Are you feeling overwhelmed by tax issues and looking for a way to resolve them with ease? We understand that navigating tax disputes can be a daunting experience, which is why we're excited to invite you to our upcoming tax mediation session! This collaborative event aims to provide you with expert guidance and support tailored to your specific needs, ensuring you leave with clarity and confidence. Join us to find out how easy it can be to take the stress out of tax negotiations and discover the solutions waiting for youâread on to learn more!

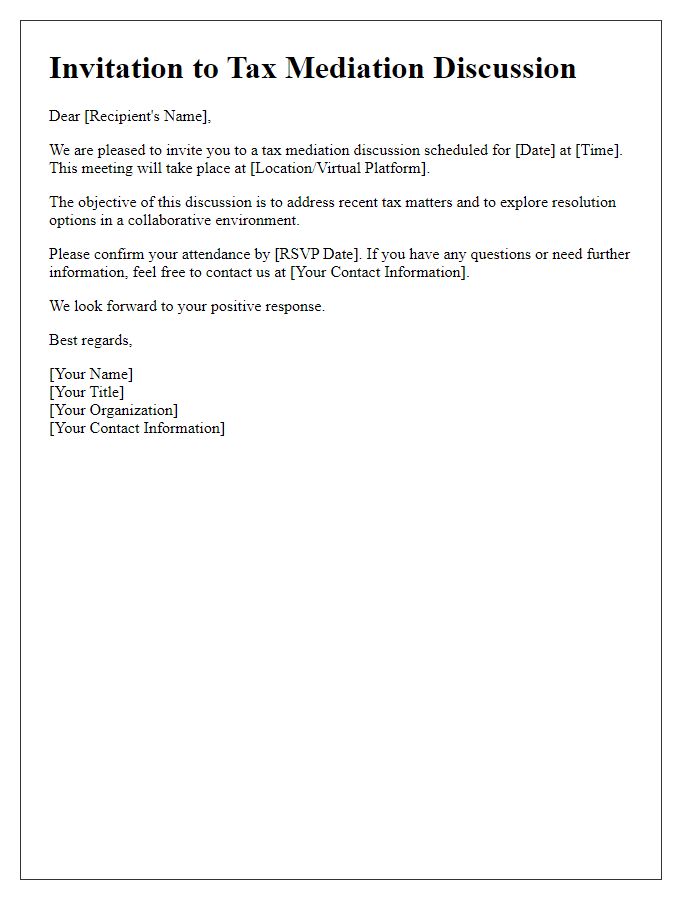

Clear subject line

The Tax Mediation Session, scheduled for February 15, 2024, at the Washington Conference Center, aims to resolve outstanding tax disputes efficiently. Participants, including tax advisors and representatives from the IRS, will discuss various issues, such as owed amounts, penalties, and compliance strategies. The session will provide valuable insights into tax regulations, enhancing understanding of obligations and rights. Attendees should prepare relevant documentation, including tax returns and communication records, to facilitate a productive dialogue. Networking opportunities will follow, encouraging collaboration among tax professionals and taxpayers alike.

