Are you considering paying off your mortgage and looking for that crucial payoff statement? Understanding how to request this document is essential for a smooth process and ensures you have all the necessary details to finalize your financial commitment. The payoff statement provides a clear breakdown of what you owe, including any interest or fees, making everything transparent for your financial planning. Ready to learn how to put together an effective request letter? Let's dive in!

Borrower's Information

A mortgage payoff statement provides critical information for borrowers, including total outstanding balance and applicable fees. Borrower's information typically encompasses full name, property address (including city, state, and ZIP code), mortgage loan number, and contact details like phone number and email address. This document helps clarify the remaining principal amount and any additional costs leading to settlement, ensuring accuracy in financial planning. Lenders usually require this statement during the closing process, whether for selling the property or refinancing existing loans, emphasizing its importance in real estate transactions.

Lender's Contact Details

To obtain a mortgage payoff statement, contacting the lender directly is necessary. The lender's contact details include essential elements such as the company name, phone number, and email address. This information is typically found on monthly mortgage statements or the lender's official website. Accurate identification requires providing the mortgage account number, property address, and personal identification details to the lender's customer service representative. Requesting the payoff statement will involve inquiring about the total outstanding balance, any fees or penalties for early repayment, and the exact date for the payoff amount validity. Secure communication ensures that personal financial information remains confidential.

Loan Account Number

To obtain a mortgage payoff statement for a loan associated with a specific Loan Account Number, it is essential to provide clear identification of the loan and necessary details. The payoff statement outlines the exact amount required to pay off the mortgage, including principal, interest, and any applicable fees or penalties. Typically, a payoff statement is requested when a borrower is preparing to sell their property or refinance their mortgage. The document usually contains vital information such as the loan servicer's address, the borrower's personal details, and relevant dates to ensure the accuracy of the payoff amount requested. This information plays a crucial role in facilitating a smooth transaction process.

Request for Payoff Statement

Submitting a request for a mortgage payoff statement is a crucial step for homeowners considering refinancing or selling their properties. A payoff statement provides a detailed account of the outstanding balance on the mortgage loan, including principal, interest, and any applicable fees. Homeowners typically seek this statement from their mortgage lender or servicer, such as Bank of America or Wells Fargo, as the critical document is often required during closing transactions. Accurate calculation, usually provided within 24-48 hours, ensures that borrowers know the exact amount needed to clear debt. The payoff statement also includes vital details like loan number, borrower information, and the expiration date of the quoted amount, which are necessary for processing a successful payoff.

Signature and Date

A mortgage payoff statement is an official document providing the remaining balance owed on a mortgage loan. Homeowners often request this statement when planning to pay off their loan fully or when refinancing. This document typically includes essential details such as the outstanding principal amount, any accrued interest, and additional fees. It may also specify the effective date for the payoff, as these balances can fluctuate daily due to interest calculations. When drafting a request for this statement, it is crucial to include personal details such as the property address, loan number, and borrower's name. This can expedite the process when contacting the lender or mortgage servicing company. Note on Mortgage Types: Fixed-rate mortgages provide borrowers stability as payments remain consistent, while adjustable-rate mortgages (ARMs) may fluctuate based on market conditions.

