Hey there! As the tax season approaches, it's crucial to stay ahead of the game and ensure you have all your documents ready for a smooth filing process. This letter serves as a gentle reminder to gather your income statements, deductions, and any other necessary paperwork you might need. Don't let the deadline sneak up on youâtaking a proactive approach can save you time and stress. Ready to dive deeper into the essentials of tax preparation?

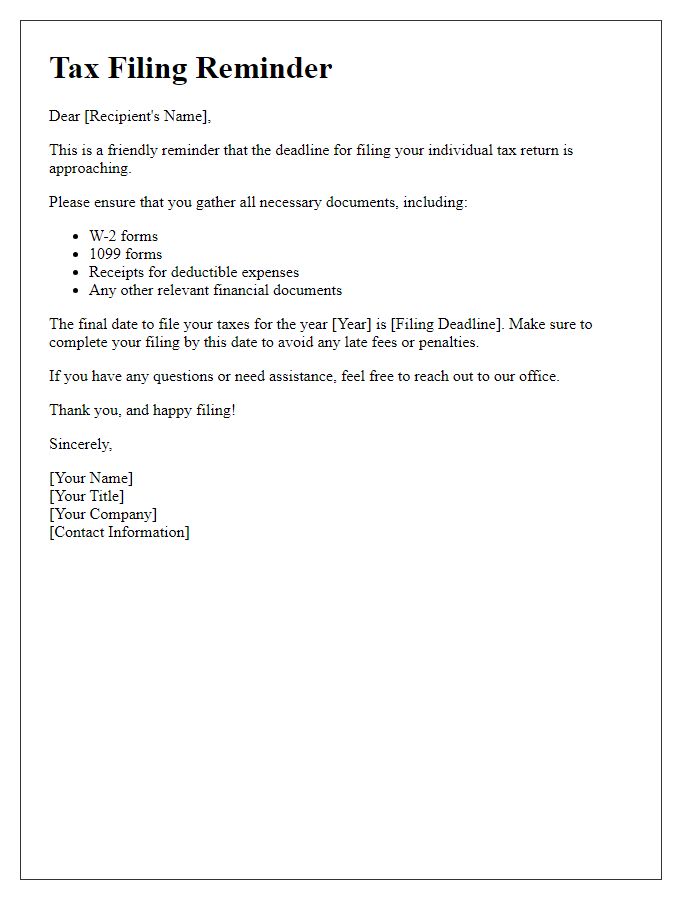

Personalized greeting

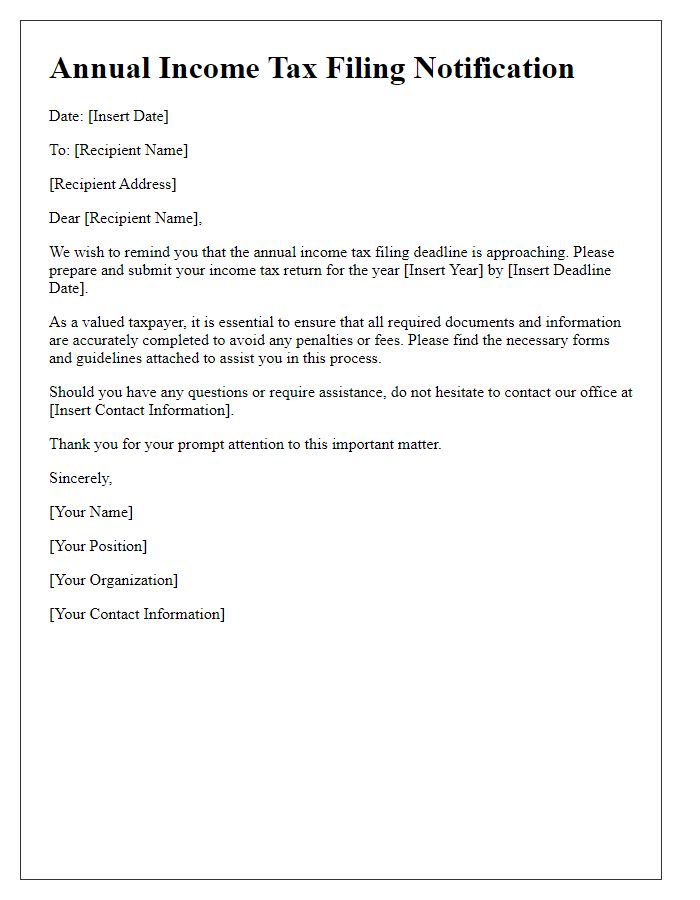

The annual income tax filing deadline, typically April 15th in the United States, approaches quickly each year, creating an important time for taxpayers to assess their financial documentation. Gathering essential records, such as W-2 forms from employers and 1099 forms for additional income, requires meticulous organization. Deductions may vary significantly, based on factors like mortgage interest payments and charitable contributions, emphasizing the importance of tracking one's financial activities throughout the year. Timely submission of tax returns can prevent penalties imposed by the Internal Revenue Service (IRS), which can accrue interest if payments are late. Corresponding with tax professionals can provide valuable guidance for maximizing possible refunds or reducing liabilities in the filing process, ensuring that individuals remain compliant with federal regulations while optimizing their financial outcomes.

