If you've ever felt overwhelmed by the ups and downs of mortgage rates, you're not alone! Understanding how an interest rate lock agreement can safeguard your financial future might just be your key to peace of mind during the home buying process. This simple yet powerful tool not only shields you from rising rates but also gives you the confidence to move forward with your purchase. Ready to learn more about how an interest rate lock agreement can benefit you? Keep reading!

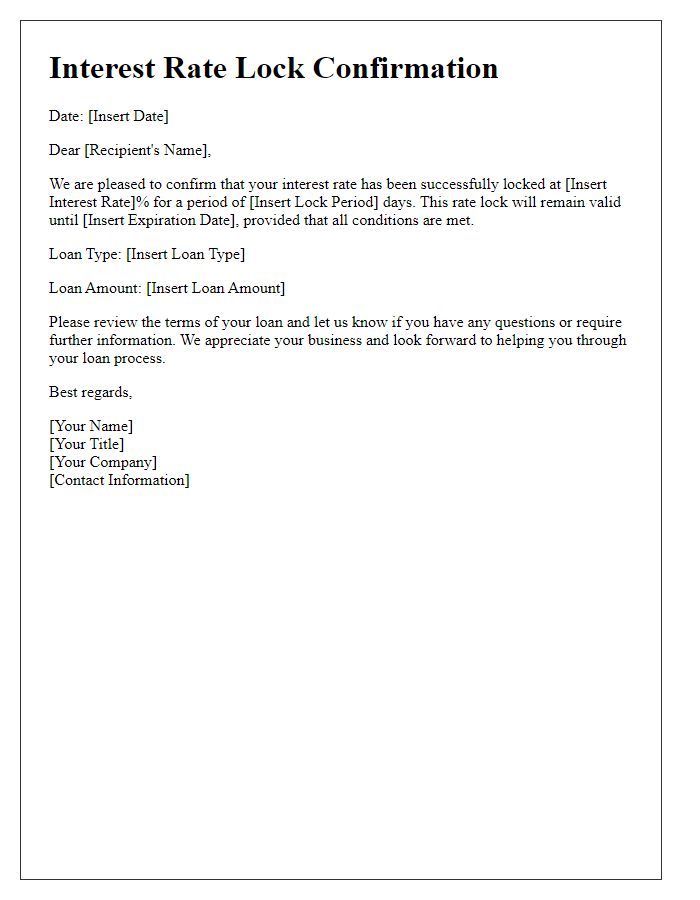

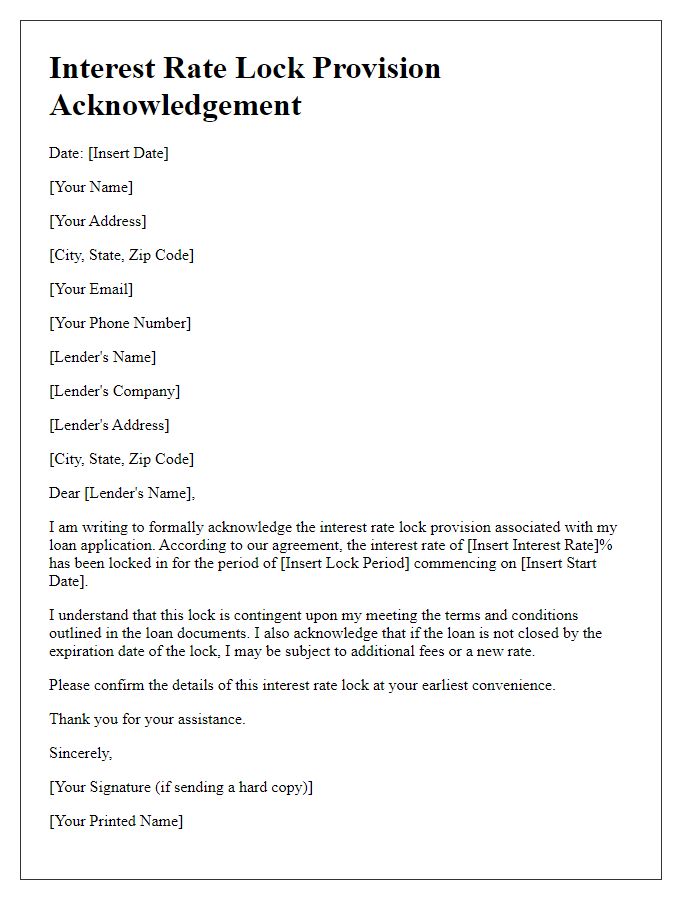

Agreement Terms and Conditions

Interest rate lock agreements serve as crucial financial contracts that stabilize mortgage terms during housing market fluctuations. Typically lasting between 30 to 60 days, this agreement secures a specified interest rate for loan amounts, often influenced by market trends and economic indicators. Lenders usually provide the locked rate based on current market calculations, where a lower interest rate can result in significant savings over the loan's lifespan. Borrowers may incur fees if the closing process exceeds the lock period, a potential risk in competitive real estate markets, such as California or New York. Essential components of the agreement include lock duration, applicable fees, and conditions for extensions or adjustments in case of market changes. Understanding each of these facets can empower borrowers to navigate their financial commitments more effectively.

