Are you feeling overwhelmed about an impending tax audit appeal? You're not aloneâmany individuals and businesses go through this challenging process, and understanding your rights and options is crucial. In this article, we'll walk you through a straightforward letter template that you can customize to notify the relevant authorities about your appeal. Keep reading to discover how to effectively communicate your position and navigate the complexities of a tax audit with confidence!

Clarity and Specificity

Tax audit appeals require precise communication for effective resolution. An appeal notification must clearly state the taxpayer's details, including full name, identification number, and the tax period in question. Involve specific references to the audit findings, illustrating discrepancies or misunderstandings, for example, discrepancies in reported income, deductions, or credits identified during audits by agencies like the Internal Revenue Service (IRS) or local tax authorities. Additionally, include deadlines for submitting the appeal, which typically span 30 to 90 days from the audit notification date. Attach supporting documents, such as tax returns or notices, and emphasize any critical tax laws or regulations that support the taxpayer's position. This structured approach aids in clarifying intentions and facilitates a smoother review process.

Formal Tone and Language

Tax audits can significantly impact financial stability, creating anxiety for individuals and businesses. The appeal process begins after receipt of the audit notification letter from the tax authority, typically the Internal Revenue Service (IRS) in the United States. This notification usually includes detailed information regarding the audit findings, such as discrepancies in reported income or allowable deductions. An effective response must include a formal letter outlining the reasons for the appeal, citing specific tax codes or regulations that support the taxpayer's position. Essential elements of the letter should include the taxpayer's identification number, the audit reference number, and a thorough explanation of the contested findings. Timely submission of the appeal, usually within 30 days of notification, is crucial to ensure consideration by the tax authority. Detailed supporting documents, such as original receipts or tax returns, should be included to strengthen the appeal.

Reference to Relevant Tax Codes

A tax audit appeal may arise when an individual or business challenges the findings of a tax authority, such as the Internal Revenue Service (IRS). This process often involves referencing specific tax codes, including Internal Revenue Code (IRC) Section 6662, which addresses penalties for substantial understatement of income tax. Additionally, taxpayers might refer to IRC Section 6015 for innocent spouse relief, which provides protection for one spouse in joint tax assessments. During the appeal, it is essential to include relevant details such as tax years in question, the specific findings of the audit, and supporting documentation that could substantiate the taxpayer's position. Surrounding tax laws, compliance timelines, and jurisdictional nuances can significantly impact the outcome of the appeal process. Engaging a qualified tax professional can provide clarity and guidance through these complex regulations.

Supporting Documentation

A tax audit appeal requires careful presentation of supporting documentation to strengthen the case against the findings of the audit. Essential documents include the original tax return filed for the year under dispute, detailed records of income sources, and receipts for all relevant deductions and credits claimed. Additionally, correspondence related to the audit notice from the tax authority, such as the IRS (Internal Revenue Service) or state tax department, must be included to illustrate the timeline of communications. Financial statements from banks that show deposits and transactions can offer clarity on income verification. Other pertinent materials encompass documents like W-2s, 1099 forms, and any existing agreements or contracts that validate business expenses. Finally, a comprehensive written explanation of the discrepancies highlighted in the audit can significantly aid in outlining the rationale for the appeal.

Deadlines and Timelines

Tax audit appeals require meticulous attention to deadlines and specific timelines established by tax authorities. For example, taxpayers typically have 30 days from the date of receiving an audit notice to respond with an appeal, ensuring compliance with Internal Revenue Service (IRS) guidelines. Additionally, the timing of submitting supporting documents, such as financial records and correspondence, is critical, often falling within a 90-day period for state-level appeals, varying by jurisdiction. Failure to adhere to these timelines may result in the forfeiture of the right to contest the audit findings, emphasizing the importance of organization and prompt action during the appeals process.