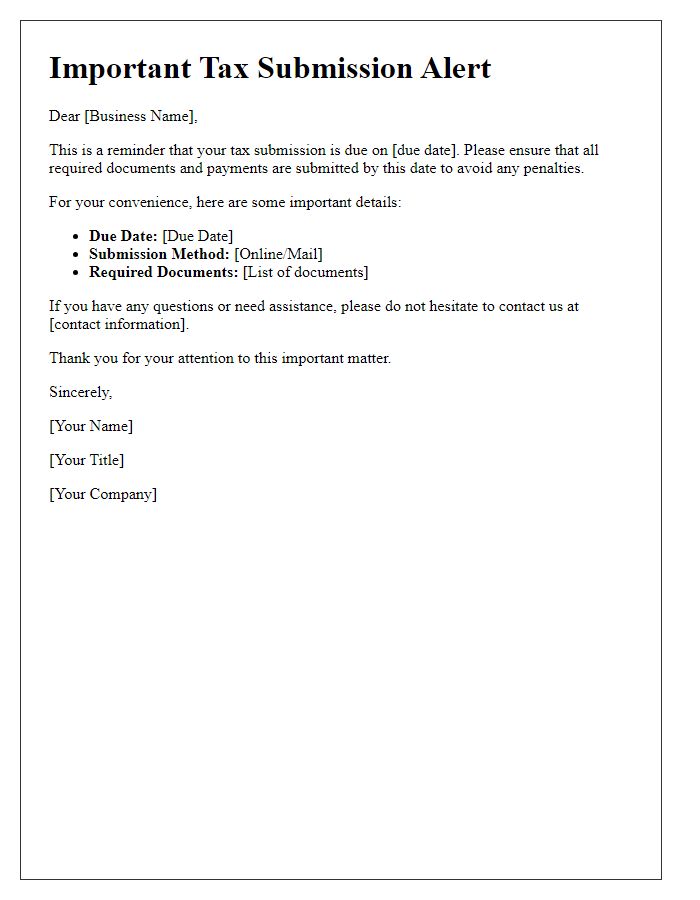

Important deadlines

Income tax filing deadlines play a crucial role in determining compliance and avoiding penalties for individuals and businesses. The primary deadline for submitting the federal income tax return in the United States, typically April 15, marks a significant date for taxpayers. In 2024, this date falls on a Monday, as April 15 is a weekend day. For taxpayers interested in an extension, the extended deadline is October 15, allowing additional time for preparation and submission. Additionally, estimated tax payments for self-employed individuals and corporations are due quarterly, with the first payment typically required by April 15. Various states also impose their own tax deadlines, which can vary significantly, underscoring the importance of being aware of local requirements. Missing these key dates can result in interest charges, penalties, and increased scrutiny from the Internal Revenue Service (IRS). Keeping organized and setting reminders for these important deadlines helps ensure timely compliance and peace of mind during tax season.

Required documents checklist

Income tax filing can be complex and requires careful attention to detail. A comprehensive checklist of required documents is essential to streamline the process. Gather W-2 forms (which report an employee's annual wages and the taxes withheld) from all employers for the tax year, 1099 forms (reflecting various types of income including freelance work or interest earned) if applicable, and any 1098 forms (for reporting mortgage interest) for itemized deductions. Keep records of other income sources, including rental property documents, along with receipts for deductible expenses such as medical bills, charity donations, and business expenses. Tax ID numbers (such as Social Security numbers for dependents) must also be available. Verify eligibility for credits by including documentation related to education expenses, health insurance, and childcare costs, thereby ensuring a complete and accurate filing.

Contact information for assistance

Individuals preparing for income tax filing often need clear guidance and assistance regarding the process. Organizations such as the Internal Revenue Service (IRS) provide resources, offering contact information for support. The IRS helpline (1-800-829-1040) is available for inquiries during business hours, assisting taxpayers with questions regarding forms and deductions. Additionally, many states have their own tax agencies, such as the California Department of Tax and Fee Administration, reachable at 1-800-400-7115. Local tax assistance centers, like those affiliated with Volunteer Income Tax Assistance (VITA) programs, provide free assistance, with locations across major cities, helping individuals navigate their tax responsibilities effectively.

Consequences of late filing

Late filing of income tax returns can incur significant consequences, including financial penalties and interest accrual. The Internal Revenue Service (IRS) imposes a fee of 5% of the unpaid tax amount per month, capped at 25%, escalating the overall tax liability. Additionally, interest racking up at an annual rate of approximately 3% (as of current market conditions) compounds the amount owed, further straining personal finances. Furthermore, taxpayers may face legal repercussions, such as audits, which can arise from discrepancies in reported income. Timeliness in filing not only averts these penalties but also facilitates potential refunds, crucial for effective financial planning. Individuals are urged to adhere to deadlines, typically April 15th for most taxpayers in the United States, to avoid adverse fiscal events.

Comments