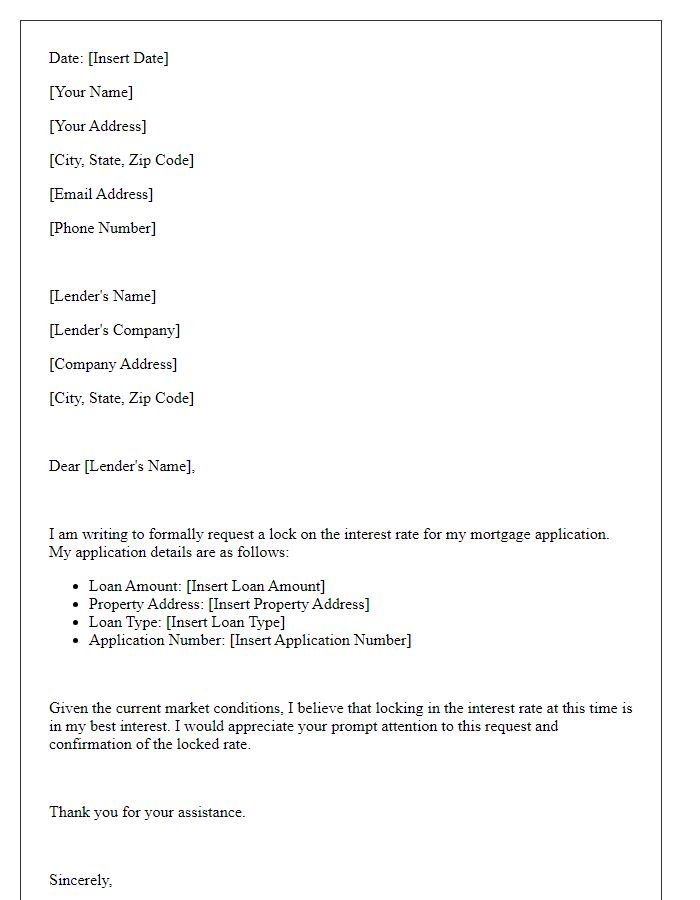

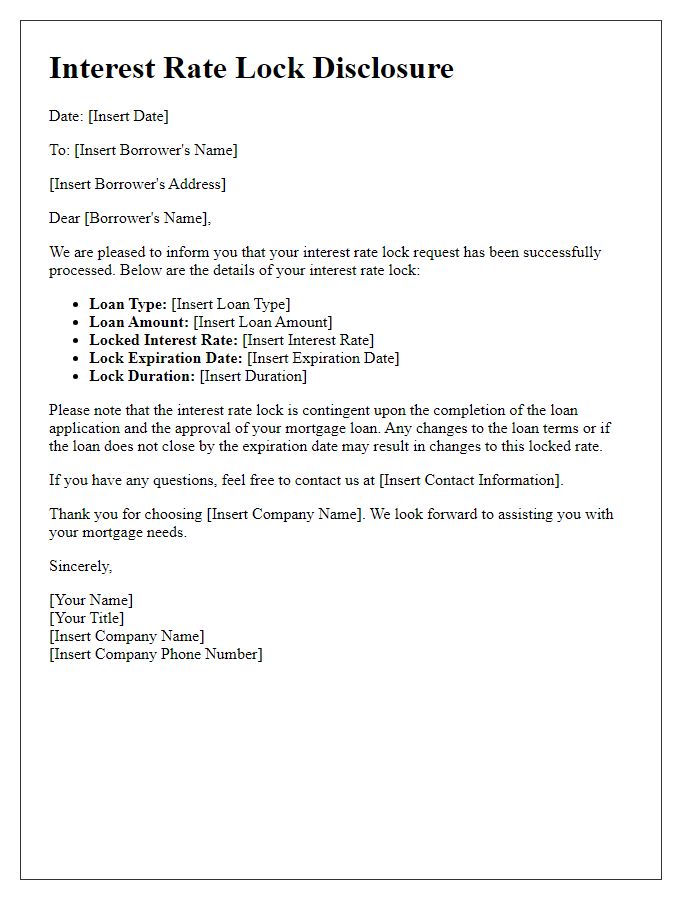

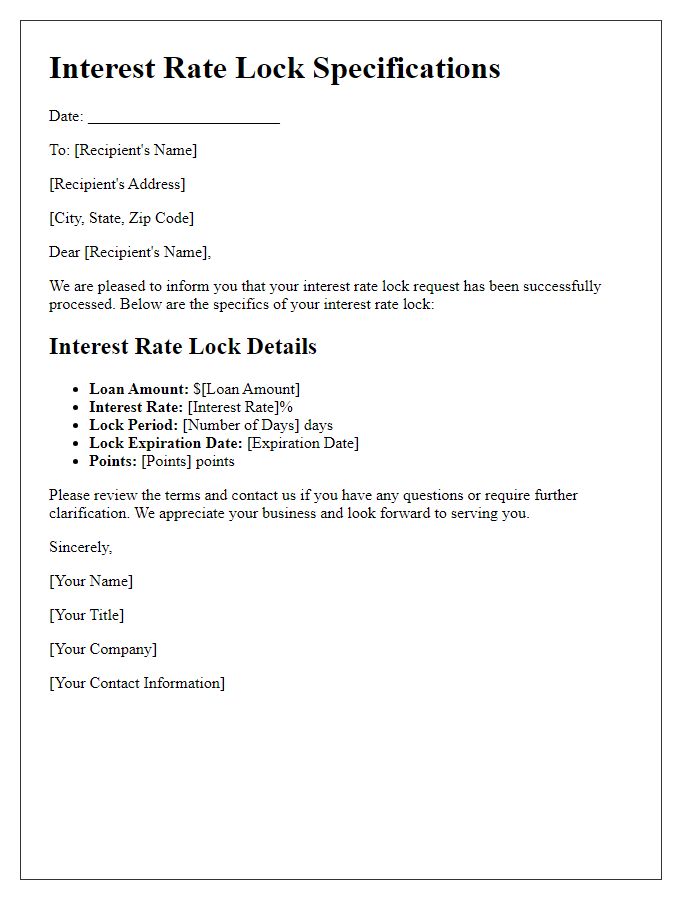

Borrower and Lender Information

Interest rate lock agreements serve as crucial contracts in the mortgage industry, ensuring borrowers secure a fixed interest rate for a defined period. This agreement outlines essential borrower information, encompassing personal details such as legal names, social security numbers, and contact information, which facilitate precise identification throughout the lending process. Lender information includes the financial institution's name, physical address, and licensing details, ensuring that borrowers are aware of the entity providing the mortgage. Both parties must carefully review and sign this agreement to prevent discrepancies and safeguard against potential interest rate fluctuations during the lock period, typically ranging from 30 to 60 days.

