Are you feeling a bit confused about how to revise your tax withholding? You're not alone! Many people encounter the need to adjust their tax withholdings due to changes in income or personal circumstances. If you're ready to take charge of your finances, keep reading to discover some helpful tips and a simple template to get started!

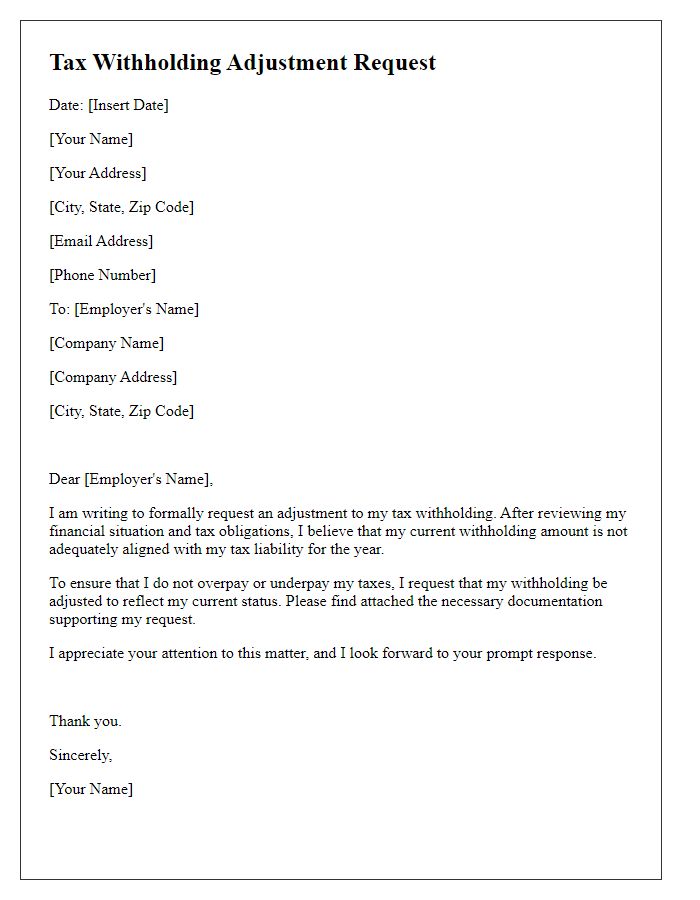

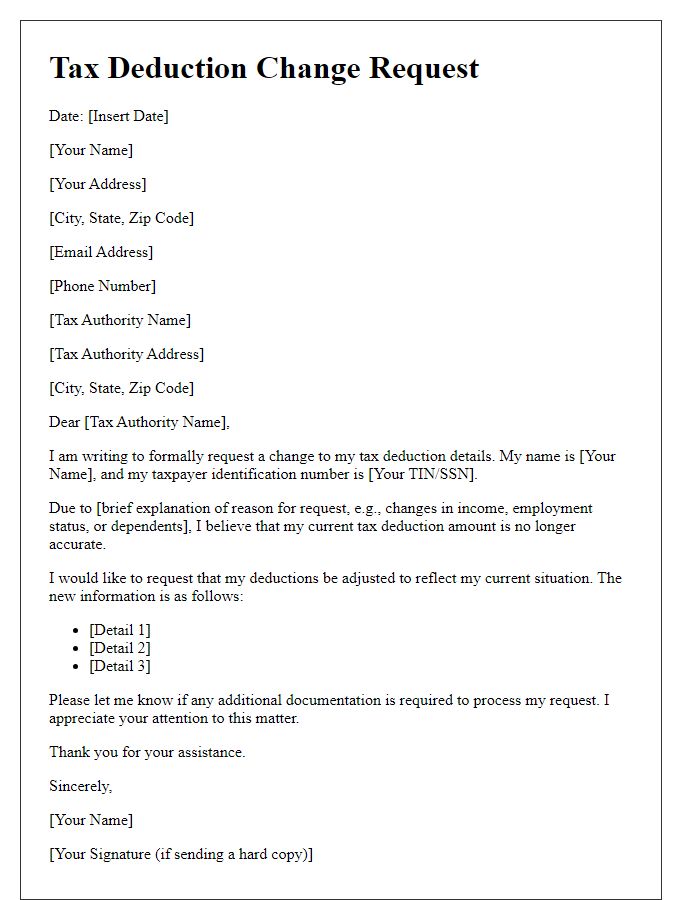

Accurate identification of taxpayer and employer information

Accurate identification of the taxpayer and employer information is crucial in the process of revising tax withholding requests for individuals, such as employees of a corporation like Acme Corp. Essential details include the taxpayer's Social Security Number (SSN), which is a unique identifier issued by the Social Security Administration, and the employer's Employer Identification Number (EIN), a nine-digit number assigned by the Internal Revenue Service (IRS). Additionally, the employee's name must match the name associated with the SSN to avoid issues during processing. Date of birth, address, and filing status (such as single, married, or head of household) are also critical components that play a significant role in determining the appropriate withholding amount. Obtaining accurate information ensures compliance with federal tax regulations while optimizing the taxpayer's paycheck.

