Are you considering requesting a waiver for your credit card's annual fee? Many cardholders don't realize that asking for a fee waiver can be a simple yet effective move that could save you money. In this article, we'll walk you through the steps to craft a compelling request that increases your chances of approval. So, let's dive in and explore how you can make your case for a fee exemption!

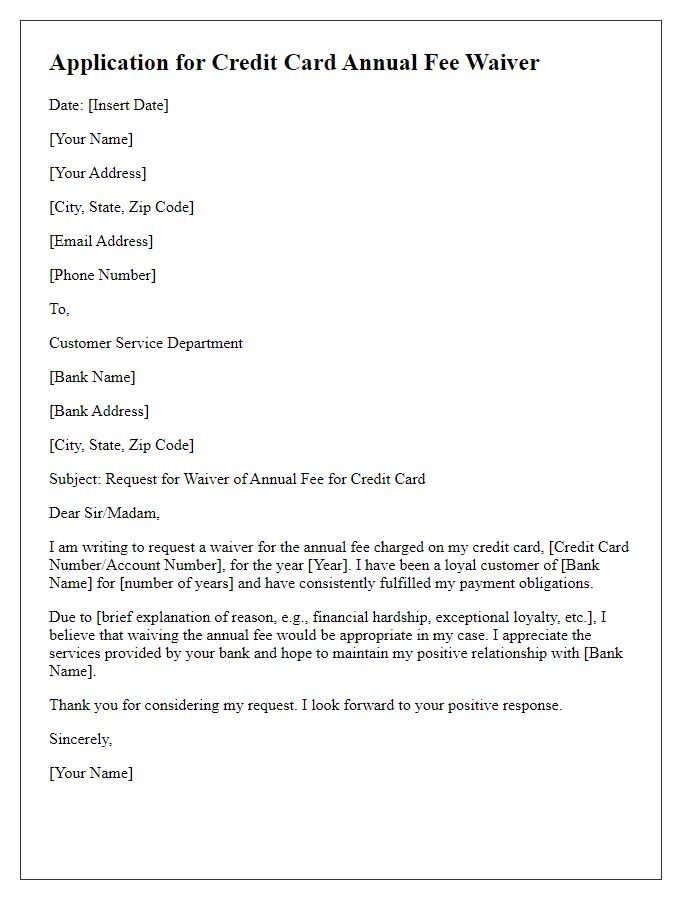

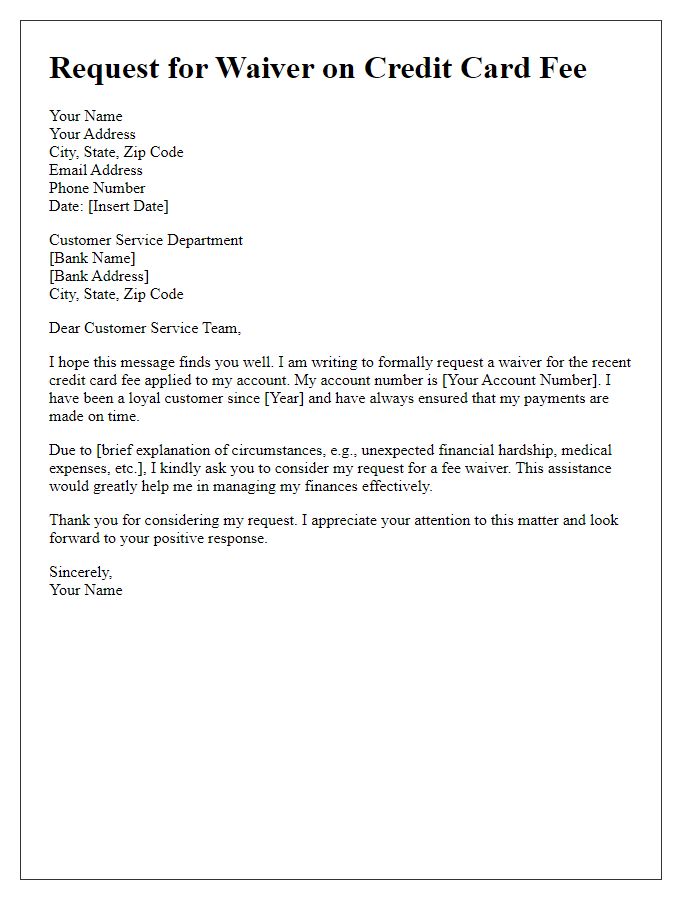

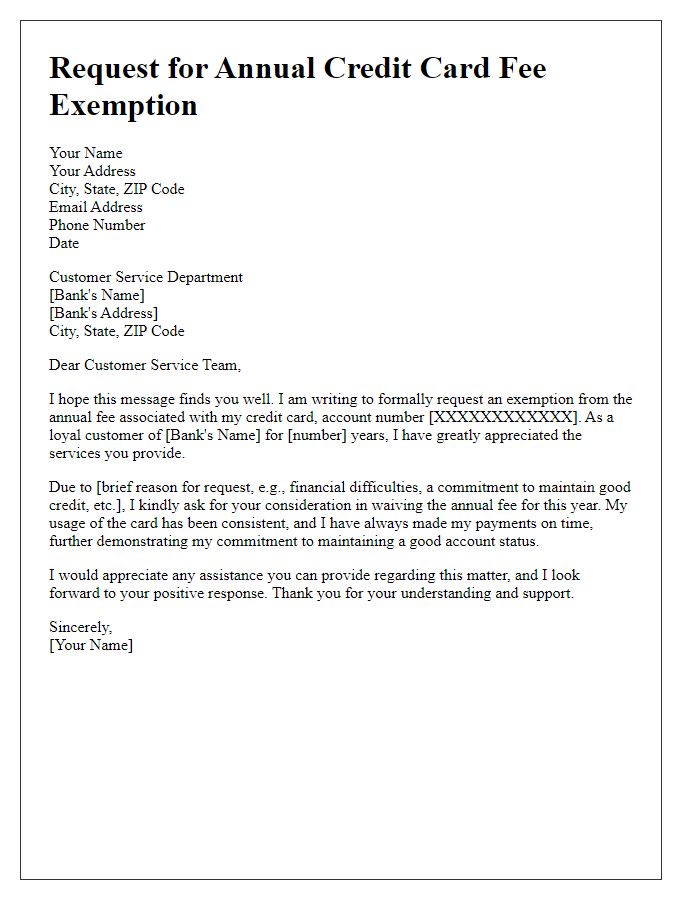

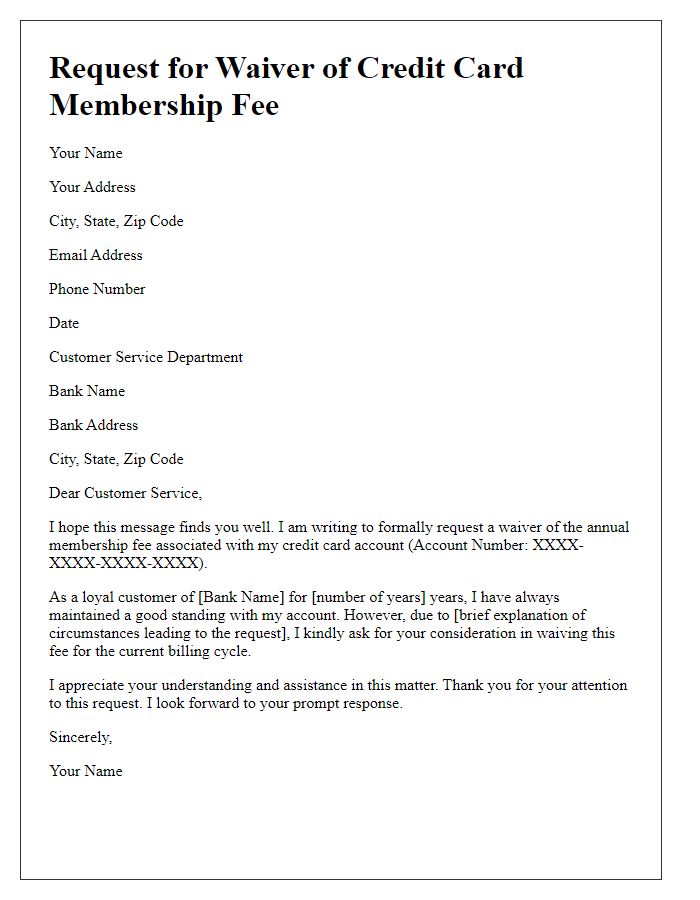

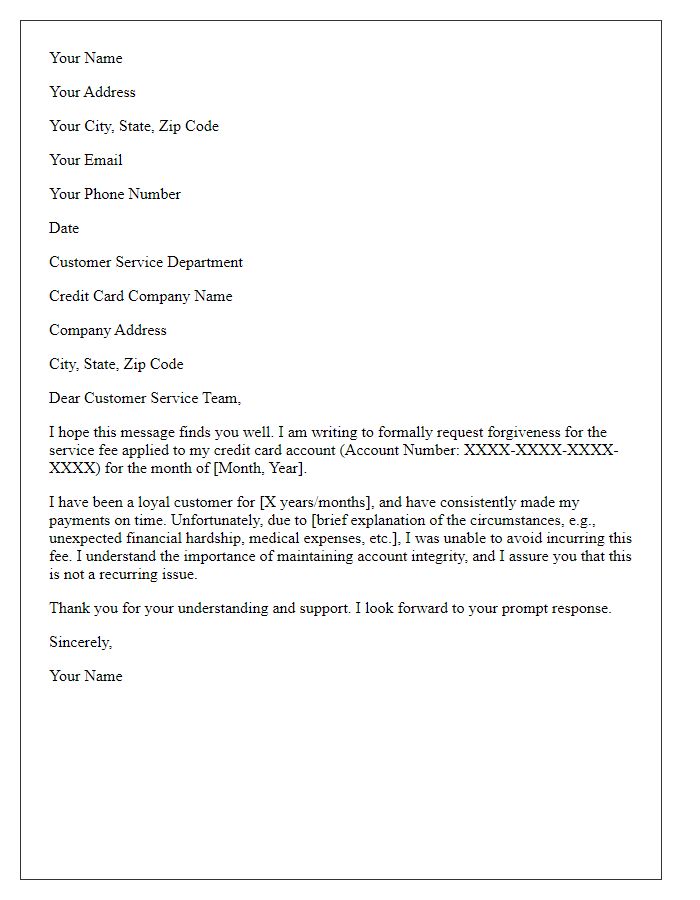

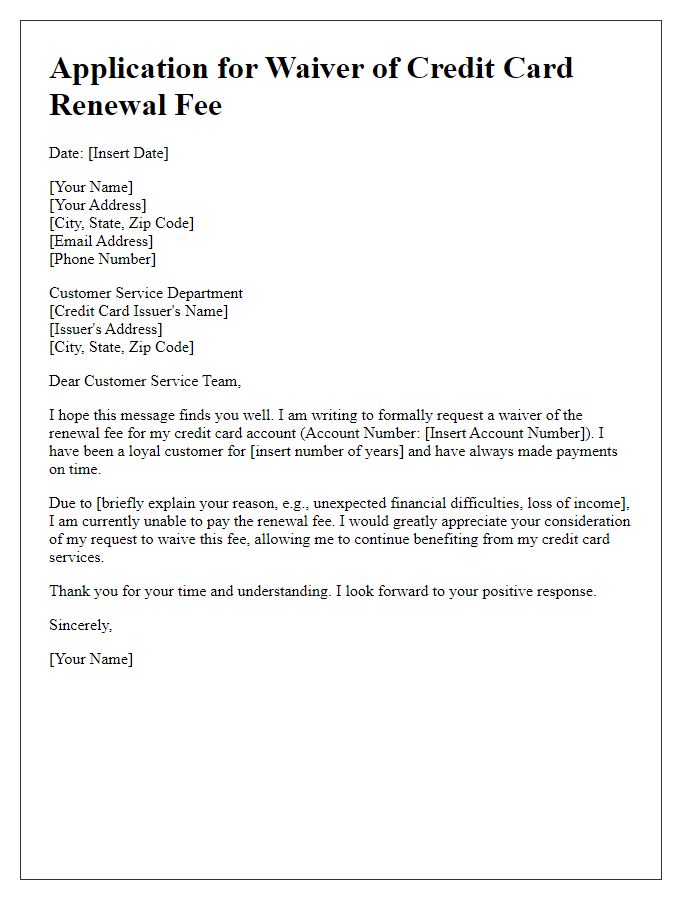

Personal account information

Navigating the process of a credit card annual fee waiver request involves understanding the specific terms associated with your particular credit card, such as the Visa or Mastercard branding. These fees typically range from $50 to over $500 annually for premium cards. Your personal account history, including the number of years you've maintained your account, plays a crucial role in this process. If you have consistently paid off your balance on time, your credit score, often ranging from 300 to 850, can positively influence the decision. Mention any significant life events like job loss or financial hardship to highlight your loyalty as a cardholder. Furthermore, referencing competitive offers from other financial institutions can strengthen your case for a fee waiver.

