Are you waiting for that final confirmation on your bank loan payment? It can feel like a significant milestone when you finally reach the end of your loan journey! In this article, we'll explore how to effectively communicate with your bank and ensure all ends are tied up neatly. So, stick around and let's dive into the essentials of confirming that last payment!

Loan Account Details

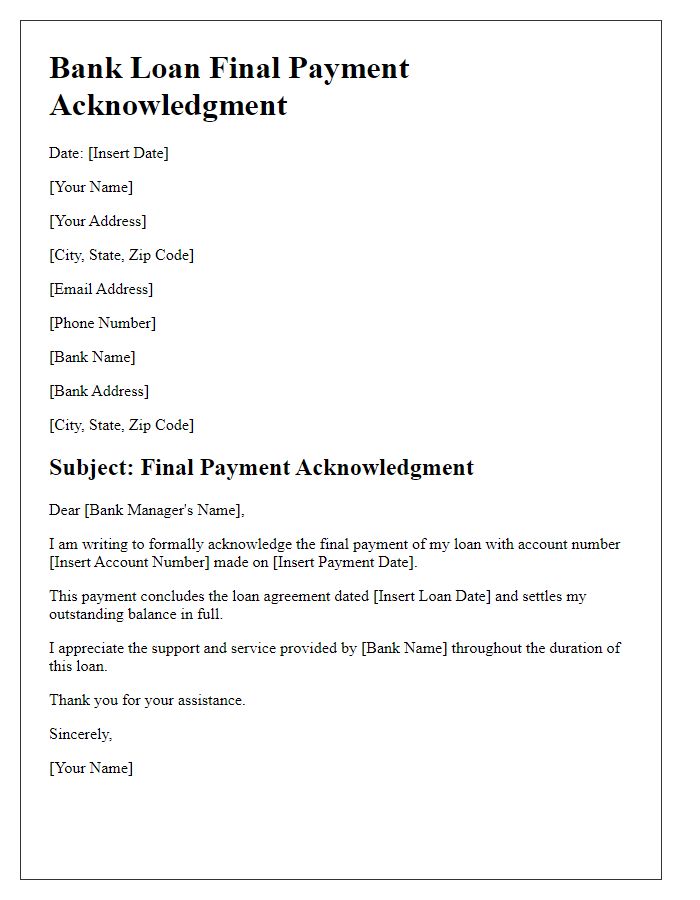

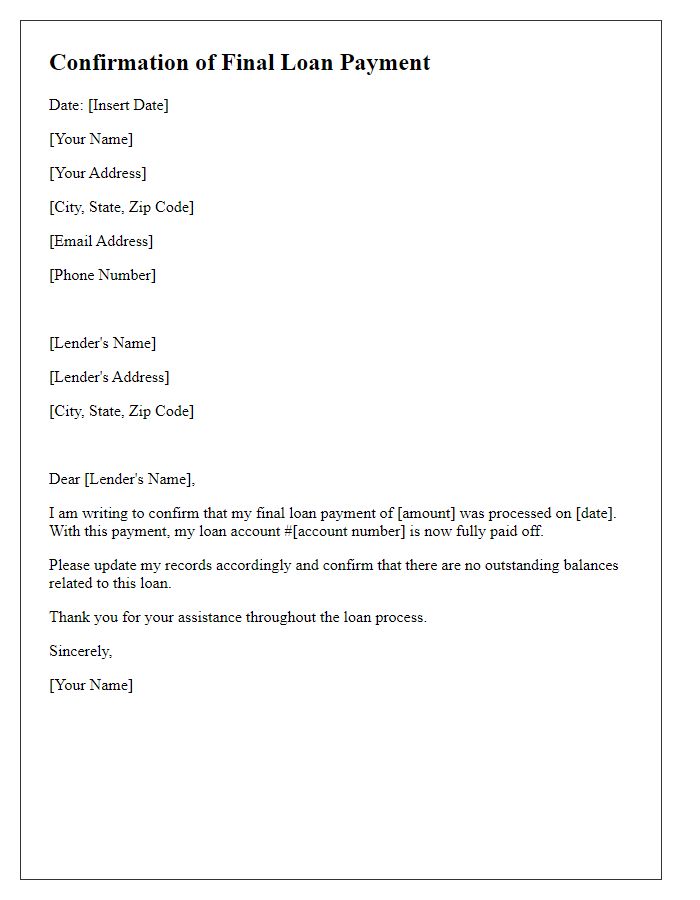

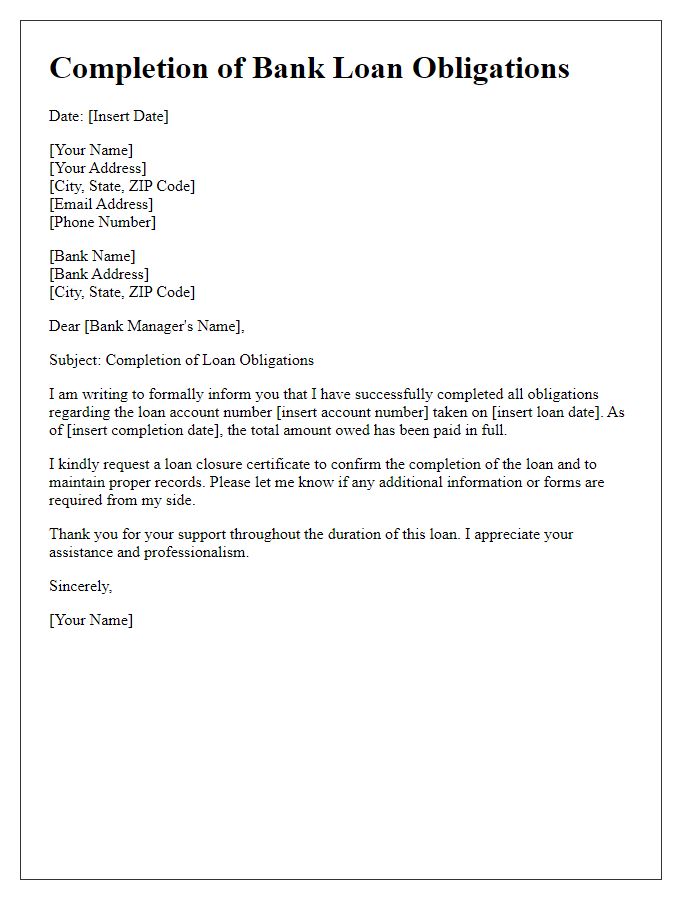

The final payment confirmation for a bank loan marks the completion of a financial commitment over a specified period. In this context, the Loan Account Details (including the account number and associated loan type, such as a personal loan or mortgage) serve as critical identifiers for the transaction. Records indicate that payments were due monthly, adhering to an agreed-upon schedule, specifying dates and amounts. Additionally, interest rates applicable to the loan (fixed at 4.5% annually in this scenario) significantly impact the total repayment amount calculated over the loan period. Upon receiving the final payment, the bank typically issues a confirmation letter, certifying that the loan obligation is met, which includes important details such as the date of final payment, total amount paid, and a statement of no outstanding balance. This confirmation is vital for credit reports and financial transparency.

Final Payment Amount

The final payment amount due for the bank loan, specifically for the personal loan account number 123456789, is $5,000. This payment represents the remaining balance owed as of October 2023. Timely submission of this amount ensures closure of the loan account with Bank of America in New York. Ensuring this payment clears by the due date of November 15, 2023, will result in confirmation of loan satisfaction. Completion of this transaction will release the borrower from any further financial obligations associated with this loan, allowing for the transfer of title documents related to the financed property.

Confirmation of Payoff