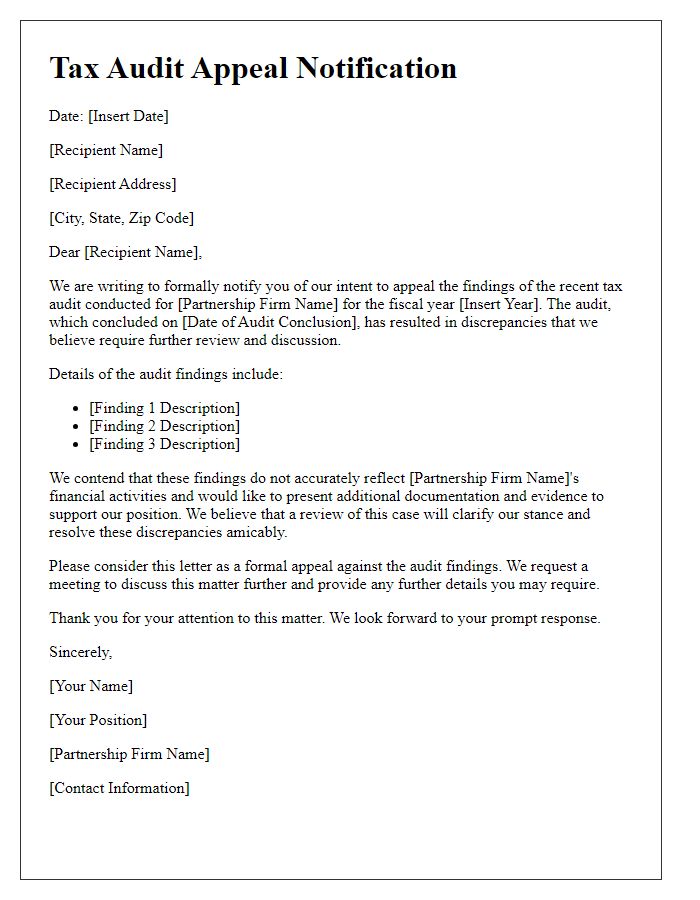

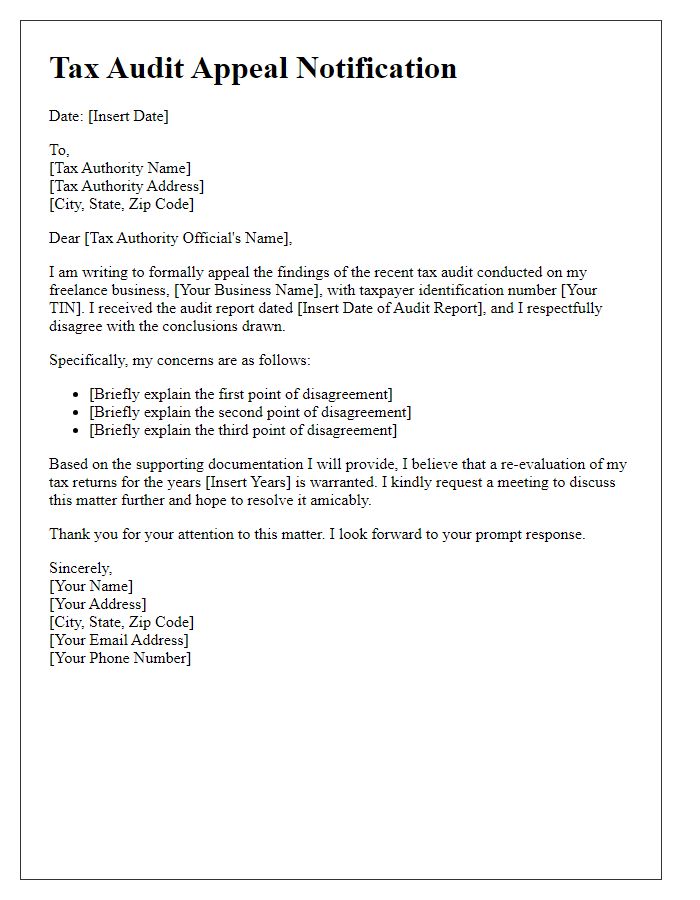

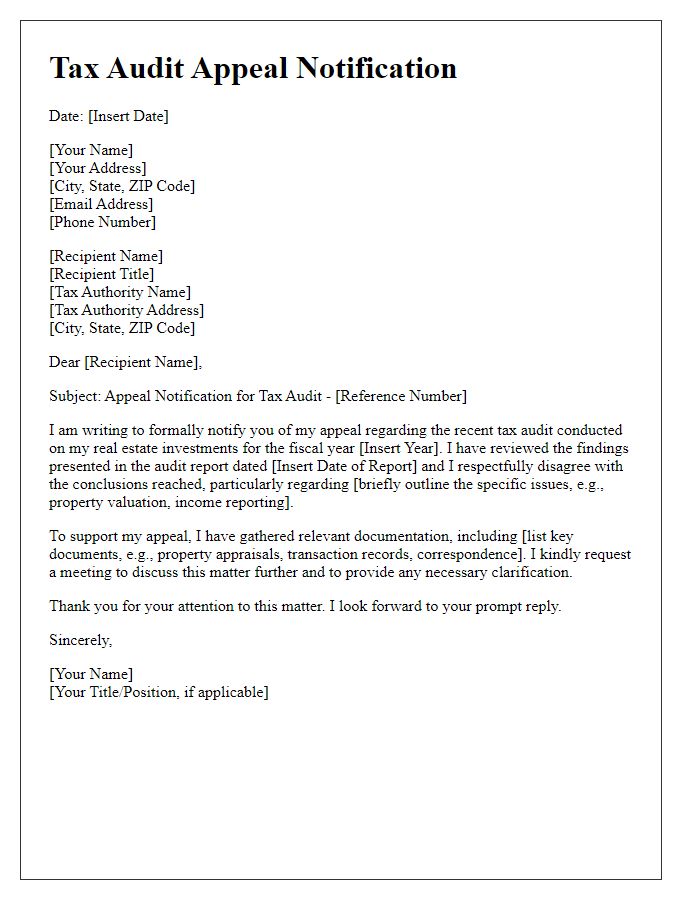

Letter Template For Notification