Are you looking to change your credit card billing cycle for better financial management? You're not alone, as many people seek more convenient payment dates to align with their income schedules and budgeting plans. Understanding the process can simplify your life and help you avoid late fees. So, if you're curious about how to navigate this request, keep reading to find out the best approach!

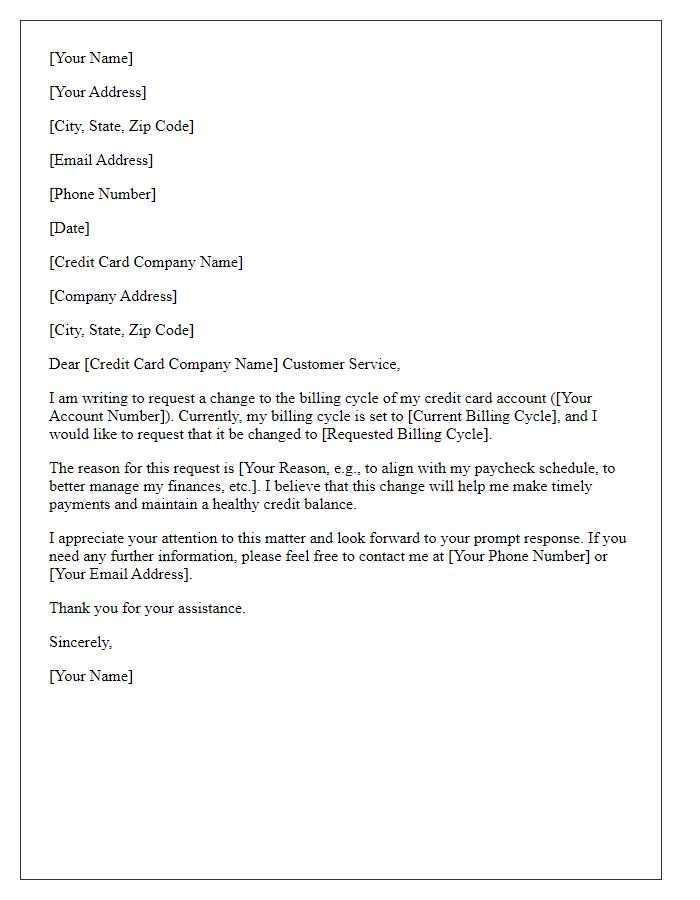

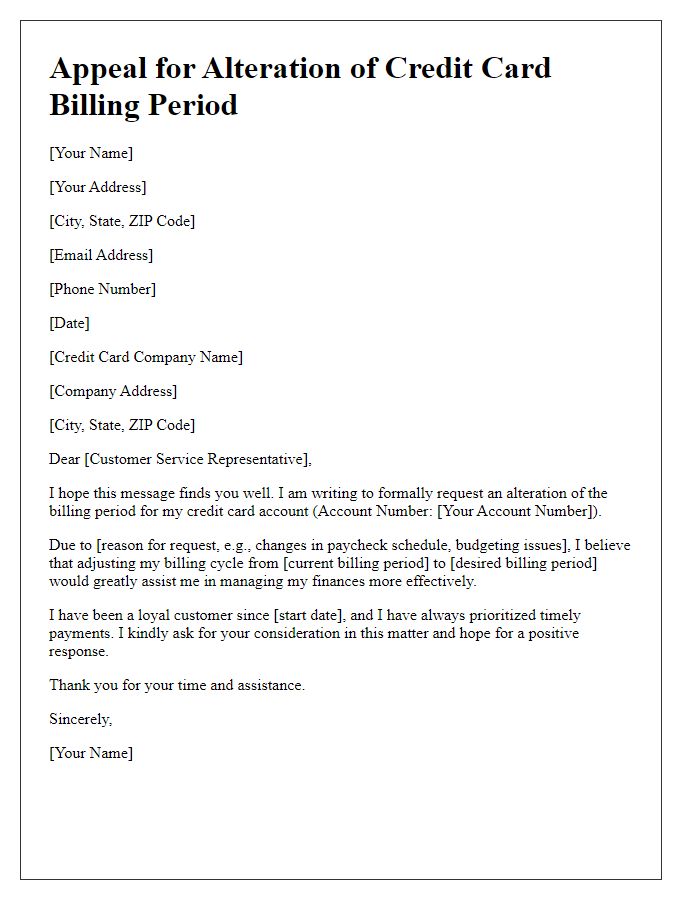

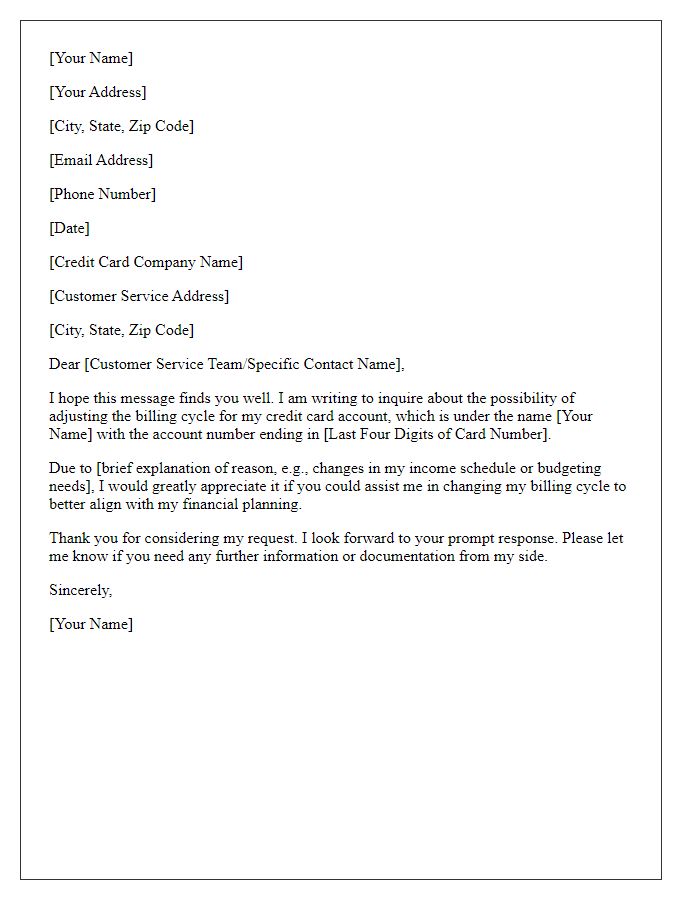

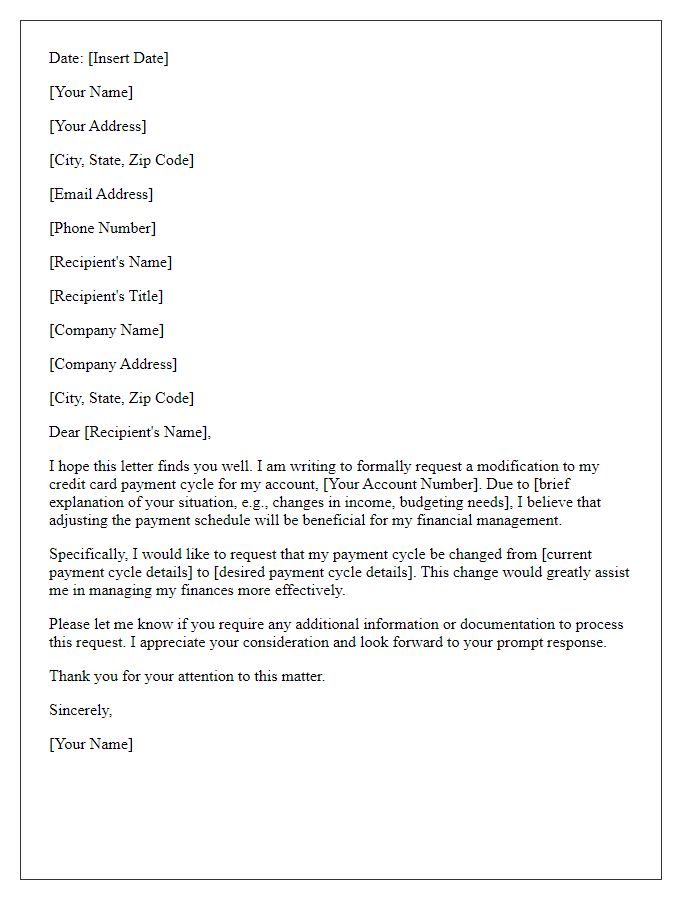

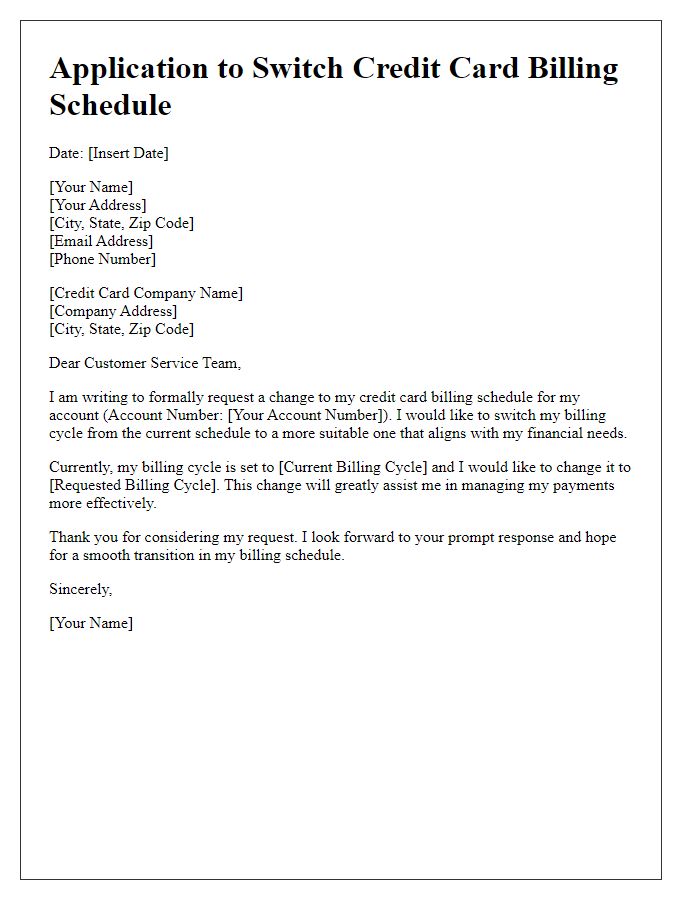

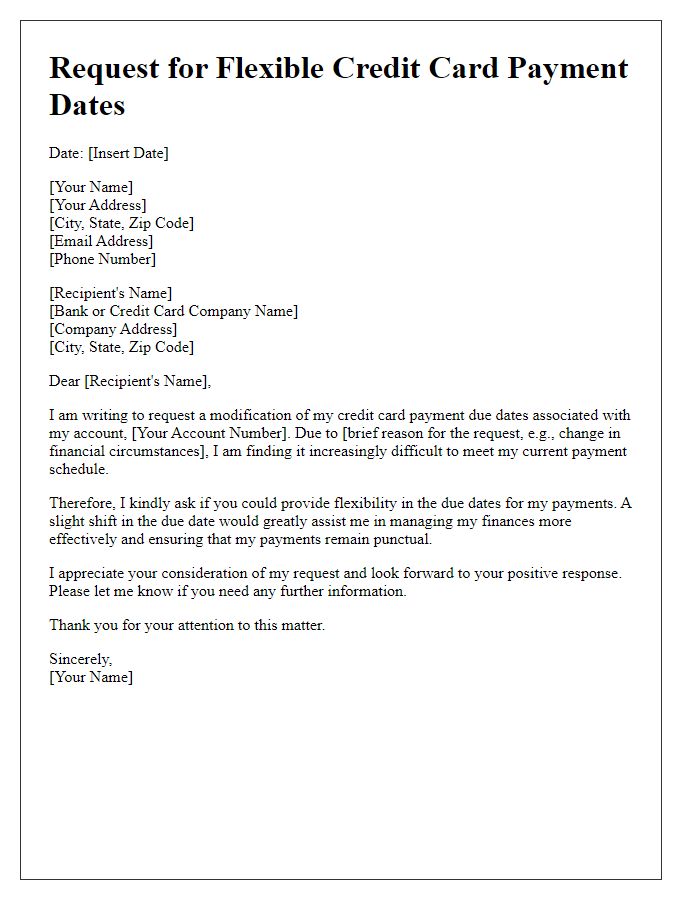

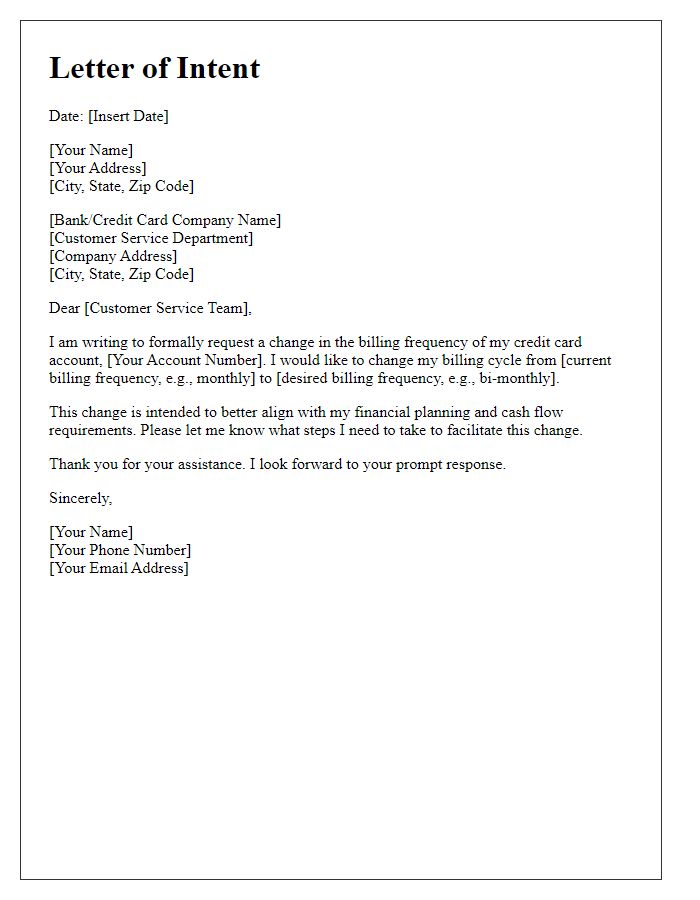

Personal Information

To request a credit card billing cycle change, include details such as your name, account number, and contact information. Personal identification details, like a Social Security Number (last four digits) can help verify identity. Address information must reflect the billing address associated with the credit card account. Providing a clear reason for the change, such as alignment with pay cycles or personal budgeting needs, can enhance the request. Include preferred billing dates or frequency adjustments to facilitate the process. Ensure to check for any specific requirements from the credit card issuer regarding the format or additional documentation needed for the request.