Finalizing loans can lead to significant financial relief for borrowers. Confirmation of loan payoff provides assurance to individuals regarding their financial obligations. For case studies, many borrowers successfully complete their final payments, ensuring all principal and interest amounts are settled. This process typically requires a formal confirmation letter from the lending institution, detailing the loan account number, outstanding balance (originally ranging from thousands to hundreds of thousands of dollars), and payoff date. In 2022 alone, banks issued thousands of these confirmations, highlighting the increased trend of debt management among consumers. Such documentation is crucial for establishing a clear financial history and facilitating future credit applications.

Release of Lien or Collateral

Final payment confirmation of a bank loan marks the conclusion of a financial agreement. Upon complete repayment, documentation such as a Release of Lien or Collateral is generated. This legal document confirms the discharge of the bank's claim on the asset used as security (collateral) for the loan, such as real estate, vehicles, or business assets. The release signifies the end of the lender's interest in the asset, allowing the borrower full ownership rights. Important details include the loan account number, property description, or VIN (Vehicle Identification Number) for vehicles. Terms indicated should reflect the satisfaction date, confirming that the borrower has met all obligations related to the loan. This confirmation is essential for future financial endeavors, providing proof of ownership and unencumbered status of the collateral.

Contact Information for Further Inquiries

Final payment confirmation for a bank loan signifies the completion of a financial obligation, particularly when dealing with institutions like Bank of America or JPMorgan Chase. Upon concluding this payment, borrowers receive formal documentation outlining the details of the loan, including the original loan amount, interest rates, and payment history. Ensuring the accuracy of this record is crucial, as it can impact credit ratings and future loan applications. Contact information for further inquiries is typically provided in this confirmation letter, including phone numbers, email addresses, and postal addresses for customer service departments. This enables borrowers to seek clarification regarding their loan status or any remaining financial obligations.

Comments