Are you a farmer looking to lighten your tax burden? Navigating agricultural tax deductions can often feel overwhelming, but with the right information and resources, you can make the most of your situation. Understanding the specific requirements and benefits of agricultural tax deductions can empower you to maximize your savings. Dive into our detailed article to discover how to apply for these deductions effectively and ensure you're not missing outâlet's get started!

Applicant Information

The agricultural tax deduction application process requires detailed applicant information to verify eligibility for beneficial tax treatment. Key details include the applicant's full name, which provides personal identification, alongside the physical address of the farm or property located within designated agricultural zones. Additionally, accurate contact information, such as a phone number and email address, ensures communication between the tax authority and the applicant. Documenting the farm's operating structure, whether family-owned or corporate, outlines legal status and tax responsibilities. Lastly, the application must specify the type of agricultural production undertaken, whether crop cultivation or livestock farming, to validate claims for specific deductions under the tax code.

Purpose of Application

The agricultural tax deduction application serves the purpose of allowing farmers and agricultural businesses to request a reduction in property taxes based on land-use practices and contributions to agricultural production. This application highlights the importance of sustainable practices, such as crop rotation and soil health management, which enhance productivity and environmental stewardship. Specific details, including the type of crops cultivated, the acreage utilized (ranging from small plots to extensive farms exceeding 1,000 acres), and the revenue generated, are critical for determining eligibility. By submitting this application, farmers can claim tax benefits that directly impact their operational costs, thereby fostering the growth of local economies and ensuring food security within their communities.

Description of Agricultural Activities

Agricultural activities encompass a range of functions essential for cultivating crops and raising livestock, significantly contributing to local economies. Examples include planting, harvesting, and maintaining crops such as corn (Zea mays) and soybeans (Glycine max) on large tracts of farmland, often exceeding 100 acres. Livestock operations may involve raising cattle (Bos taurus) or poultry (Gallus gallus domesticus), with annual production numbers reaching thousands. Implementation of sustainable practices, such as crop rotation and integrated pest management, enhances soil health and productivity. The use of agricultural machinery, including tractors and plows, is vital in these processes, often supported by federal and state incentives. Such activities not only provide food and resources but also ensure compliance with agricultural regulations and tax requirements for deductions.

Financial Details and Records

Agricultural tax deduction applications require detailed financial records to support eligibility. Taxpayers must present annual revenue statements, including all income from farming operations within a fiscal year, accurately reflecting gross earnings. Expense documentation should provide itemized accounts for agricultural inputs like seeds, fertilizers, and machinery maintenance, totaling an annual expenditure amount. The farm's inventory records, detailing collected crops and livestock numbers, play a crucial role in establishing eligible deductions. Additionally, financial statements should include depreciation schedules for equipment and property, demonstrating long-term asset values and enhancements. All documents must be organized chronologically and maintained for five years in accordance with IRS guidelines, ensuring transparency and compliance during audits.

Compliance with Tax Regulations

Applying for an agricultural tax deduction requires strict compliance with tax regulations set forth by governing bodies such as the Internal Revenue Service (IRS) in the United States. Farmers and landowners must provide detailed documentation, including the revenue generated from crop sales or livestock production within the taxable year. Necessary forms such as Schedule F (Profit or Loss from Farming) must be accurately completed and submitted. Supporting documents, including receipts, bank statements, and records of expenses related to farming operations, are crucial to verify eligibility. Furthermore, understanding specific regulations regarding conservation easements and soil preservation efforts can enhance possible deductions. Local tax authorities may have particular guidelines affecting claims related to equipment depreciation and land-use assessments, which must be carefully reviewed to ensure compliance and maximize potential tax benefits.

