods of contact, such as a direct phone number including area code and a professional email address, allowing for flexibility in communication. Outline response instructions that specify the preferred method of reply, addressing any deadlines for responses to ensure an organized and prompt liquidation process. Additionally, state the importance of retaining confidentiality for any shared financial information during the communication.

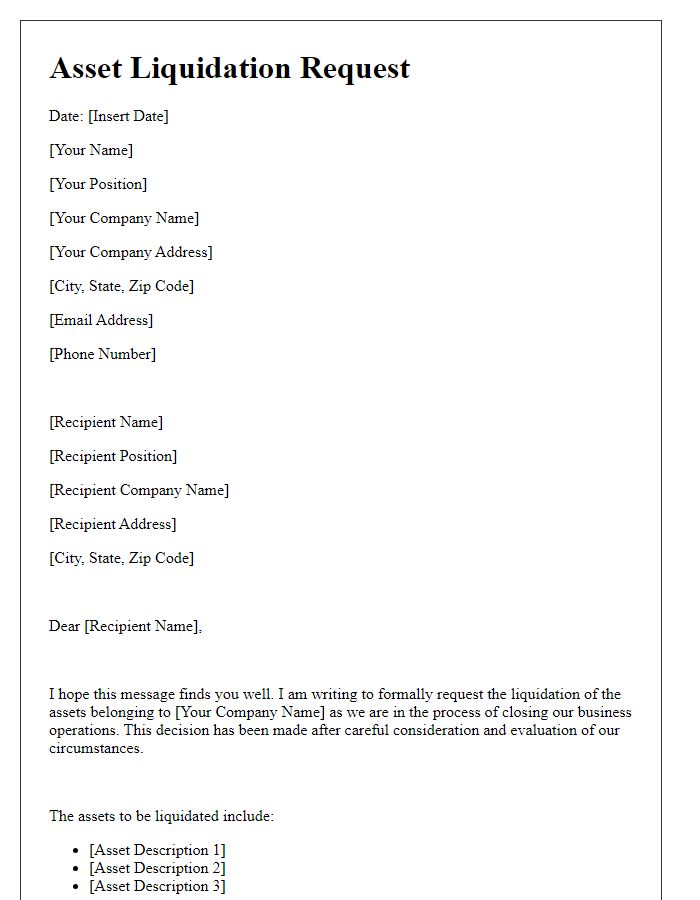

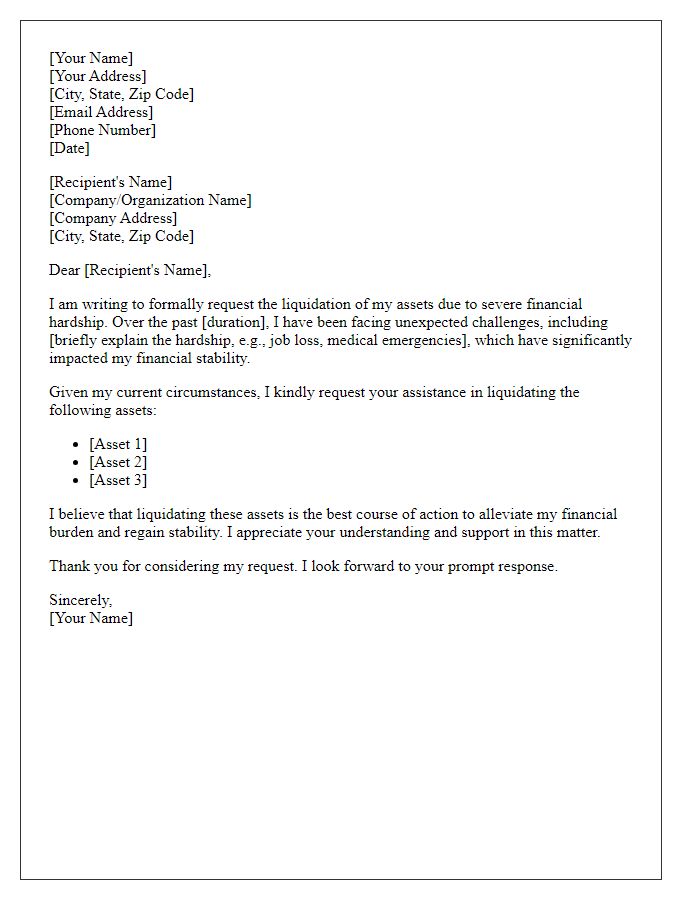

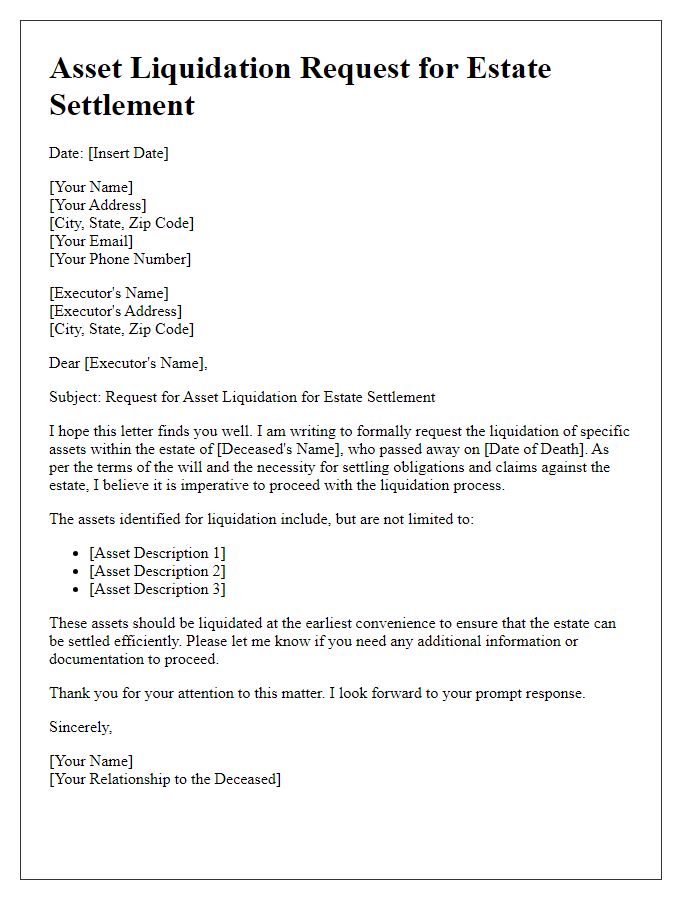

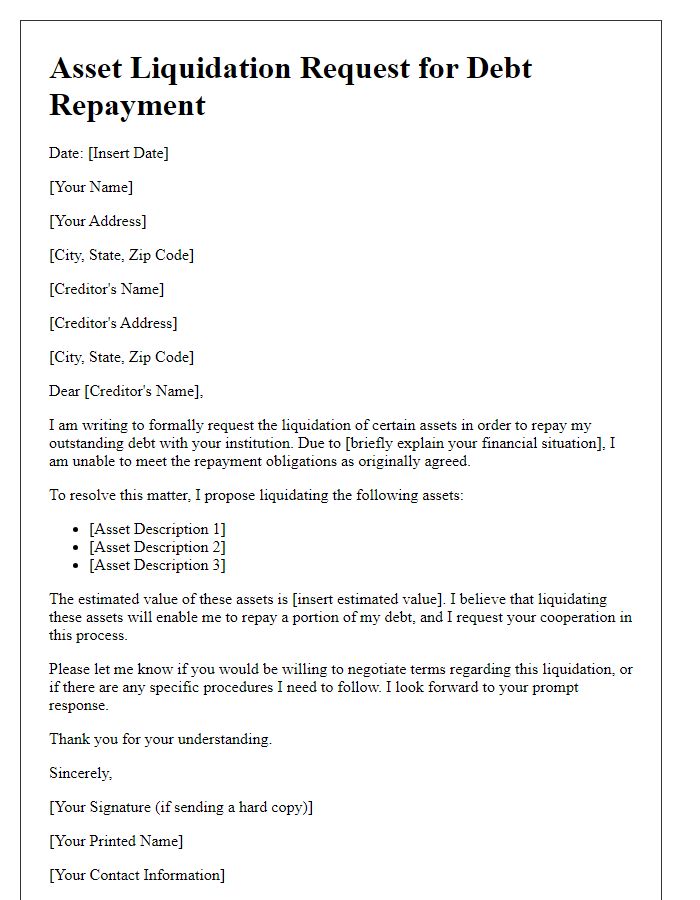

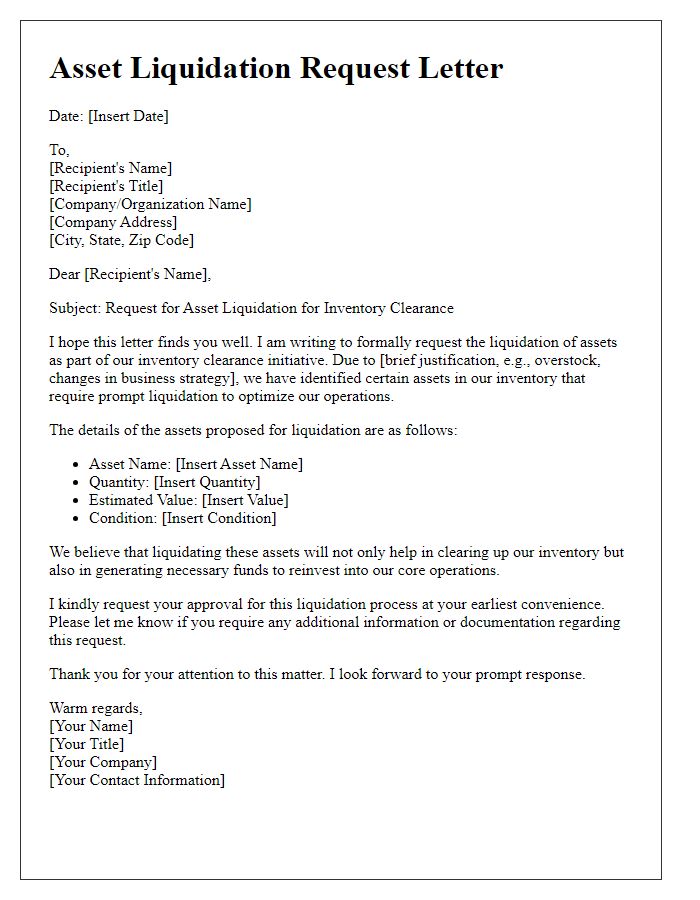