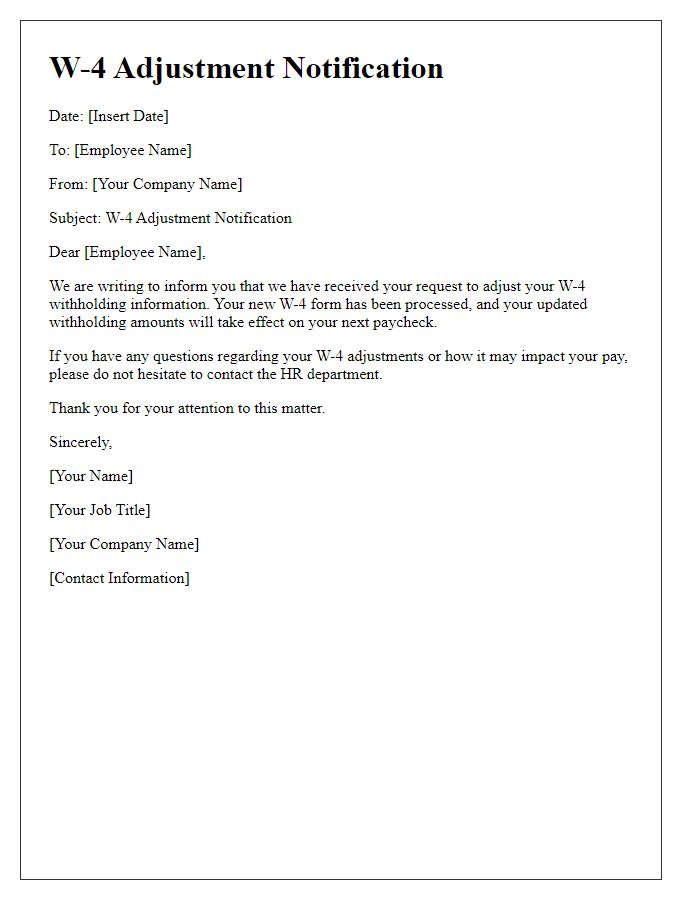

Clear explanation of the reason for revision

Tax withholding adjustments become necessary when a change in personal circumstances occurs, impacting the amount withheld from an individual's paycheck. For example, events such as marriage, divorce, or the birth of a child can alter family size and tax filing status, which significantly affects tax liabilities. Additionally, fluctuations in income or eligibility for tax credits, like the Earned Income Tax Credit, may require updated withholding preferences. Submitting a revised W-4 form (Employee's Withholding Certificate) to the employer ensures that the correct amount of federal income tax is withheld, preventing potential underpayment or overpayment at tax time. Understanding these factors allows for more accurate tax planning and compliance with IRS guidelines.

