Have you ever faced the frustration of a credit card transaction being denied unexpectedly? It can feel disheartening, especially when you're left wondering what went wrong. In this article, we'll guide you through writing an effective appeal letter to address a transaction denial, ensuring your concerns are communicated clearly and persuasively. So, grab a cup of coffee and join us as we explore the steps to rectify your credit card woes!

Cardholder Information

Cardholder information refers to specific details about an individual who holds a credit card, including full name, card number (usually the last four digits), billing address, contact number, and email address. This information is essential in identifying the cardholder's account during transactions, especially when investigating issues like denial appeals. Accurate identification ensures that the credit card issuer can efficiently process appeals regarding rejected transactions, potentially addressing misunderstandings or fraudulent activities that may have caused the denial. Verification may require the submission of supporting documentation or additional details pertaining to the transaction in question.

Transaction Details

A credit card transaction denial appeal requires a focus on specific transaction details to clarify the situation effectively. Transaction details include date of transaction (such as May 15, 2023), merchant name (such as Amazon.com), amount charged (like $150.00), and last four digits of the credit card (for example, 1234). This information allows the card issuer to investigate the denial. Customers should maintain records of these transactions, including receipts or confirmation emails, which help substantiate claims during the appeal process. The reason for denial should be noted if provided, as it can guide the appeal's explanation, allowing for a clear resolution path to re-establish access to funds or confirm the legitimacy of the transaction.

Clear Reasoning for Dispute

Credit card transaction denials can often arise from various reasons such as insufficient funds, suspected fraud, or merchant errors. Customers facing a denial may wish to appeal these decisions to regain access to their funds. A clear and well-structured reasoning within the appeal can include essential details such as the transaction date (for instance, September 15, 2023), amount ($120.50), and specific merchant name (like Amazon) involved in the purchase. Identifying any potential issues, like a system error from the bank's end or a mistake by the retailer, adds credibility. Providing supporting documents, such as receipts or prior communication with customer service representatives, strengthens the case. Additionally, a brief explanation of the customer's usual transaction patterns can help illustrate any discrepancies that may have triggered the denial.

Supporting Documentation

Credit card transaction denial can significantly impact consumer purchasing ability and overall financial stability. Instances of denial often occur due to insufficient funds, security measures triggered by high-risk transactions, or billing address mismatches. Supporting documentation plays a crucial role in appealing these denials, including bank statements, transaction records, identification verification, and merchant correspondence. Accurately presenting this information can expedite the review process by financial institutions and help consumers regain access to their credit card privileges. Additionally, keeping meticulous records can assist in identifying trends or potential errors in account handling by credit card companies, contributing to a smoother transaction experience moving forward.

Polite and Formal Tone

When a credit card transaction is denied, it can be both frustrating and inconvenient. An effective appeal can help resolve the situation. Mention the specific denial date and any relevant transaction details (merchant name, transaction amount, etc.) to provide context. Emphasize the importance of the transaction, especially if it affects essential services, such as travel arrangements or urgent purchases. Addressing the credit card company directly, express appreciation for their prompt attention to your issue. Clearly request a review of your account activity and express your willingness to provide any additional information needed to facilitate the process. Remaining polite and formal enhances the likelihood of a successful resolution.

