Choosing the right fixed-rate mortgage can feel overwhelming, but it doesn't have to be! Understanding your options and what to look for can make all the difference in securing your dream home. Whether you're a first-time buyer or looking to refinance, the process can be simplified with the right knowledge. Let's dive in and explore how to select the best fixed-rate mortgage for your needs!

Loan Amount and Term

Choosing a fixed-rate mortgage involves careful consideration of both the loan amount and the loan term. The loan amount, typically ranging from $50,000 to several million dollars, significantly impacts monthly payments and overall interest paid over the life of the loan. A typical loan term in the United States spans 15 to 30 years, with the longer term leading to lower monthly payments (but higher total interest costs). For instance, a $300,000 loan at a 3% interest rate over 30 years results in approximately $1,264 monthly payments, whereas the same amount at a reduced rate over 15 years increases the monthly payment to around $2,073, significantly decreasing the total interest accrued. Market conditions, such as current interest rates (averaging 3.5% as of 2023), and personal financial situations, including gross income and credit score, should guide this selection process.

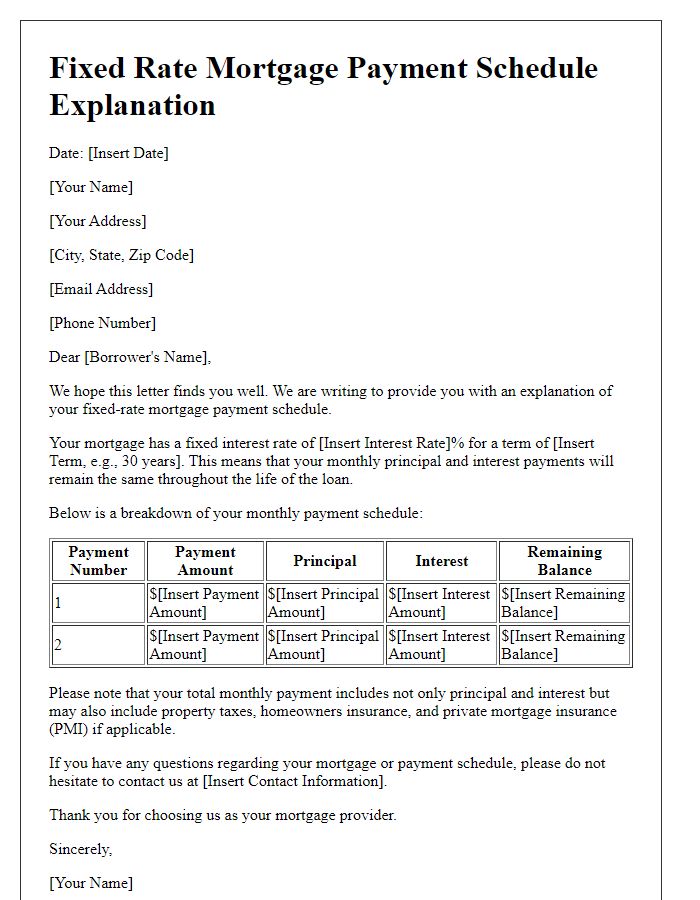

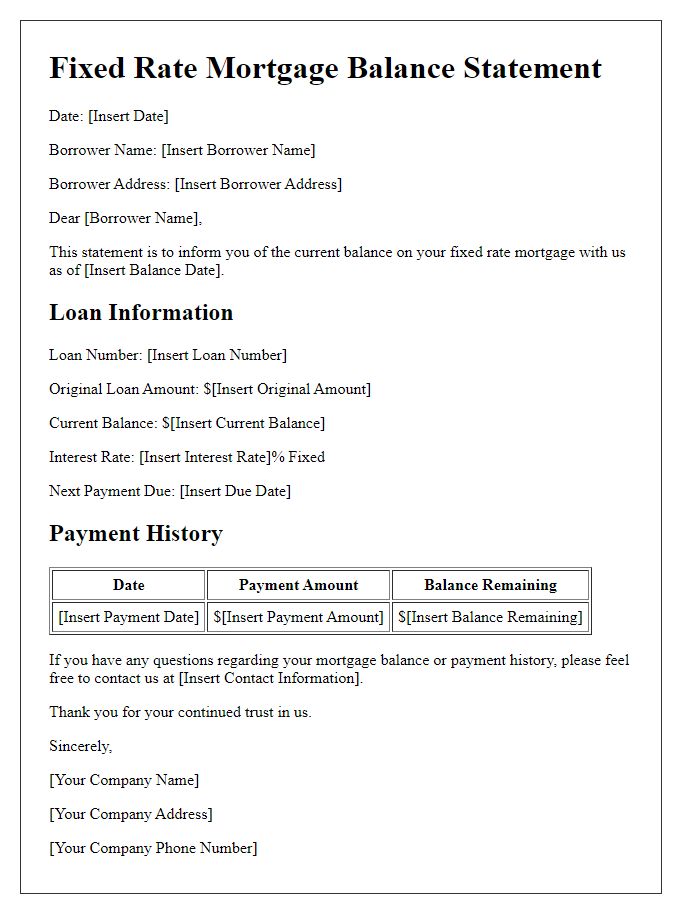

Interest Rate and Payment Details

Choosing a fixed-rate mortgage can provide financial stability for homeowners, with consistent monthly payments over the loan term, commonly spanning 15, 20, or 30 years. Current interest rates in October 2023 range from approximately 3.5% to 6.5%, varying based on credit score, loan amount, and lender policies. Borrowers should assess the total interest paid over the life of the loan, which can significantly impact overall expenditure, with a $300,000 mortgage at 4% interest resulting in almost $215,000 in interest over 30 years. Fixed-rate mortgages also safeguard against market fluctuations, providing predictability in budgeting. Understanding amortization schedules, which illustrate payment breakdowns between interest and principal over time, is crucial for borrowers committing to long-term loans.

Closing Costs and Fees

Fixed-rate mortgages are a popular choice for homebuyers due to their stability and predictability in monthly payments. Closing costs, typically ranging from 2% to 5% of the mortgage loan amount, can include expenses such as loan origination fees, title insurance, appraisal fees, and inspection costs. These fees are necessary to finalize the mortgage process and can vary significantly based on location, lender, and property type. For instance, in metropolitan areas like New York City, closing costs may be substantially higher than in rural regions. Understanding these costs upfront helps buyers budget effectively and make informed decisions regarding their home purchase. Potential borrowers should thoroughly review the Good Faith Estimate provided by lenders, which outlines all fees associated with obtaining a mortgage, to ensure complete transparency and avoid unexpected expenses at closing.