Of Tax Audit Appeal Samples

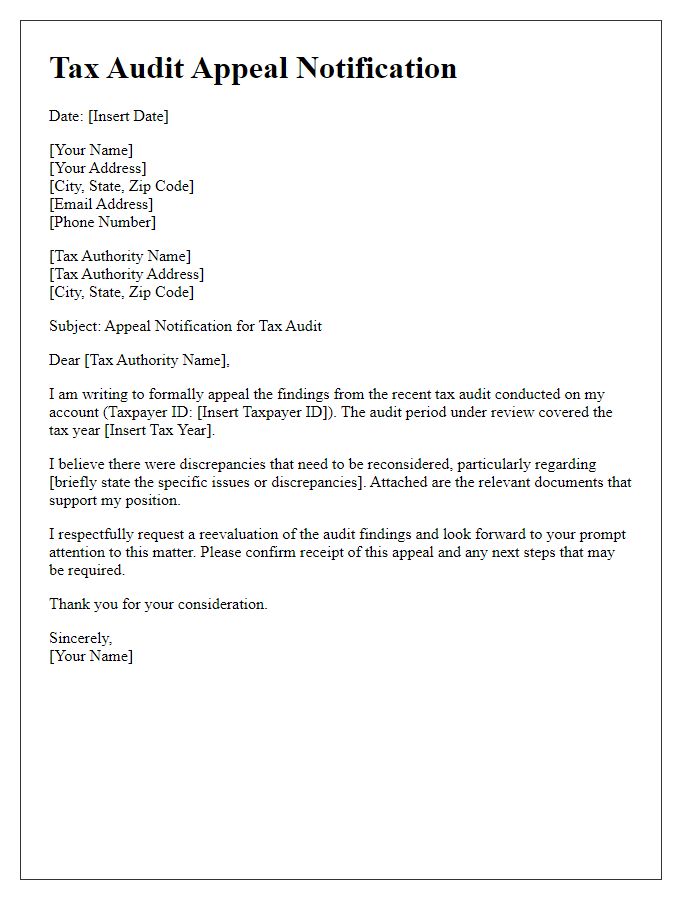

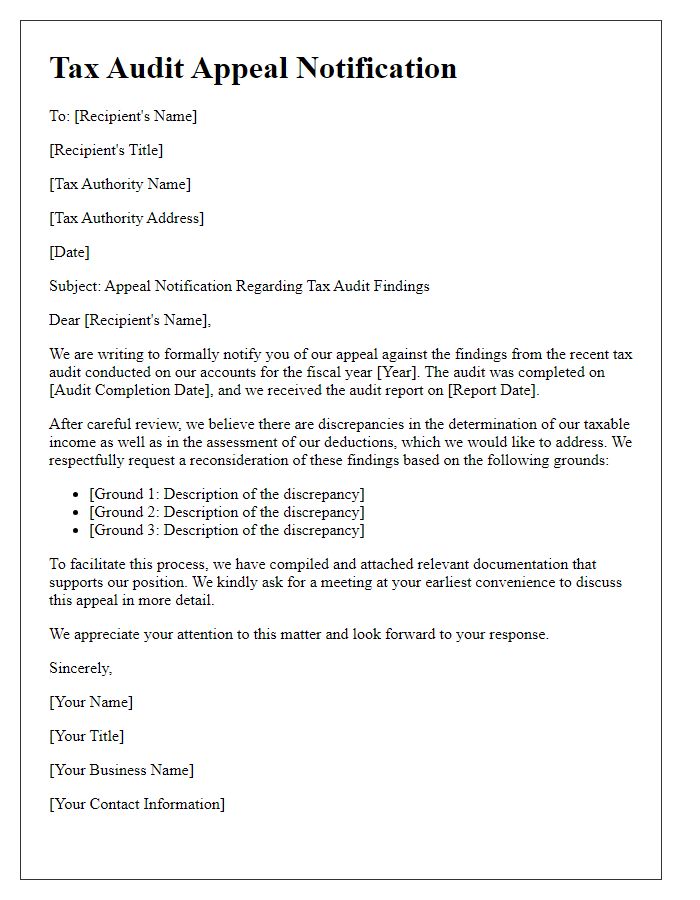

Letter template of tax audit appeal notification