Are you feeling overwhelmed by the confusion surrounding your mortgage loan balance? You're not alone; many homeowners find themselves questioning the accuracy of their statements and seeking clarity in their financial dealings. In this article, we'll guide you through the essential steps to craft a compelling letter to dispute any discrepancies with your mortgage lender. So, if you're ready to take control and get the answers you deserve, read on for helpful tips!

Accurate account and personal details

Disputing a mortgage loan balance can be a critical step in addressing potential errors in financial records. Accurate account details, such as the loan number (often a unique identifier), and personal information including your full name, address, and Social Security number (to verify identity) are essential for clarity. When reaching out to the mortgage servicer (the entity managing your loan), including specific discrepancies found in the loan statement (for instance, payments made versus reported balances) allows for a precise examination. Supporting documents, such as payment receipts or account statements (dated, maybe from the last 12 months), strengthen your claim. Ensuring these details are correct expedites the review process and enhances the chances of resolving the dispute successfully.

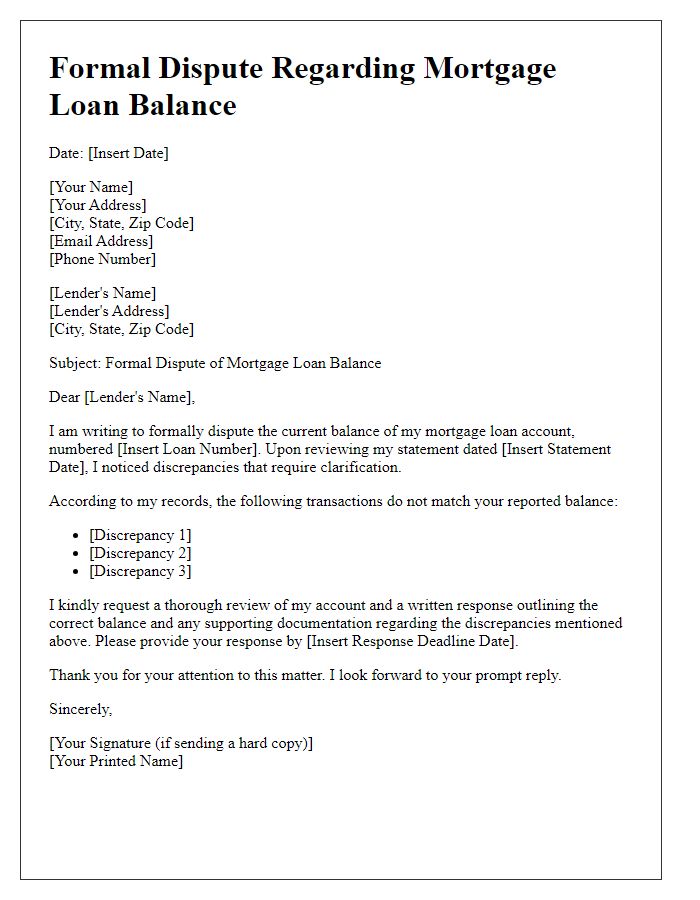

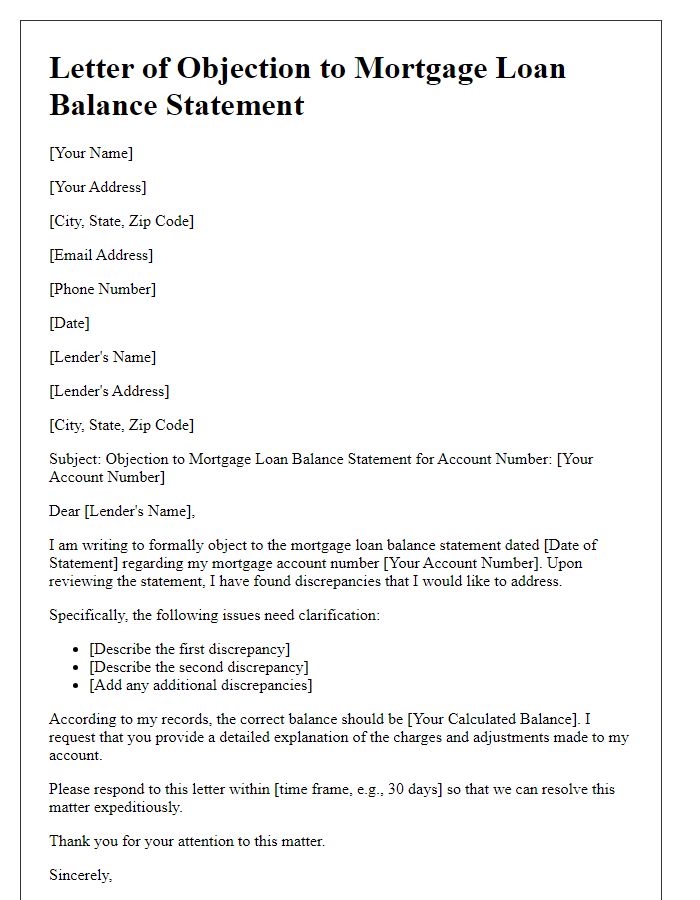

Clear statement of dispute and specific errors

