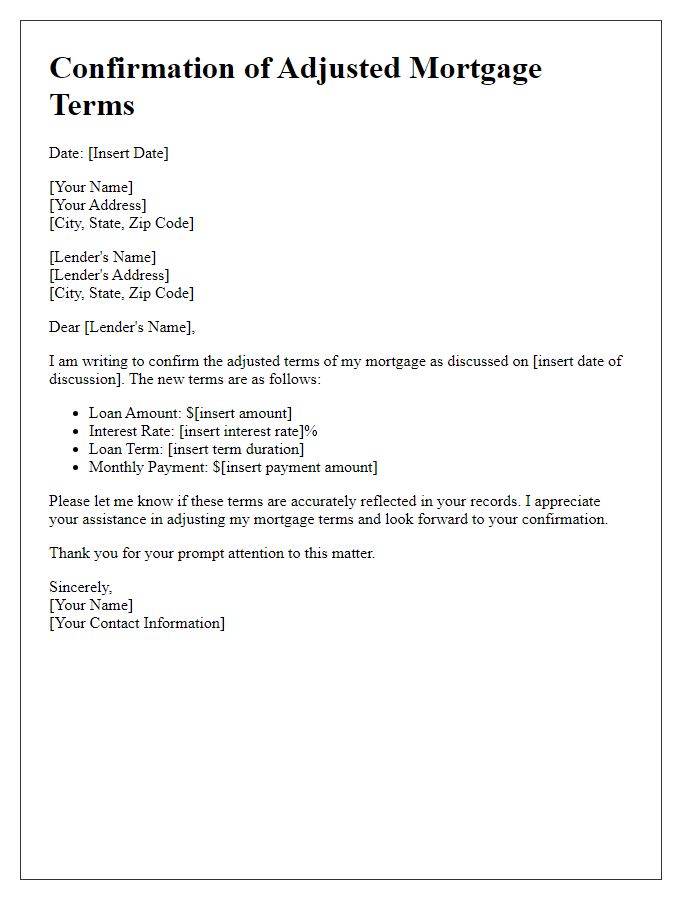

If you've recently made changes to your mortgage account, it's essential to confirm those adjustments in writing. A well-crafted letter can help ensure that everyone is on the same page and that your updates are officially documented. Not only does this provide peace of mind, but it also helps prevent any future misunderstandings with your lender. Curious about how to write this confirmation letter effectively? Read on to discover a practical template that will guide you through the process!

