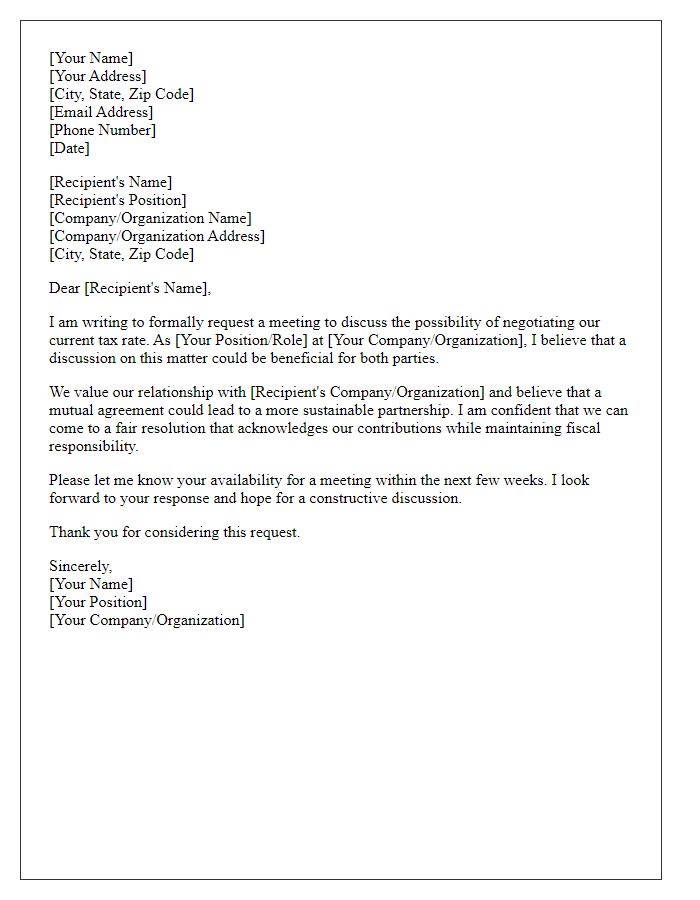

Are you facing challenges with tax rates that seem a bit too high? You're not aloneâmany individuals and businesses find themselves needing to negotiate their tax burdens to foster growth and sustainability. It can be a daunting process, but with the right approach, you can initiate a productive conversation with your local tax authorities. Ready to learn how to request a meeting for tax rate negotiations? Keep reading for tips and a sample letter to get you started!

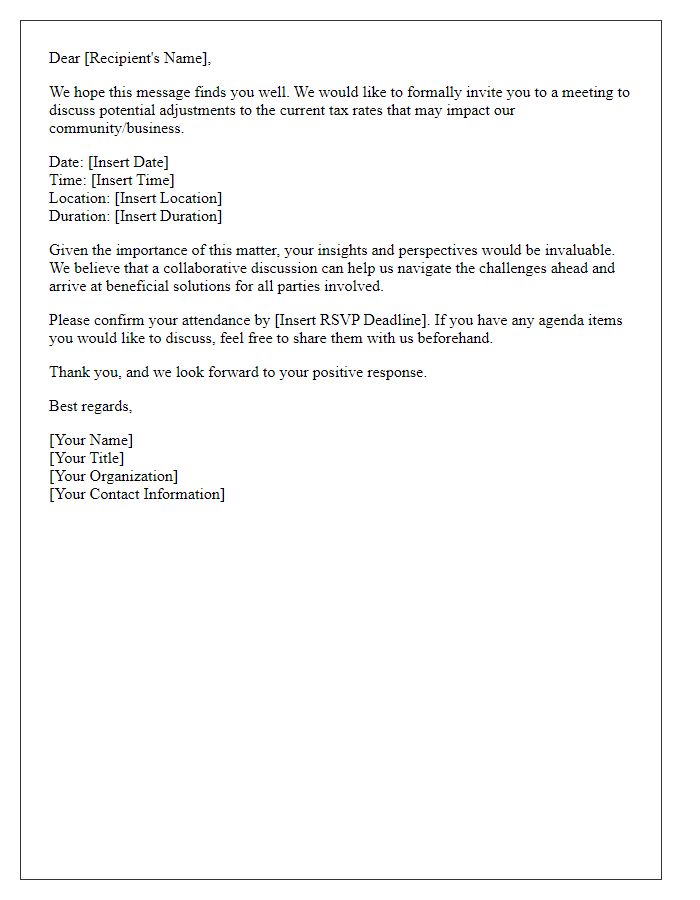

Purpose of Meeting

The purpose of the meeting involves the discussion surrounding the adjustment of the tax rate applicable to local businesses in Springfield, a city experiencing economic fluctuations. Specifically, this pertains to evaluating the current corporate tax rate set at 25% in comparison to surrounding regions, such as Jefferson County (20%) and Lincoln City (22%). The meeting will aim to analyze the impact of the tax rate on economic growth, job creation statistics (with a focus on the last five years), and funding for public services. Stakeholders from various industries, including technology, manufacturing, and retail, will present data-driven arguments to suggest a potential tax rate reduction to foster business expansion and attract new investment. Additionally, insights will be shared regarding the implications of tax incentives that were recently implemented in neighboring areas.