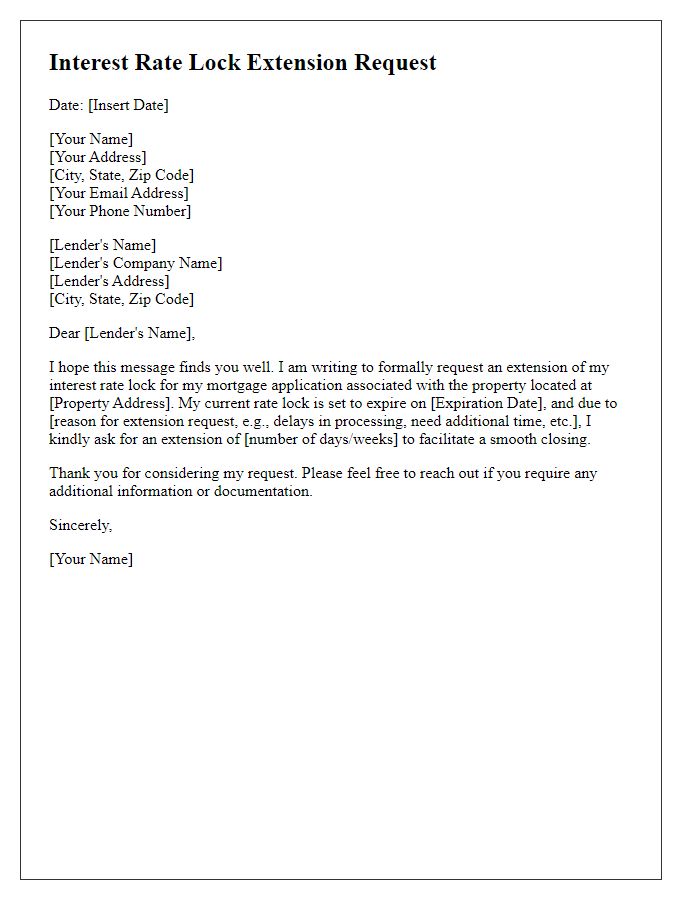

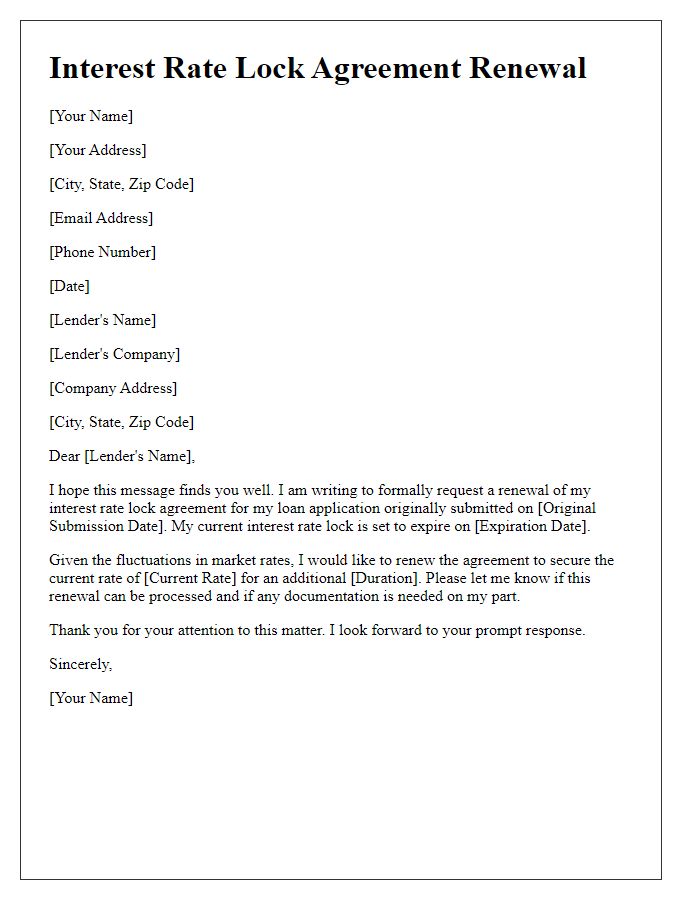

Lock-in Period and Expiration Date

An interest rate lock agreement is a critical component for homebuyers securing favorable mortgage terms. Typically, lenders allow a lock-in period, often ranging from 30 to 90 days, during which the borrower can fix an interest rate, protecting them from fluctuations in the market. This window is particularly vital during volatile economic periods, where rates can shift significantly, sometimes by as much as 0.5% in just a few days. The expiration date marks the end of this protective period; if the loan is not closed by that date, the rate may revert to current market conditions, potentially impacting monthly payments dramatically. For instance, a difference of a mere 1% can equate to thousands of dollars over the life of a loan. Being mindful of these timelines ensures borrowers make informed decisions and can secure their desired financing terms.

Loan Amount and Interest Rate

An interest rate lock agreement secures a fixed interest rate for a specified loan amount, typically for a mortgage or refinancing transaction, providing financial stability during the application process. The loan amount, often ranging significantly based on the property value and borrower qualification, plays a crucial role in determining the interest rate. Borrowers must understand that fluctuations in interest rates can impact overall loan costs, necessitating a clear agreement outlining the fixed rate duration, often 30 to 60 days. This proactive measure protects borrowers from sudden increases in rates, especially in volatile markets, ensuring affordability and predictability in monthly payments.