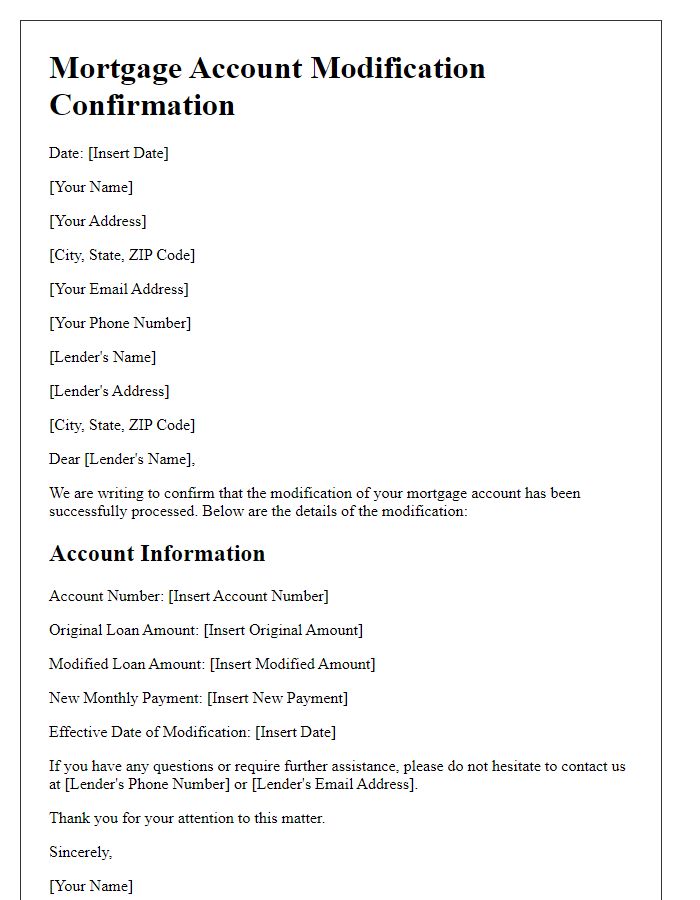

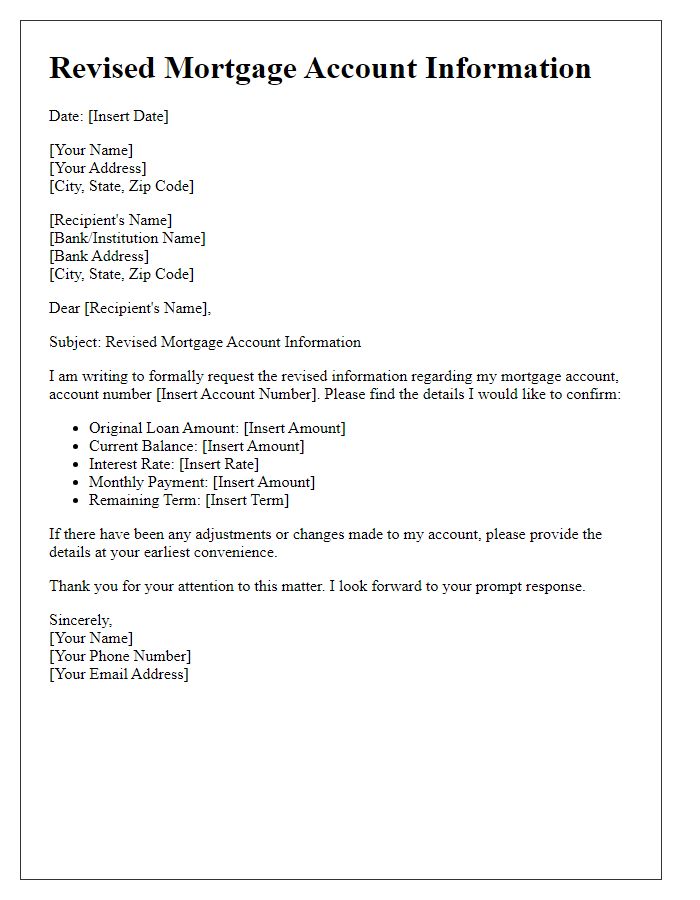

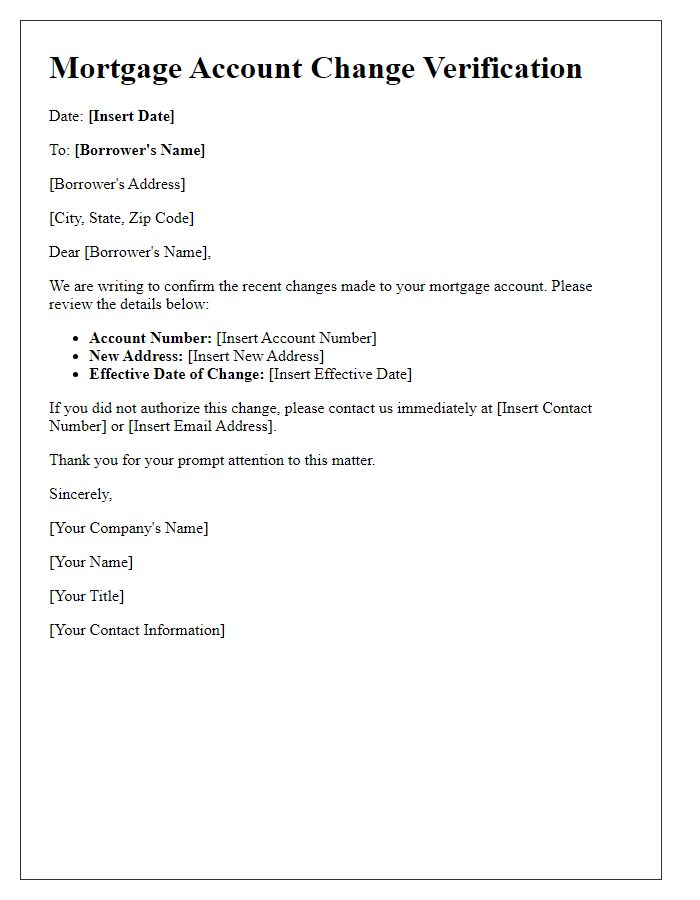

Borrower's Identifying Information

Confirmation of mortgage account changes typically involves an acknowledgment of the borrower's identifying information, which includes essential data such as the full name, social security number (usually nine digits), and mailing address. For example, a borrower named John Doe may have an address listed as 123 Elm Street, Springfield, IL 62701. Additionally, the mortgage account number, which serves as a unique identifier for the borrower's specific loan, is crucial to ensure accurate processing of account modifications. It is important to verify the contact information on file, such as email addresses and phone numbers, to facilitate smooth communication regarding these changes. Documenting this information accurately helps in maintaining clarity and ensuring proper updates to the mortgage records.

Account Number Reference

Mortgage account modifications can impact payment schedules and interest rates significantly. A confirmation letter serves as an official document regarding any changes made to the mortgage account, including alterations to the account number reference, which specifically identifies the mortgage and distinguishes it from other financial products. It details the effective date of changes and may outline new terms agreed upon by both parties involved, ensuring transparency between the borrower and the lending institution, such as a bank or credit union. Additionally, maintaining accurate records of these changes is essential for future reference and any potential disputes, as it ensures both parties are aligned on the updated mortgage conditions.

