Are you seeking to maximize your capital investment tax credits? Understanding the nuances of the approval process can significantly boost your financial benefits. In this article, we'll explore the essential steps and strategies to ensure your application stands out. Join us as we delve into the details and uncover tips that could help you secure those valuable credits!

Legal compliance and eligibility criteria

The capital investment tax credit (CITC) approval process necessitates thorough legal compliance and adherence to specific eligibility criteria. Entities seeking this tax credit must ensure their investments align with regulatory frameworks defined by the Internal Revenue Service (IRS) under Section 48 of the Internal Revenue Code, applicable to certain qualifying properties, including renewable energy systems like solar panels or wind turbines. Eligible investments typically exceed $5,000, involving significant outlays that stimulate job creation and economic development in targeted locations, such as designated enterprise zones. Documentation of project costs, timelines, and employment generation must be meticulously presented to substantiate eligibility. Compliance with local, state, and federal environmental regulations is also critical, as projects must not only contribute to economic growth but also adhere to the sustainability mandates outlined by agencies such as the Environmental Protection Agency (EPA).

Detailed project description

A capital investment tax credit approval requires a comprehensive project description that outlines the significant financial commitment to infrastructure enhancement. The project involves the construction of a new manufacturing facility in Austin, Texas, aimed at producing renewable energy equipment. The facility, estimated to cost $15 million, will occupy 50,000 square feet and create approximately 100 jobs over the next two years. The initiative aligns with local government efforts to promote green technology and jobs, as noted in the 2022 Austin Economic Development Plan. Key components include state-of-the-art solar panel assembly lines and energy-efficient machinery that reduce carbon emissions by 30%. The project anticipates a 15% increase in regional economic activity, directly contributing to sustainable development goals. Additionally, the completion timeline spans 18 months, reflecting a commitment to timely execution and responsibility toward community development.

Financial projections and return on investment

Financial projections play a crucial role in assessing potential returns on investment (ROI) for capital investment tax credit approvals. Accurate forecasting outlines expected revenue growth, typically estimating a 15-25% increase over a five-year period based on historical data from similar projects in sectors like renewable energy or manufacturing. Detailed analysis of expenses, including capital expenditures and operational costs, provides a clear picture of net profit margins, which can range from 10% to 30%. The ROI, calculated by comparing net income to investment costs, yields compelling figures, indicating an average payback period of three to seven years for eligible projects located in economically distressed areas. Additionally, factors like job creation, community benefits, and long-term sustainability bolster the attractiveness of the investment, making it a strategic financial decision for stakeholders involved.

Supporting documentation and substantiations

Capital investment tax credits play a crucial role in encouraging businesses to invest in infrastructure and equipment. These tax credits, often part of state or federal initiatives, can significantly reduce financial burdens by allowing eligible companies to deduct a percentage of their capital expenditures from their tax liabilities. For instance, in states like California, businesses may be eligible for credits of up to 8% of qualified investments in new equipment over $100,000. Supporting documentation typically required includes detailed financial statements, invoices for purchased equipment, and timelines of project implementation to substantiate claims. Additionally, project feasibility studies and environmental impact assessments can strengthen applications, showcasing a commitment to sustainable development while maximizing tax relief benefits. Ensuring accurate and comprehensive submission can facilitate smoother approval processes with tax authorities, such as the Internal Revenue Service (IRS).

Clear articulation of social and economic benefits

The Capital Investment Tax Credit (CITC) program offers businesses a significant opportunity to enhance financial sustainability while contributing to community growth. Companies investing over $1 million in qualified new capital assets, such as advanced manufacturing equipment or renewable energy projects, can receive a credit of up to 20% on their state taxes. This incentive promotes job creation, as evidenced by the 5,000 new jobs generated in the state of Texas since the program's inception in 2020. Moreover, local economies benefit from increased sales tax revenue and improved infrastructure. Communities impacted by these investments witness enhanced public services, such as better schools and healthcare access, contributing to overall quality of life improvements. In summary, the CITC not only supports business growth but also fosters sustainable economic development in both urban and rural areas.

