Are you curious about the ins and outs of a mortgage assumption agreement? Understanding this vital document can empower you as a homeowner to navigate your mortgage options more effectively. With the right information, you can tackle the complexities of assuming a mortgage and make informed financial decisions. So, let's dive deeper into this topic and uncover everything you need to know!

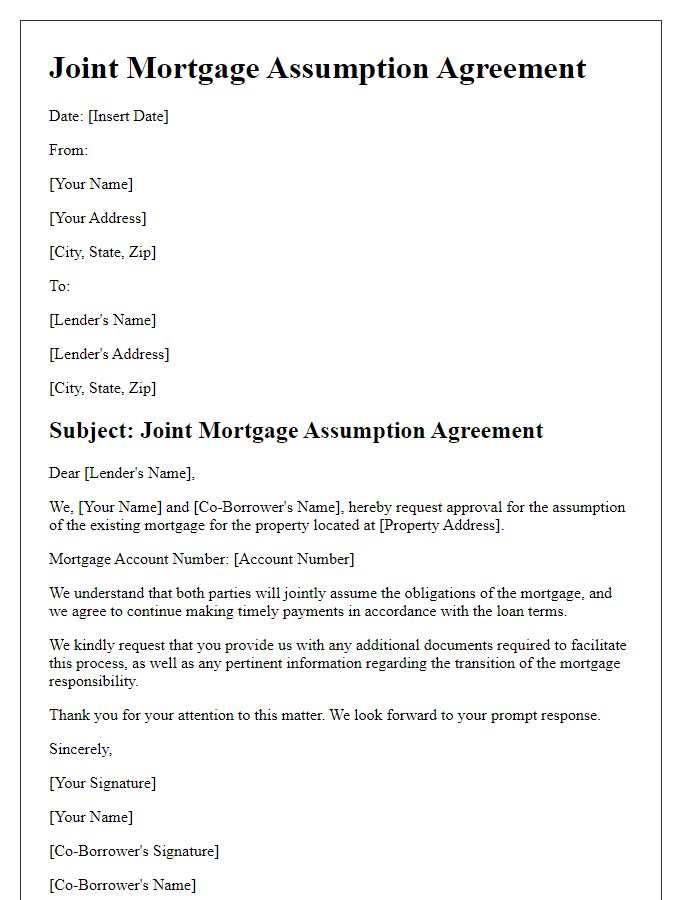

Parties Involved

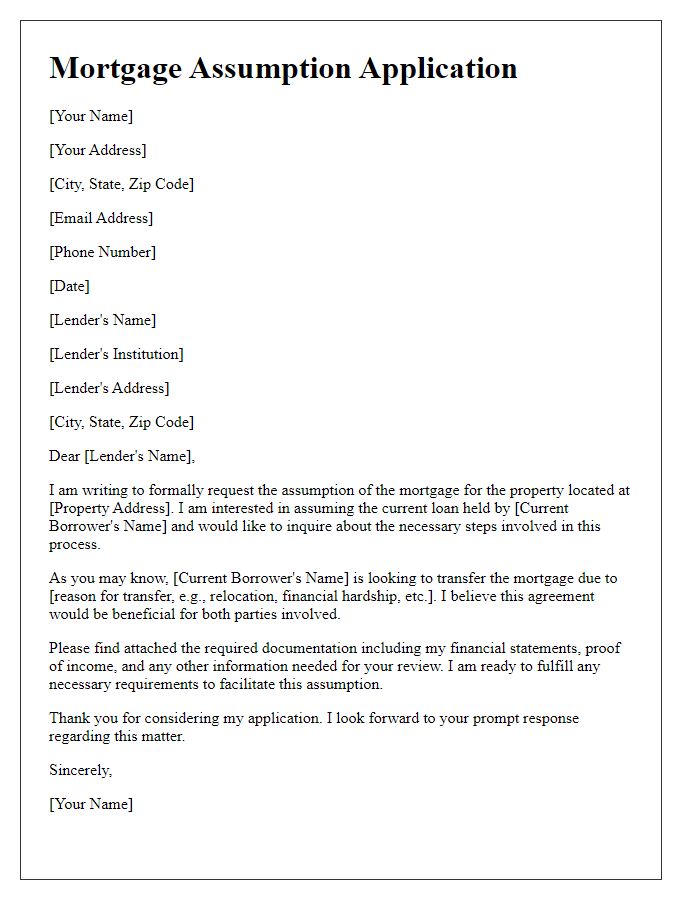

A mortgage assumption agreement involves multiple parties, each with specific roles and responsibilities. The original borrower, typically the homeowner, remains the primary party responsible for the mortgage debt linked to the property. The new borrower, often a buyer assuming the mortgage, must meet the lender's qualifications for creditworthiness and income stability. The lender, usually a financial institution like Bank of America or Wells Fargo, provides consent for the assumption and outlines the terms in the agreement. Important legal terminology includes "assumable mortgage," which allows the new borrower to take over the existing loan without renegotiation, and "default," defining the obligations regarding timely payments. Clear identification of the property, usually noted by its address (e.g., 123 Main St, Springfield), ensures all parties understand the asset tied to this agreement.

Property Description

A mortgage assumption agreement is a legal document that outlines the terms under which one party (the buyer) assumes the mortgage obligation of another party (the seller) for a specific property. The property description should contain vital details to accurately identify the location and characteristics of the property involved in the transaction. This includes the complete address, which should specify the street name and number, city, state, and zip code. Detailed descriptions should encompass the type of property, such as single-family residence, condominium, or multi-family dwelling. Additionally, the property's legal description, which may include parcel numbers, lot numbers, and boundary information, should be clearly stated to avoid confusion. The agreement should also include any relevant zoning information, the total square footage, and any distinguishing features, such as the number of bedrooms, bathrooms, and the presence of any additional structures like garages or sheds. This comprehensive property description ensures all parties involved have a clear understanding of the property tied to the mortgage assumption.

