Are you feeling the weight of an unexpected tax penalty? Many individuals find themselves in this frustrating situation, but there's good news: you might be eligible for a tax penalty abatement. Understanding the process can make all the difference in easing that burden. Let's dive into how you can effectively craft a letter to request a tax penalty abatement and give yourself some financial relief.

Clear Explanation of Reason for Request

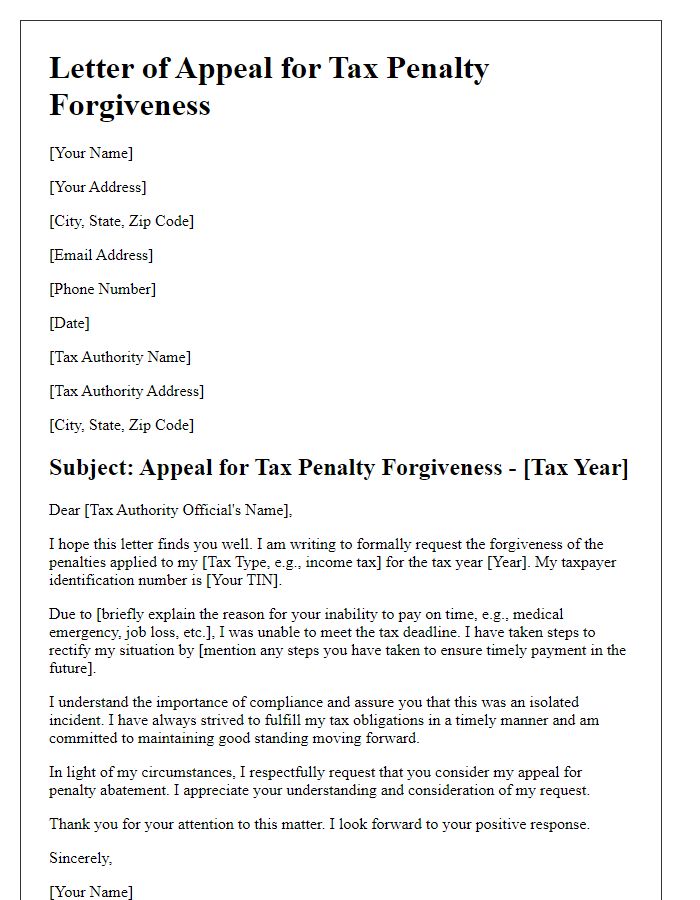

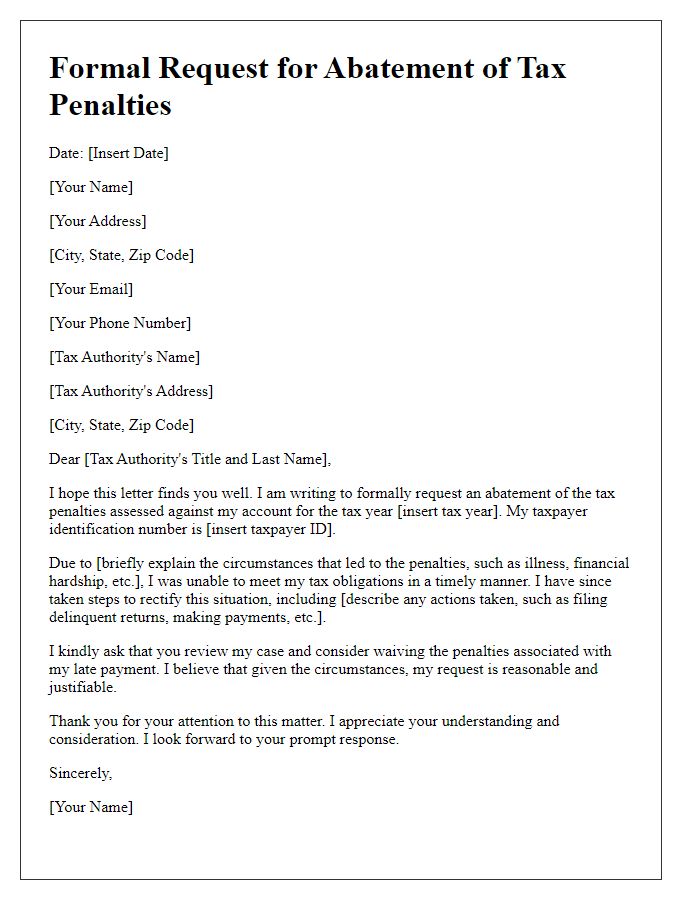

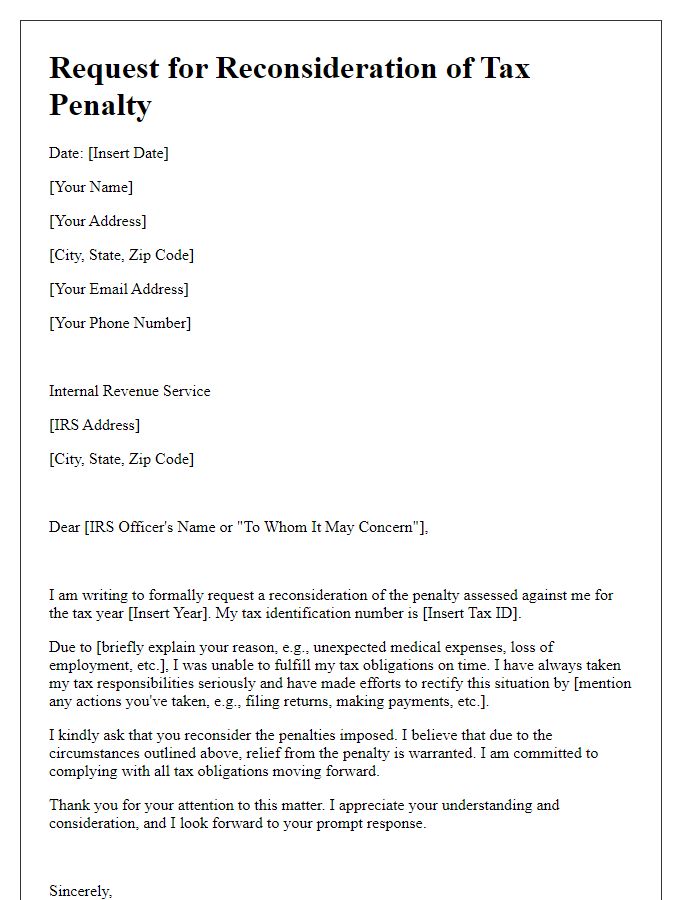

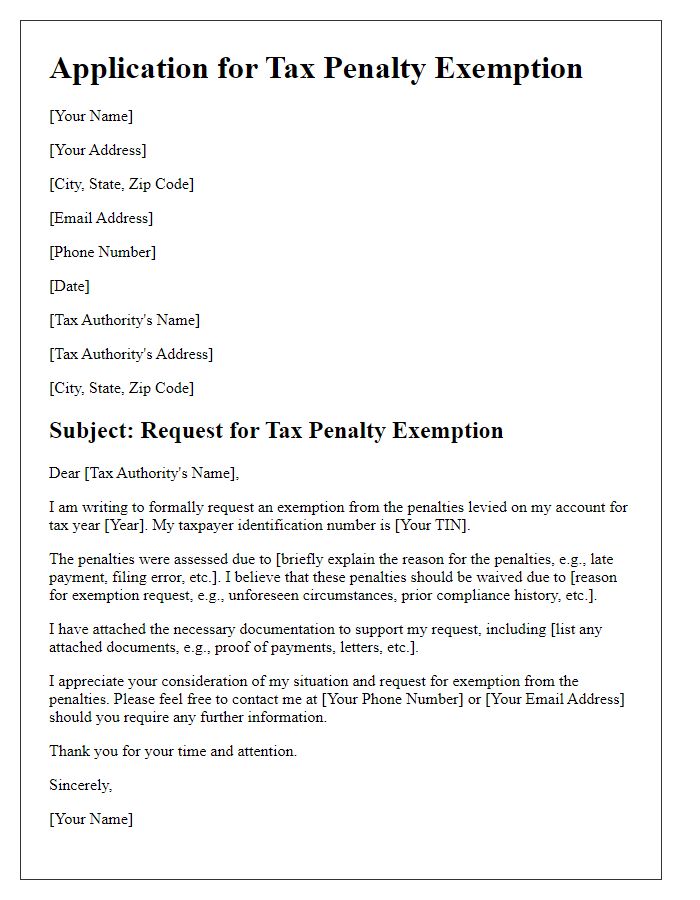

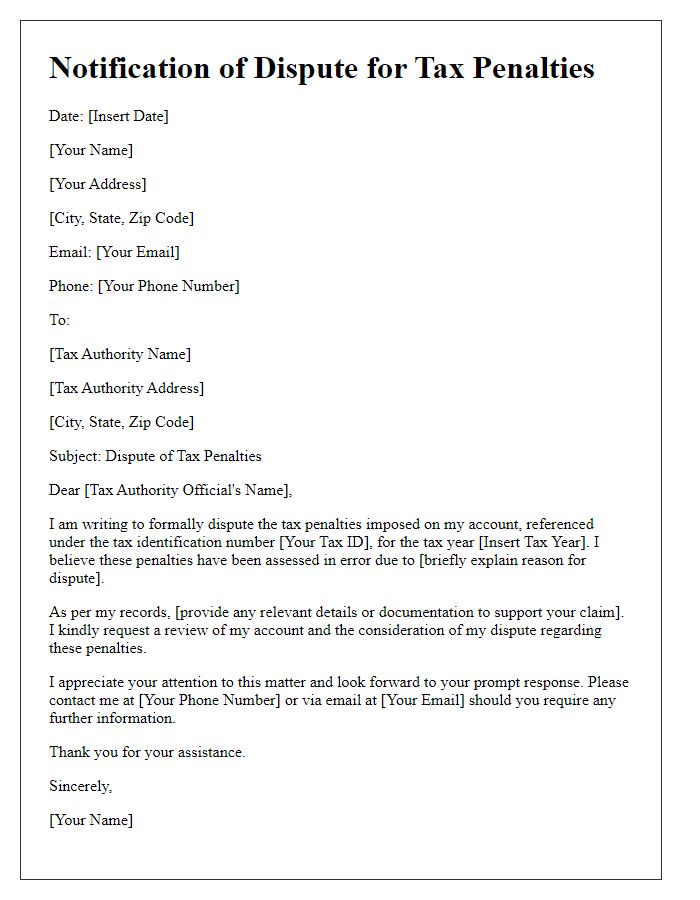

Tax penalties can incur significant stress for individuals and businesses alike, often resulting from unfortunate circumstances such as unexpected financial hardship or errors in tax preparation. The Internal Revenue Service (IRS) may consider requests for penalty abatements, especially in situations