Are you looking to request a tax residency certificate but don't know where to start? Writing an effective letter can seem daunting, but it doesn't have to be! With the right template and a few key pointers, you can craft a clear and concise request that gets the job done. Ready to learn the ins and outs of this essential process? Let's dive in!

Applicant Details

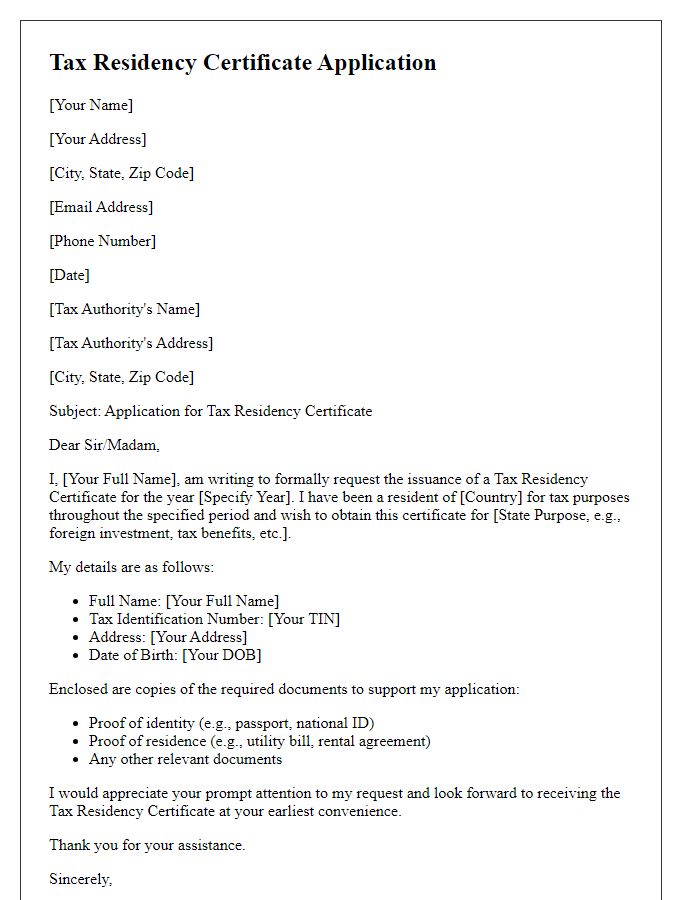

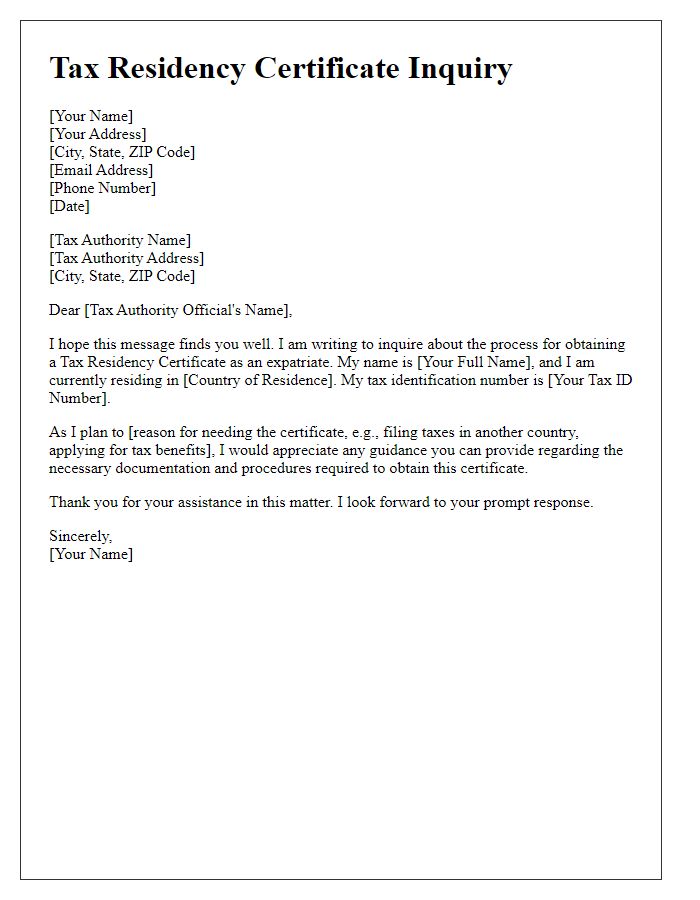

An applicant requesting a tax residency certificate typically needs to provide specific details to facilitate processing. Essential information may include full name, residential address including postal code, date of birth (often formatted as DD/MM/YYYY), nationality or citizenship status, taxpayer identification number (TIN) issued by local tax authorities, the purpose for requesting the certificate (e.g., investment, employment abroad), and contact details like email address and phone number. Additionally, it can be helpful to include any relevant tax filing year(s) or periods that the request pertains to, ensuring that the authorities have a comprehensive understanding of the applicant's tax residency status and intentions.

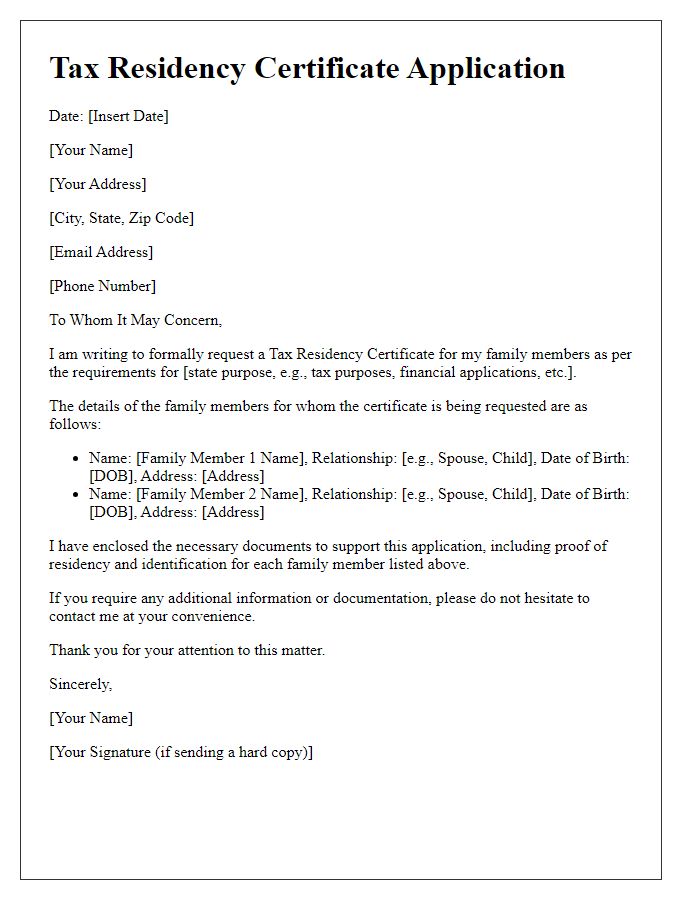

Purpose of the Request

A tax residency certificate serves as an official document issued by the country of residence, confirming an individual's tax status for the purpose of avoiding double taxation on income. Individuals may need this certificate for various reasons, such as claiming tax treaty benefits, ensuring compliance with international tax regulations, or proving residency for financial institutions. Many countries, including the United States and the United Kingdom, require specific documentation, including identification, proof of residency, and prior tax returns, to process the certificate request. The request process may vary based on jurisdiction and can involve fees, processing times, and submission methods. Obtaining this certificate is essential for expatriates, foreign investors, and businesses engaged in cross-border transactions, ensuring they meet their tax obligations efficiently.

Information of Tax Authority

Tax residency certificates serve as essential documents for individuals and entities seeking to confirm their tax status in a specific jurisdiction for international tax purposes. For example, the Internal Revenue Service (IRS) in the United States issues these certificates to compliant taxpayers allowing them to benefit from tax treaties. Residents might need to submit their request to the relevant tax authority, which often includes specific identifiers such as tax identification numbers (TIN), full legal names, and addresses. It is important to detail the reason for the request and contextual information about prior tax filings, which can streamline the approval process. Furthermore, the response time may vary, typically ranging from a few weeks to several months based on the authority's workload and jurisdictional regulations.