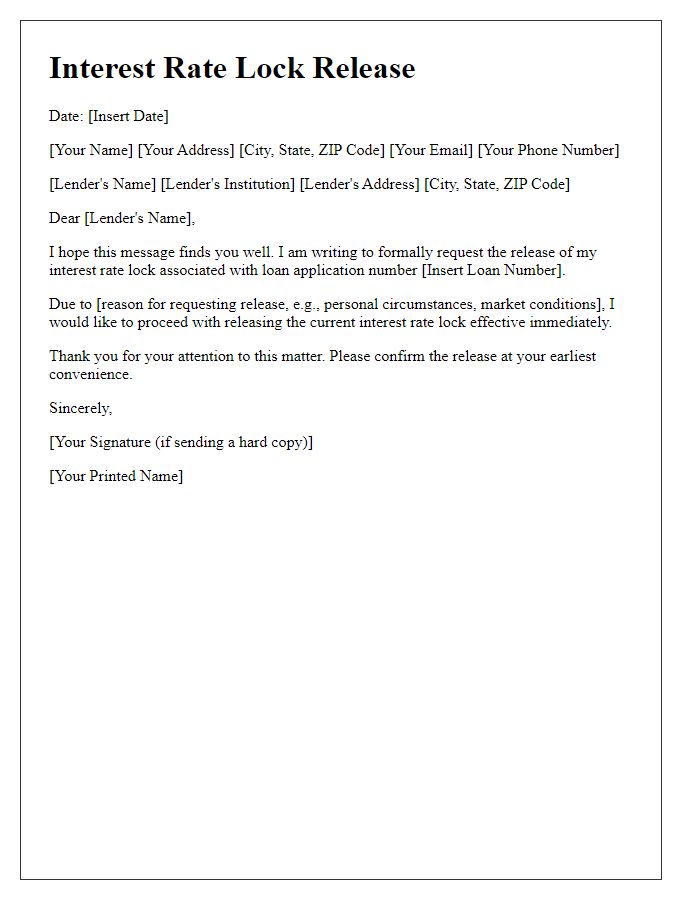

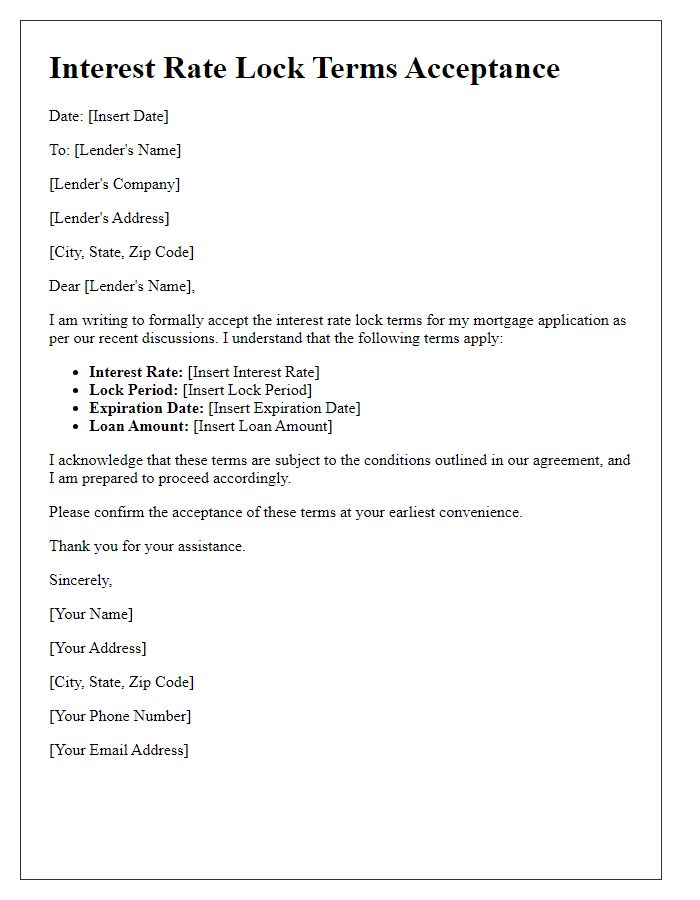

Signatures and Date

An interest rate lock agreement is a critical document in real estate transactions, particularly for mortgage loans, providing borrowers with a secured interest rate for a specified period of time. Both parties, the lender and the borrower, must sign this agreement to ensure a mutual understanding of the terms. Signatures from authorized representatives, along with the respective dates, validate the agreement's enforceability. Typically, the borrower's signature reflects their acceptance of the loan conditions set forth, while the lender's signature confirms their commitment to honoring the locked interest rate, often applicable for loan amounts greater than $100,000 for residential mortgages in the United States. It is essential to include spaces for full names, titles, and the date of mutual consent to maintain clarity and legality.

Comments