Letter Template For Requesting Mortgage Payoff Statement Samples

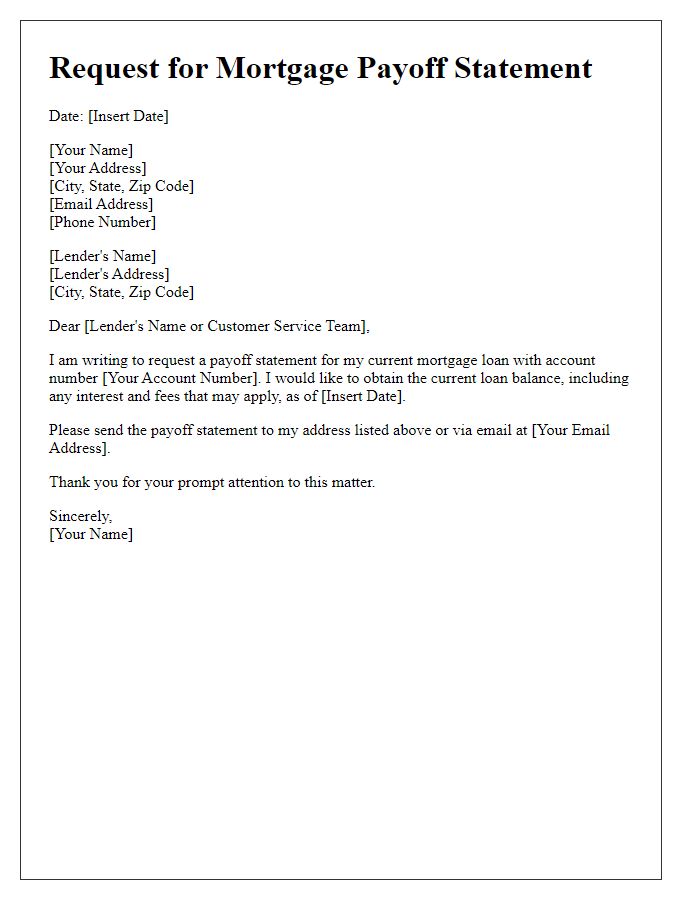

Letter template of request for mortgage payoff statement for current loan balance.

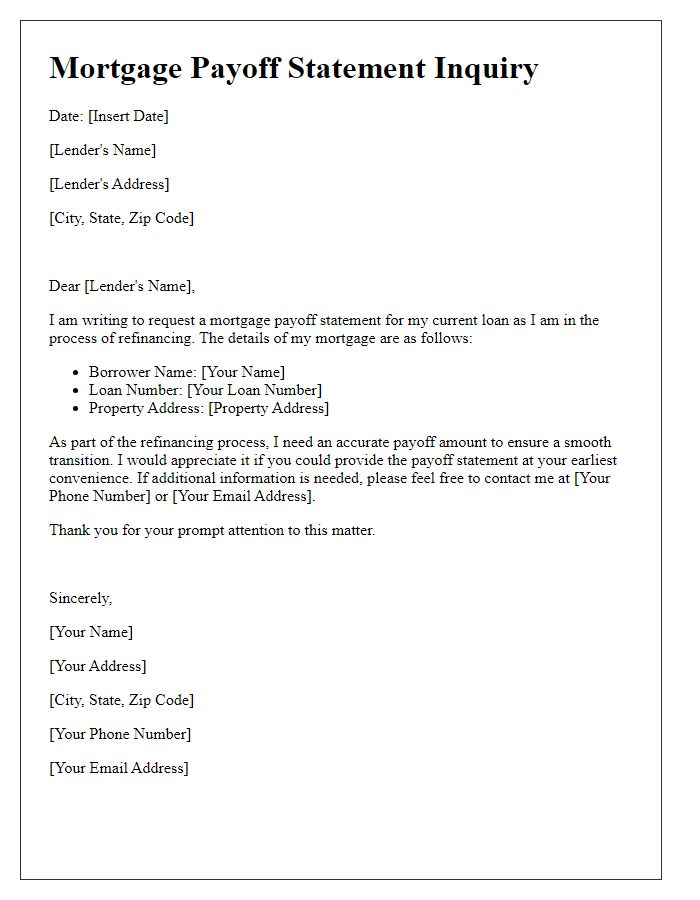

Letter template of inquiry for mortgage payoff statement due to refinancing.

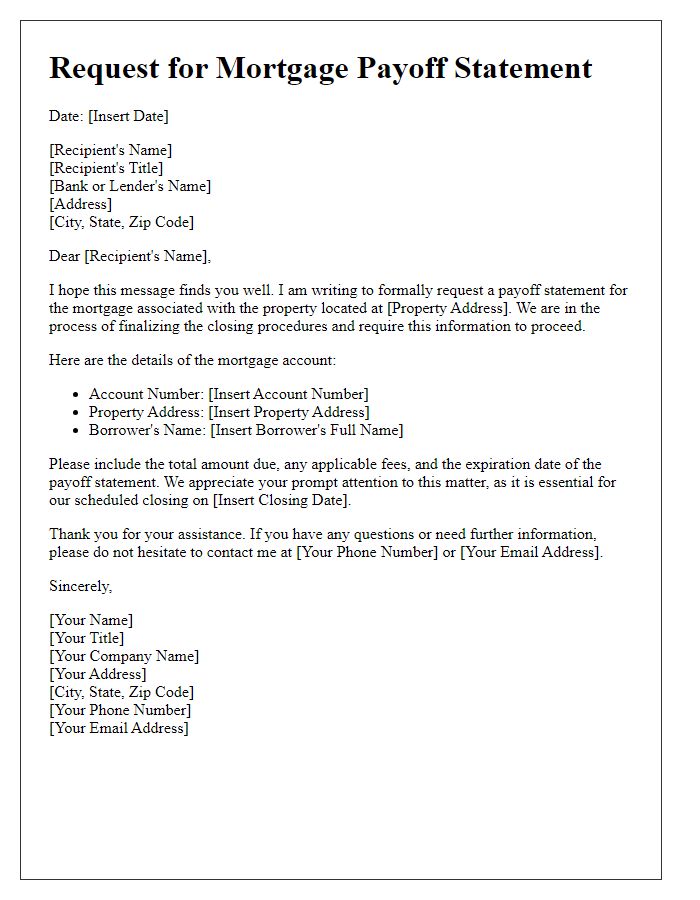

Letter template of solicitation for mortgage payoff statement for closing procedures.