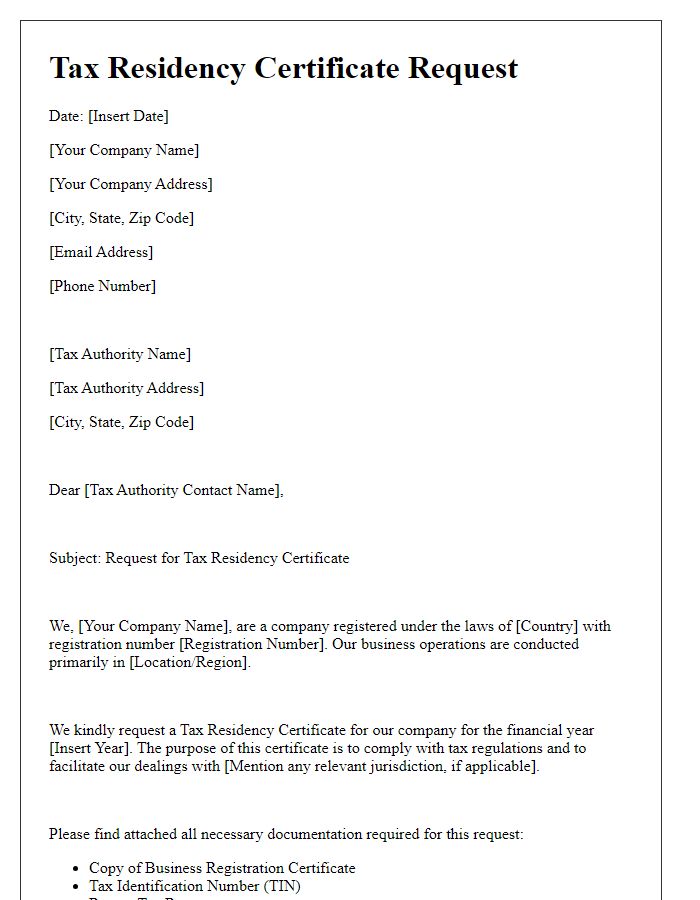

Required Documents List

A tax residency certificate, vital for verifying an individual's tax obligations and benefits in a specific jurisdiction, necessitates the compilation of key documents to support the application. Essential documents include a completed application form specific to the tax authority, valid identification such as a government-issued photo ID (like a passport or national ID card), proof of residence (utility bills or lease agreements) showing the individual's name and address, and financial documents, such as tax returns or bank statements, proving income sources. Additional supporting documentation may include employment letters or contractual agreements to establish employment status, along with any relevant correspondence from tax authorities that clarify the individual's tax status. These documents collectively enable tax authorities to assess residency status accurately, helping to prevent double taxation and ensuring compliance with international tax laws.

Contact Information for Queries

When seeking a tax residency certificate, individuals must ensure their contact information is clear and easily accessible in their request. Providing specific details such as a full name, street address, city, and postal code is essential for effective communication. A valid email address, which should include a professional domain if possible, allows for prompt digital correspondence. Additionally, a direct phone number with the appropriate country code, typically including a mobile or landline option, ensures that any inquiries can be addressed swiftly. Including alternate contact methods can also enhance the chances of a quick response.

Letter Template For Tax Residency Certificate Request Samples

Letter template of tax residency certificate application for individuals.