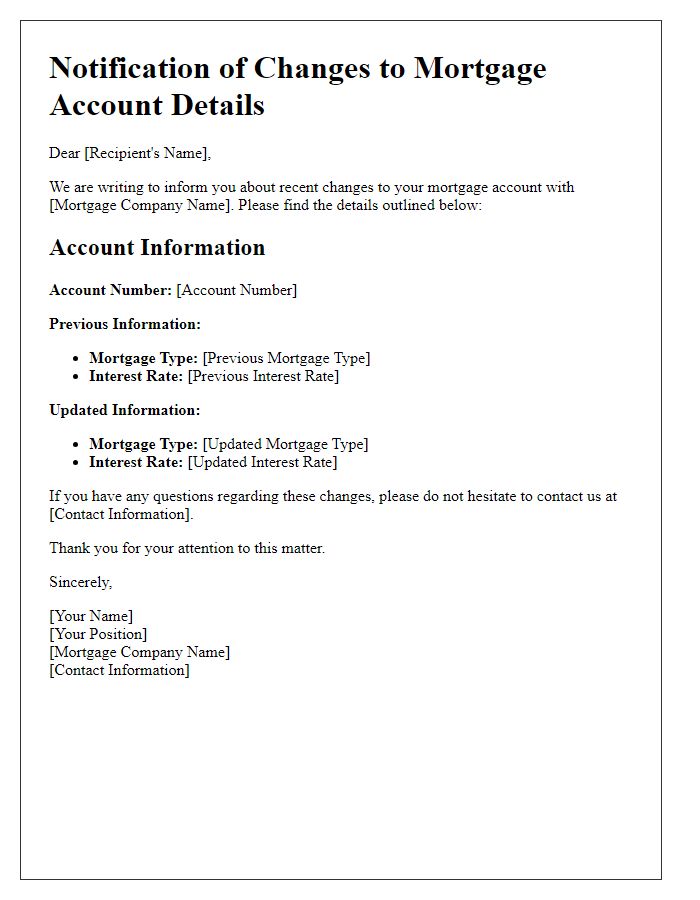

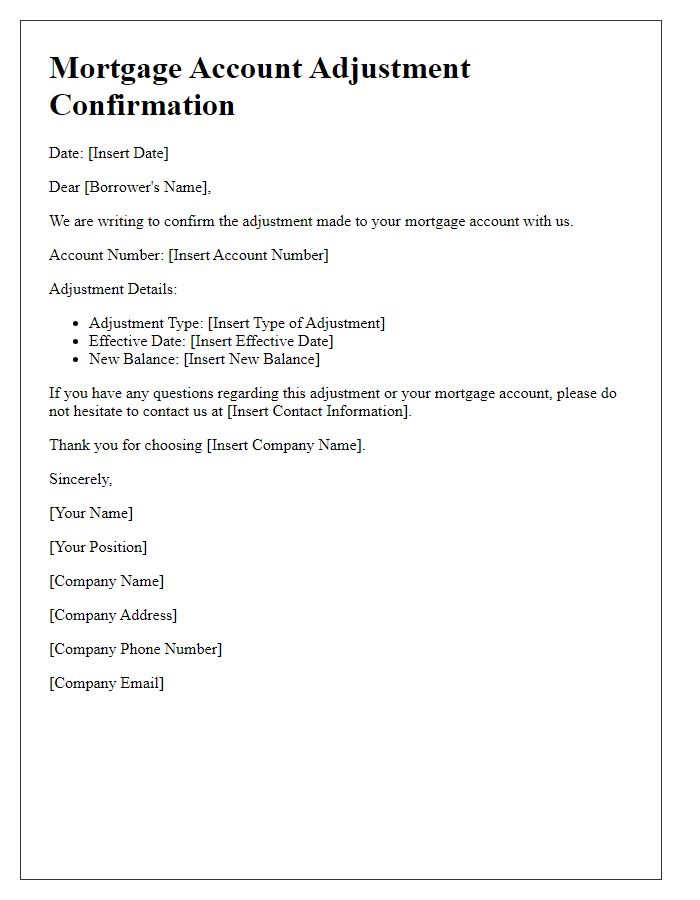

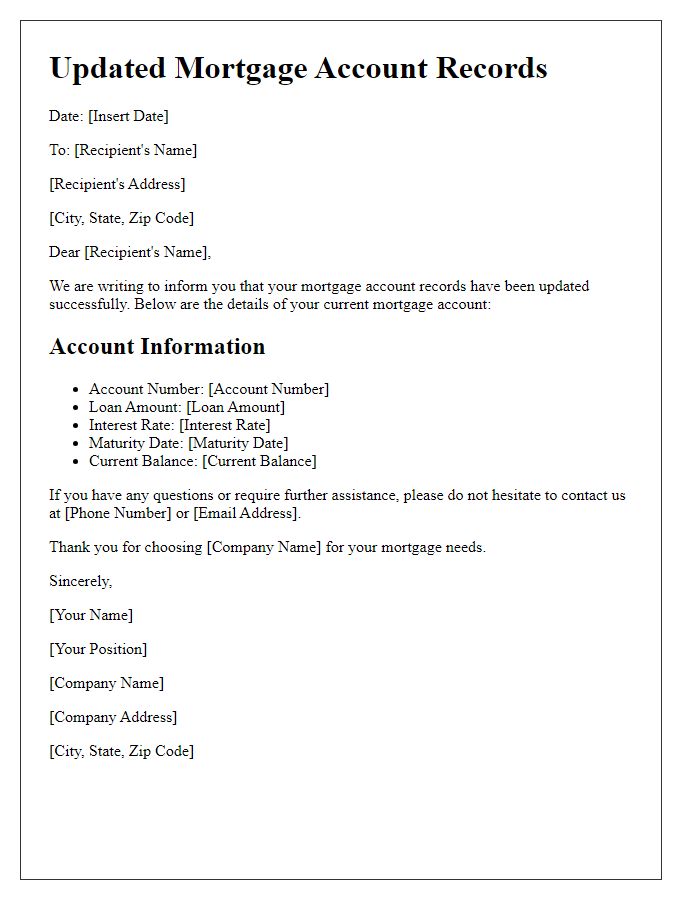

Description of Changes Made

Mortgage account changes may include adjustments to interest rates, modifications in payment schedules, or alterations in loan terms. For instance, interest rates on a 30-year fixed mortgage could be lowered from 4.5% to 3.8%, resulting in monthly payments decreasing from $1,200 to approximately $1,050. Changes in payment schedules may involve transitioning from a bi-weekly payment plan to a monthly payment plan, affecting cash flow management. Additionally, terms of the mortgage could be modified from a 20-year repayment term to a 15-year term, impacting total interest paid over the life of the loan. These changes, executed primarily to optimize financial benefits for the borrower, must be documented clearly to ensure transparency and understanding of obligations moving forward.

