Are you looking to add an endorsed cardholder to your credit card account? Understanding the process can be a bit daunting, but it's simpler than you might think. With just a few steps, you can ensure that a trusted individual has access to your credit line, making expenses a breeze to manage together. Dive into our article to learn everything you need to know about this convenient option!

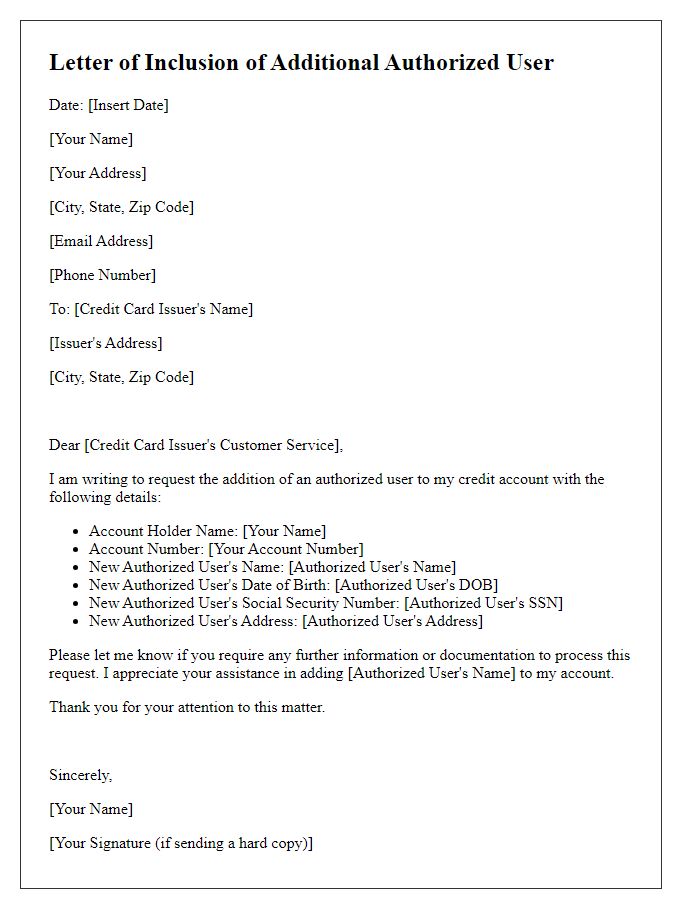

Cardholder's full name and contact information

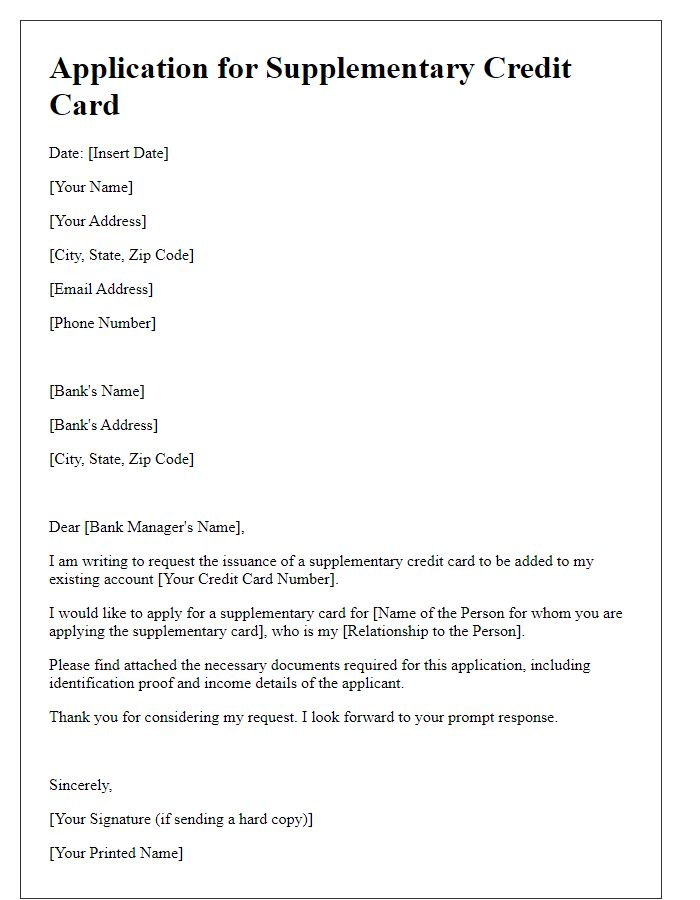

Adding an endorsed cardholder to a credit card account allows authorized users access to the same credit line, which can help with budgeting and build credit history. For example, a primary cardholder may consider adding a spouse, family member, or trusted friend (such as John Smith, residing at 123 Elm Street, Springfield, IL, with a contact number of (555) 123-4567) to enhance their financial flexibility. This process often requires the primary cardholder's personal identification information, the authorized user's full name, and contact details to ensure proper verification and security measures are upheld. Banks typically assess the creditworthiness of the new cardholder, which can impact the overall limits and terms associated with the account.