where taxpayers demonstrate reasonable cause based on their unique scenarios. For instance, natural disasters like Hurricane Katrina in 2005 or severe illness impacting the ability to file on time can be valid grounds for requests. Taxpayers must provide comprehensive documentation, such as medical records or Federal Emergency Management Agency (FEMA) assistance letters, to support claims. Addressing the timing and context of the circumstances can further strengthen a penalty abatement request. For example, clearly illustrating a timeline of events leading to the tax compliance issue bolsters the argument for relief and demonstrates the taxpayer's commitment to rectifying the situation. Furthermore, illustrating a history of compliance can provide evidence of good faith efforts to adhere to tax obligations, a critical aspect the IRS assesses in abatement considerations.

Documentation of Circumstances

The tax penalty abatement request requires detailed documentation of circumstances that led to the penalty, specifically focusing on hardship and extraordinary circumstances. Taxpayers must gather relevant information such as Notices of Tax Due from the Internal Revenue Service (IRS) detailing penalties incurred, proof of unexpected medical expenses (e.g., hospital bills exceeding $10,000) that hindered timely tax payment, and employment termination letters, documenting loss of income. Additional evidence may include documentation of natural disasters impacting property (e.g., Hurricane Katrina in 2005) or family emergencies that exacerbated financial difficulties. Clear timelines of events, financial statements demonstrating income fluctuations, and consistent records of previous tax compliance further strengthen the request. This comprehensive approach not only illustrates the taxpayer's intent to comply in the past but also underscores the unavoidable nature of the circumstances faced.