Letter Template For Credit Card Transaction Denial Appeal Samples

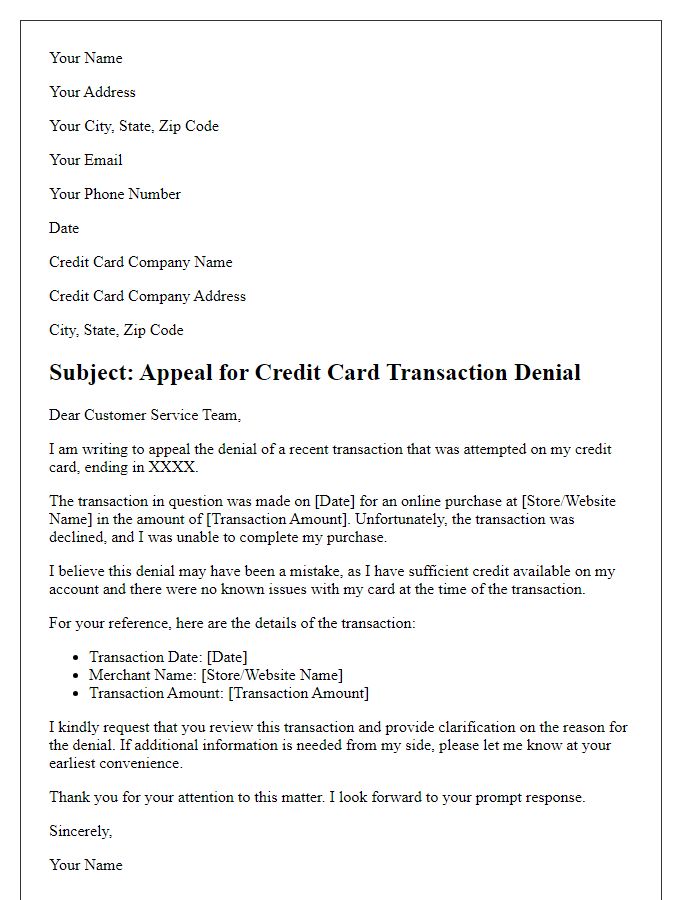

Letter template of credit card transaction denial appeal for online shopping.

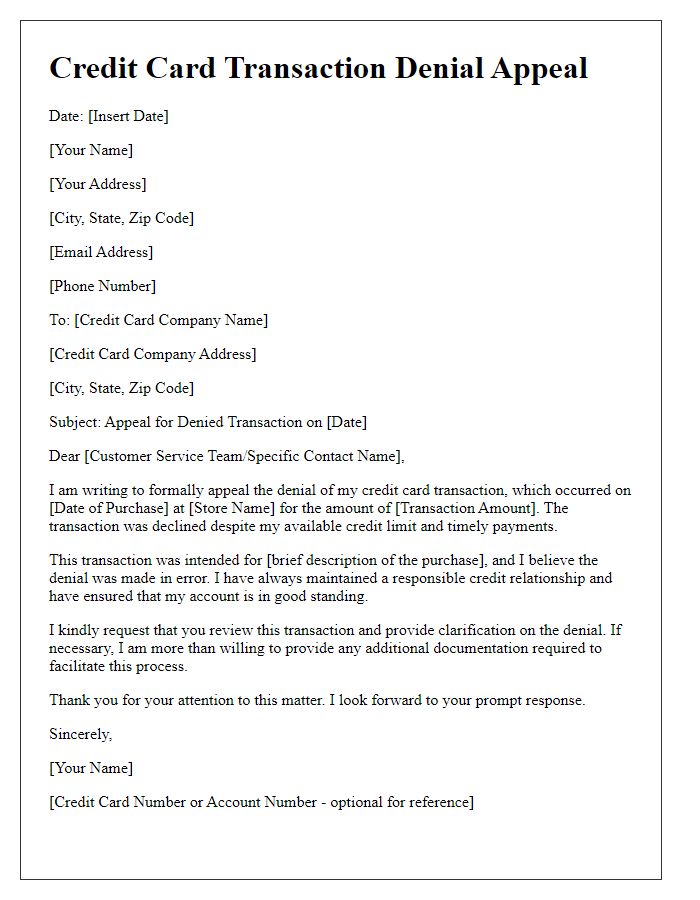

Letter template of credit card transaction denial appeal for in-store purchases.