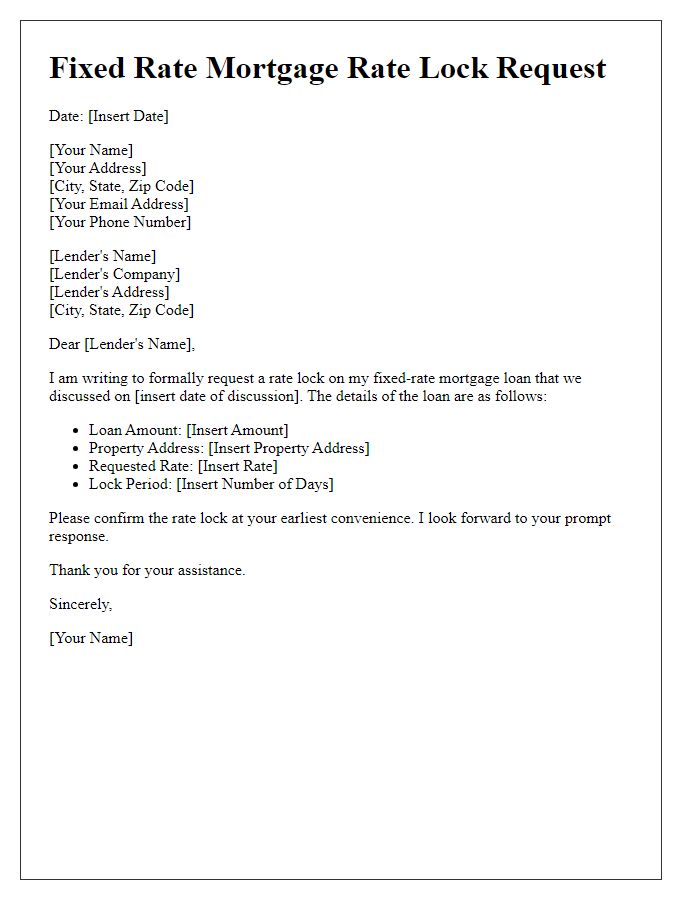

Lock-In Period and Rate Adjustment Terms

Selecting a fixed-rate mortgage requires understanding lock-in periods and rate adjustment terms. A lock-in period typically ranges from 30 to 60 days, during which borrowers secure the specified interest rate, protecting them from market fluctuations. For example, if a lender offers a 3.5% fixed interest rate for a 30-year mortgage, this rate remains unchanged throughout the loan's lifespan, eliminating future adjustments. Post lock-in, rate adjustment terms become critical; for instance, some agreements might allow for modifications based on economic indicators like the Consumer Price Index (CPI). Understanding these terms is essential, as they impact monthly payments and overall financial planning. Borrowers should carefully assess market conditions and anticipate potential future interest rate changes before committing.

