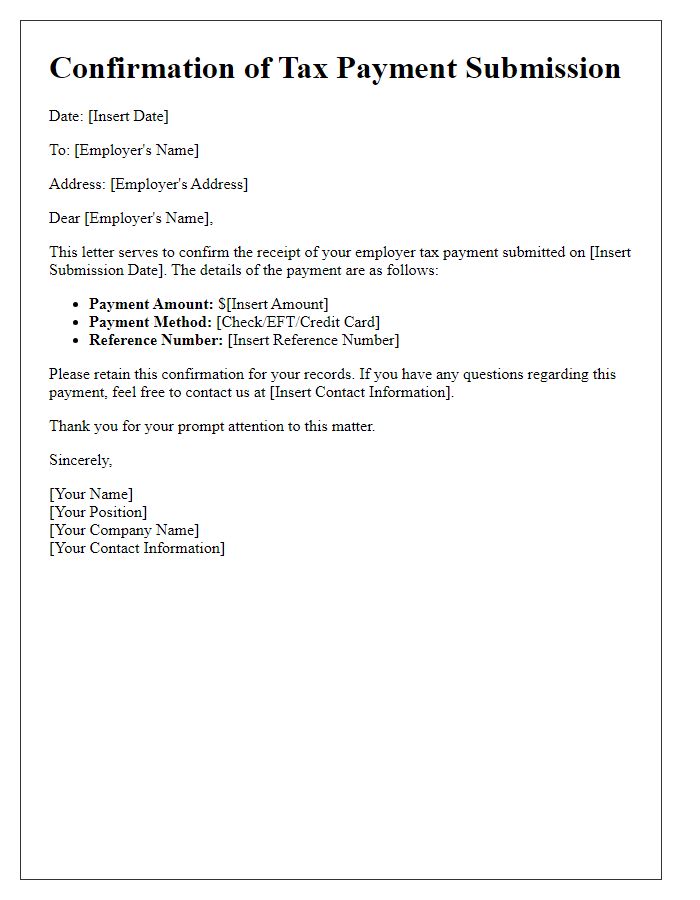

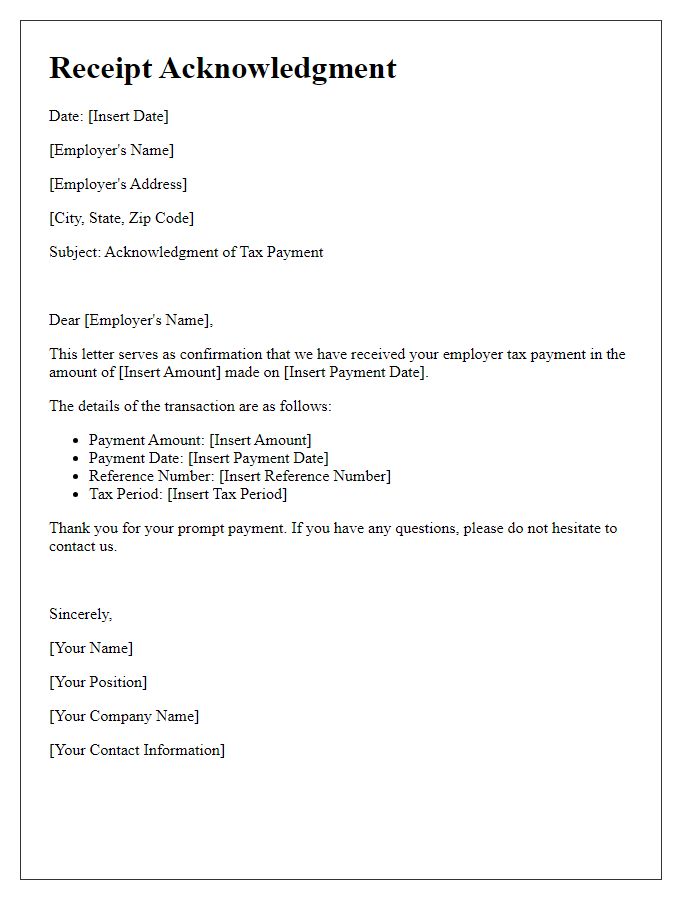

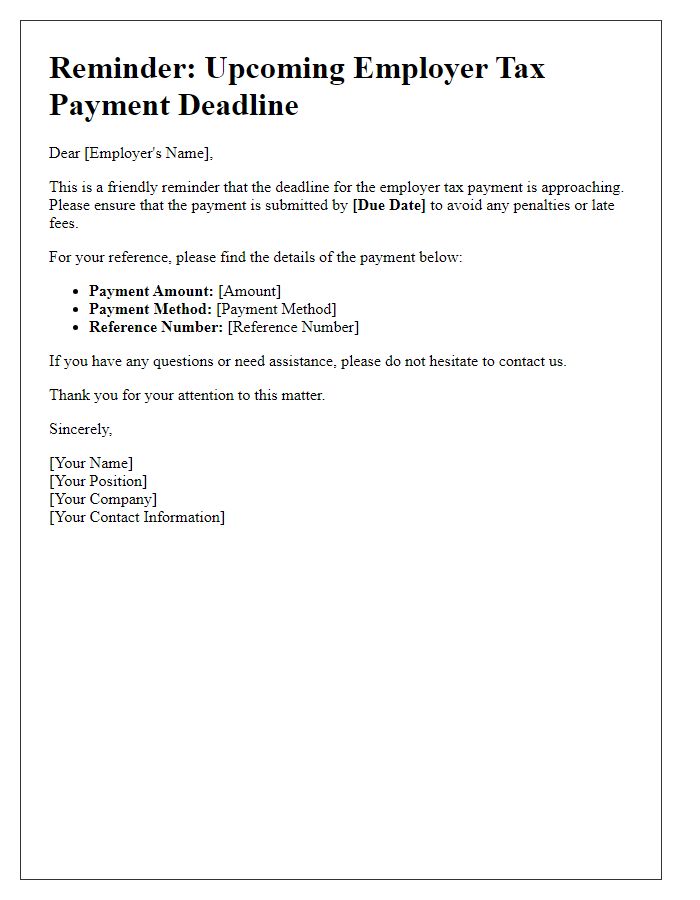

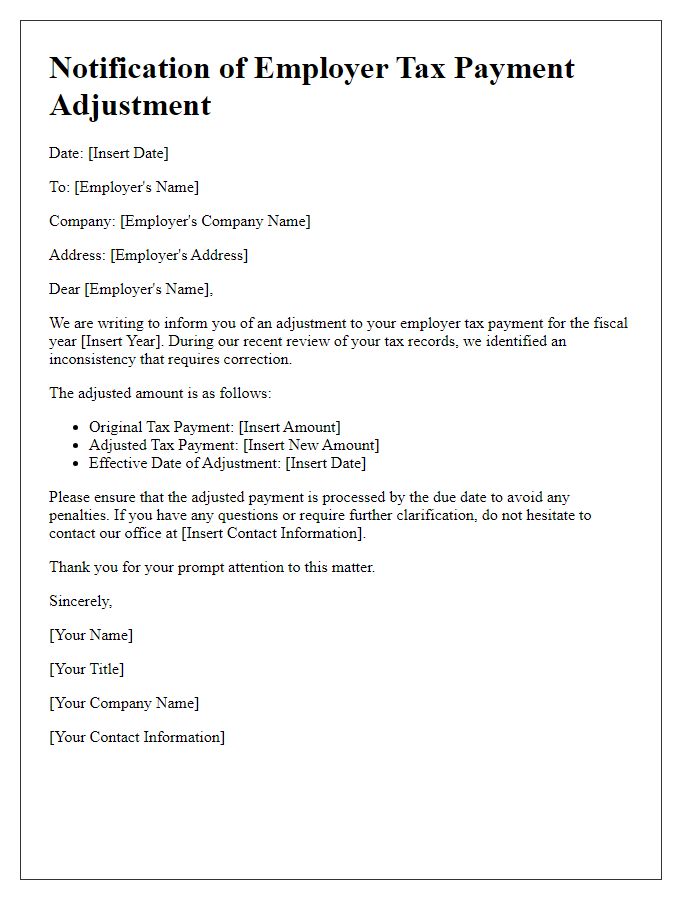

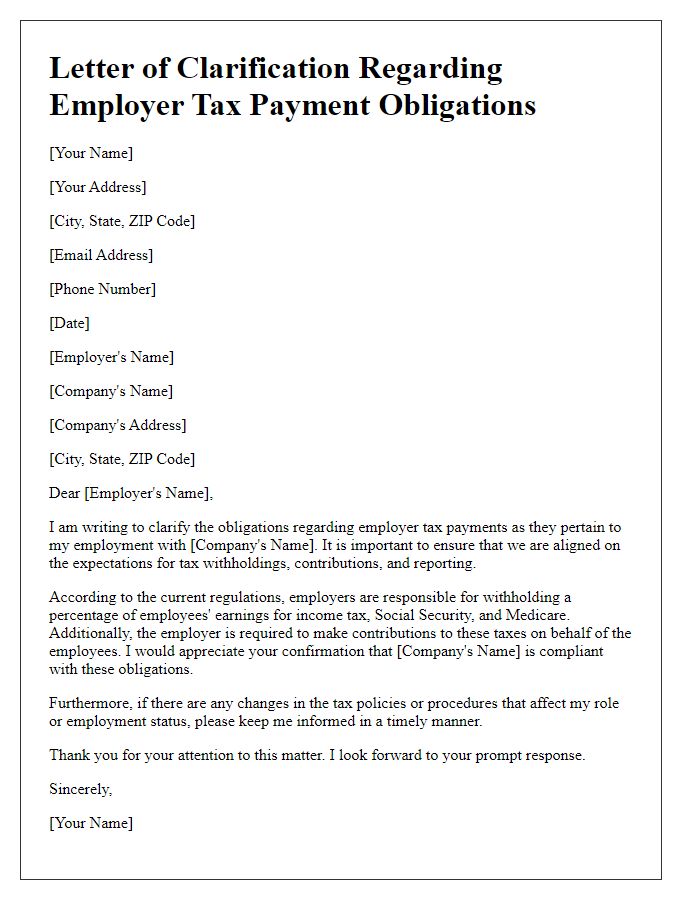

Hello there! If you're an employer navigating the complexities of tax payments, you've likely realized the importance of timely notifications to your employees. These letters not only keep everyone informed but also foster transparency and trust within your organization. By clearly outlining the details of tax payments, you can help alleviate any confusion and ensure everyone is on the same page. So, let's dive in and explore how to craft the perfect notification letter that effectively communicates this essential information!

Employer Identification Number (EIN)

Timely payment of employer taxes is crucial for compliance with federal regulations, specifically regarding the Employer Identification Number (EIN) issued by the Internal Revenue Service (IRS). The EIN, a unique identifier used for tax administration, is essential for reporting income, establishing accounts, and processing payroll tax obligations. Employers must ensure accurate remittance to avoid penalties, which can accumulate rapidly. Federal tax obligations include the Federal Insurance Contributions Act (FICA) taxes, which support Social Security and Medicare. Consistent payment schedules, typically quarterly, help maintain compliance and avoid interest on unpaid balances, ensuring operational stability for the business and transparency with the IRS.