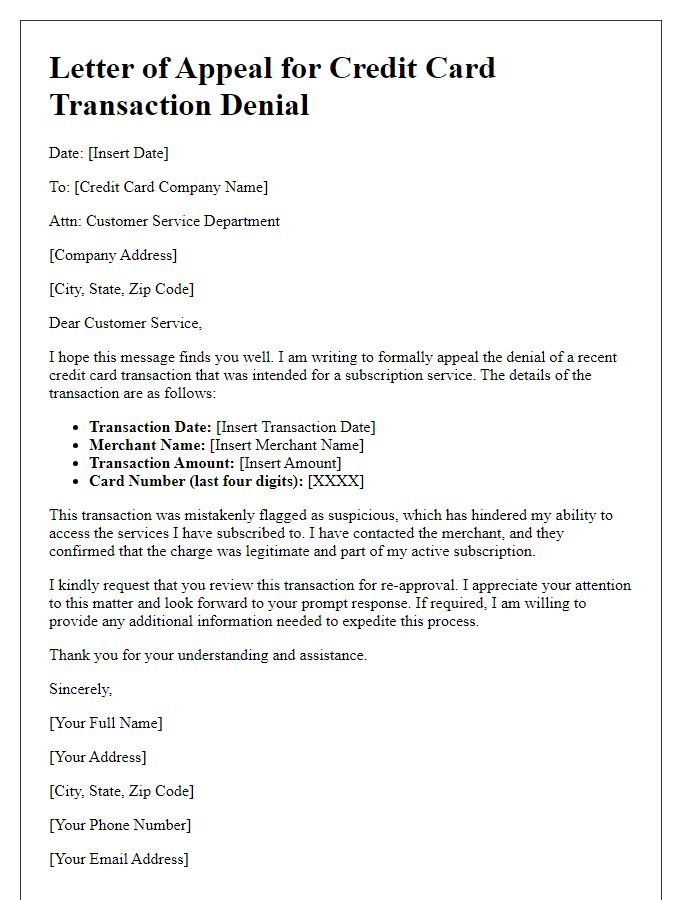

Letter template of credit card transaction denial appeal for subscription services.

Letter template of credit card transaction denial appeal for international transactions.

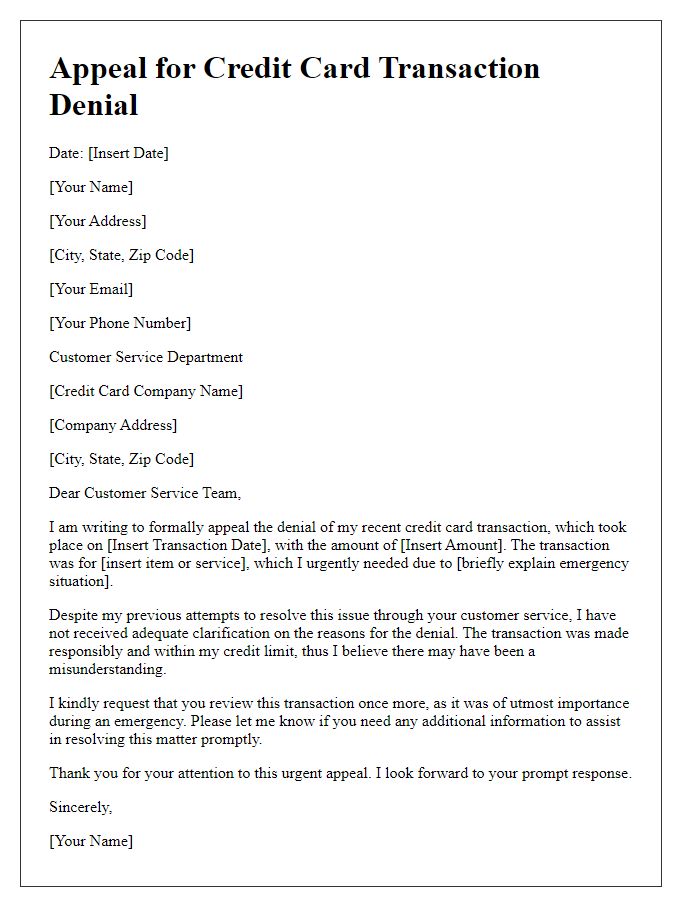

Letter template of credit card transaction denial appeal for travel expenses.

Letter template of credit card transaction denial appeal for recurring payments.

Letter template of credit card transaction denial appeal for fraudulent activity.