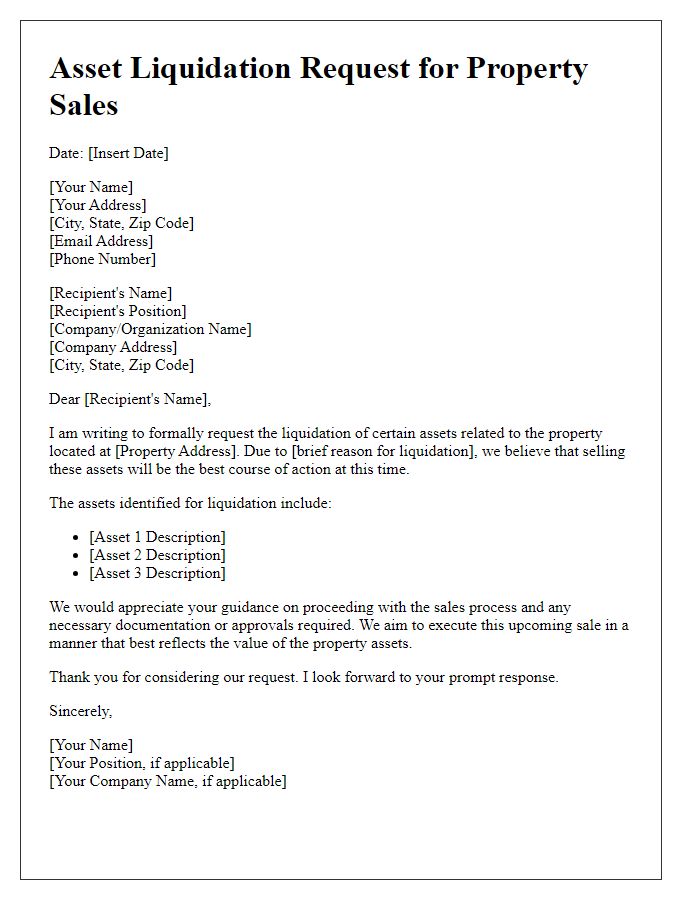

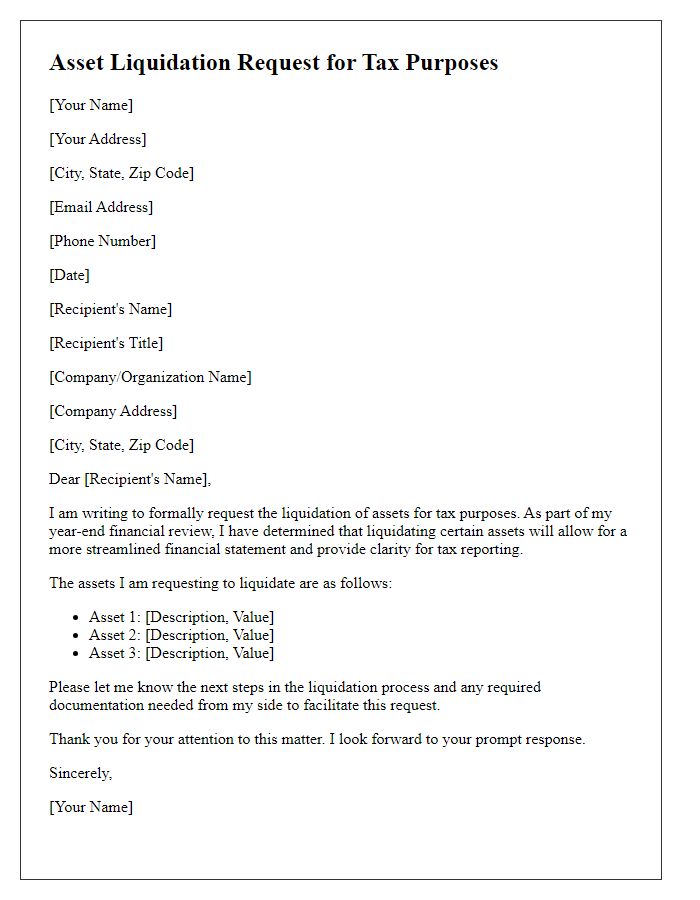

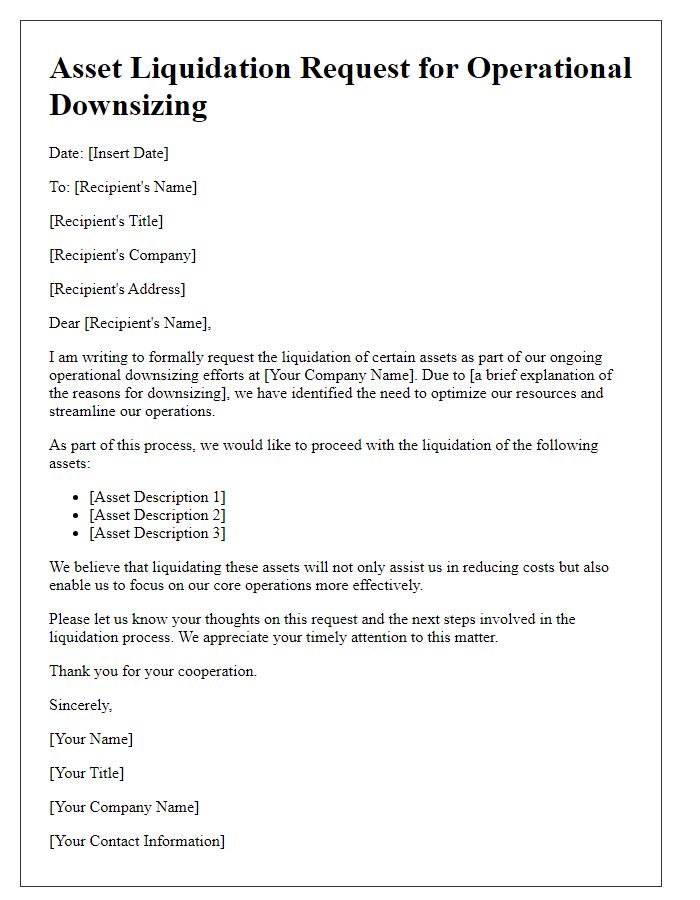

Letter Template For Asset Liquidation Request Samples

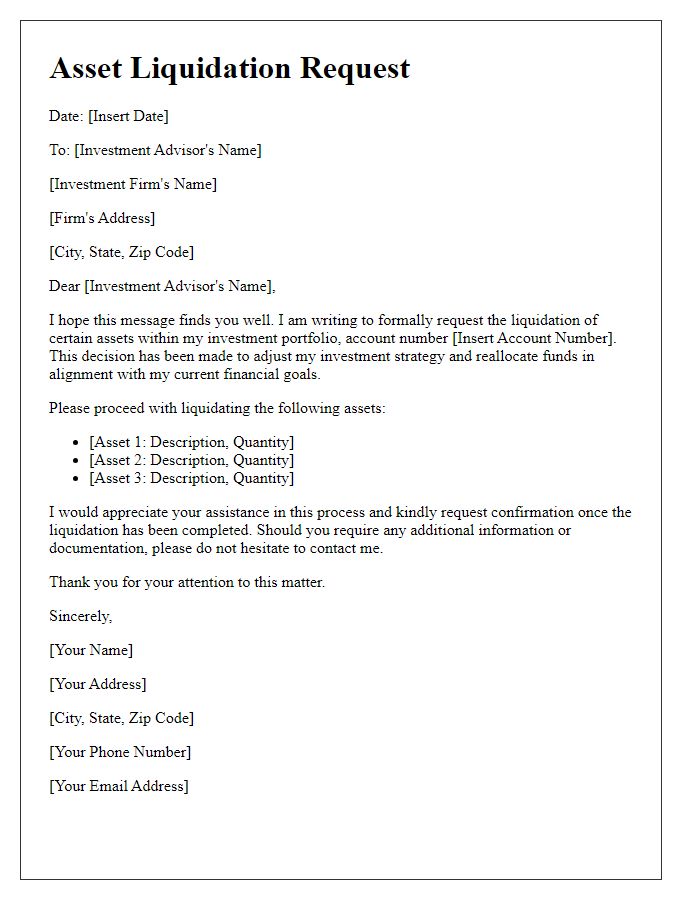