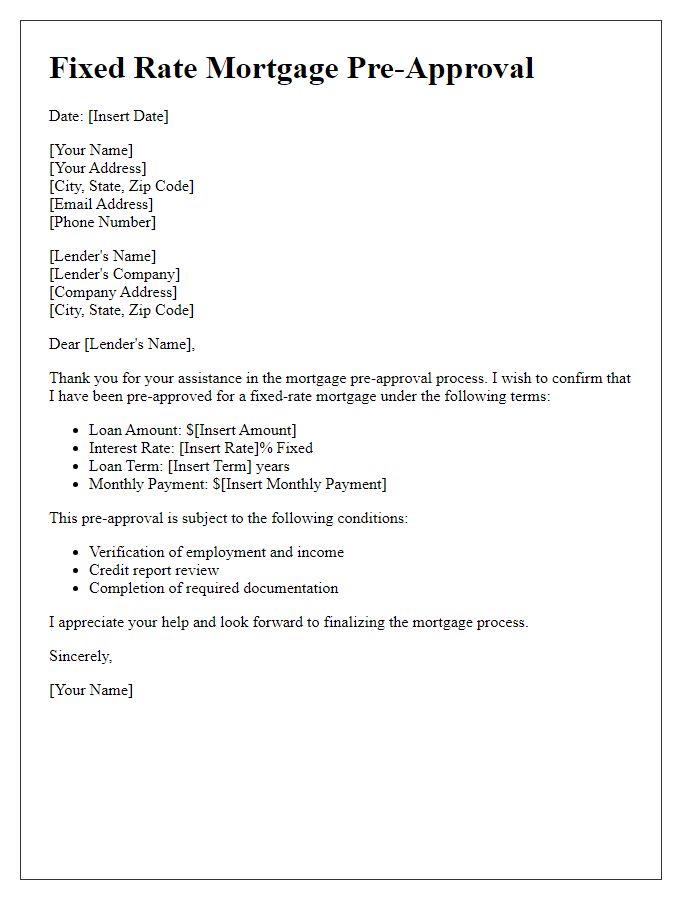

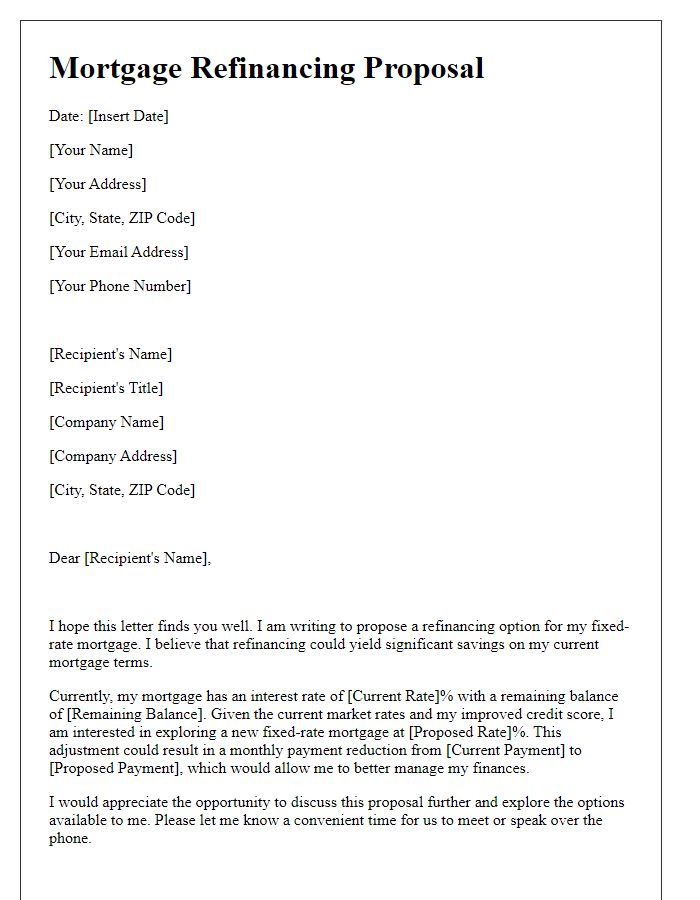

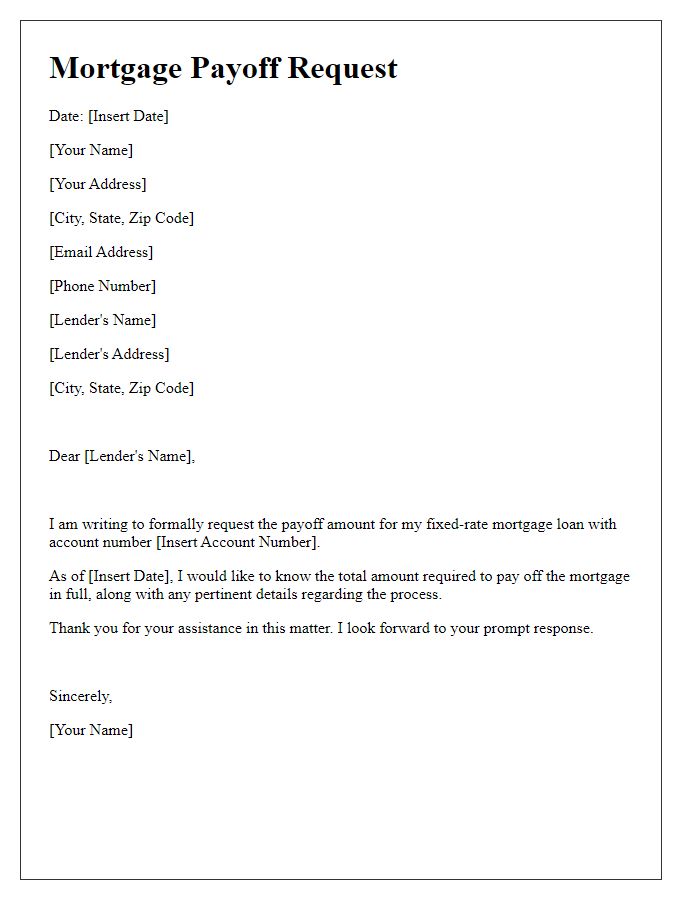

Lender Contact Information and Next Steps

Selecting a fixed-rate mortgage involves careful consideration of lender options and next steps towards securing financing. Prospective borrowers should gather lender contact information, including phone numbers, email addresses, and physical addresses, for major institutions such as Bank of America or Wells Fargo, known for their competitive rates and customer service. After identifying potential lenders, it is crucial to prepare necessary documentation, such as income statements and credit reports, to facilitate the qualification process. Additionally, setting up appointments for consultations can provide deeper insights into individual mortgage products, including terms, interest rates, and repayment options. Understanding the timeline for processing applications, typically ranging from 30 to 45 days, is essential to ensure a smooth transition to homeownership.

Comments