Payment Amount and Payment Due Date

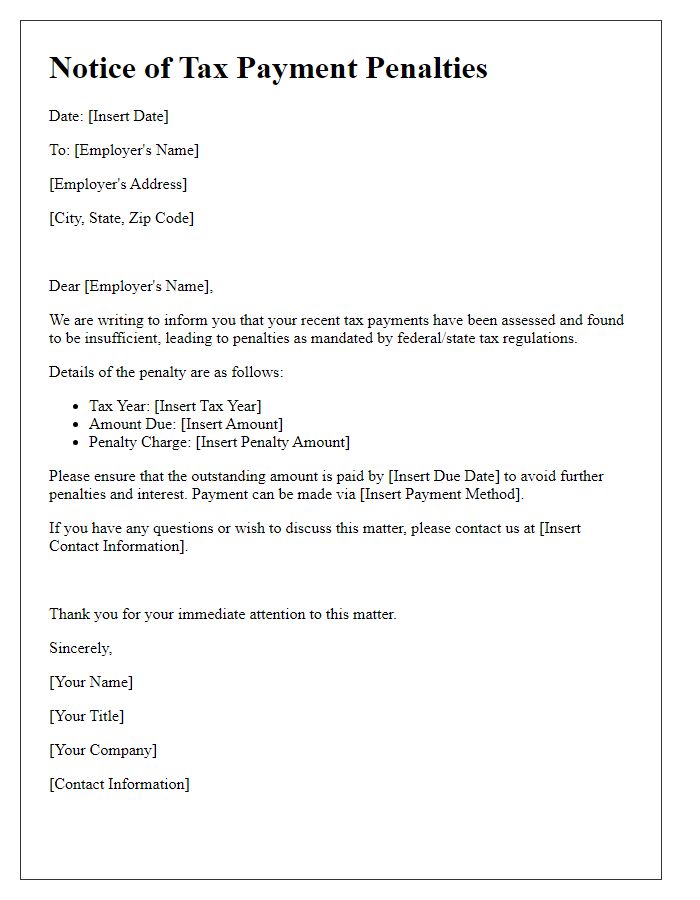

The timely payment of employer taxes, a responsibility for business owners, is essential for compliance with regulations set by the Internal Revenue Service (IRS). The specified payment amount, often calculated as a percentage of employee wages, varies depending on factors such as state and federal tax rates (typically ranging from 6.2% for Social Security to 1.45% for Medicare). The payment due date typically falls on the 15th of the month following the end of each quarter (for most employers), aligning with federal guidelines. Failing to adhere to these deadlines can result in penalties, which can accumulate interest and increase the financial burden on the business. Therefore, diligently monitoring tax obligations ensures the business remains in good standing and avoids unnecessary fees.

Tax Period and Type of Tax

Employers are required to make tax payments for various periods, including quarterly and annual submissions, with specific types of taxes such as payroll tax, unemployment tax, or income tax. Accurate reporting is essential to avoid penalties from tax authorities, such as the Internal Revenue Service (IRS) in the United States, which oversees federal tax collection. Tax periods may range from 941 quarterly filings, due on the last day of the month following the quarter, to annual returns (such as Form 940) for employment taxes, due in January. Timely payments and appropriate record-keeping contribute to compliance and financial accuracy for employers. Notifications about upcoming payment deadlines are crucial to ensure that taxes are paid within designated timeframes to prevent interest accrual and maintain business operations smoothly.

Instructions for Remittances

Employer tax payment notifications require clear communication of remittance instructions. Deadline for quarterly federal taxes, such as FICA (Federal Insurance Contributions Act) tax, is April 30, July 31, October 31, and January 31 of each year, necessitating timely processing. Employers must remit these amounts electronically via the IRS Electronic Federal Tax Payment System (EFTPS) to avoid penalties. Specific details, such as Employer Identification Number (EIN) and the amount due, must be included to ensure proper allocation of payments. Additionally, awareness of state tax filing deadlines, which vary by state, increases compliance. Utilizing robust accounting software helps maintain accurate records and streamline the remittance process, safeguarding against potential miscalculations and late fees.

Contact Information for Queries

For any queries regarding employer tax payment, please reach out to our dedicated support team. You can contact us via email at support@taxauthority.gov or call our helpline at (555) 123-4567 during business hours (Monday to Friday, 9 AM to 5 PM). For in-depth assistance, refer to our official website, www.taxauthority.gov, where you can find additional resources, FAQs, and informative guides pertaining to employer tax obligations. Don't hesitate to ask questions regarding specific tax codes, payment deadlines, or changes in regulations to ensure compliance with local tax laws.

Comments