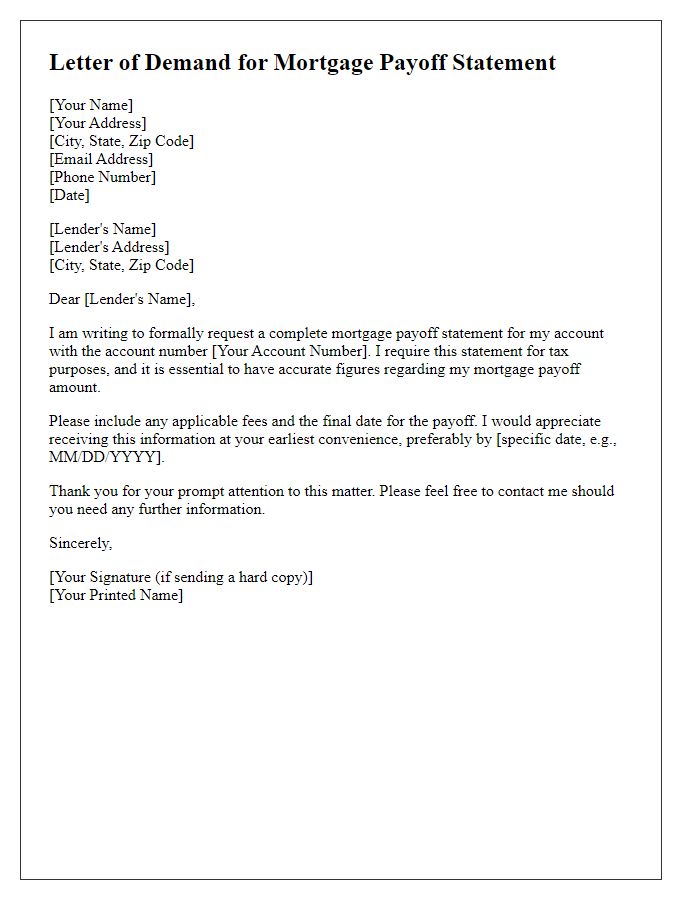

Letter template of demand for mortgage payoff statement for tax purposes.

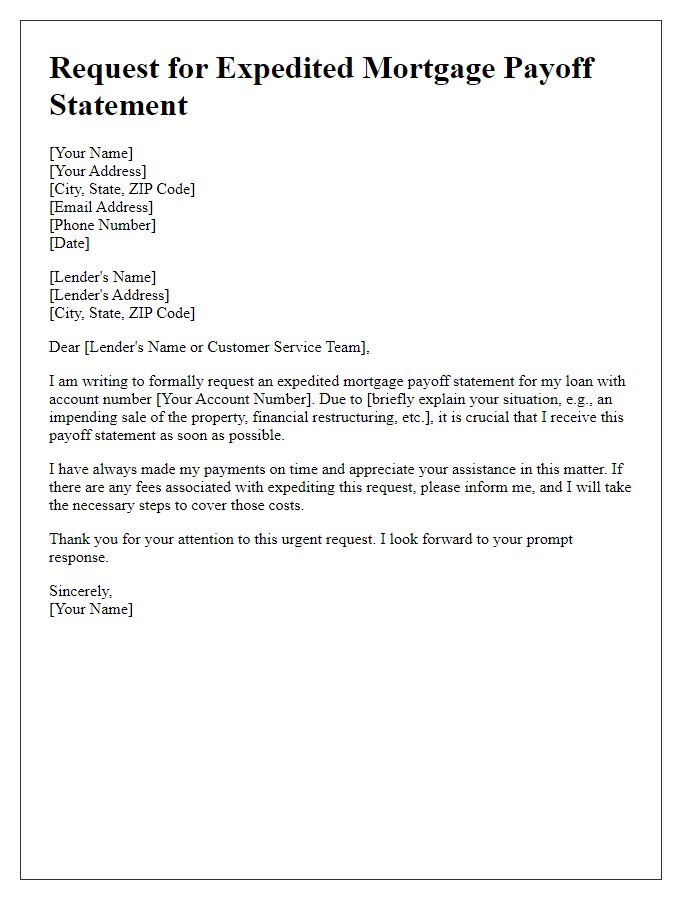

Letter template of appeal for expedited mortgage payoff statement request.

