Are you feeling overwhelmed by tax debt and unsure where to turn for help? You're not aloneâmany people find themselves in this situation, grappling with the burden of owing money to the IRS. Fortunately, there may be options available for tax debt forgiveness that could provide you with some much-needed relief. In this article, we'll explore the steps you can take to request tax debt forgiveness and help pave the way toward financial freedomâso keep reading!

Personal Information

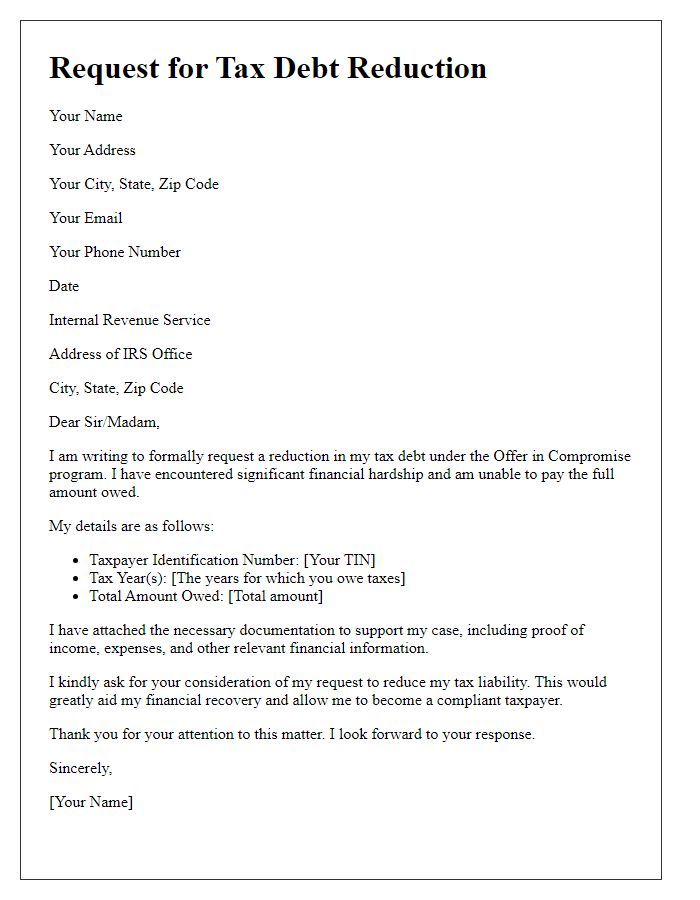

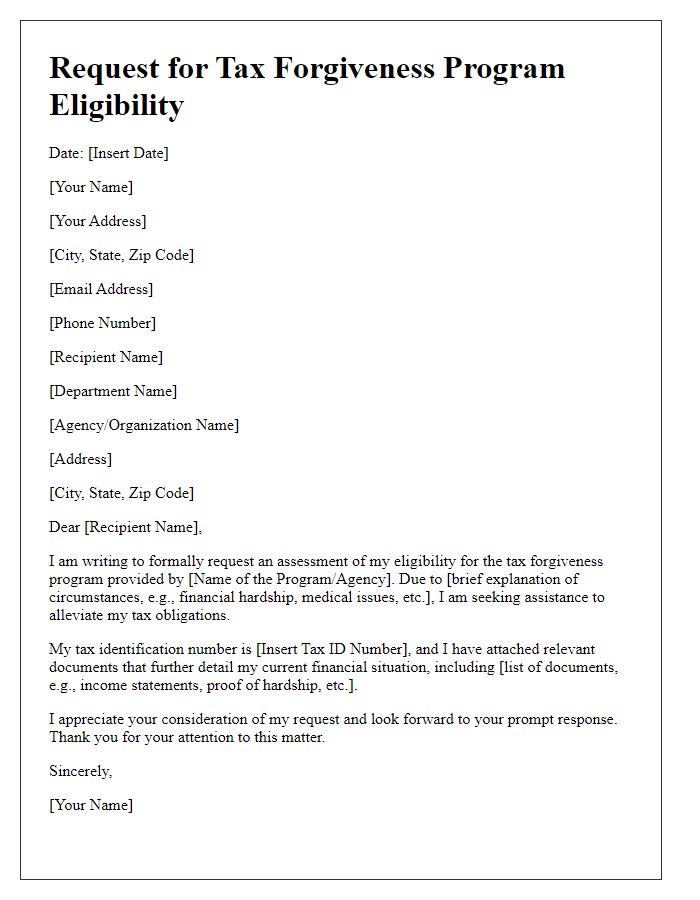

Submitting a request for tax debt forgiveness involves detailing personal information critical for processing. Essential details include full name, date of birth, Social Security number (to verify identity), address (including ZIP code), and contact number. Additionally, include relevant tax identification numbers such as Employer Identification Number (EIN) if applicable. It is important to specify the tax year(s) related to the request, along with