Are you navigating the often complex world of adoption tax credits? Understanding how to secure and maximize these benefits can make a significant difference in your financial journey as an adoptive parent. In this article, we'll break down the essential steps and important details you need to know about the adoption tax credit confirmation process. So, grab a cup of coffee and let's dive deeper into this invaluable resource for your family's growth!

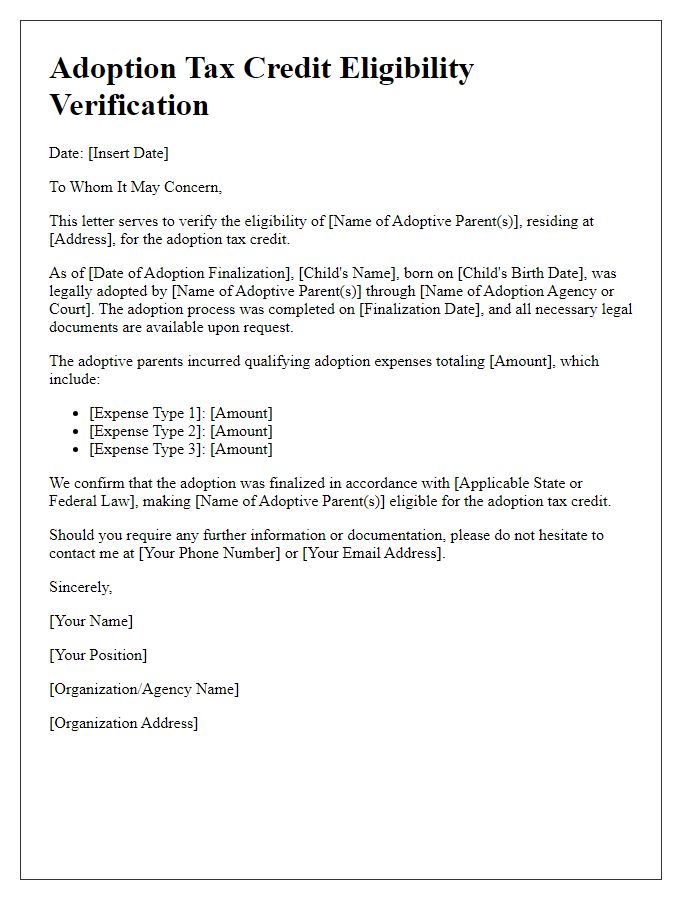

Applicant's personal information

The adoption tax credit confirmation is essential for applicants undergoing the legal process of adopting a child. This credit can alleviate some of the financial burdens associated with adoption expenses, which can average between $20,000 to $50,000 in the United States. Personal information of the applicant, including full name, Social Security number, and current address, must be accurately provided for verification purposes. Furthermore, the adoption agency's identification number and the child's name along with date of birth are crucial components of this documentation. Timely submission is critical for reimbursement claims, especially considering the annual tax filing deadline of April 15.