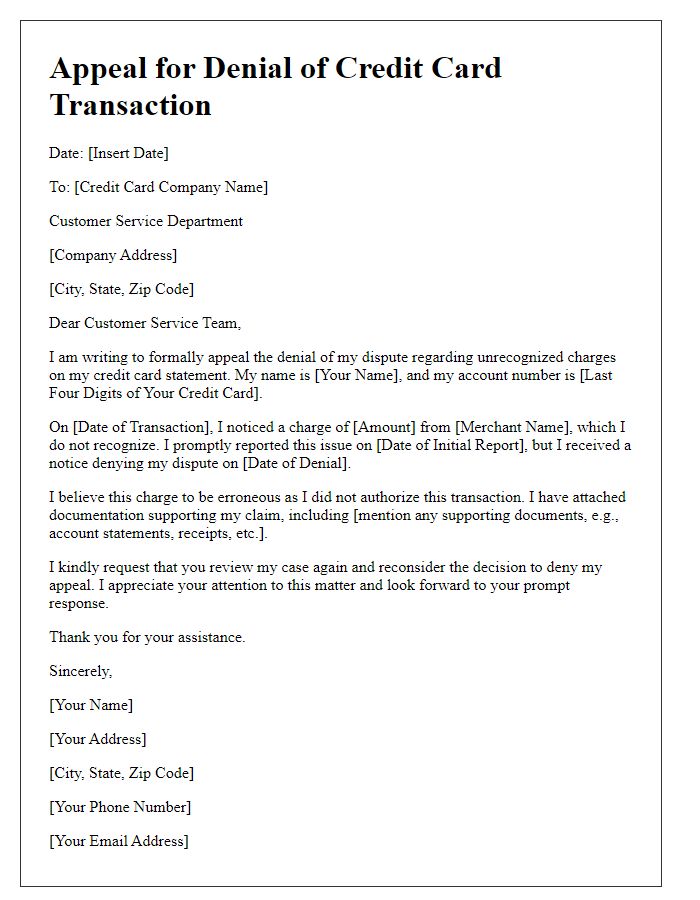

Letter template of credit card transaction denial appeal for unrecognized charges.

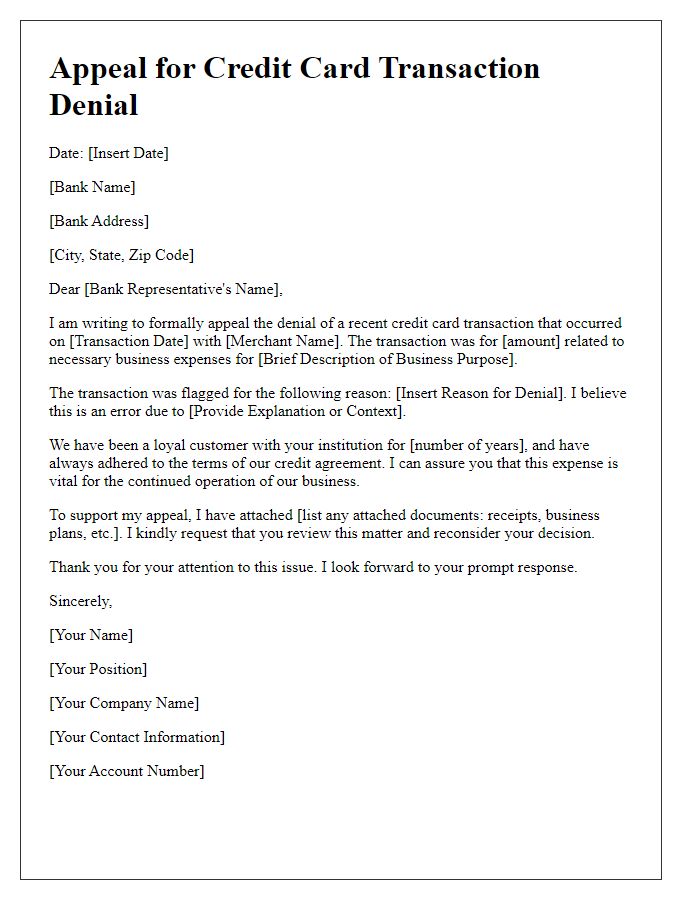

Letter template of credit card transaction denial appeal for business expenses.

Comments