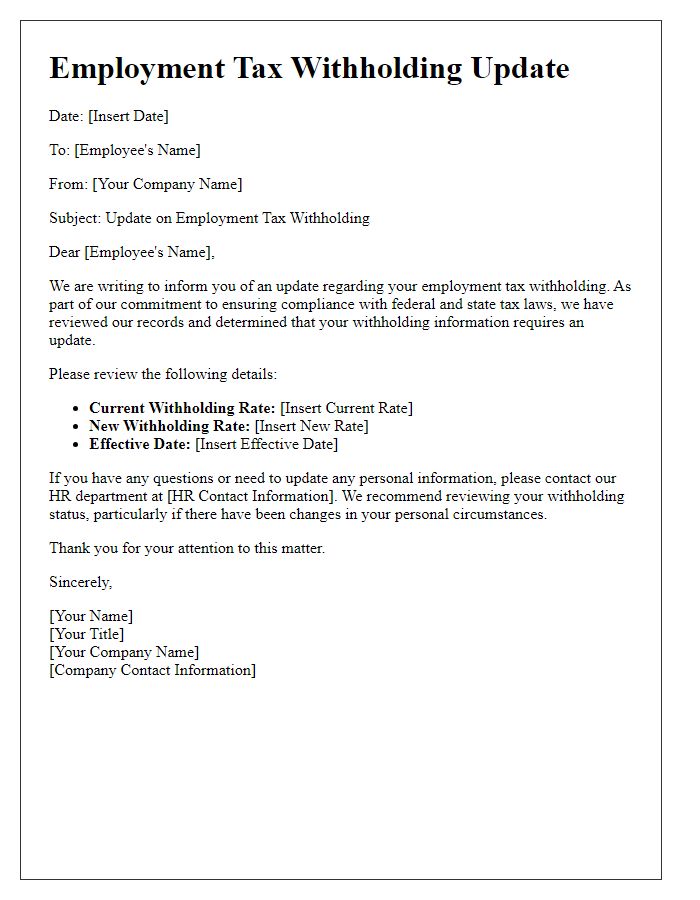

Reference to previous withholding details or documents

Tax withholding adjustments are essential for accurate payroll processing, particularly for employees adjusting their federal and state tax rates. Documents such as W-4 forms, which provide personal information and filing status (single or married), directly influence the withholding amounts. The IRS guidelines, updated annually, mandate specific withholding calculations based on the employee's income bracket and exemptions claimed. Additionally, local tax authorities may have varying requirements that must align with federal guidelines to avoid underpayment penalties. Any discrepancies in withholding can affect the employee's financial situation significantly, especially during tax season when accurate calculations are critical for final tax returns.