Disputing a mortgage loan balance requires attention to detail and clarity regarding specific errors. A borrower may identify discrepancies, such as erroneous interest rates or misapplied payments that result in an inflated balance. For instance, an inaccurate interest rate of 5% instead of the agreed 4% can lead to significant overpayments. Additionally, if a payment of $1,500 intended for principal reduction was instead allocated to late fees, this misallocation can dramatically alter the outstanding balance displayed by the lender. It is crucial to document communication dates, relevant loan account numbers, and the lender's contact details to strengthen the dispute process effectively.

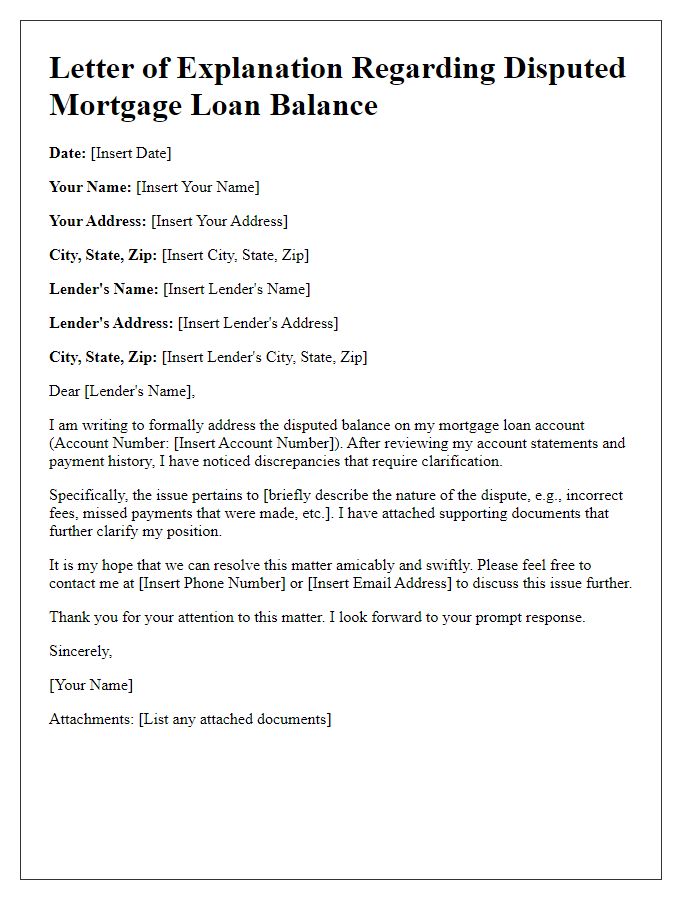

Supporting documentation and evidence

Disputing a mortgage loan balance requires a thorough examination of supporting documentation and evidence. Homeowners often gather essential paperwork such as mortgage statements (monthly records outlining the loan balance, interest rates, payments), payment history (a comprehensive report detailing every payment made since loan origination), property valuation reports (assessments from certified appraisers to establish market value), and relevant correspondence (emails or letters exchanged with the lender that may clarify terms). Legal documents like the original loan agreement (contract stipulating terms, interest, and obligations) and any amendments (changes made to the original contract) also hold significant weight. Additionally, discrepancies found in the lender's reports (errors in payment allocation or balance projections) can serve as pivotal evidence. All gathered data must be presented in a coherent manner, ensuring clarity and precision to effectively address the mortgage loan balance dispute.