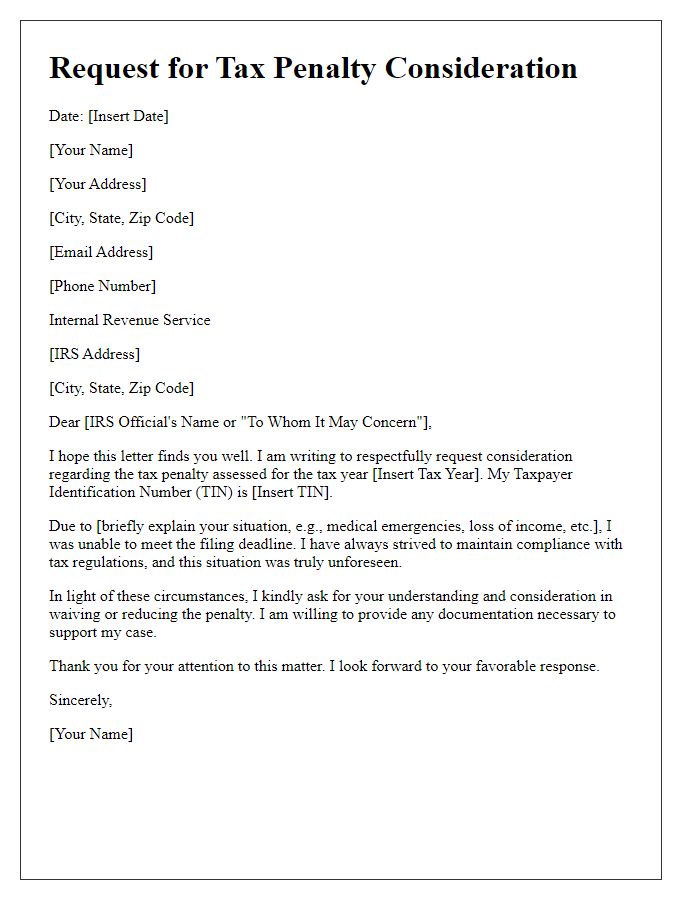

Evidence of Compliance History

Tax penalty abatement requests often revolve around a taxpayer's compliance history with the IRS. Documenting a consistent record of timely payments and filings is essential in such requests. For instance, a taxpayer with a clean record over the last five years, who has consistently submitted Form 1040 (the individual income tax return) and made quarterly estimated tax payments, can bolster their case for penalty relief. The IRS considers evidence such as confirmation of payment dates, copies of filed returns, and records of communication with tax authorities. Demonstrating that previous penalties were successfully abated due to a valid reason, such as medical emergencies or natural disasters, adds further weight to the request. A strong compliance history indicates a commitment to fulfilling tax obligations, potentially swaying IRS officials in favor of leniency during penalty assessments.