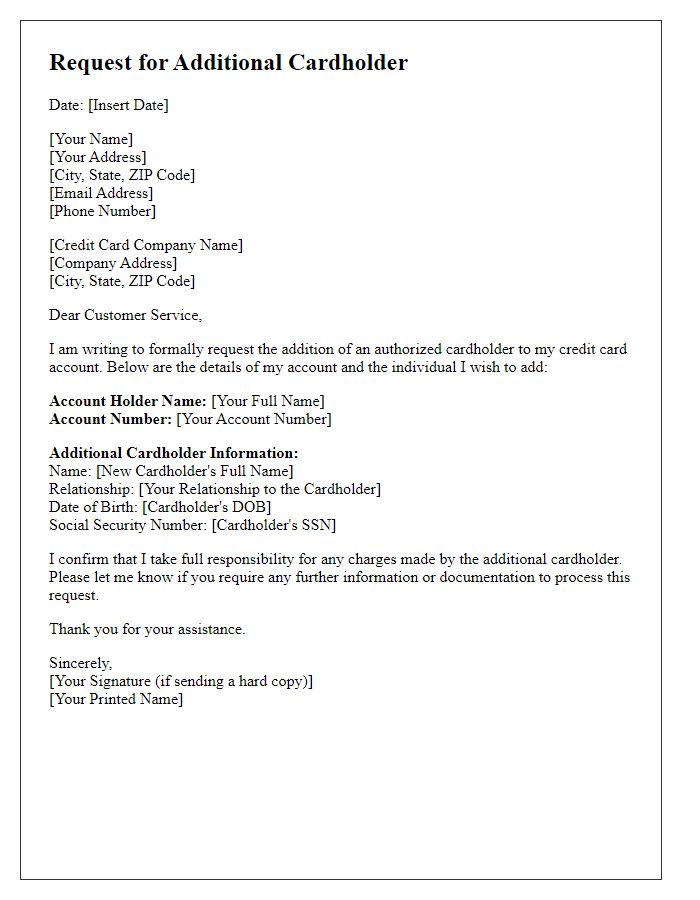

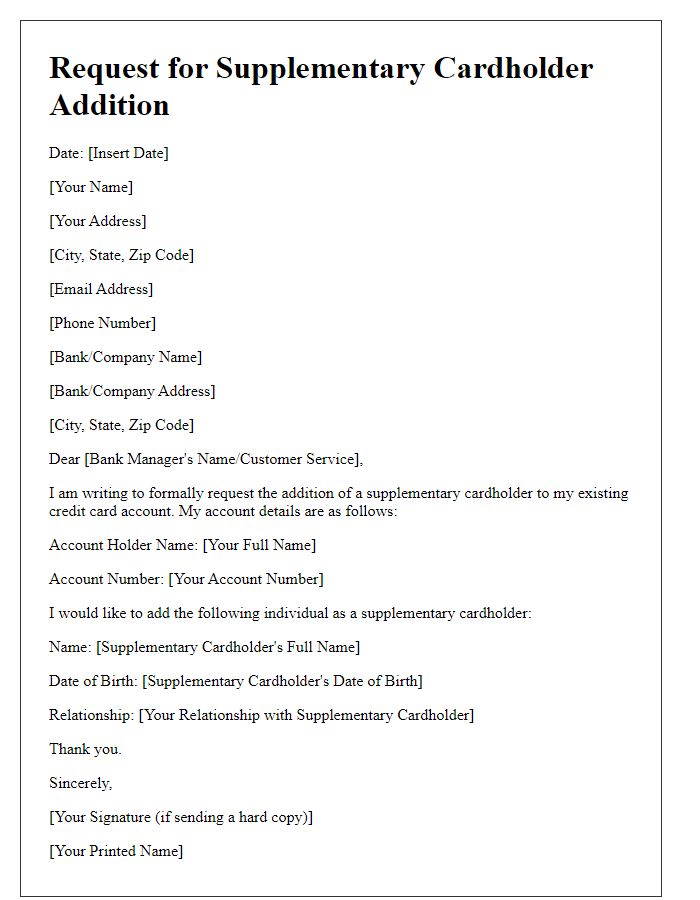

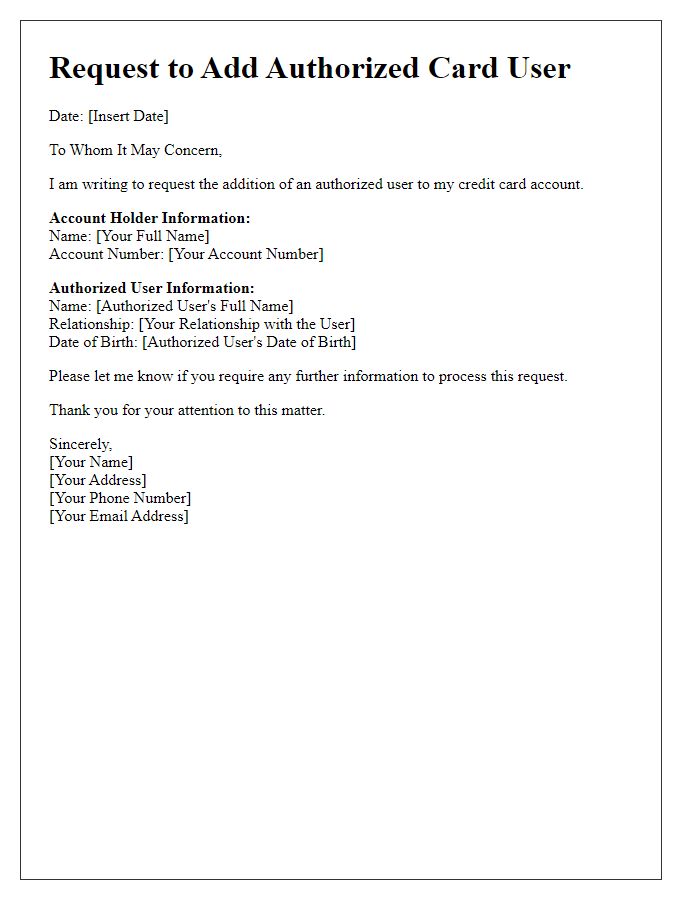

Primary account holder's full name and account number

The process of adding an endorsed cardholder to a credit card account involves providing detailed information such as the primary account holder's full name, which must match the name on the credit card, and the unique account number, which is typically a 16-digit identifier linked to the primary account. This addition allows the endorsed cardholder to utilize the credit line while building their own credit history. It is important to follow the specific guidelines set by financial institutions, as each may have varied requirements and potential fees associated with adding an additional cardholder to the account, often requiring both parties to verify their identity.