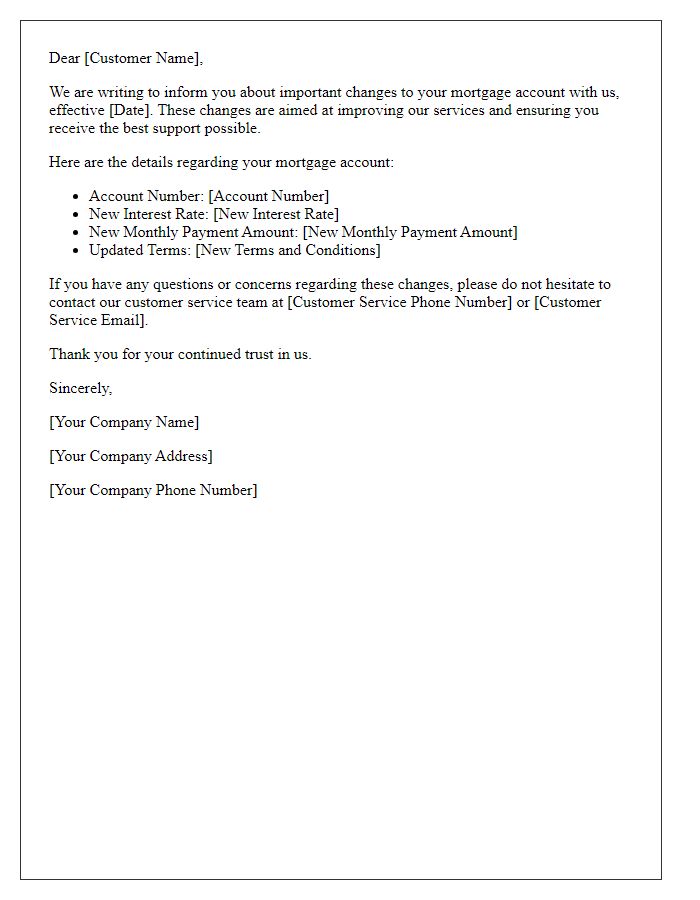

Effective Date of Changes

Effective changes to mortgage accounts can significantly impact borrowers' financial obligations. Commonly observed alterations may include modifications to interest rates, changes in monthly payment amounts, or adjustments to loan terms. These changes typically take effect on specified dates indicated in formal communication from lenders. Borrowers should review their mortgage agreements for details such as the effective date, which is crucial for budgeting and financial planning. Keeping track of these dates helps borrowers avoid late payments and penalties, ensuring compliance with updated terms that can vary depending on individual loan conditions or market fluctuations.