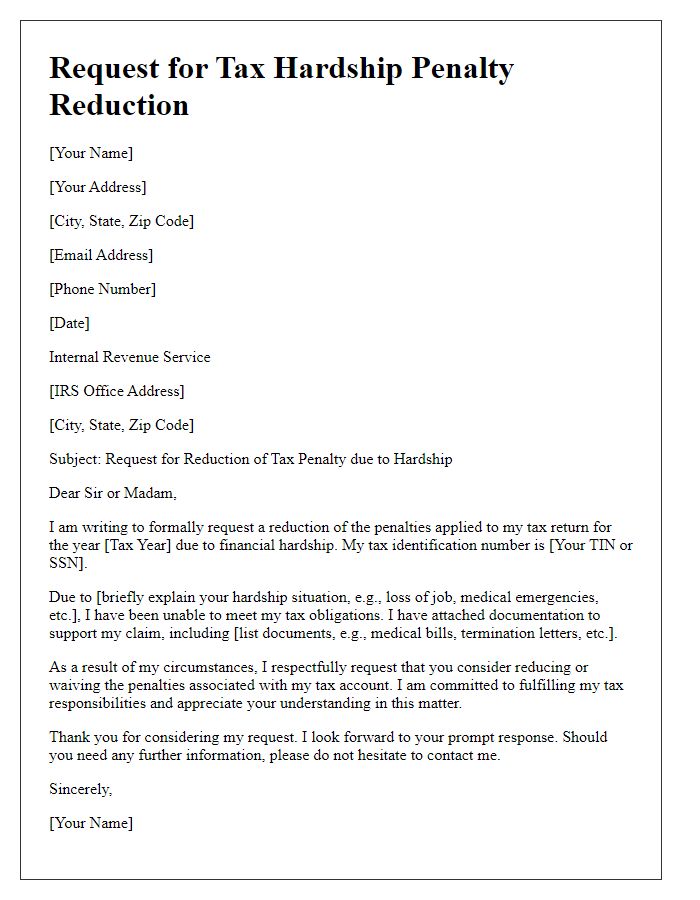

Demonstration of Corrective Actions Taken

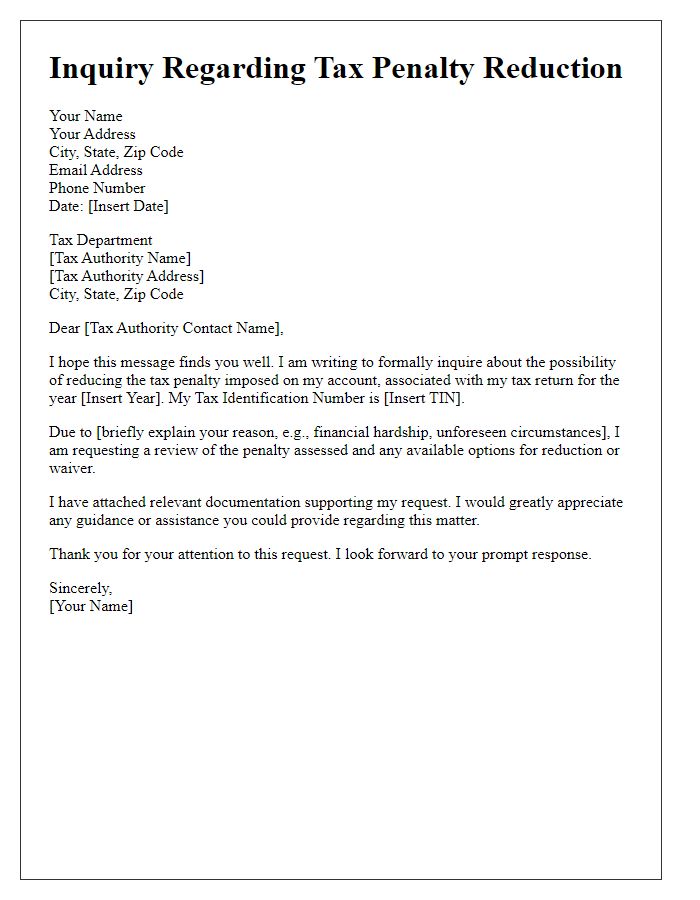

Tax penalty abatement requests often center on the demonstration of corrective actions taken by taxpayers. For example, taxpayers can provide evidence of timely tax payment systems implemented or voluntary disclosures made regarding prior discrepancies. Entities, such as small businesses or individuals, can showcase changes in accounting practices or software upgrades to improve compliance. Additionally, documentation of employee training sessions on tax obligations or consultations with tax professionals demonstrates a proactive approach to preventing future issues. Taxpayers can also detail any financial hardships, such as unexpected medical expenses or job loss, that contributed to previous penalties while highlighting the steps taken to remedy the situation. This comprehensive view of corrective actions can be pivotal in persuading tax authorities for penalty relief.