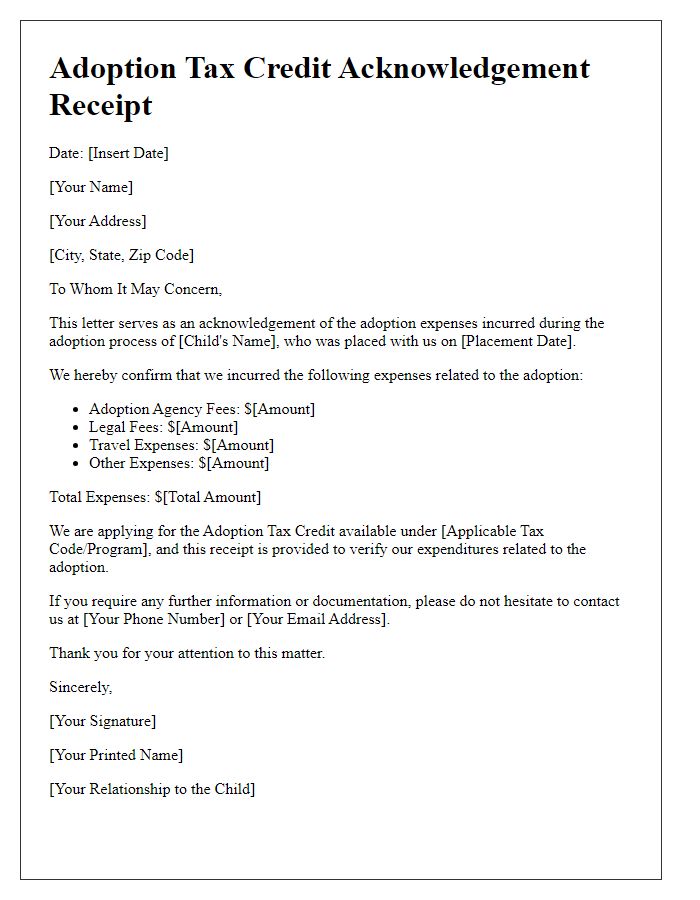

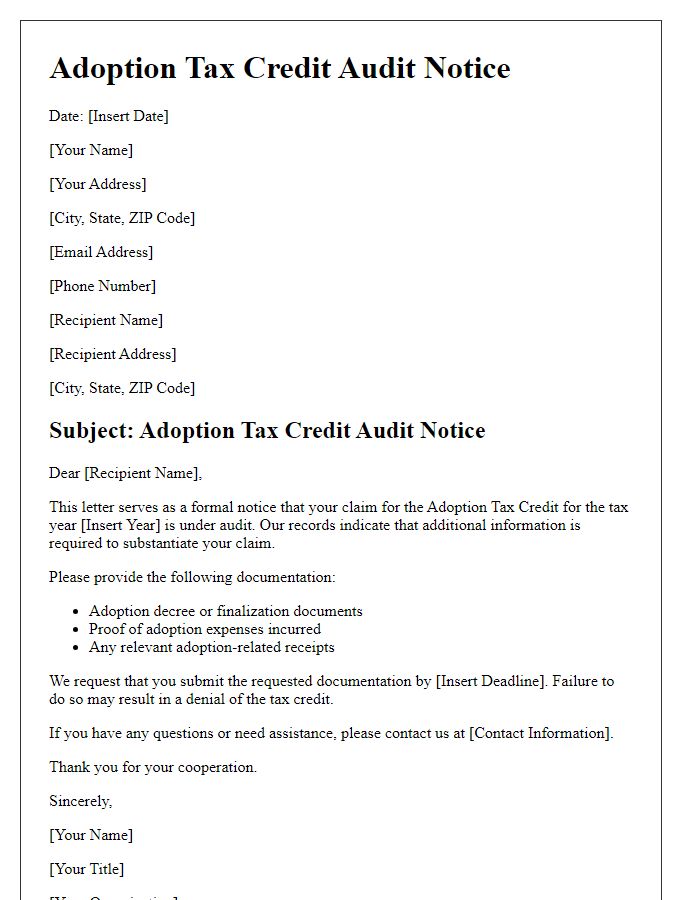

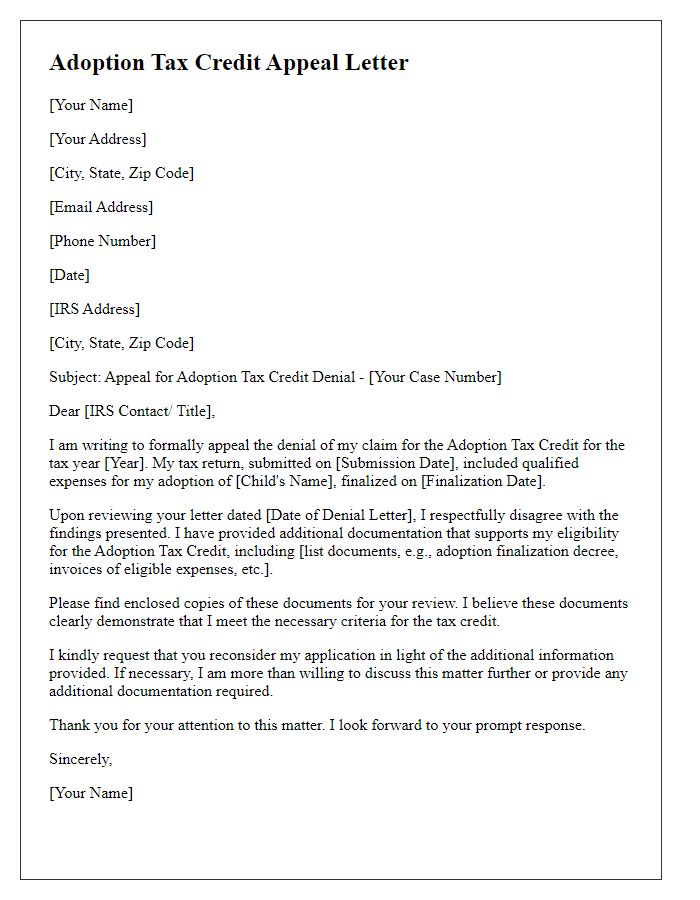

Adoption details and official documents

The adoption tax credit confirmation involves critical information, such as adoption finalization dates, eligible expenses incurred, and the specific adoption agency details. This credit, applicable to families adopting children in the United States, can cover qualifying costs up to $14,440 per child as of 2021, impacting financial planning significantly. Essential documentation includes the finalized adoption decree from the family court, receipts for adoption-related expenses like legal fees and travel, and official letters from the adoption agency, which must be recognized under state regulations. Accurate records ensure eligibility during tax filing, aligning with IRS guidelines for tax credits and deductions for adoptive parents.