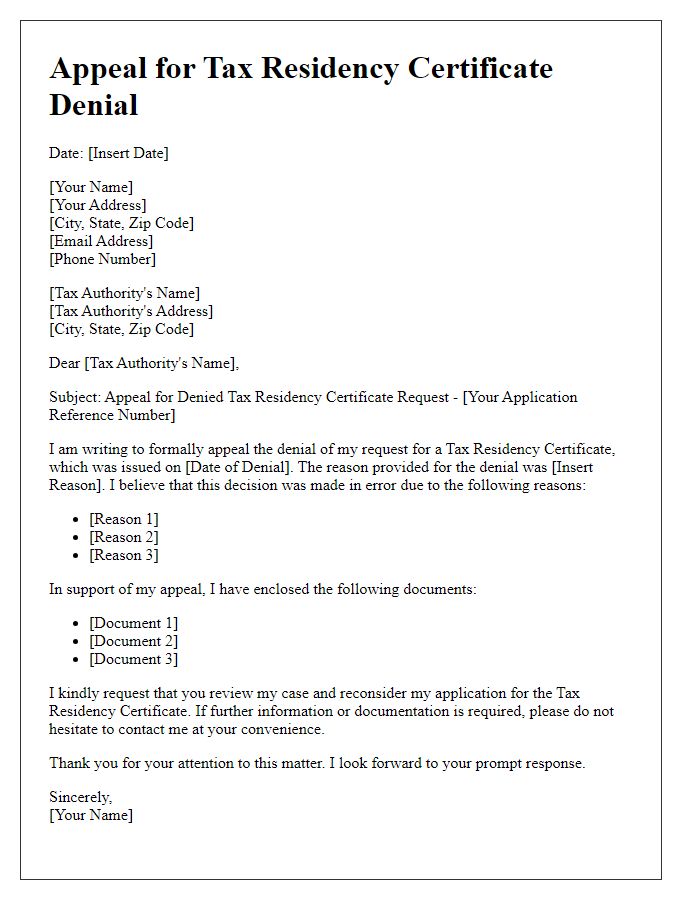

Letter template of tax residency certificate appeal for denied requests.

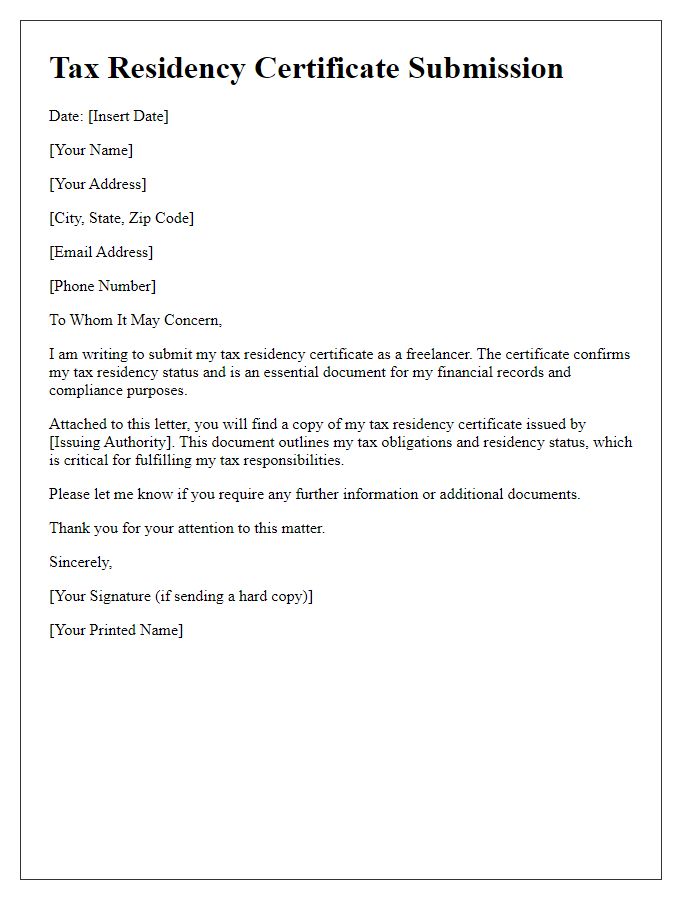

Letter template of tax residency certificate submission for freelancers.