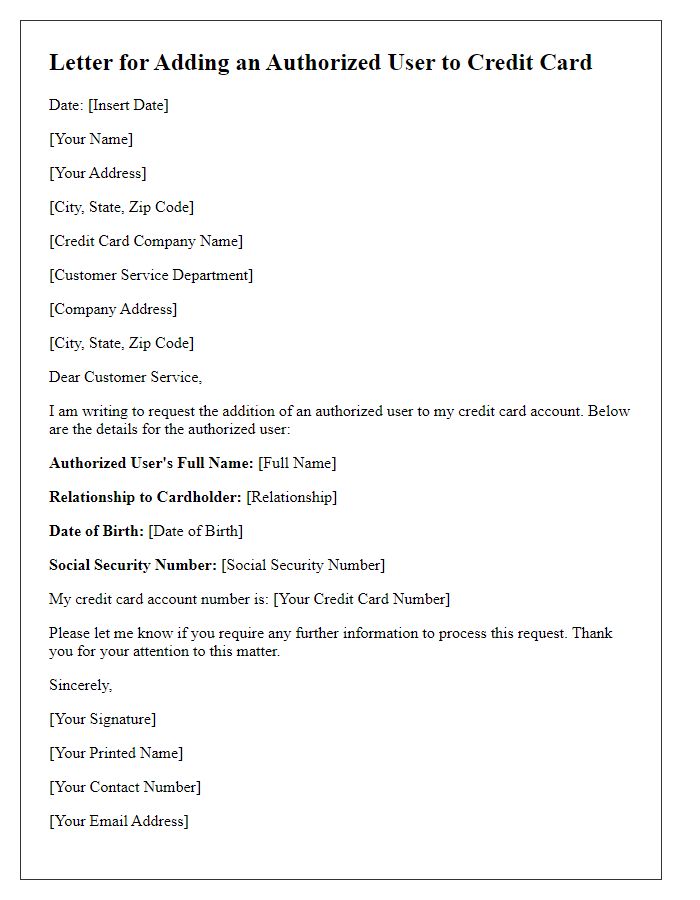

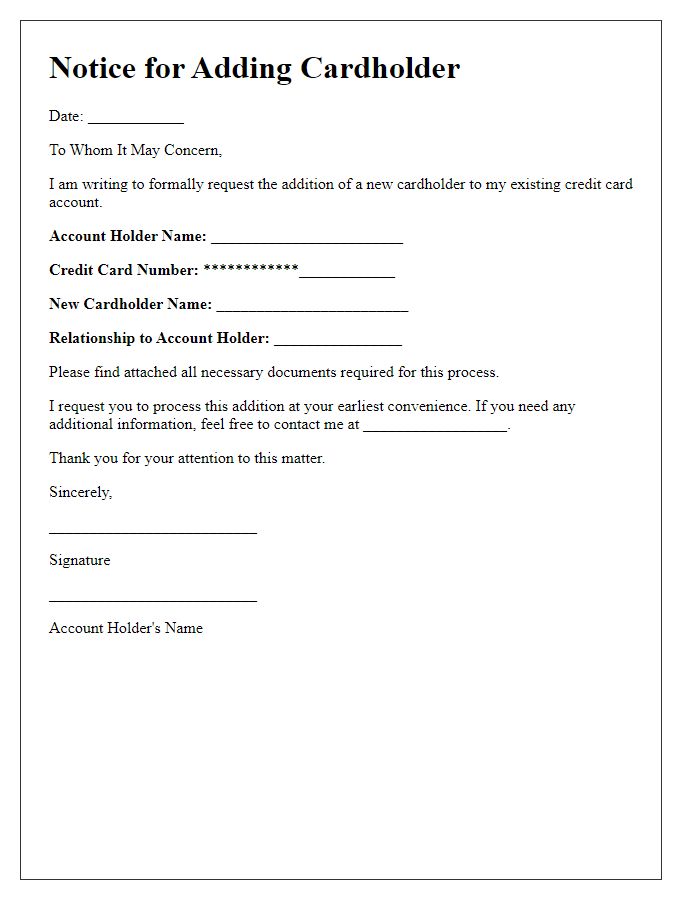

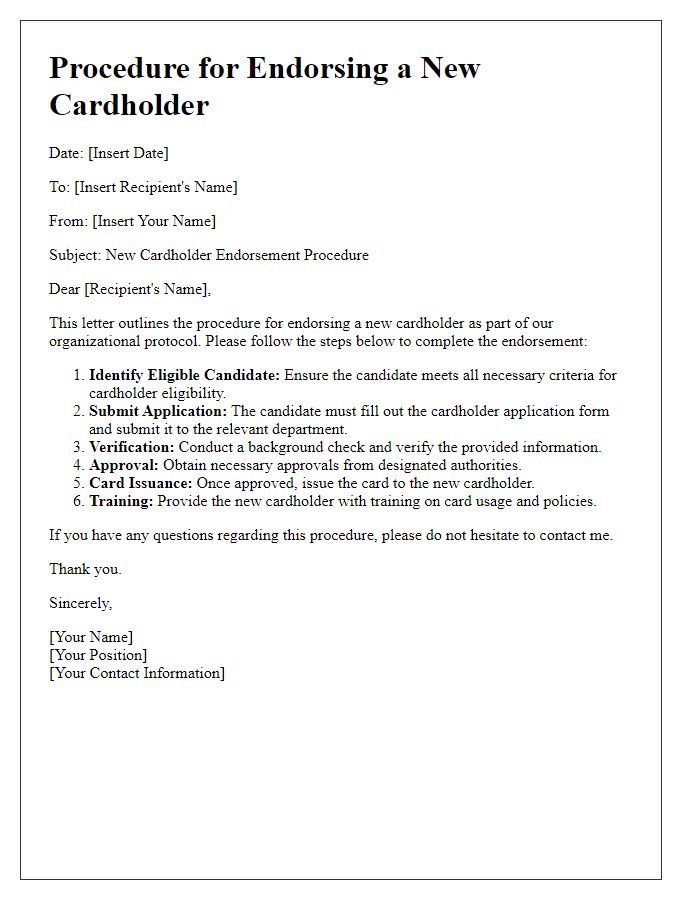

Clear request for adding an endorsed cardholder

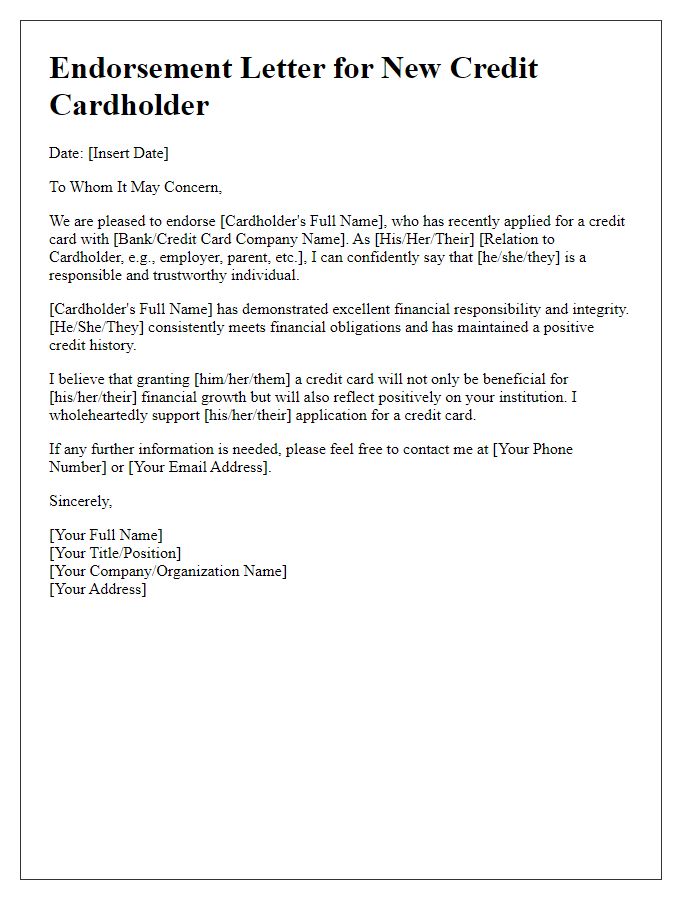

Adding an endorsed cardholder to a credit card account can enhance convenience and facilitate shared financial responsibility. The primary account holder should submit a formal request to the issuing bank, providing essential details such as the endorsed cardholder's name, date of birth, and social security number. Many banks require verification of the relationship between the primary holder and the endorsed cardholder, such as spouse, sibling, or business partner, to ensure responsible account management. This addition allows the endorsed cardholder access to the credit limit associated with the account, while also contributing to building their credit history. Furthermore, cardholder benefits extend to the endorsed individual, including rewards programs and fraud protection services provided by the issuer.