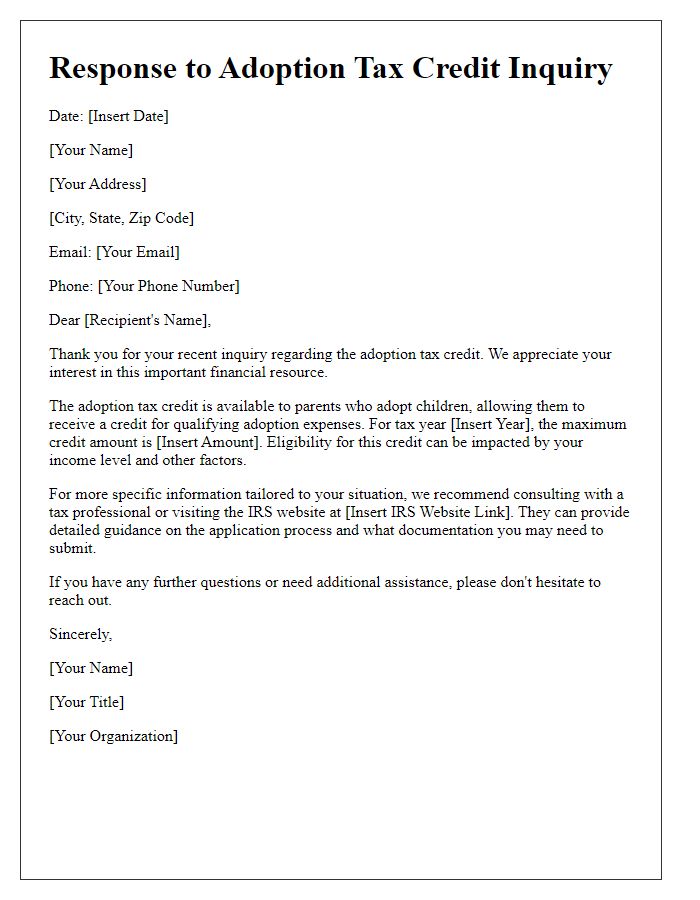

Tax credit eligibility criteria

The adoption tax credit provides financial relief to families adopting children, specifically for eligible taxpayers based on criteria established by the Internal Revenue Service (IRS). The maximum credit amount typically varies annually, with 2023 offering up to $15,950 per eligible child. Qualifying expenses include adoption fees, court costs, and attorney fees incurred during the adoption process, particularly for children with special needs or those adopted from foster care. Taxpayers must ensure they meet eligibility requirements, such as modified adjusted gross income limits set at $239,000 for full credit, while a gradual phase-out occurs for higher incomes. Essential documentation, including Form 8839, is required to substantiate claims for these credits, ensuring the adoption process remains financially feasible for deserving families.