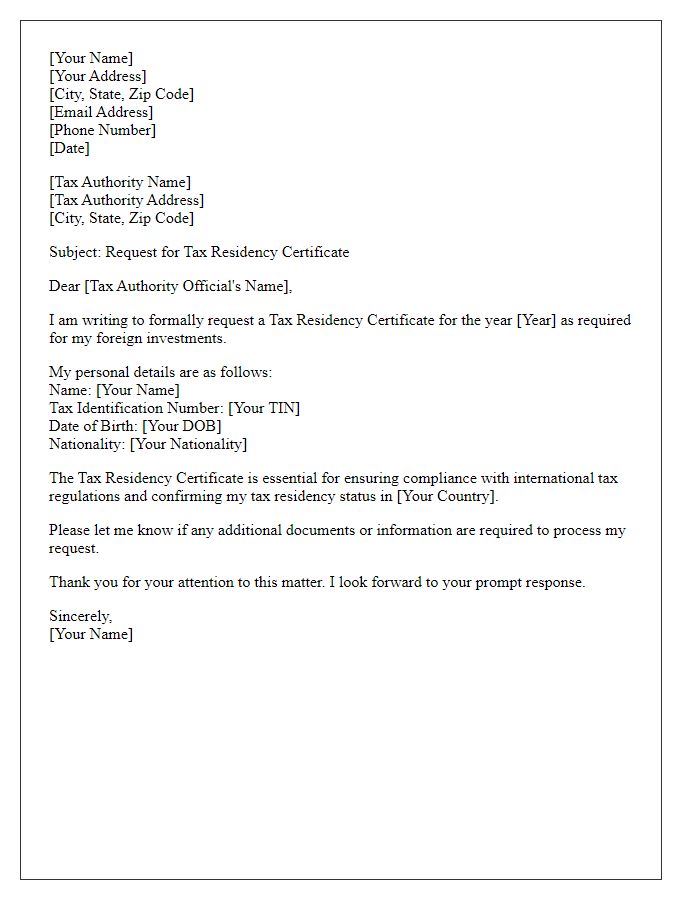

Letter template of tax residency certificate request for foreign investments.

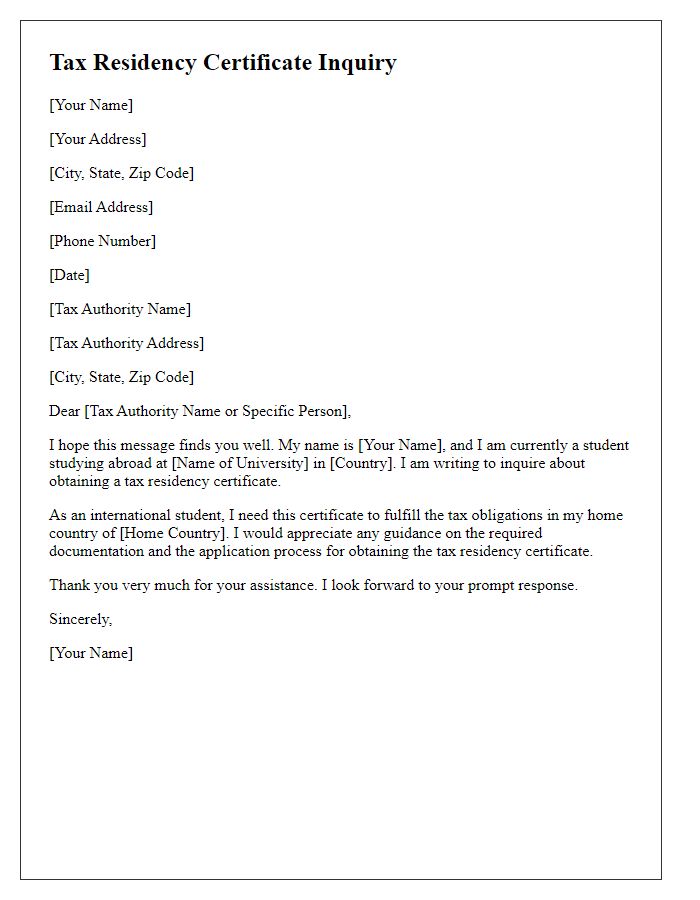

Letter template of tax residency certificate inquiry for students abroad.