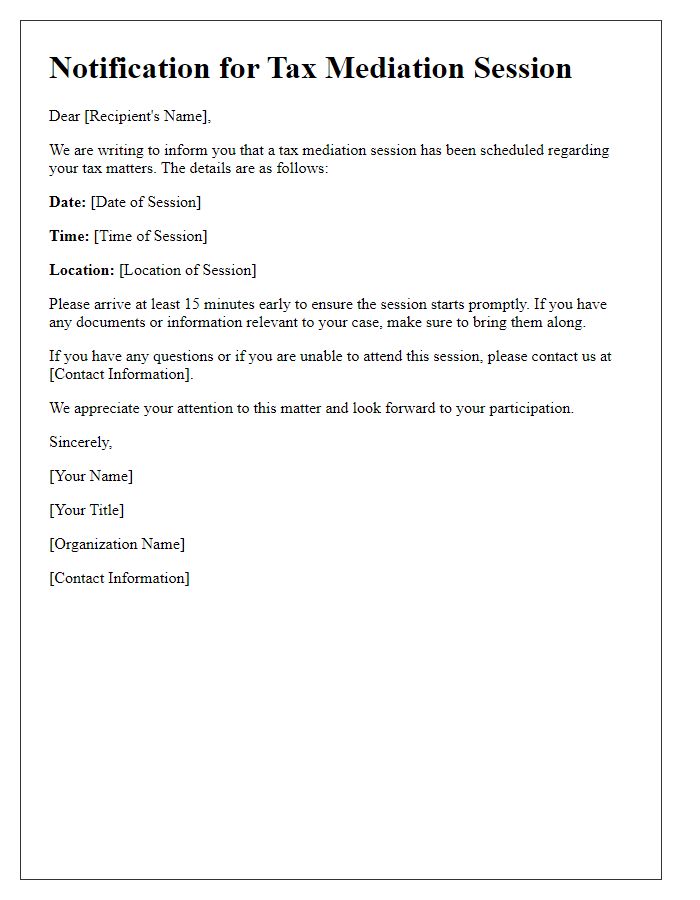

Detailed session date and time

The tax mediation session is scheduled for January 15, 2024, at 10:00 AM. The event will take place at the conference room of the local tax office located at 123 Main Street, Springfield. Participants are expected to arrive at least 15 minutes prior to the session to ensure a prompt start and to allow for check-in procedures. Documentation relevant to the case should be prepared for review during the meeting, as this will facilitate an efficient discussion.

Comprehensive location information

The upcoming tax mediation session is scheduled to take place at the community center located at 123 Main Street, Springfield. This venue features a spacious meeting room accommodating up to 50 attendees, equipped with audiovisual aids for presentations. Ample parking is available on-site, with additional spots on nearby Elm Street. The community center is conveniently accessible via public transportation, with bus routes 5 and 12 stopping within a two-block radius. Local landmarks include the Springfield Library and the City Park, ensuring easy navigation for participants. The session is planned for November 15, 2023, starting at 10:00 AM, offering an opportunity for taxpayers and tax officials to engage in dialogue regarding their financial matters.