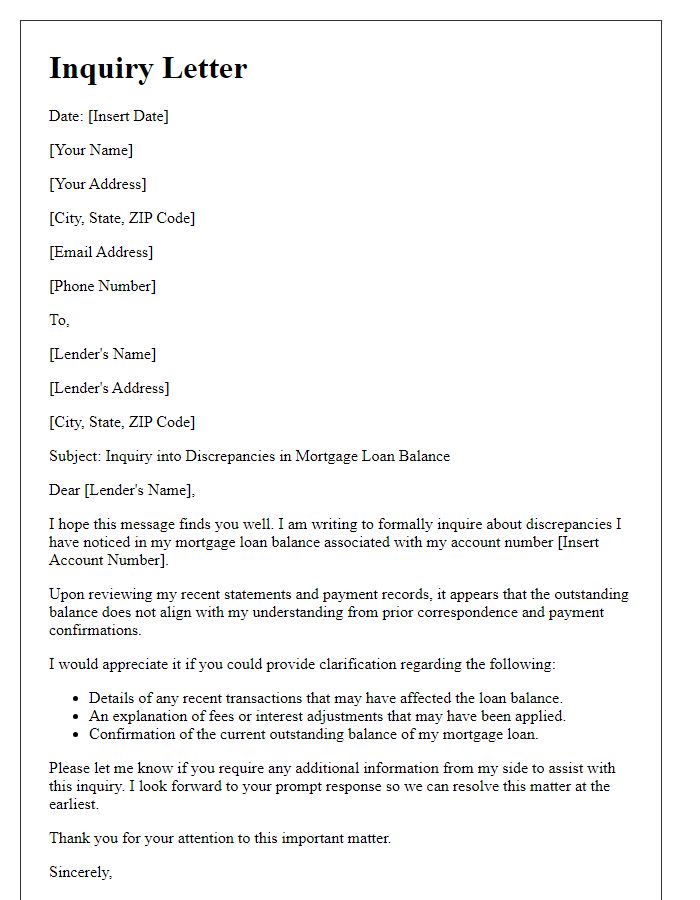

Request for detailed account breakdown

Homeowners often face discrepancies in mortgage loan balances, leading to confusion and disputes. A detailed account breakdown helps clarify any misunderstandings. Homeowners should request a detailed statement from the mortgage lender, including all transactions (payments, interest charges, fees) since the loan's inception. This breakdown should cover key elements such as the principal amount (the original sum borrowed), current balance, payment history, and any additional costs incurred, including late fees or escrow payments. Engaging with customer service representatives or financial advisors could facilitate communication and ensure that all details are accurately addressed, ultimately aiding in resolving balance disputes.