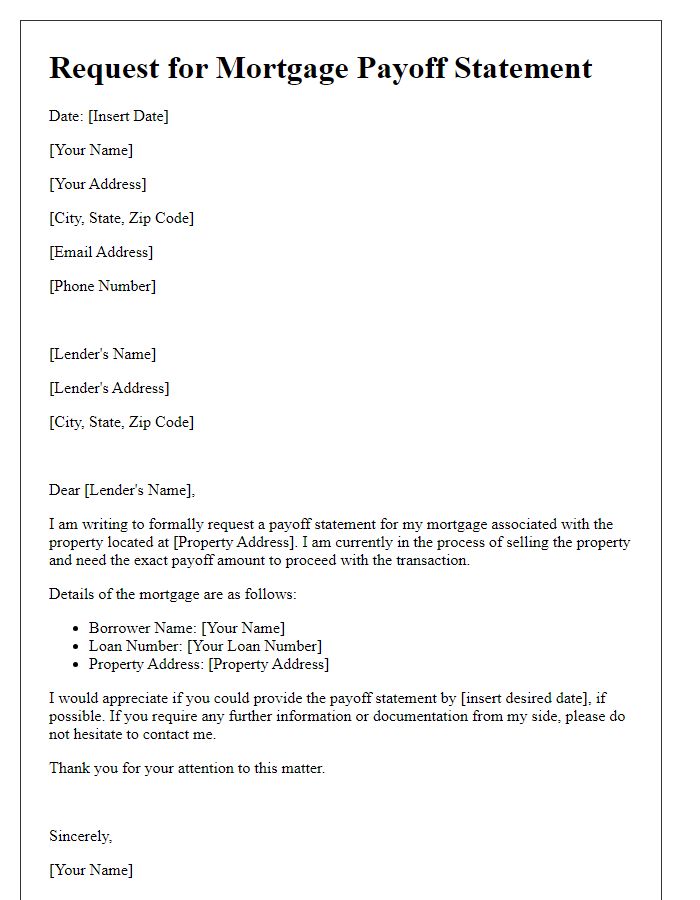

Letter template of requirement for mortgage payoff statement for property sale.

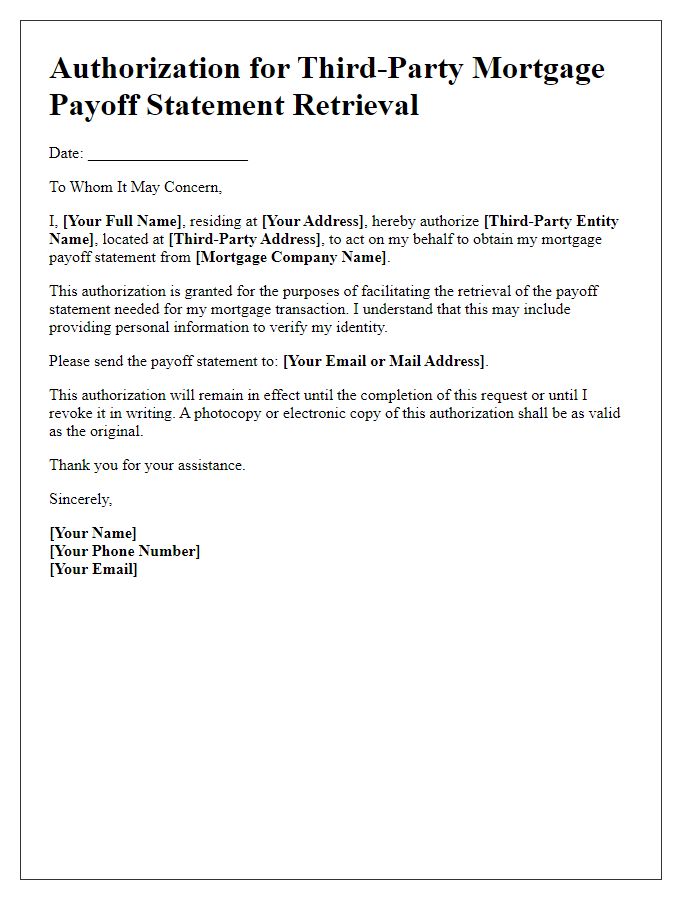

Letter template of authorization for third-party mortgage payoff statement retrieval.

Letter template of confirmation request for mortgage payoff statement delivery method.

Letter template of notice for mortgage payoff statement for account verification.

Comments