Are you dealing with pesky credit card verification code issues? You're not alone! Many individuals find themselves scratching their heads over failed transactions or unexpected denials. Let's dive deeper into the common pitfalls and effective solutions for troubleshooting these frustrating situationsâread on to discover how you can navigate this challenge like a pro!

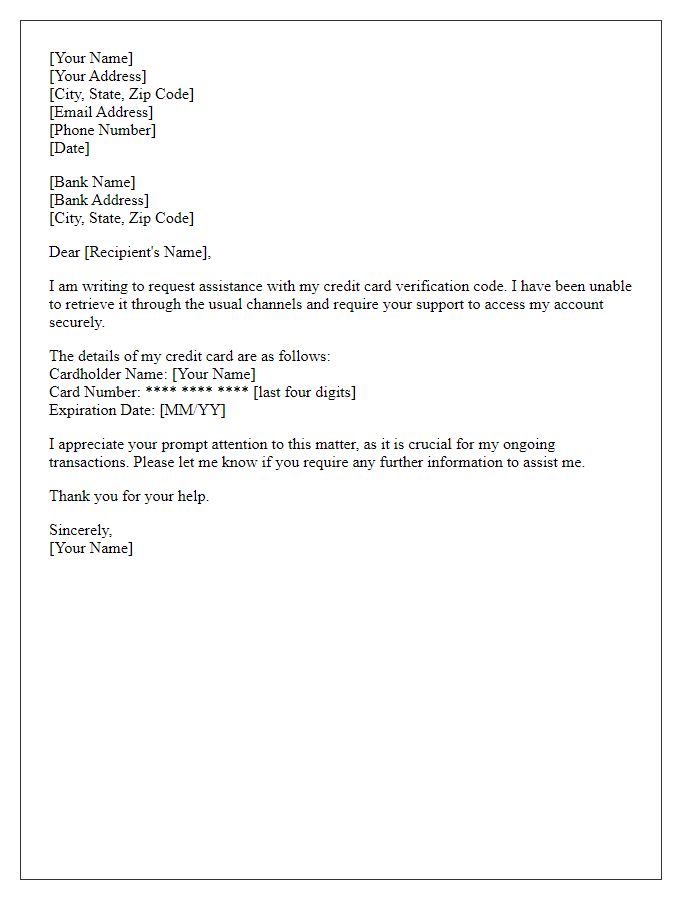

Cardholder Information

Credit card verification code issues can hinder online transactions, impacting the user experience for cardholders. The security feature known as Card Verification Value (CVV), typically located on the back of the card, safeguards against fraud by verifying transactions. Inaccurate CVV inputs lead to transaction failures across various platforms, such as Amazon or eBay, disrupting purchases. Cardholders must ensure the card number, expiration date, and CVV align correctly with the financial institution records to facilitate successful payments and maintain account security. Frequent issues may require contacting customer service or the issuing bank, which can provide additional assistance in resolving verification challenges.