for individual taxpayers

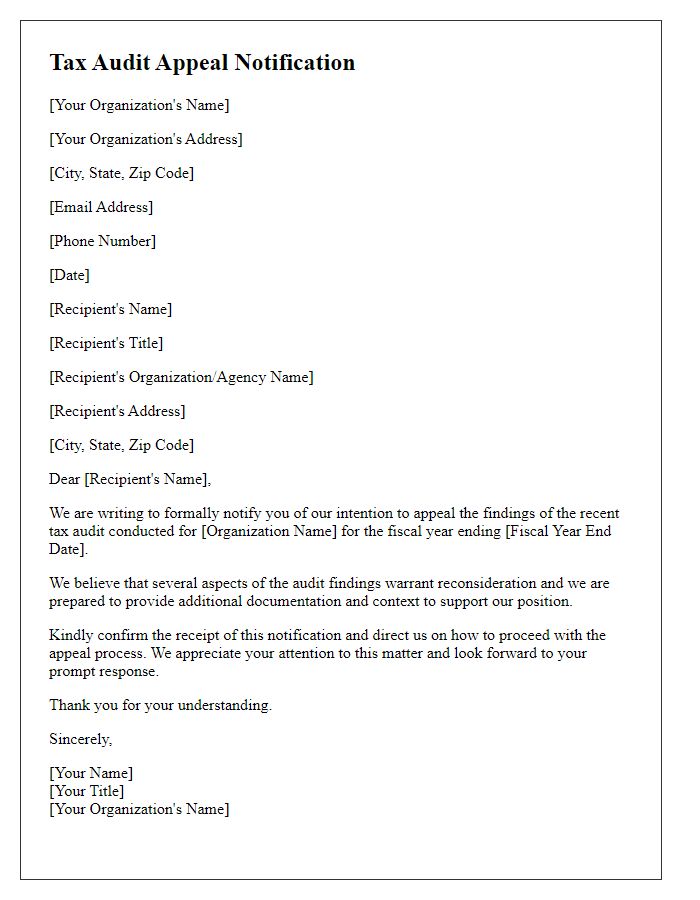

Letter template of tax audit appeal notification for nonprofit organizations