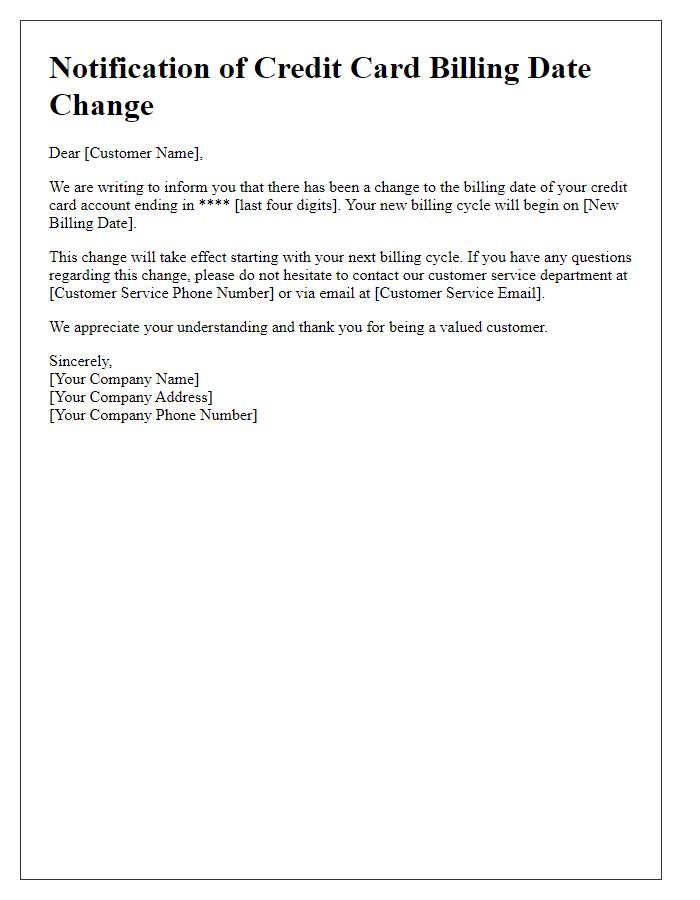

Account Details

The process of changing a credit card billing cycle can significantly impact personal finance management. Account holders must be aware of critical details, such as account number (unique identifier for each credit card account), billing cycle length (typically 28 to 31 days), and payment due dates (usually aligned with the end of the billing cycle). Additionally, understanding the implications such as potential interest charges or changes in due dates on cash flow is essential. Requests should be directed to customer service departments of financial institutions, which may require specific forms or written communication to document the request officially. Timely submissions (ideally at least a month before the next billing cycle) are crucial for ensuring that the changes take effect without disrupting payment schedules.

