Hey there! If you've ever found yourself dealing with overdue tax payments, you know how stressful it can be. This not-so-fun situation can arise for many reasons, whether it's an overlooked deadline or unexpected expenses. In this article, we'll break down a simple yet effective letter template that can help you notify the tax authorities about your overdue payment, alleviating some of that stress. So, let's dive in and see how we can make this process a little easier for you!

Clear identification of the taxpayer's details.

Clear identification of the taxpayer's details is essential for effective communication regarding overdue tax payments. Specifically, the taxpayer's full name must be prominently displayed, providing clarity on the individual or entity being addressed. Furthermore, inclusion of the taxpayer identification number (TIN), essential for accurate identification, ensures proper linkage to tax records. The address of the taxpayer should be formatted correctly, including street number, street name, city, state, and postal code for effective mail delivery. Lastly, reference to the specific tax year or filing period pertaining to the overdue payment enhances the context and urgency of the notification, allowing for immediate understanding of the outstanding obligation.

Accurate statement of the overdue amount and due date.

Overdue tax payments, particularly concerning income tax obligations, often result in penalties and interest accruing on the unpaid amount. Common due dates, such as April 15 for federal income taxes in the United States, are critical for taxpayers to meet. Failure to comply can lead to implications, including a 5% monthly penalty on unpaid taxes and potential legal actions from the Internal Revenue Service (IRS). Taxpayers should be aware of the total overdue amount, which might include the initial liability as well as accumulated interest, often calculated at a rate of 3% per annum. Timely resolution of such matters maintains good standing with tax authorities and prevents further financial strain.

Explanation of potential penalties and interest.

Taxpayers who fail to submit overdue payments on their federal or state taxes, typically due on April 15, may incur penalties and interest charges. The IRS imposes a late payment penalty, generally 0.5% per month on the unpaid balance until the payment is made, up to a maximum of 25%. Additionally, interest accrues daily on the outstanding tax amount, compounded quarterly, which can significantly increase the total owed. This interest rate fluctuates quarterly, based on the federal short-term rate plus 3%. Ignoring overdue tax notifications from the IRS can escalate situations into tax liens or levies against assets, complicating financial stability further. Taxpayers are encouraged to address unpaid amounts promptly to mitigate these consequences.

Instructions on payment methods and contact information.

Due to overdue tax payments, individuals may face penalties and interest that accrue daily. Taxpayers can resolve outstanding balances via several payment methods: electronic funds transfer using the IRS Direct Pay system, credit card payments through authorized service providers, or mailing a check to the appropriate tax office at the address listed on the bill statement. For direct assistance, taxpayers can contact the Internal Revenue Service hotline at 1-800-829-1040, available Monday through Friday, 7 a.m. to 7 p.m. local time. Additionally, taxpayers can visit the IRS website to access their account information and make inquiries regarding payment plans or options. Prompt action is encouraged to avoid further legal complications.

Reminder of possible legal actions for non-compliance.

Overdue tax payments can lead to serious legal consequences for individuals and businesses. Tax authorities, such as the Internal Revenue Service (IRS) in the United States, may initiate collection actions if payments are not received within specified deadlines, typically 30 days past due. Legal actions may include wage garnishments, property liens, or even bank levies to recover owed tax amounts. Additionally, penalties for late payment can accrue, compounding the financial burden. It is crucial for taxpayers to address overdue amounts promptly, as failure to comply can result in further legal complications and increased financial liabilities.

Letter Template For Overdue Tax Payment Notification Samples

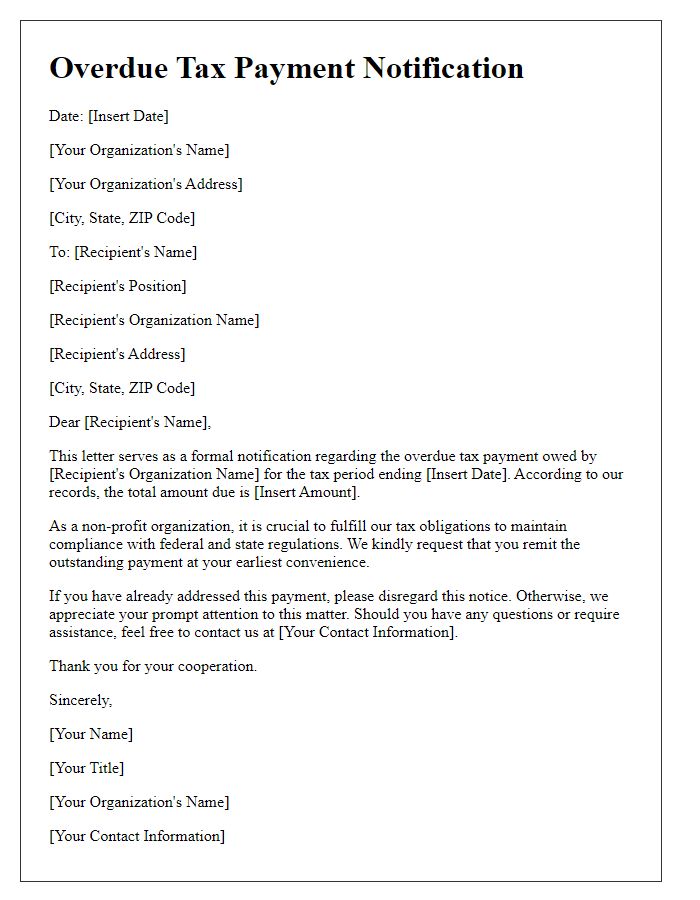

Letter template of overdue tax payment communication for non-profit organizations.