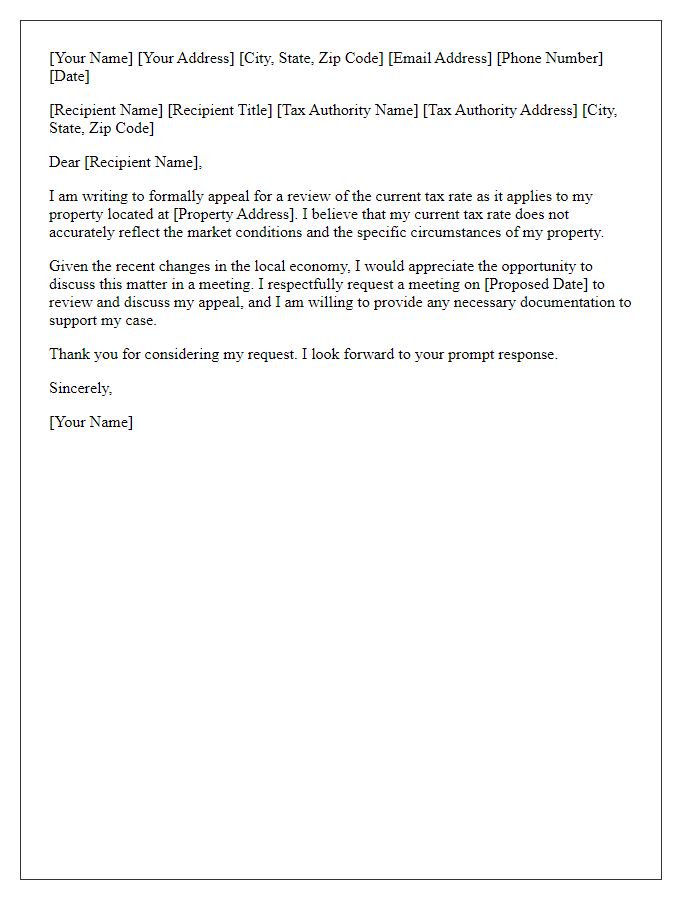

Current Tax Rates

Current tax rates play a crucial role in shaping economic policies and influencing business growth. Different jurisdictions, such as states or countries, set varying tax rates on income, sales, and property, which can affect overall profitability for companies and individuals. For instance, corporate tax rates in the United States average around 21% post-2017 reforms, while in countries like Ireland, the rate is significantly lower at approximately 12.5%, attracting foreign investments. Understanding these nuanced tax structures helps businesses strategize in areas such as expansion, compliance, and finance planning. Consequently, discussions aimed at negotiating current tax rates could lead to enhanced economic stability and equitable growth opportunities within specific regions.

Proposed Adjustments

In recent years, significant tax rate fluctuations have impacted local businesses within the small business sector, particularly in urban areas like Seattle, Washington. The current rate of 9.0% imposed on sales has resulted in increased financial pressure on these businesses, leading to discussions around potential adjustments. A recent survey indicated that 65% of local entrepreneurs believe a reduction to 7.5% could stimulate economic growth and job creation. Additionally, similar adjustments in municipalities such as San Francisco and Portland have shown positive outcomes, resulting in a 15% increase in small business revenue post-adjustment. Given these factors, a meeting is proposed to explore these adjustments further, aiming to create a more favorable economic environment for local businesses while ensuring sustainable revenue for city services.

Supporting Documentation

Supporting documentation for tax rate negotiation meetings often includes detailed records, relevant financial statements, and insights into local tax policies. Important documents may consist of tax returns from the previous three fiscal years, profit and loss statements (often covering any significant financial changes), and balance sheets highlighting assets and liabilities. Additionally, records of local economic conditions, such as unemployment rates (8% as of 2023 in some urban areas) or changes in local property values, can offer vital context. Comparisons with similar jurisdictions, including tax rates and revenue collection practices, can bolster the negotiation stance. It is essential to organize this information clearly to facilitate discussions and provide transparency during negotiations.

Contact Information

A tax rate negotiation meeting involves various stakeholders, including government officials, tax advisors, and business representatives. The meeting's objective is to discuss and potentially revise the tax rate applicable to businesses in specific jurisdictions, which can significantly impact economic activity. Accurate contact information, essential for coordination, typically includes full names, phone numbers, email addresses, and mailing addresses of all participants. This meeting, often held at a designated venue such as a city hall or conference center, may involve reviewing current tax policies, analyzing financial data, and addressing community concerns regarding equitable taxation practices. Preparing relevant documentation, such as previous tax rate agreements or economic impact studies, will facilitate a productive dialogue during this critical negotiation process.

Comments