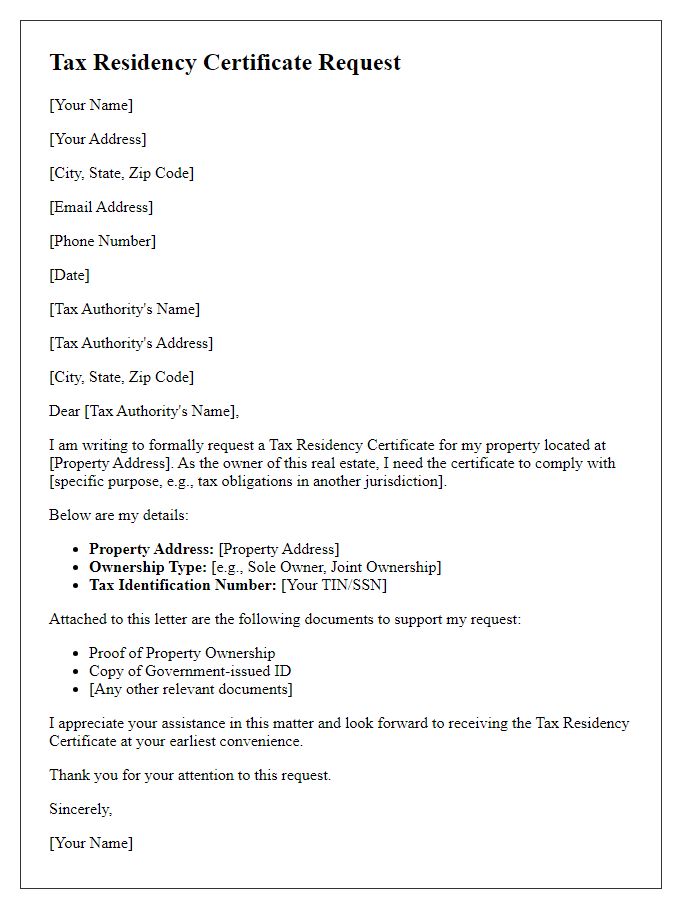

Letter template of tax residency certificate request for real estate owners.

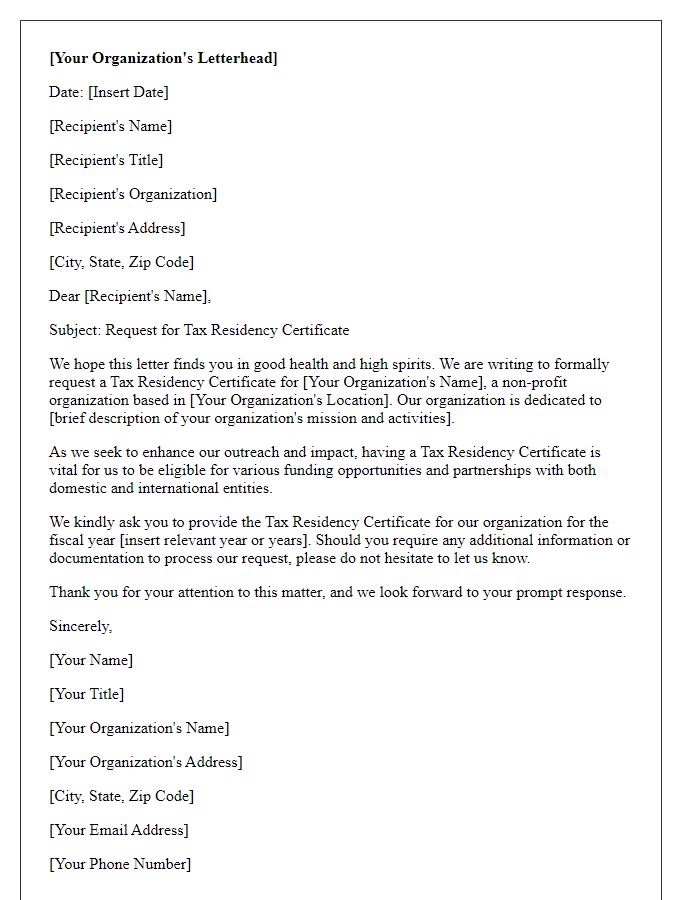

Letter template of tax residency certificate request for non-profit organizations.

Comments