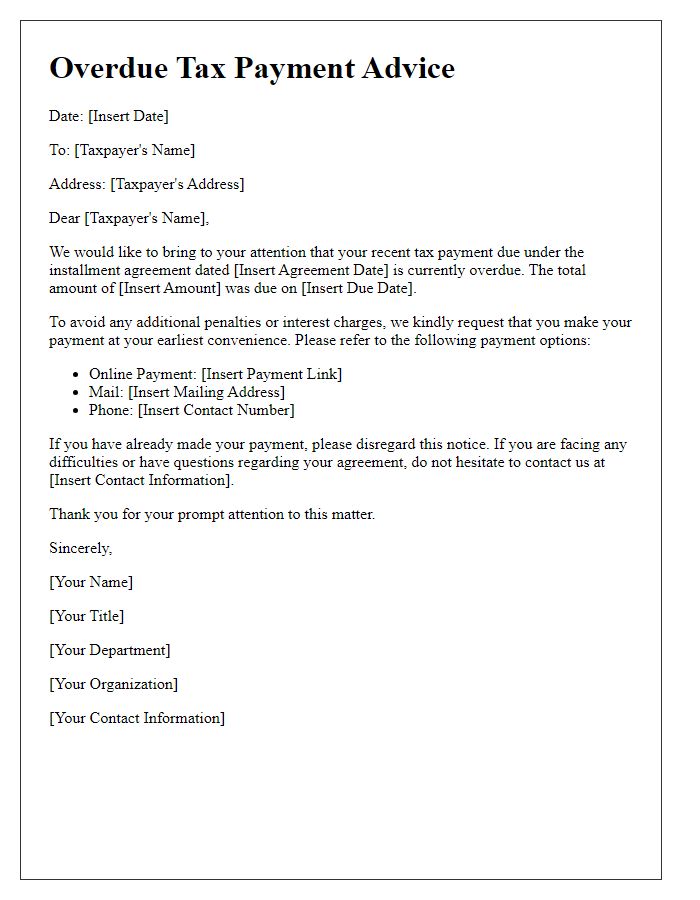

Letter template of overdue tax payment advice for installment agreements.

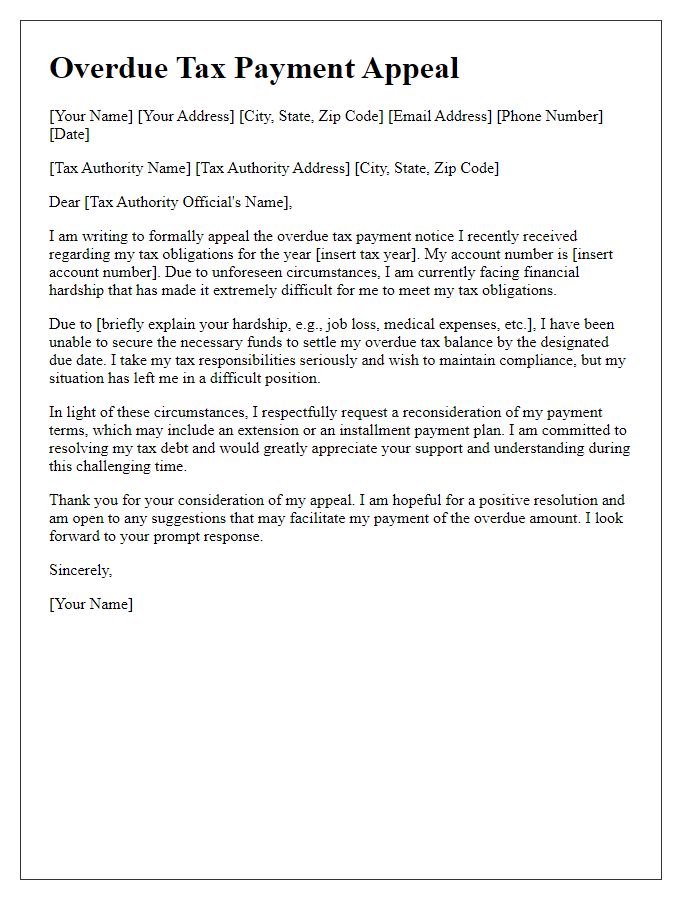

Letter template of overdue tax payment appeal for taxpayers facing hardship.

Comments