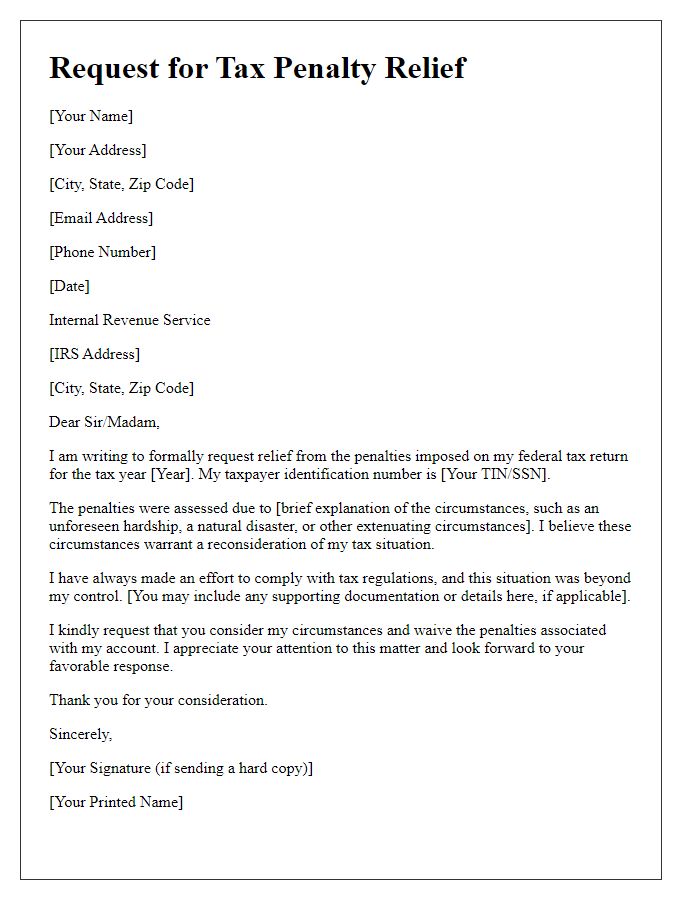

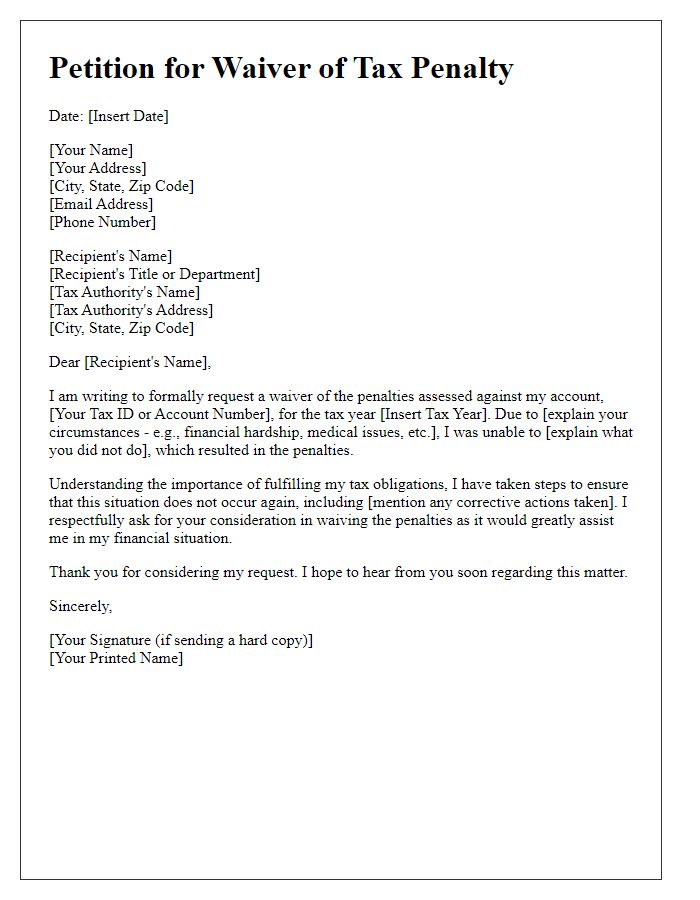

Professional and Respectful Tone

Increased tax liabilities can cause significant stress for individuals and businesses alike, particularly when penalties have been imposed by the Internal Revenue Service (IRS). Tax penalties, like failure-to-file or failure-to-pay fees, can accumulate rapidly, often reaching hundreds or thousands of dollars. Many taxpayers, especially in states such as California or New York, seek tax penalty abatement to reduce or eliminate these charges. This process typically requires a formal written request detailing circumstances leading to the penalties, which may include emergencies such as natural disasters or personal hardships, along with supporting documentation. Understanding IRS guidelines and invoking reasonable cause criteria can enhance the chances of successful abatement. Tax professionals often advocate for taxpayers, ensuring compliance with legal requirements while navigating the complexities of tax codes.

Comments