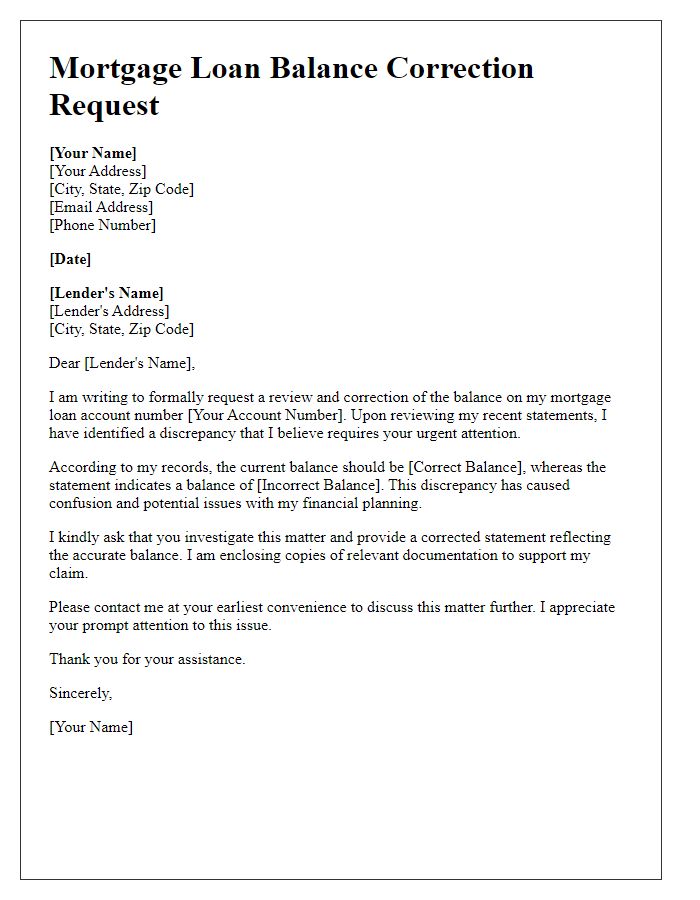

Statement of desired resolution or correction

Disputing mortgage loan balances can be a complex process that necessitates a clear and structured approach. Homeowners often face discrepancies in their statements, which can involve overpayment, misapplied payments, or erroneous interest calculations. A desirable resolution typically includes a request for a detailed account review from the mortgage servicer, an updated statement reflecting accurate balance figures, and a formal acknowledgment of the disputed charges. Key information for inclusion may encompass the loan number (e.g., 123456789), the specific amounts in dispute (such as $1,500), and relevant dates of transactions (like payments made on January 15, 2023). Additionally, presenting documents such as payment histories, correspondence with the lender, and previous statements supports the resolution process significantly. An organized approach improves the chances of achieving a satisfactory adjustment to the mortgage loan balance.