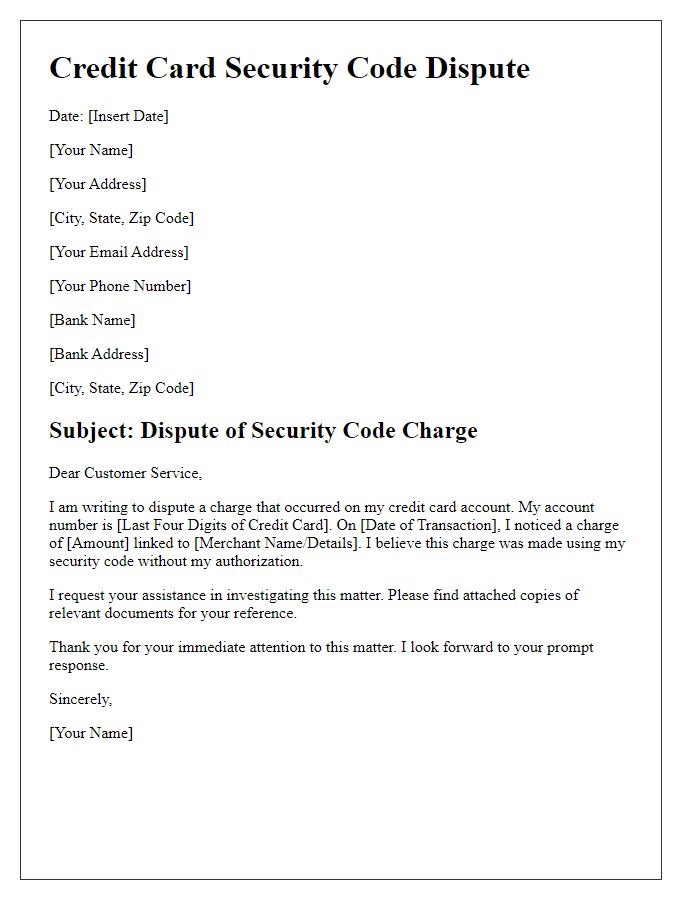

Transaction Details

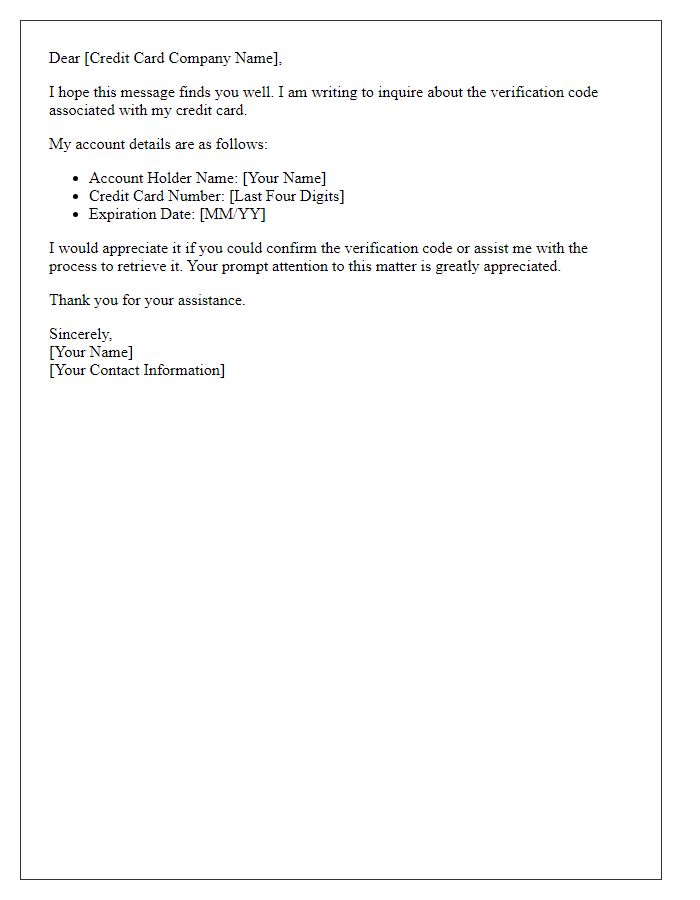

Credit card verification code issues often arise during online transactions, necessitating clear communication for resolution. Transaction details include the date of purchase, merchant name, transaction amount, and unique transaction identifier. The credit card verification code, typically a three or four-digit number found on the back of the card, ensures secure processing and prevents fraud. Detailed documentation of discrepancies in these codes can facilitate prompt investigation by financial institutions or payment processors. This comprehensive information aids in resolving issues efficiently, ensuring customer satisfaction and transaction security.

Verification Code Issue Explanation

A letter template for addressing credit card verification code issues serves as a crucial tool for consumers encountering difficulties with their payment processes. This document outlines the specific circumstances surrounding the verification code problem, which is essential for maintaining security during transactions. It includes key details such as the date of the transaction, the affected credit card number, and the error message received, ensuring clarity in communication. Additionally, it may request assistance from customer service regarding the correction or understanding of the verification code procedures. This template streamlines interactions, safeguarding financial information while enhancing the resolution process.

Requested Action

Credit card verification code issues often stem from discrepancies in the entered security code, typically the three or four-digit number found on the back (Visa and MasterCard) or front (American Express) of the card. Users may experience declined transactions (around 20% of attempted purchases) due to inaccurate input during online shopping on platforms like Amazon or eBay. Bank policies dictate that incorrect verification code entries trigger additional security measures, which can lead to account lockouts. Regularly updated personal information with issuing banks is essential, especially for users experiencing frequent issues, as outdated data can lead to failed verifications.

Contact Information

Credit card verification code issues are often linked to various factors impacting online transactions, including inaccurate data entry or technical glitches. For instance, the verification code, typically a three or four-digit number printed on the back of a card, serves as an additional security measure against fraud. Incorrect input can result in transaction failures or delays in processing payments. Various payment gateways like PayPal or Stripe might have specific protocols for troubleshooting this issue. Additionally, contacting customer support through designated channels, such as dedicated phone lines or online chat, can provide timely assistance. It's essential to have bank details at hand, including the last four digits of the card number and personal identification information, to expedite the verification process.

Letter Template For Credit Card Verification Code Issues Samples

Letter template of requesting assistance for credit card verification code

Comments