Identification and relationship details of additional cardholder

To add an additional cardholder to a credit card account, it is essential to provide identification details and relationship context. The process typically requires the additional cardholder's full name, date of birth, and social security number for identity verification. Additionally, the primary cardholder must specify the relationship type, such as spouse, partner, or family member, to clarify the bond between the two parties. Banks often request proof of address, such as utility bills, to ensure accurate documentation. The institution may also require consent from the additional cardholder, often necessitating a signature to authorize the addition.

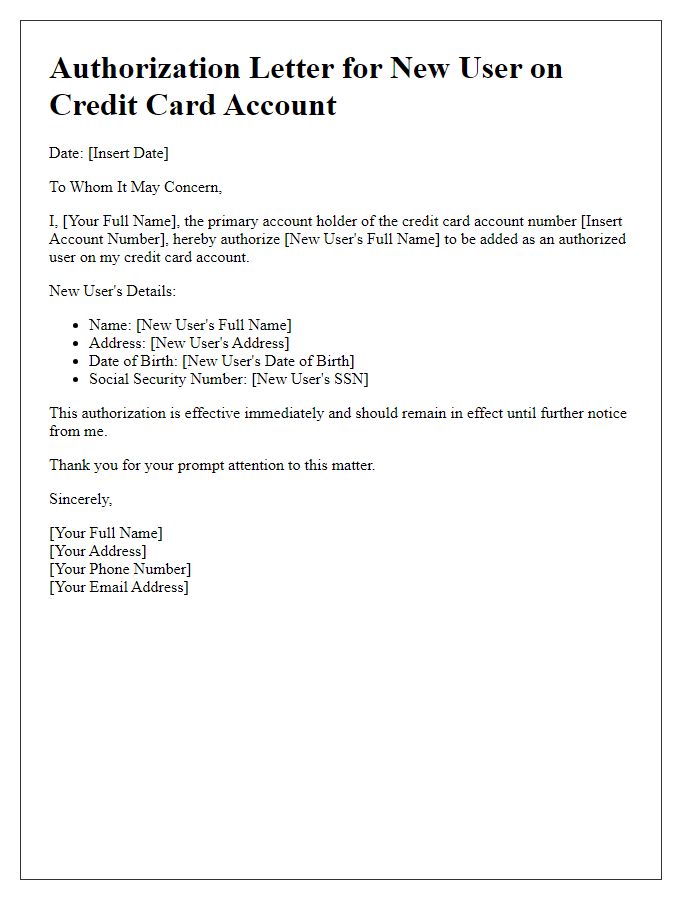

Authorization and consent statement, including signatures

Adding an endorsed cardholder to a credit card account requires a formal authorization and consent statement. The statement should include details such as the primary cardholder's name, account number, and the intended additional cardholder's information. The primary cardholder must provide clear consent by signing the document, affirming their agreement to add the new cardholder. Explicit mention of responsibilities, such as payment obligations and usage terms, should be included. An acknowledgment section can be incorporated for the additional cardholder, requiring their signature to confirm acceptance of the card and the associated terms. This ensures both parties are fully informed of their roles and liabilities regarding the credit card usage.

Letter Template For Credit Card Endorsed Cardholder Addition Samples

Letter template of request for additional cardholder on credit card account

Letter template of inclusion of additional authorized user on credit account

Comments