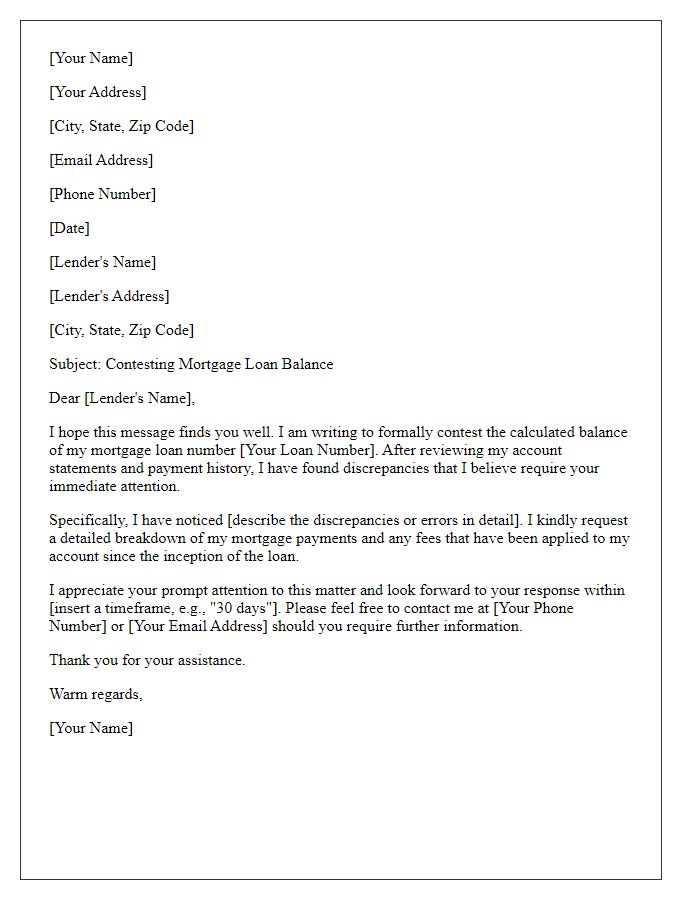

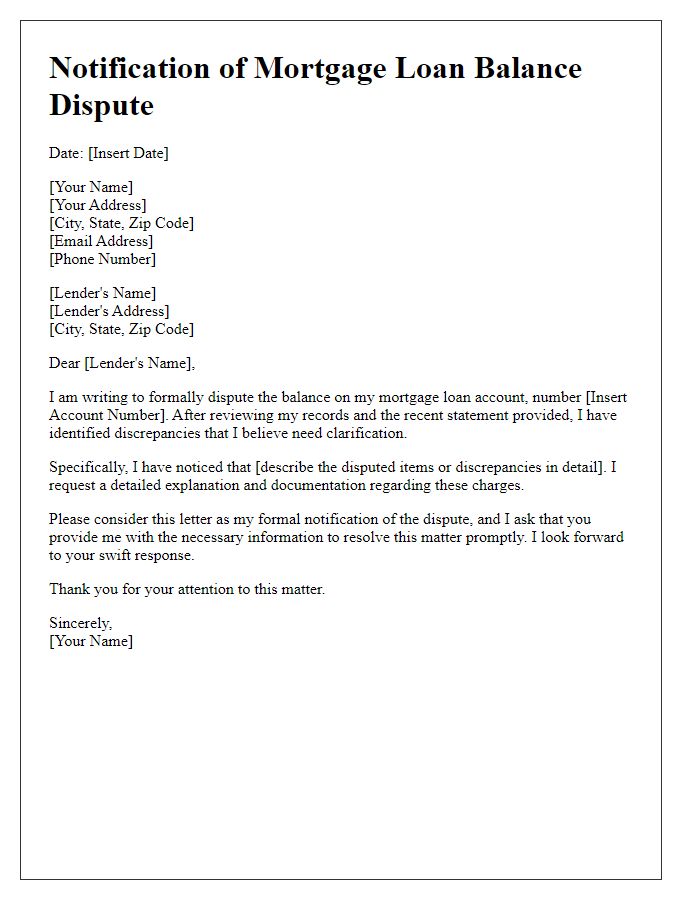

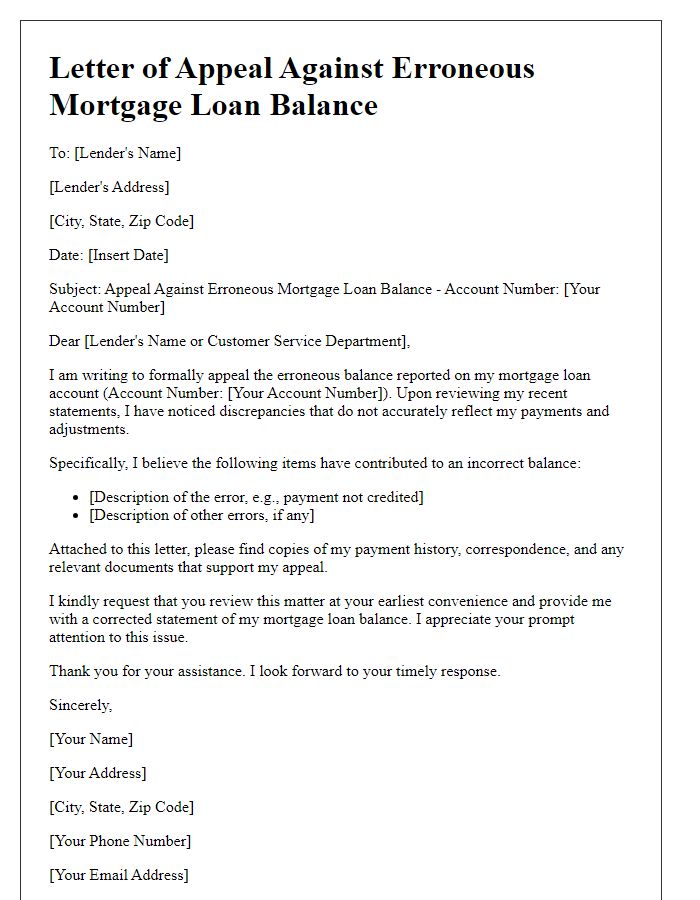

Letter Template For Disputing Mortgage Loan Balance Samples