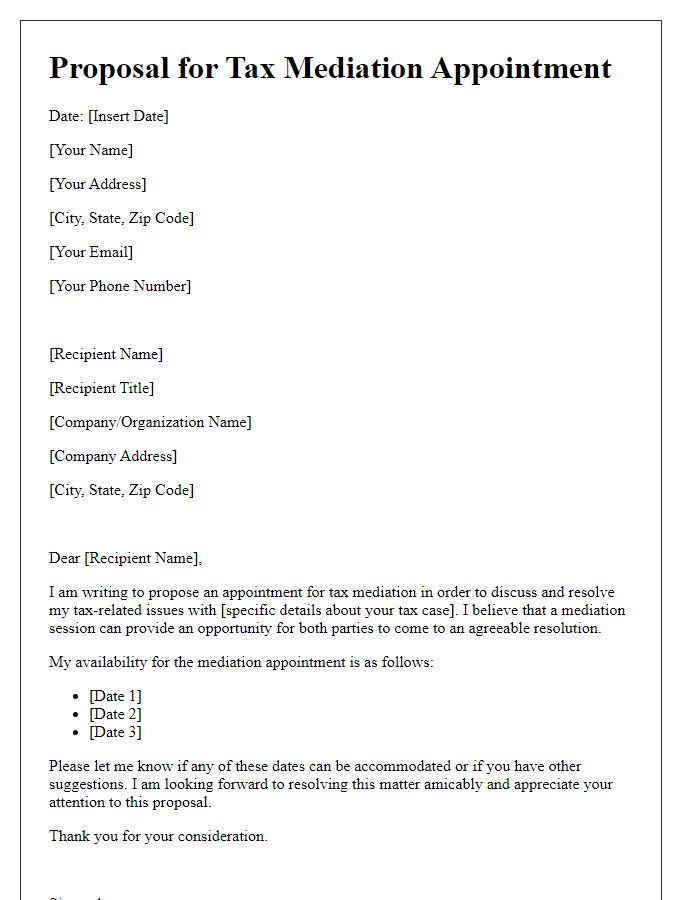

Contact information for queries

The tax mediation session, focusing on the resolution of outstanding disputes regarding federal tax obligations, is scheduled for June 15, 2024, at the downtown conference center in Springfield, Illinois. This session aims to facilitate dialogue between taxpayers and IRS representatives, addressing issues such as tax liabilities, audit challenges, and penalties. Participants are encouraged to come prepared with relevant documentation, including tax returns from 2020 to 2023, correspondence from the IRS, and any supporting financial records. The conference center offers accessible facilities, ensuring a comfortable environment for all attendees to engage in constructive negotiations and achieve amicable resolutions. For any inquiries regarding the session or logistical details, participants can reach out to the designated contact at (555) 123-4567 or via email at mediation@taxservices.com.

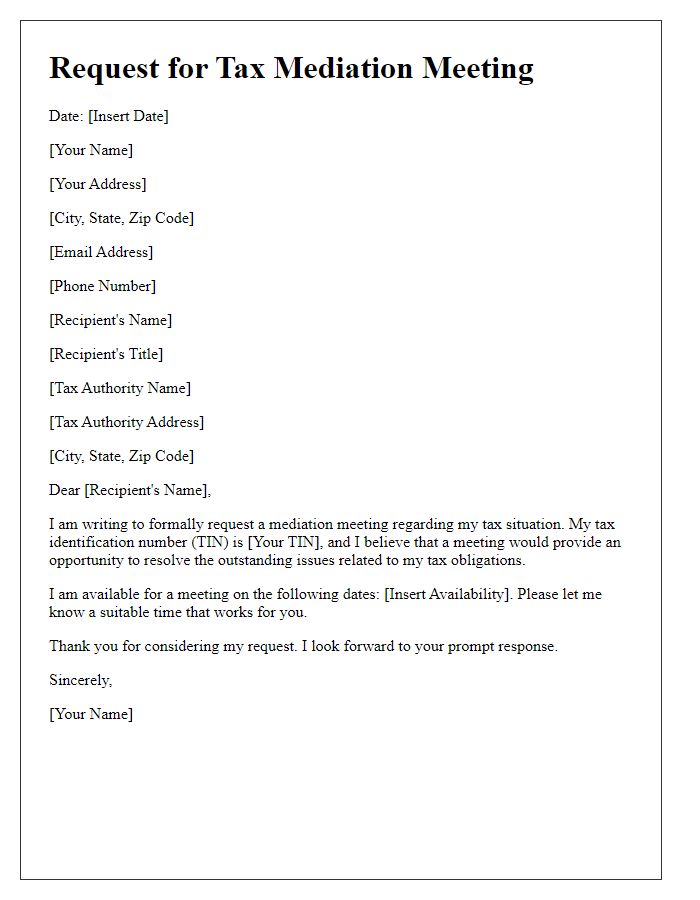

Instructions for document preparation

In preparation for the upcoming tax mediation session, involved parties must compile relevant documents to ensure a productive discussion. Essential materials include tax returns for the past three years, supporting financial statements, and any previous correspondence with the IRS (Internal Revenue Service). Participants should also gather documentation pertaining to income statements, including W-2 forms and 1099s, to establish a comprehensive financial picture. Additionally, records of any tax payments made, such as canceled checks or bank statements, are critical for clarity in discussions. It is advisable to organize these documents in chronological order, facilitating easier reference during the mediation process. Finally, a list of questions or concerns regarding outstanding tax issues may also be beneficial to address during the session. This thorough preparation enhances the likelihood of a favorable outcome in resolving tax disputes.

Comments