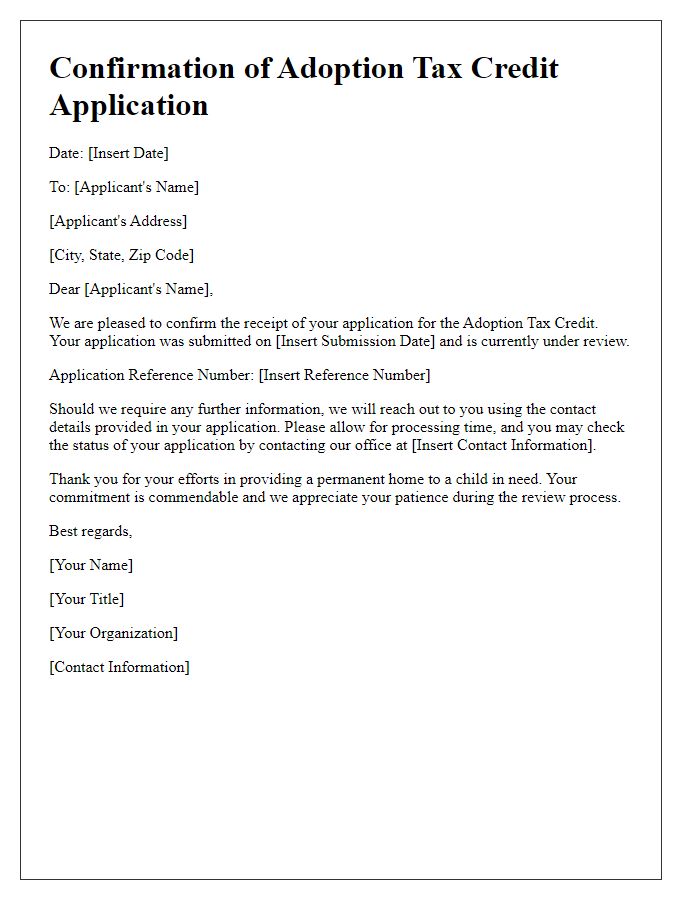

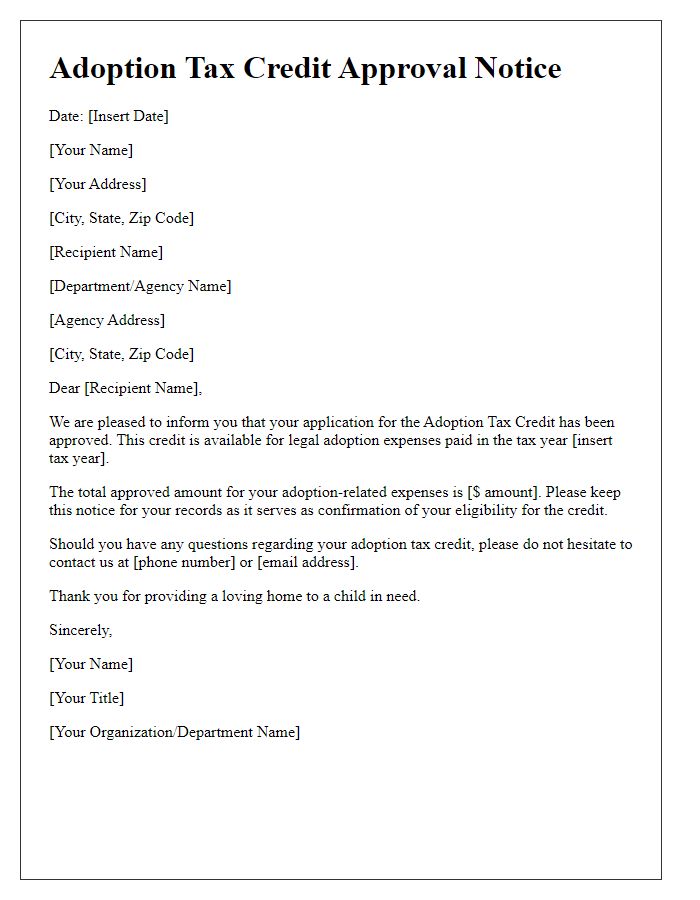

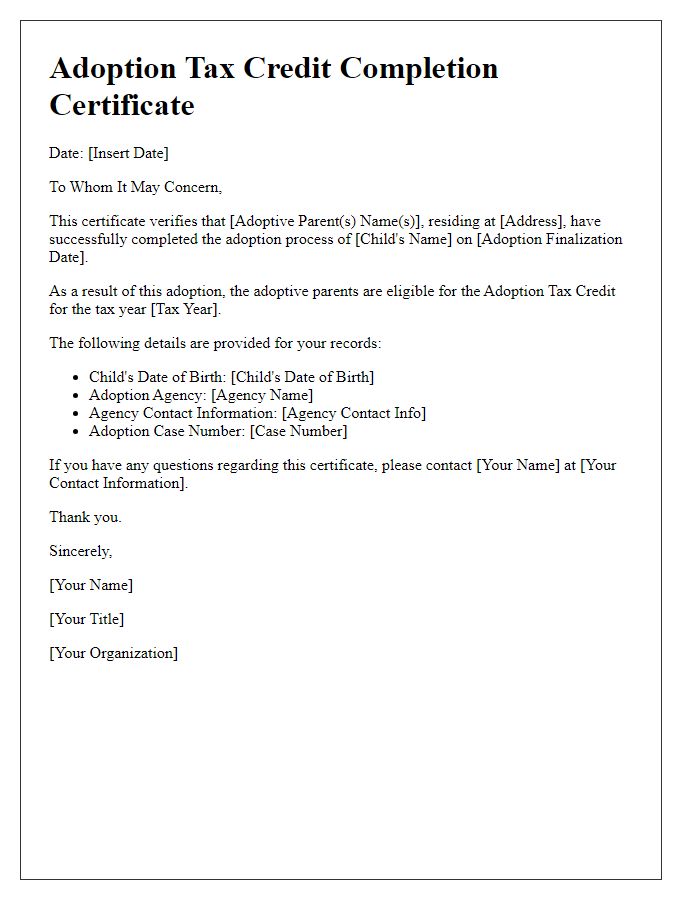

Confirmation and approval statement

The adoption tax credit is a valuable financial benefit for families who have welcomed children into their homes through adoption. In 2023, eligible adoptive parents may receive a tax credit amounting to $15,950 per child for qualified adoption expenses. The families must file the appropriate IRS forms, specifically Form 8839, to claim the credit and ensure they provide documentation of the adoption process from authorized agencies or legal entities. Approval from the IRS is typically issued within a few weeks after submission, confirming the eligibility and amount of the credit. Maintaining accurate records of all related expenses, including legal fees and travel costs associated with the adoption, is essential for maximizing this financial support.