Letter template of asset liquidation request for investment portfolio adjustment

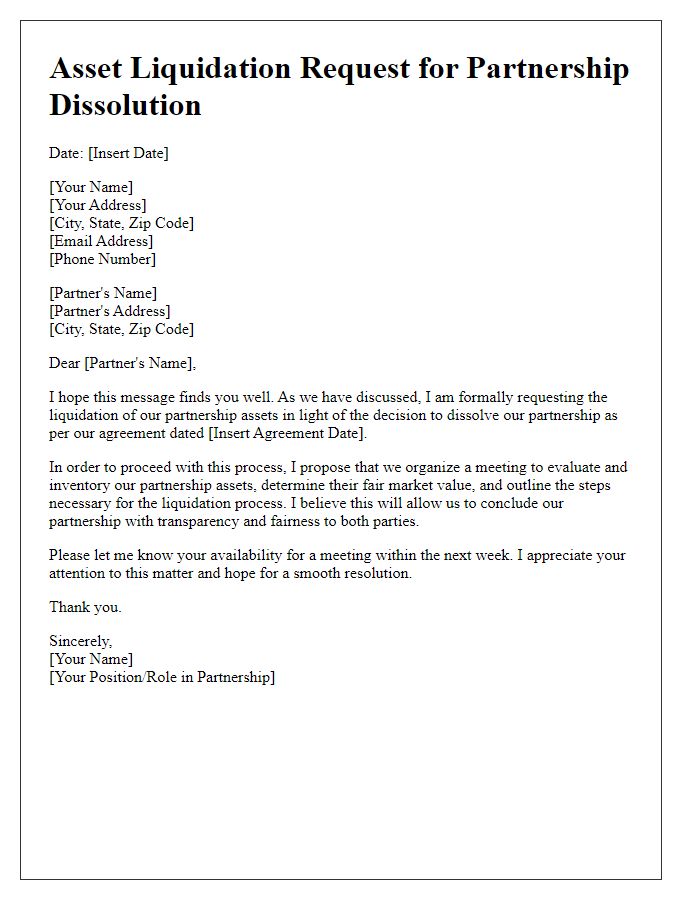

Letter template of asset liquidation request for partnership dissolution

Comments