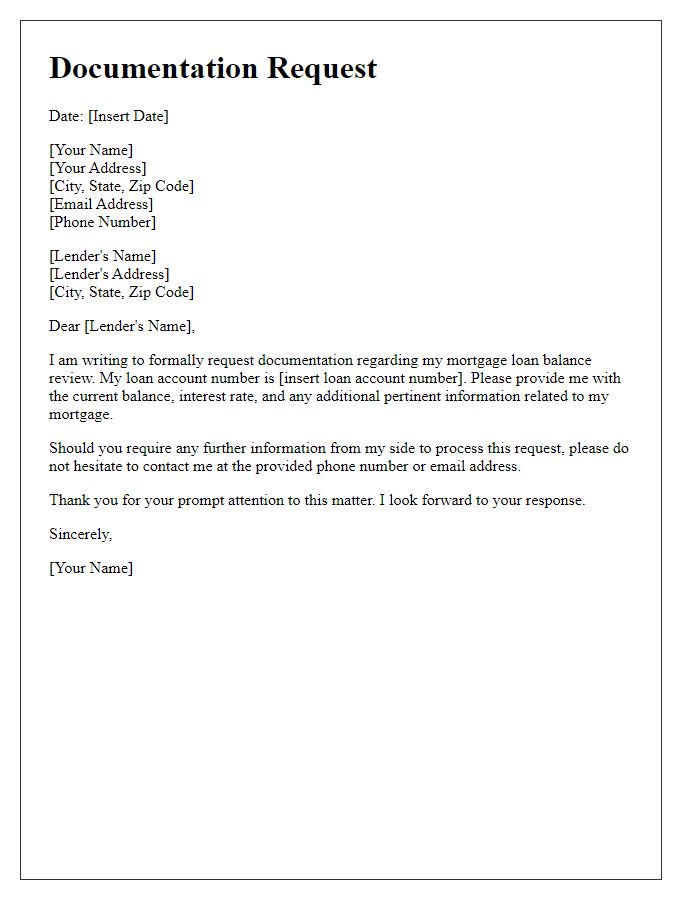

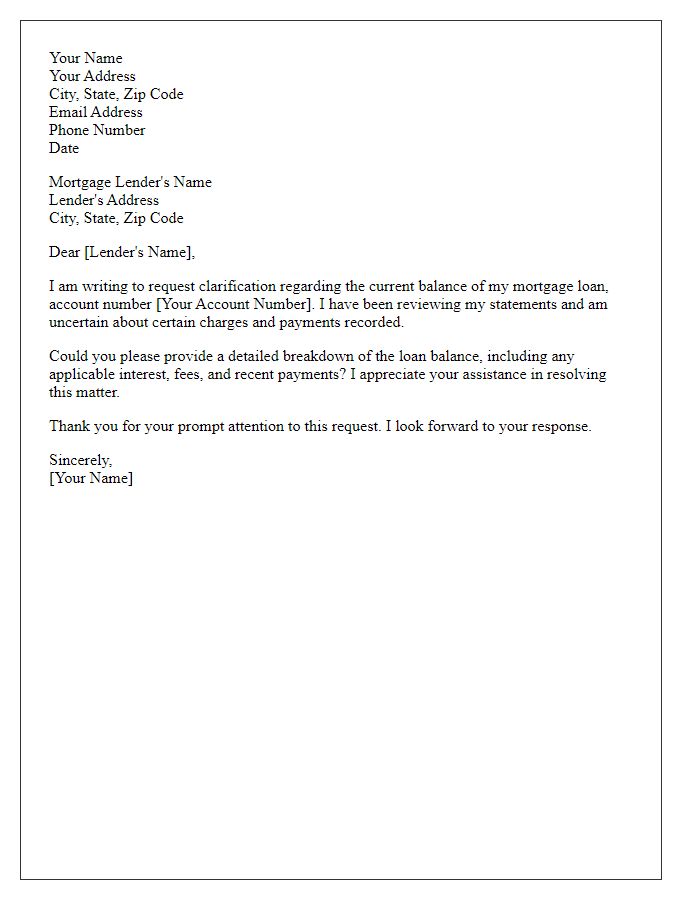

Letter template of documentation request for mortgage loan balance review.

Comments