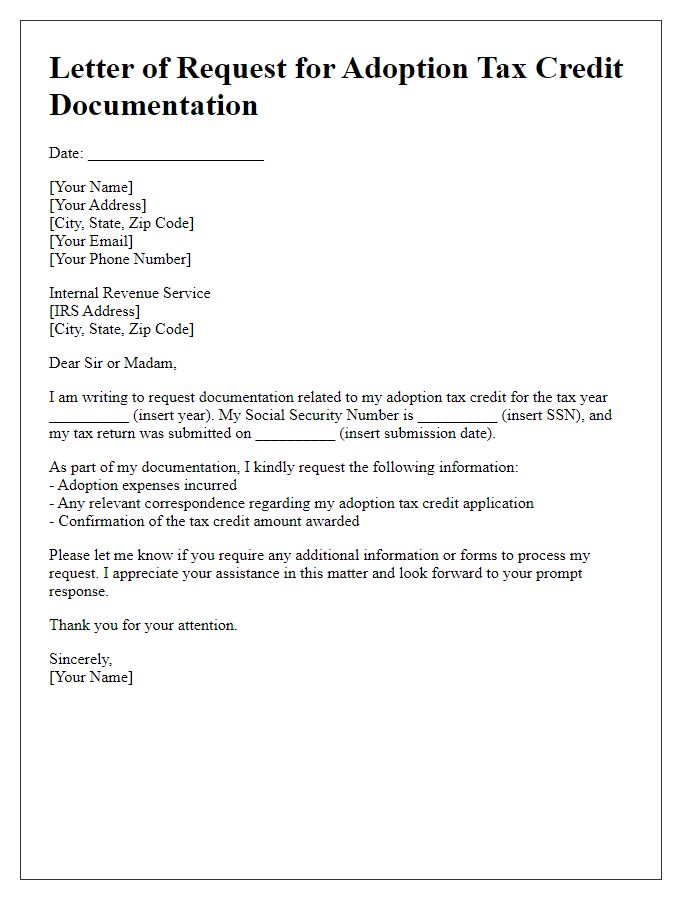

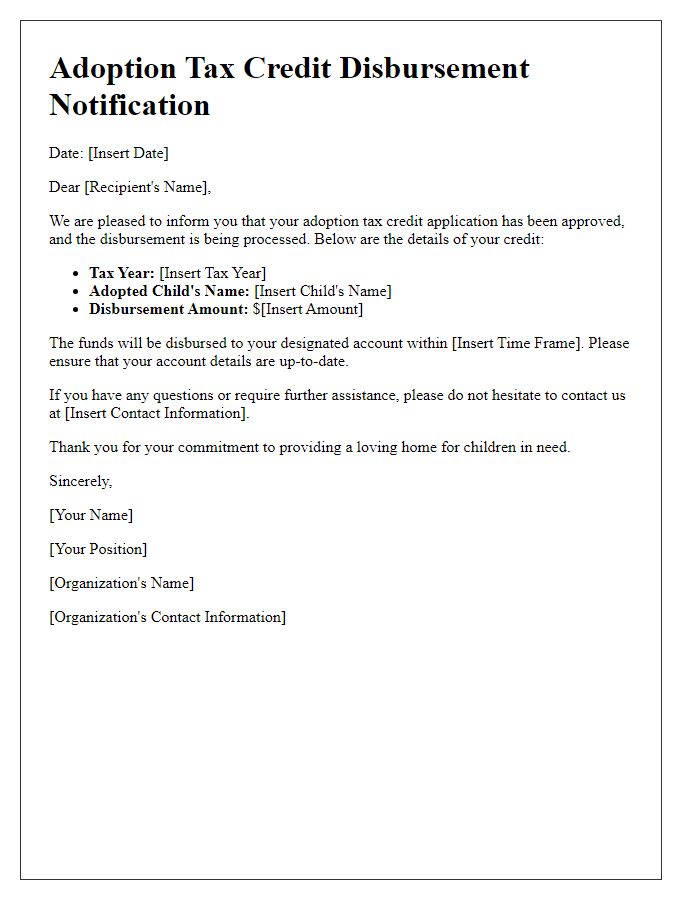

Contact information for further inquiries

The adoption tax credit confirmation provides essential financial support for families welcoming a child through adoption, helping with expenses incurred during the process. This federal tax benefit can offer credits up to $14,440 per child (as of 2021), significantly alleviating the financial burden associated with adoption procedures. Families interested in obtaining confirmation of their eligibility or seeking guidance on the necessary documentation should consider reaching out to the Internal Revenue Service (IRS), the official U.S. tax authority, through their website or helpline. Local adoption agencies and financial advisors specializing in tax credits may also provide valuable resources and assistance to navigate the complexities of the adoption tax credit.

Comments