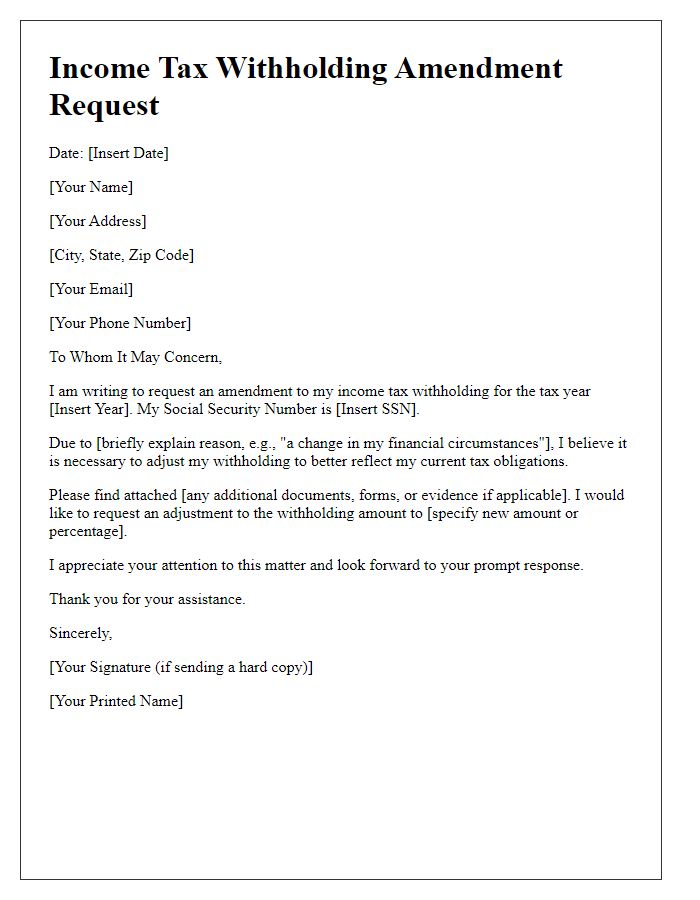

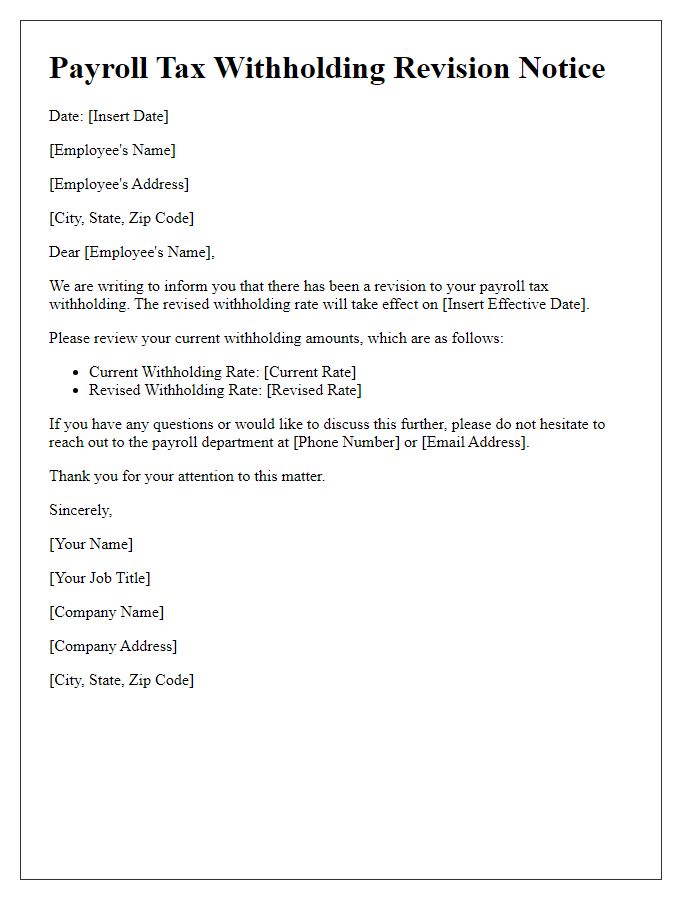

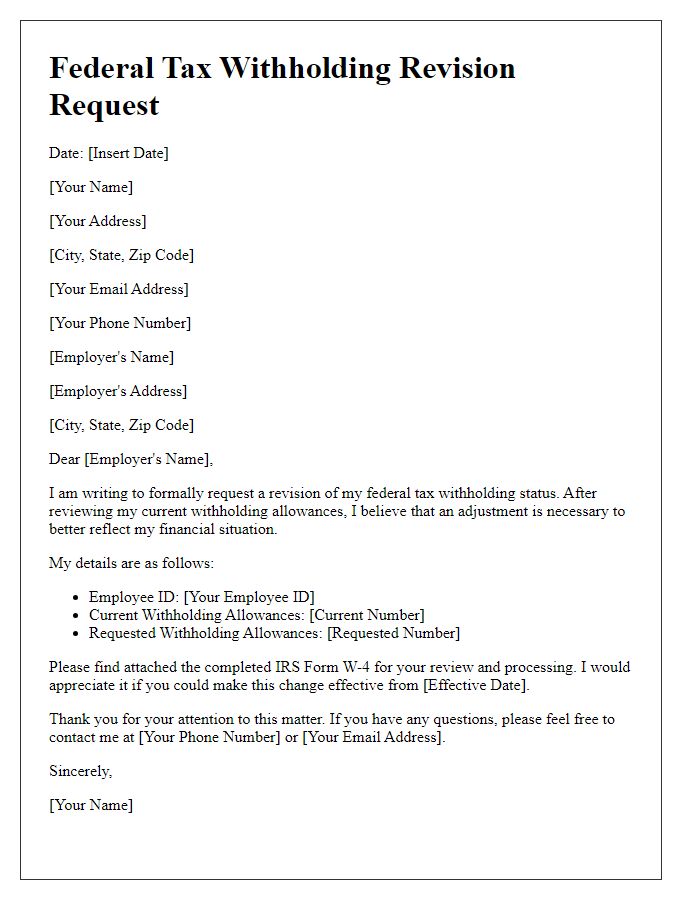

Specific requested changes in withholding amounts

The revision of tax withholding requests should include precise adjustments to the withholding amounts based on federal guidelines. Taxpayers often need to modify withholding due to changes in personal circumstances, such as marriage, divorce, or the birth of a child. Current federal withholding tables published by the Internal Revenue Service (IRS) reflect the necessary calculations that account for expected income levels and deductions. Specific instructions on Form W-4 guide taxpayers on adjustments to withholding allowances; for instance, increasing the number of allowances could reduce withholding amounts. Additionally, individuals might specify additional dollar amounts to be withheld if anticipating owing a large sum in tax; this is often advisable for those with significant non-wage income sources, like dividends or rental income. It is crucial to review any changes in state tax withholding requirements, as they can vary significantly by state, impacting overall tax obligations. Clear, detailed documentation submitted to the employer will ensure that withholding reflects the updated financial situation accurately.

Compliance with tax regulations and form requirements

Tax withholding requests are essential for ensuring compliance with federal and state tax regulations. Accurate submission of IRS Form W-4 is necessary for determining appropriate withholding allowances based on individual income levels and filing statuses. For example, taxpayers may claim allowances for dependents, such as children under the age of 17, thereby reducing the amount withheld from wages, which is beneficial during tax season. Employers, under guidelines from the IRS, are obligated to implement these withholding requests and report the amounts on Form W-2 at the end of the fiscal year. Clear understanding keeps both employees and employers aligned with the latest tax form requirements and minimizes future liabilities or penalties.

Comments