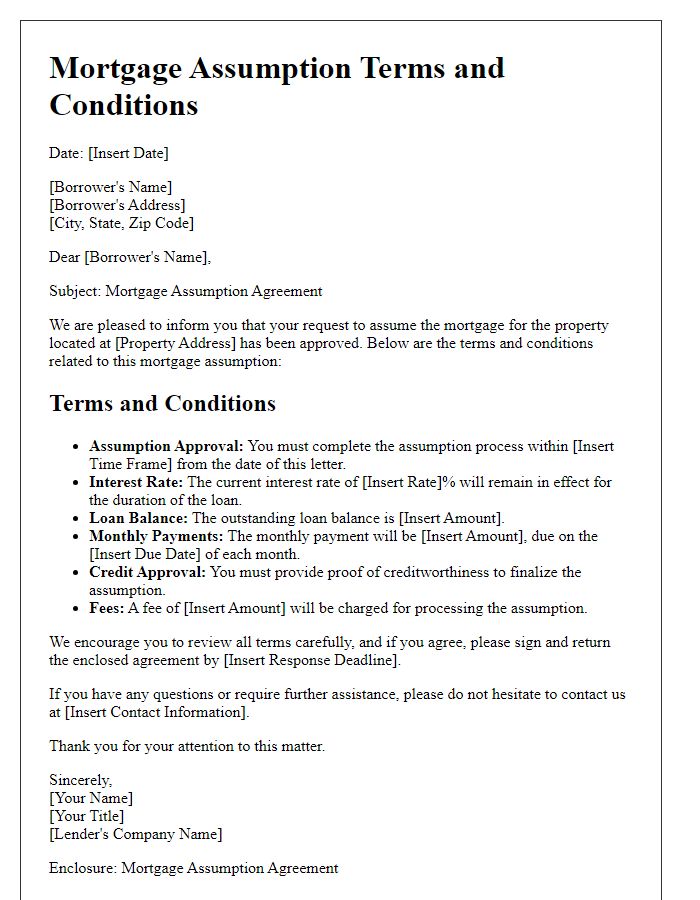

Loan Terms

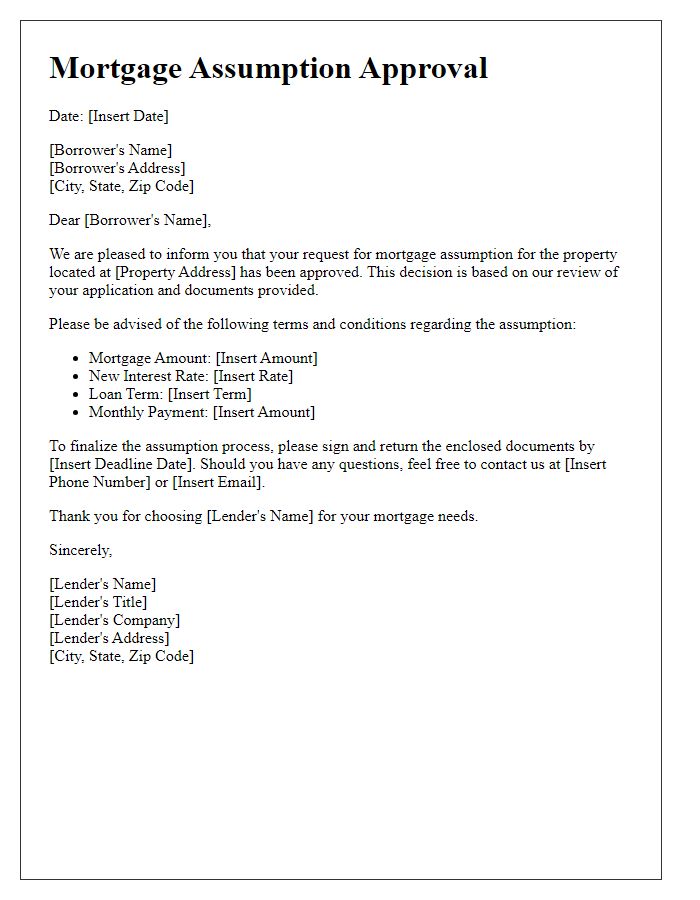

A mortgage assumption agreement outlines the transfer of mortgage liability from one borrower to another, typically including specific loan terms for clarity. Loan amount represents the total outstanding balance, often a significant figure like $250,000, depending on the property value. Interest rate may be fixed or variable; current market rates hover around 3.5% as of October 2023. Loan term usually spans 15 to 30 years, defining the repayment schedule's length. Monthly payment details provide clarity on expected payments, including principal and interest components, for example, $1,200 monthly. The agreement also specifies any fees, such as assumption fees, which can range from $500 to $1,000, impacting the overall cost of transitioning the mortgage. Property address is vital, pinpointing the location associated with the debt obligation, ensuring both parties are aligned on the asset in question.