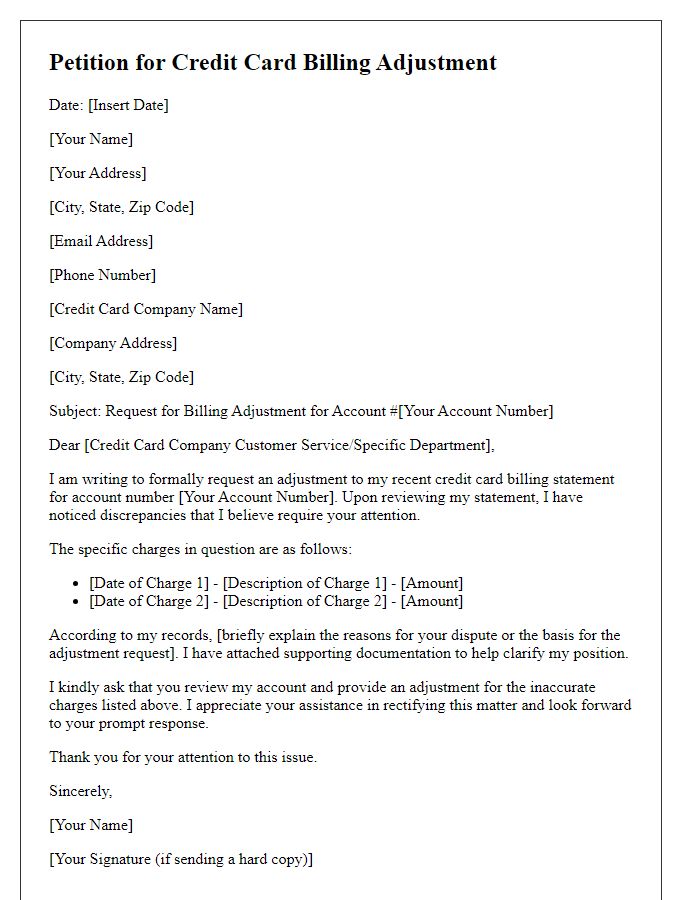

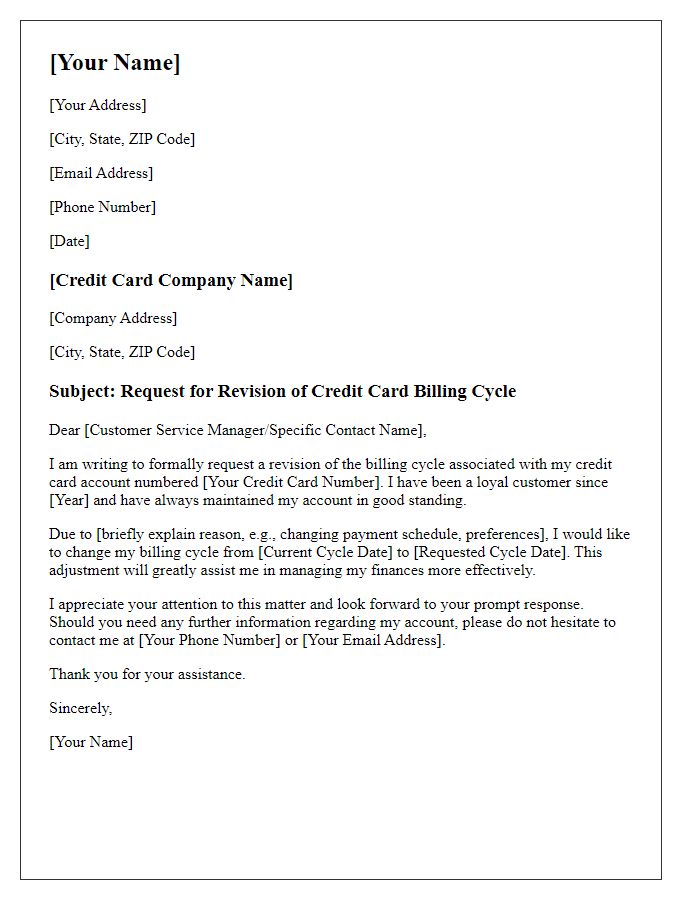

Specific Change Request

Credit card billing cycles can significantly impact personal finance management, especially for cardholders such as consumers using Citibank or Chase. A change request may arise due to factors like an altered payment schedule or improved cash flow timing. For example, transitioning to a billing cycle that aligns with the recipient's payday can simplify budgeting. Credit card companies typically require notification regarding significant changes, and it's advisable to submit the request in writing or through secure digital communication channels. Expectations around processing time may vary; it often takes up to one billing cycle for changes to take effect, emphasizing the importance of planning ahead to avoid late fees or interest charges.

Justification for Request

Companies often adjust billing cycles to enhance customer convenience. A common reason for requesting a credit card billing cycle change involves aligning payment due dates with the timing of income, such as monthly salary deposits. For instance, individuals receiving paychecks on the last day of the month may prefer a billing cycle that concludes on the first of each month, thereby simplifying financial planning. This adjustment may also help avoid late payment fees, improve credit utilization ratios, and support better budgeting practices. Understanding billing cycles and their impact on personal finance is crucial for effective money management.

Contact Information

A credit card billing cycle change request can significantly impact personal finance management. Many cardholders seeking to adjust the billing cycle may benefit from understanding their account information details, such as the credit card issuer's name (like Visa or Mastercard), account number (typically a 16-digit sequence), and customer service contact number (often found on the back of the card). Additionally, cardholders may need to provide their full name as listed on the account, billing address (including street, city, state, and zip code), and email address for correspondence. Changes to billing cycles can affect payment deadlines, interest calculations, and ultimately, a consumer's credit score as reported to major credit bureaus like Experian, TransUnion, or Equifax. Be prepared to specify desired billing cycle adjustments, whether shifting to a monthly or bi-monthly schedule.

Comments