Letter Template For Agricultural Tax Deduction Application Samples

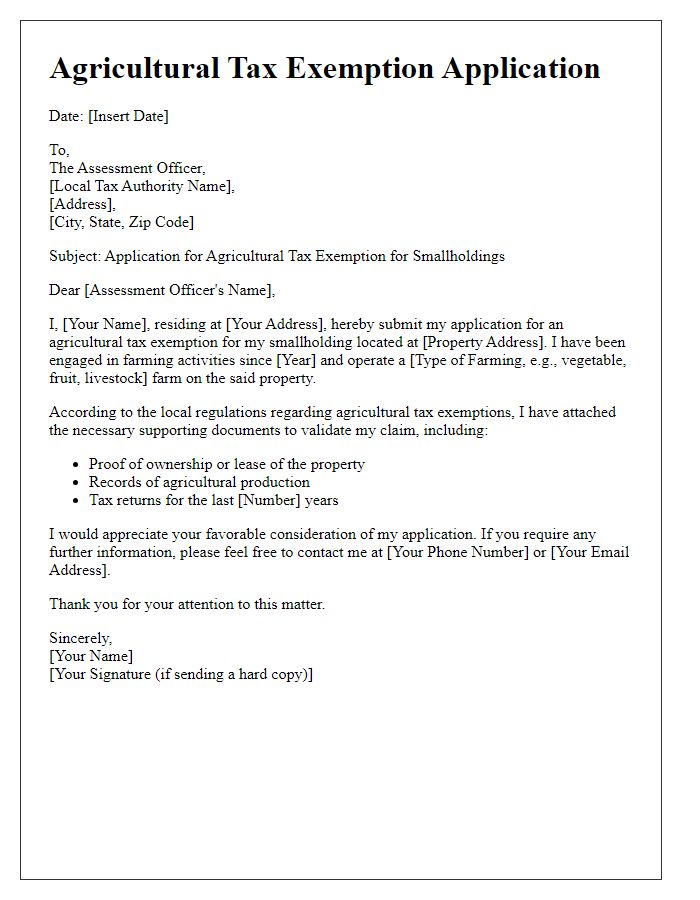

Letter template of agricultural tax exemption application for smallholdings

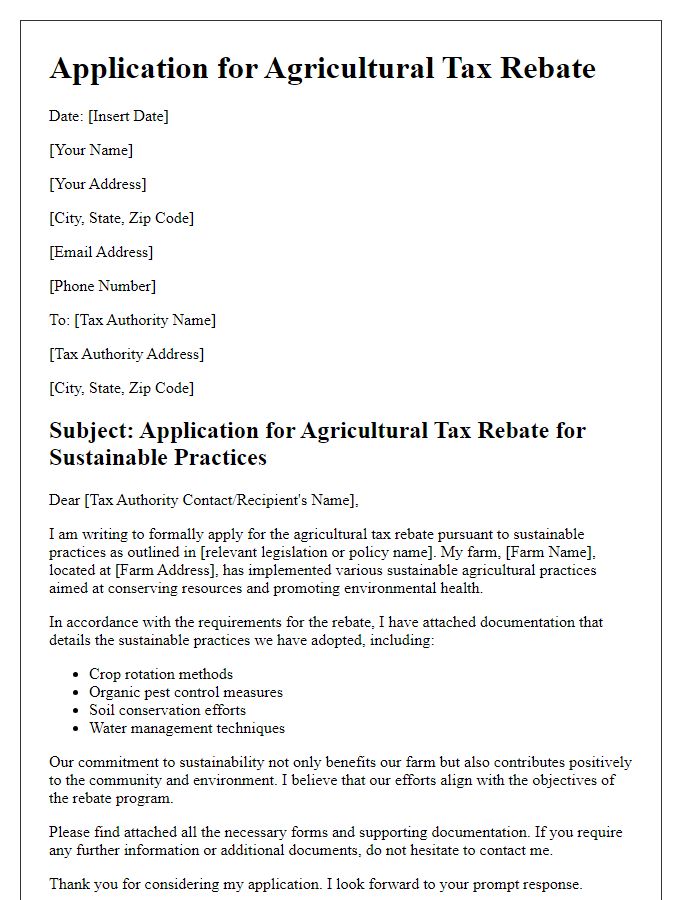

Letter template of agricultural tax rebate application for sustainable practices

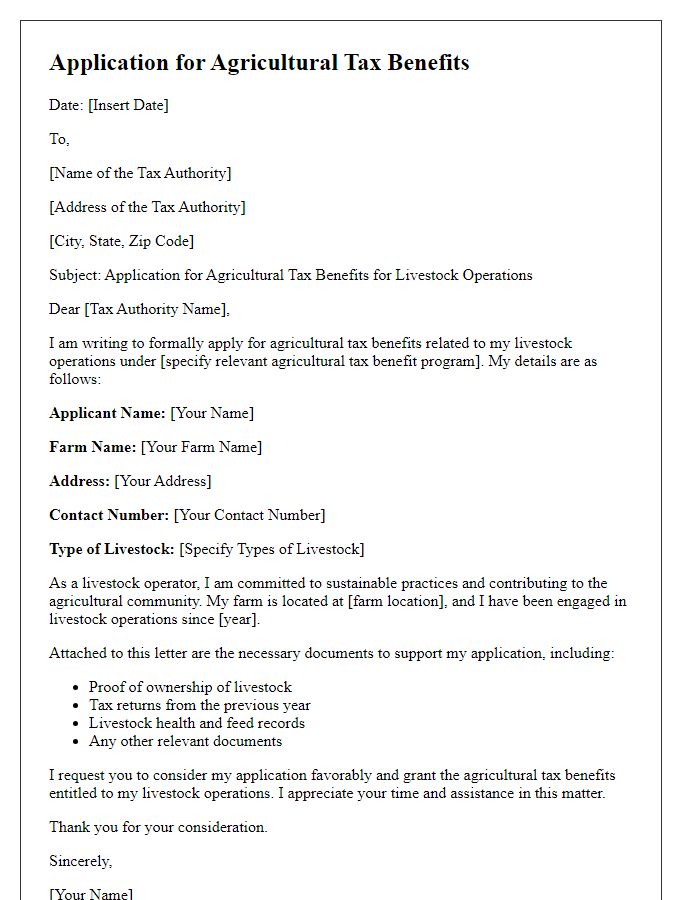

Letter template of agricultural tax benefit application for livestock operations

Letter template of agricultural tax waiver request for seasonal challenges

Comments