When it comes to the outcomes of a tax audit, it's crucial to understand what the results mean for you and your financial responsibilities. Receiving notification can be a bit overwhelming, but it's an opportunity to gain clarity on your financial practices and ensure compliance with tax regulations. In this article, we'll delve into the key components of a tax audit notification letter, breaking down the essential information you need to know. So, grab your coffee and read on to empower yourself with insights that can make tax season a breeze!

Concise Summary of Audit Findings

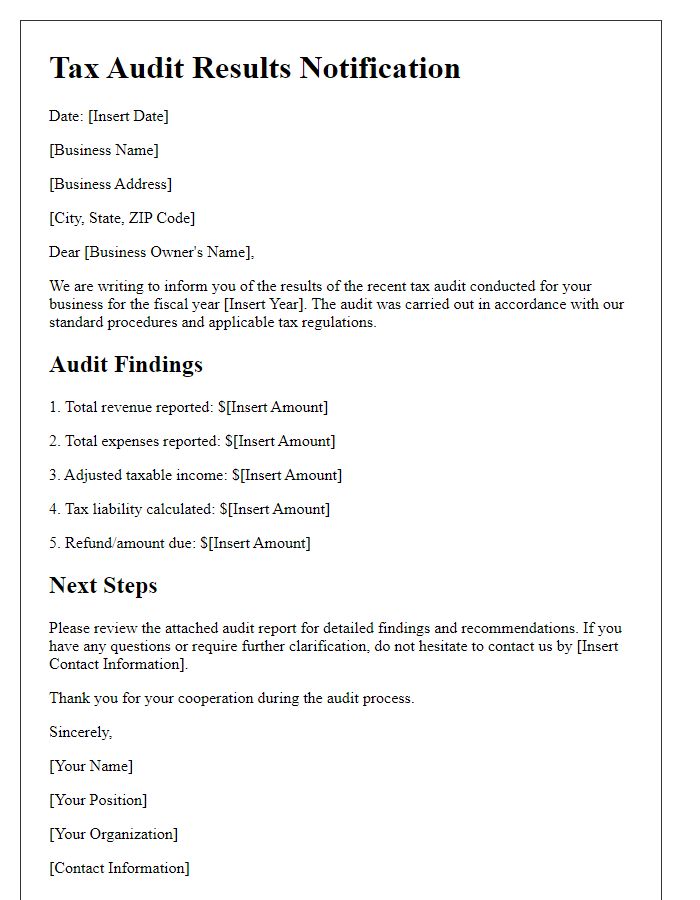

The tax audit results indicate several key discrepancies in reported income and deductions for the fiscal year 2022. Total reported income was $150,000, while the audit revealed an additional $20,000 in unreported earnings from freelance work. Deductions claimed amounting to $30,000 for business expenses were found to be inflated, with $10,000 deemed non-deductible personal expenses. The audit, conducted by the Internal Revenue Service (IRS), shows a potential tax liability increase of $5,500 along with interest accrued since the audit's initiation in January 2023. Additionally, the audit process examined three years of tax returns, highlighting the necessity for improved record-keeping practices to ensure compliance with tax regulations.

Explanation of Adjustments

Tax audit results often lead to adjustments based on a thorough examination of financial documents and practices. Adjustments may include reclassification of expenses (e.g., meals, travel), income discrepancies (e.g., unreported earnings), and disallowed deductions (e.g., personal expenses claimed as business). The audit might reveal non-compliance with tax laws (e.g., incorrect filing of forms like IRS Form 1040 for individuals or Form 1120 for corporations). Specific adjustments are likely outlined in the completed audit report, often detailing the amount of additional tax owed, penalties (which can range from 5% to 25%), and interest accrued since the original filing. The taxpayer (individual or entity) may need to respond to these findings within a specified period (typically 30 days) to address potential appeals or payment arrangements, ensuring compliance with the Internal Revenue Service regulations (IRS).

Payment or Refund Instructions

Tax audit results often require careful review and action. When taxpayers receive their audit results, the notification will likely include clear payment instructions or refund details. For instance, in the United States, the Internal Revenue Service (IRS) outlines steps for taxpayers when an audit determines underpayment or overpayment. Taxpayers may owe additional amounts, such as penalties or interest, necessitating full payment by a specific deadline, usually within 30 days of receiving the notice. Conversely, if a refund is due, taxpayers might receive instructions on how to apply for the refund, generally processed within 6 to 8 weeks of the audit conclusion. It is crucial for taxpayers to act promptly, adhering to outlined timelines to avoid further complications.

Appeal or Dispute Process

Tax audit results inform taxpayers regarding findings from an examination of financial records by a government agency, such as the Internal Revenue Service (IRS) in the United States. The appeal or dispute process typically involves formally contesting the audit findings, usually within a specified timeframe, often 30 days from the date of notification. Taxpayers may need to gather pertinent documents, such as receipts, statements, and past tax returns, to support their case. An appeals officer will review the case, ensuring adherence to guidelines outlined in the Internal Revenue Code, and taxpayers may also seek assistance from a certified public accountant (CPA) or tax attorney for expert advice. Formal written communication and adherence to deadlines are crucial components of this process to avoid additional penalties or consequences.

Contact Information for Questions

Tax audit results can significantly impact individuals and businesses, such as the comprehensive findings from the Internal Revenue Service (IRS) audit. Detailed reports provide clarity on discrepancies, adjustments, and liabilities assessed during the audit process. For inquiries regarding the audit outcomes, reach out to the dedicated audit resolution team at the IRS, which operates through a toll-free helpline at 1-800-829-1040, available from 7 a.m. to 7 p.m. local time on weekdays. Additionally, taxpayers may consult licensed tax professionals or certified public accountants (CPAs) for tailored guidance, especially regarding tax obligations in specific states like California or New York. Proper documentation, including prior tax returns and supporting financial statements, is crucial when seeking clarification or remediation options following audit results.

Letter Template For Notification Of Tax Audit Results Samples

Letter template of tax audit results notification for non-profit organizations.

Comments