Specific waiver request statement

Many credit card holders often seek to waive the annual fee associated with their credit cards, typically ranging from $50 to $500, depending on the card's benefits. Card issuers like Visa, Mastercard, and American Express usually consider factors like customer loyalty (length of account history), payment history (timeliness), and total spending (amount charged annually). For instance, someone holding a Platinum card, which often carries a $450 fee, might present a history of on-time payments for over three years and a substantial annual spend of $20,000 as leverage in their request. Additionally, competitors may offer introductory promotions or fee waivers, making it essential to cite such offers while negotiating for a potential waiver.

Justification or reason for the request

Credit card annual fees often range from $95 to $550, depending on the card issuer and benefits offered. Many customers, including long-term holders, seek waivers due to loyalty and consistent payments. Instances of financial hardship or unexpected expenses, such as medical bills, can also justify a request. Potential impacts on credit utilization (affecting credit score) could motivate cardholders to lower their expenses. Additionally, increased competition among financial institutions may lead to promotional waivers, offering enticing alternatives that can be leveraged. Understanding these reasons can facilitate a successful request to waive annual fees.

Positive account history or loyalty mention

Frequent travelers benefit greatly from credit card point accumulation, especially from rewards programs offered by major banks. A solid payment record (such as no missed payments over the last 12 months) demonstrates responsible credit usage. Loyalty to specific financial institutions often results in additional perks, such as waived annual fees, which can range from $95 to $550 per year, depending on the card tier. Such financial institutions may also take into account long-standing relationships (over five years) and overall account management to decide on fee waiver considerations, enhancing customer satisfaction and retention.

Closing statement with appreciation

Thank you for considering my request for a waiver of the annual fee for my credit card account. I sincerely appreciate your assistance in this matter and value the relationship I have built with your institution. Your support in addressing my request would be greatly appreciated, enhancing my loyalty as a customer. Please do not hesitate to reach out if you need any additional information. Thank you once again for your understanding and support.

Comments