Assumption Conditions

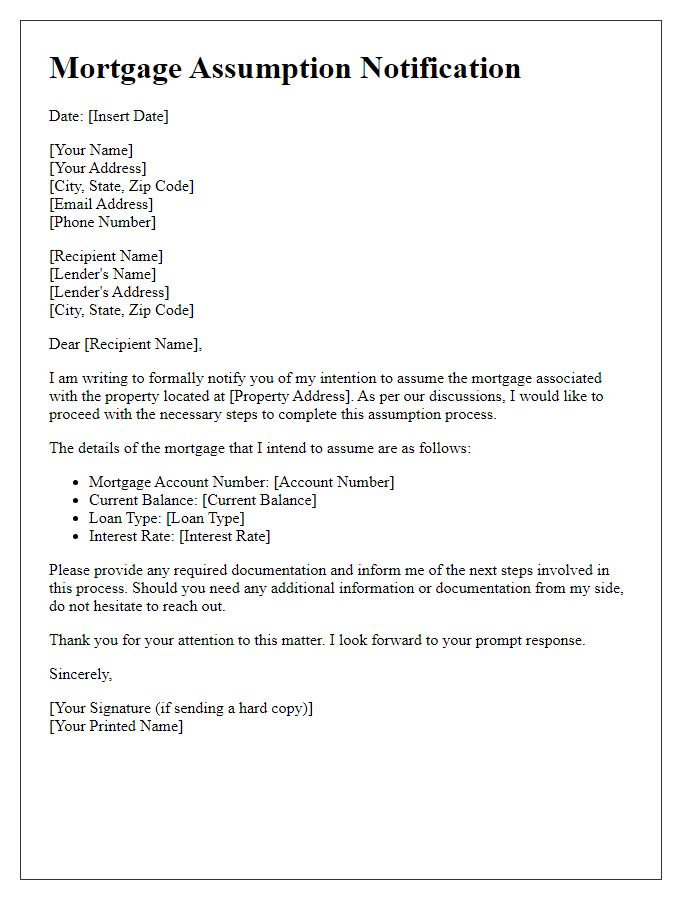

A mortgage assumption agreement outlines the conditions under which one party assumes responsibility for another party's existing mortgage, allowing the new borrower to take over the payments and terms of the loan. Key conditions often include the buyer's creditworthiness, which must meet lender standards, and the acceptance of terms outlined by the original lender, often including interest rates, payment schedules, and remaining loan balance. Additionally, the agreement may specify any necessary fees or penalties for transferring the mortgage and the required disclosures about the property's condition, necessary repairs, or existing liens against the property. It's essential that the agreement complies with local regulations, such as those found in places like California, New York, or Texas, which may have specific legal requirements for mortgage assumptions. Proper documentation and signatures from all parties involved are critical to finalize the transfer of obligations and ensure a smooth transition.

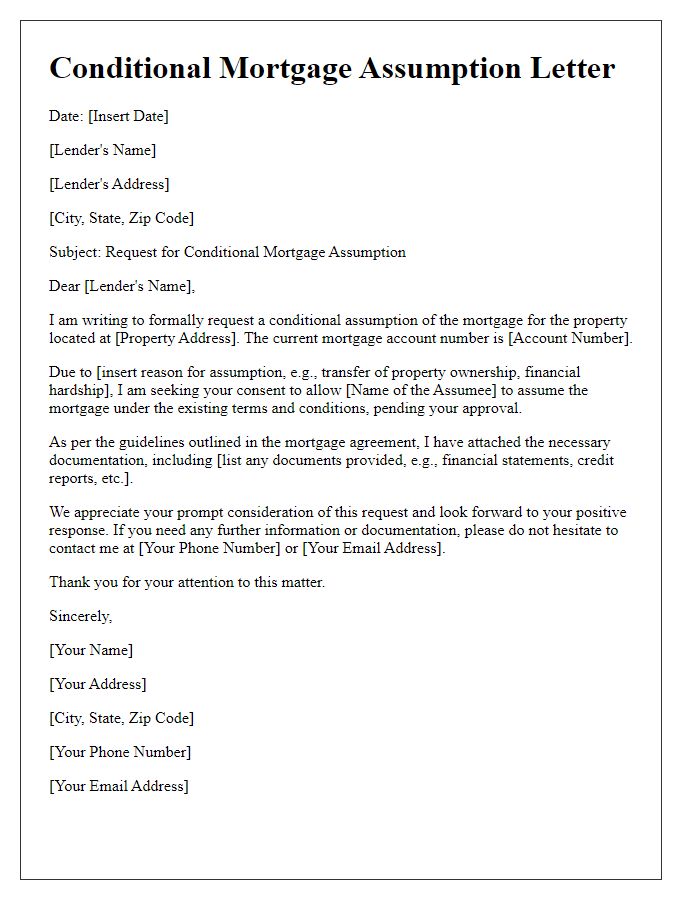

Legal Provisions

A mortgage assumption agreement allows a buyer to take over the seller's existing mortgage under specific legal terms. The agreement typically outlines crucial provisions, such as the assumption of liability, where the buyer agrees to make future payments and assume responsibility for the outstanding loan balance, which may total hundreds of thousands of dollars. The agreement must specify the lender's approval for the assumption, which may require a detailed credit check, income verification, and other financial assessments aligned with lending regulations. Key legal terms may include representations and warranties, governing law, and default clauses that outline consequences for failure to meet payment obligations. In addition, the agreement may address additional costs, such as assumption fees or property taxes, that might arise during the transition, ensuring all parties are informed of their responsibilities and rights under the law governing mortgage assumptions in states like California or Texas.

Comments