information about the amount of debt owed, as well as any financial hardships experienced, such as job loss or medical expenses. This context aids in demonstrating the need for forgiveness under programs like the IRS Fresh Start Initiative or other relevant local tax assistance programs.

Reason for Debt Forgiveness Request

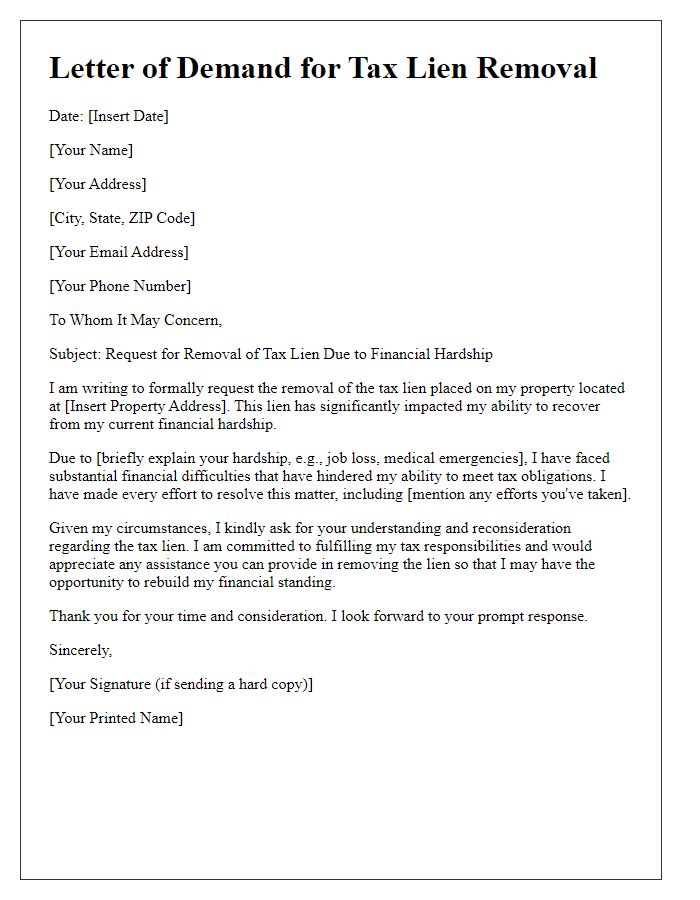

Tax debt forgiveness requests may arise due to financial hardships caused by circumstances such as job loss or medical emergencies. For example, an individual who experienced unemployment for over six months (from January to July 2023) might seek forgiveness for a tax debt amounting to $5,000 accrued during that period. Furthermore, unexpected medical expenses, like a $10,000 surgery in March 2023, can significantly impact a person's ability to meet their tax obligations. Highlighting these specific events and their financial implications paints a clearer picture of the taxpayer's situation, which may lead to a more favorable consideration of the request.