Letter Template For Capital Investment Tax Credit Approval Samples

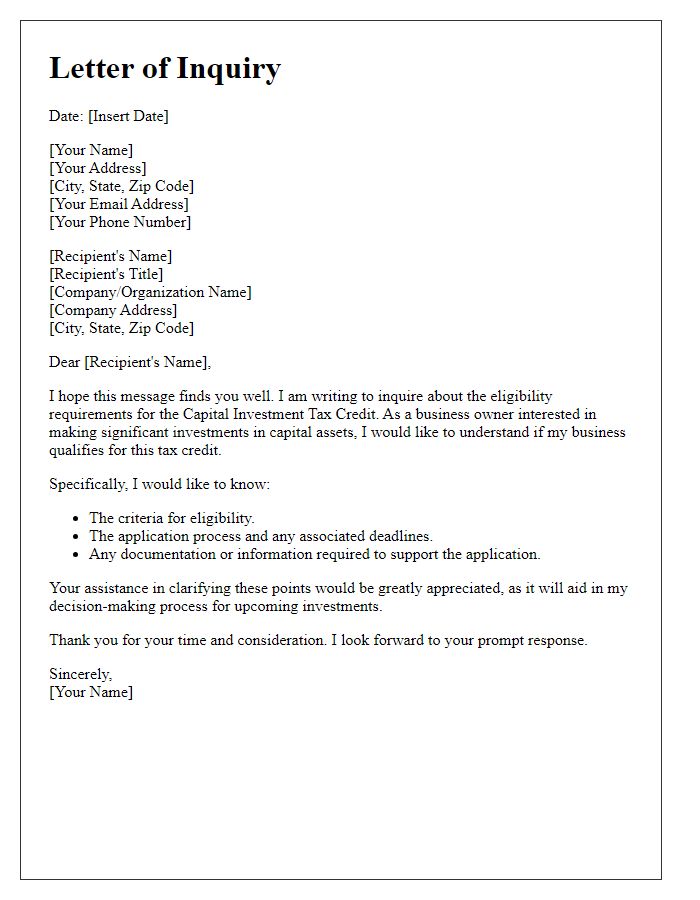

Letter template of inquiry regarding capital investment tax credit eligibility

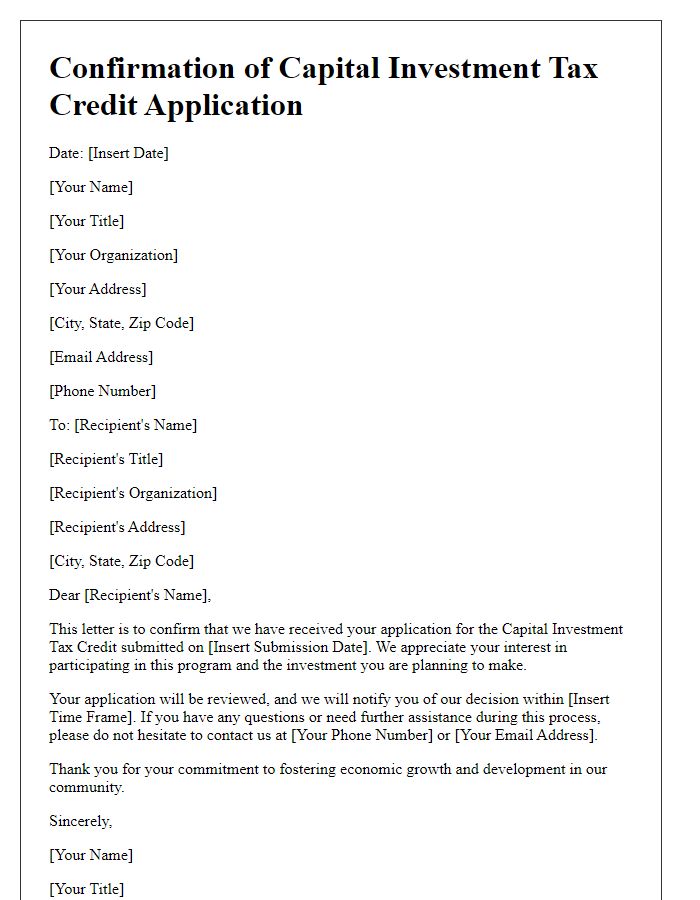

Letter template of confirmation for capital investment tax credit application

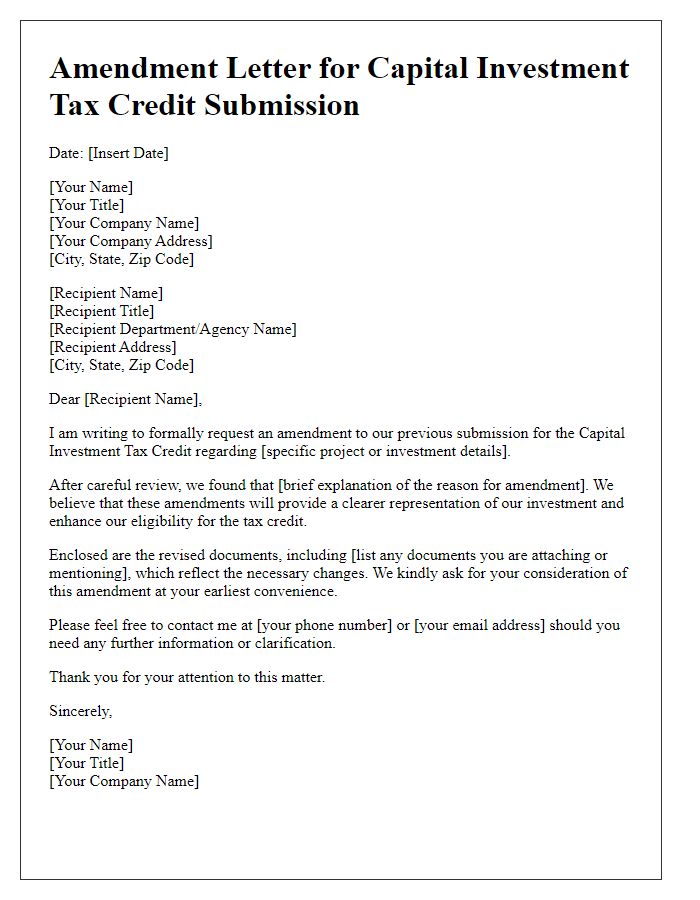

Letter template of amendment for capital investment tax credit submission

Letter template of supporting documents for capital investment tax credit

Letter template of notification for capital investment tax credit approval

Comments