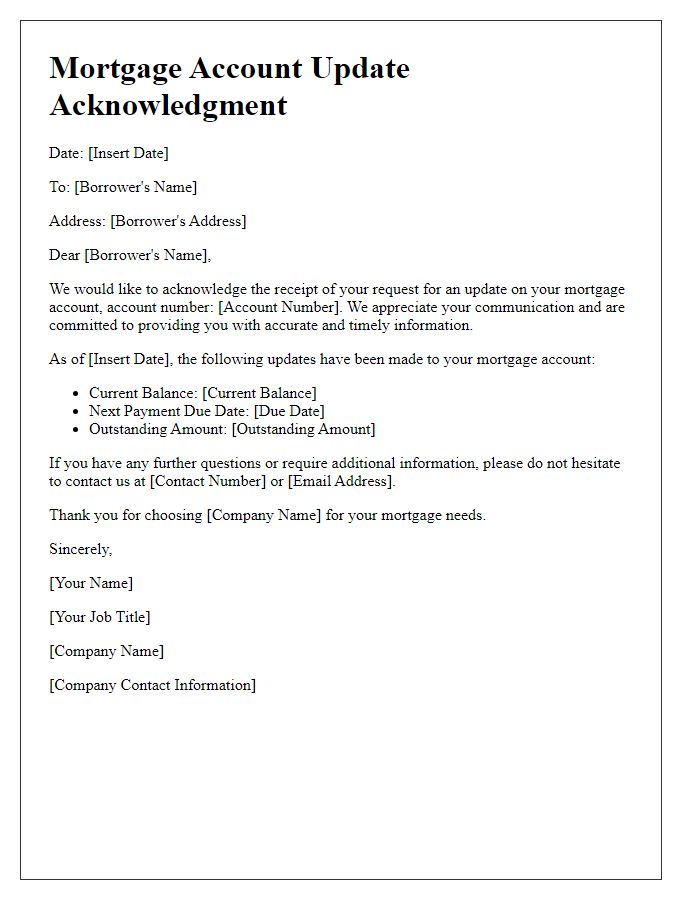

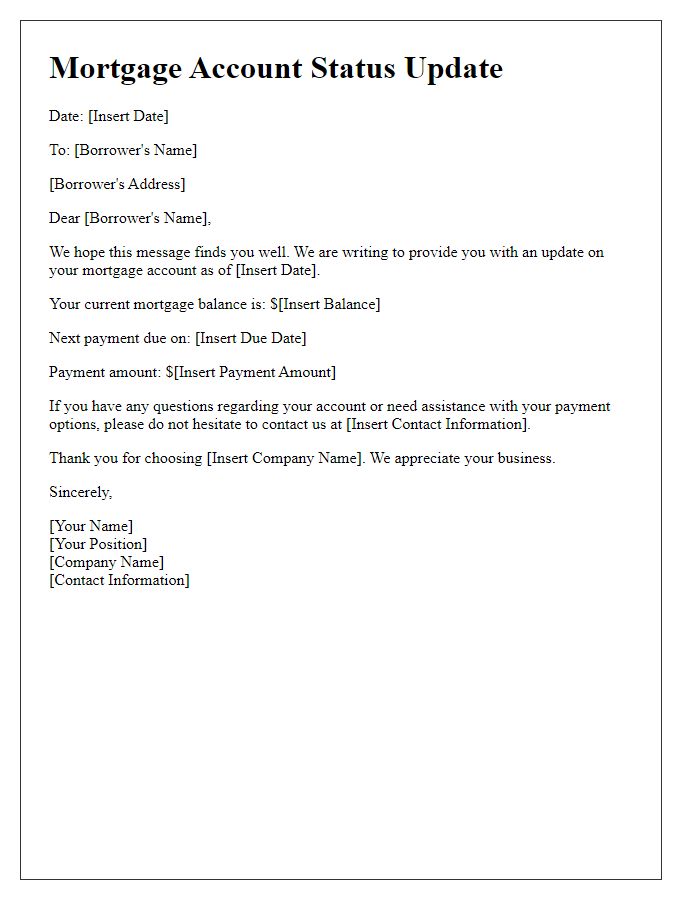

Contact for Further Inquiries

Mortgage account modifications can impact payment schedules and interest rates significantly. Changes may include adjustments to term lengths or refinancing options, which can affect monthly payment amounts and overall loan costs. For more information on specific adjustments, contact your mortgage lender or financial institution's customer service team. They can provide insights on how these changes align with current market conditions and rates. Additionally, understanding your new account terms is crucial to maintaining financial stability throughout the mortgage period.

Comments