Financial Hardship Explanation

Financial hardship manifests when individuals face significant challenges meeting their essential living expenses due to unforeseen events such as job loss, medical emergencies, or economic downturns. A noteworthy example includes individuals in the United States, where over 10 million people reported unemployment during the 2020 COVID-19 pandemic, leading to widespread economic instability. Tax debt, often incurred when individuals struggle to maintain financial stability, can exacerbate this hardship. During this period, many Americans faced accumulated tax obligations, which led to increased anxiety and pressure, particularly for those living in states like California and New York, where the cost of living is considerably higher. The IRS provides considerations for tax debt forgiveness, allowing individuals to request relief based on their financial situation, thereby facilitating a path towards recovery and normalcy amidst overwhelming economic pressures.

Supporting Documentation

Tax debt forgiveness applications often require comprehensive supporting documentation to substantiate claims. Essential documents include a completed Form 656, which outlines the Offer in Compromise (OIC) request details. Recent income statements indicate financial status, such as pay stubs, Social Security benefits statements, or disability income records for the previous six months. Last year's tax returns provide valuable context regarding total income and any potential deductions. Detailed monthly expense statements, showcasing necessary household expenditures like rent, utilities, and food, help illustrate financial strain. Additional documentation such as bank statements (at least three months), proof of assets, and any relevant medical bills underline an inability to pay the debt. This thorough collection of evidence aids in presenting a compelling case for tax debt forgiveness under IRS guidelines.

Clear Call to Action

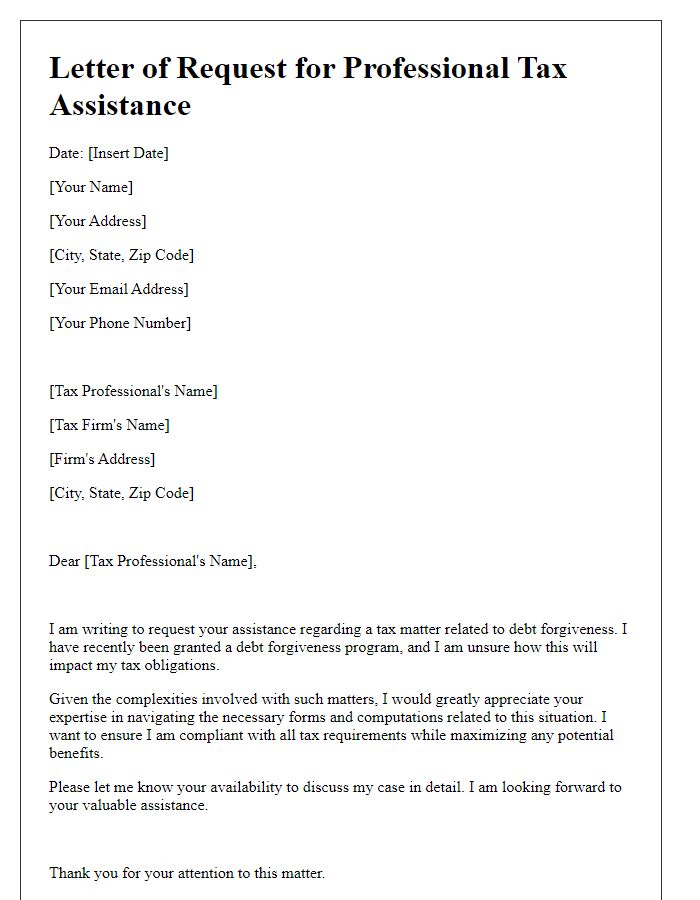

Tax debt forgiveness programs provide individuals relief from financial burden, especially for those affected by economic hardships. The Internal Revenue Service (IRS) offers options such as Offer in Compromise, allowing eligible taxpayers to settle their tax liabilities for less than the total amount owed. To initiate the process, individuals must complete Form 656, demonstrating their financial situation through Form 433-A or 433-B. Additionally, many states have their relief programs aimed at reducing unpaid taxes for residents facing severe financial distress. Seeking the assistance of a tax professional can enhance the likelihood of approval and ensure that all necessary documents are accurately submitted to the appropriate agency.

Comments