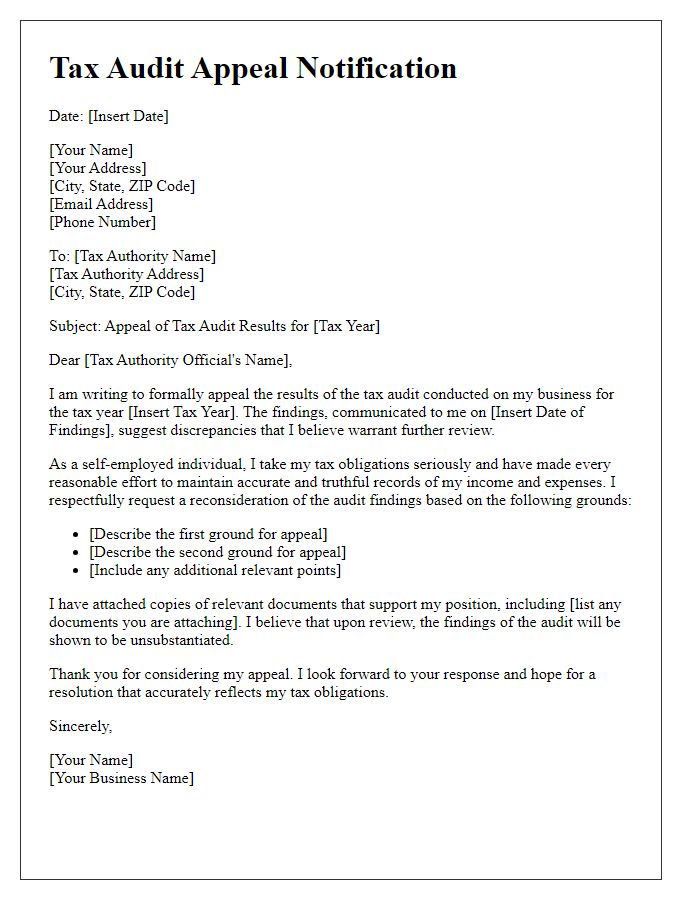

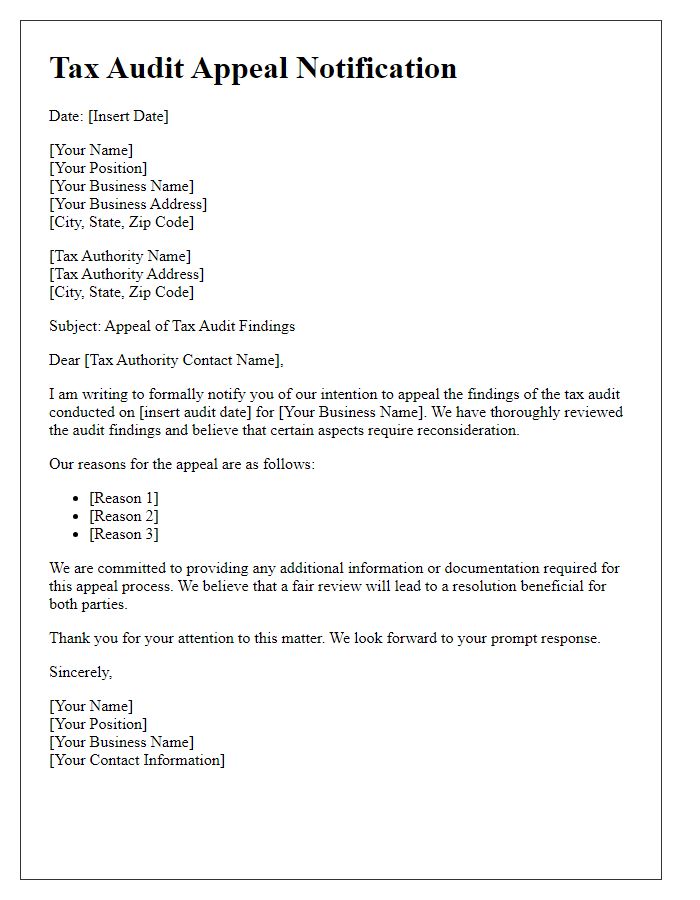

Letter template of tax audit appeal notification for self-employed individuals

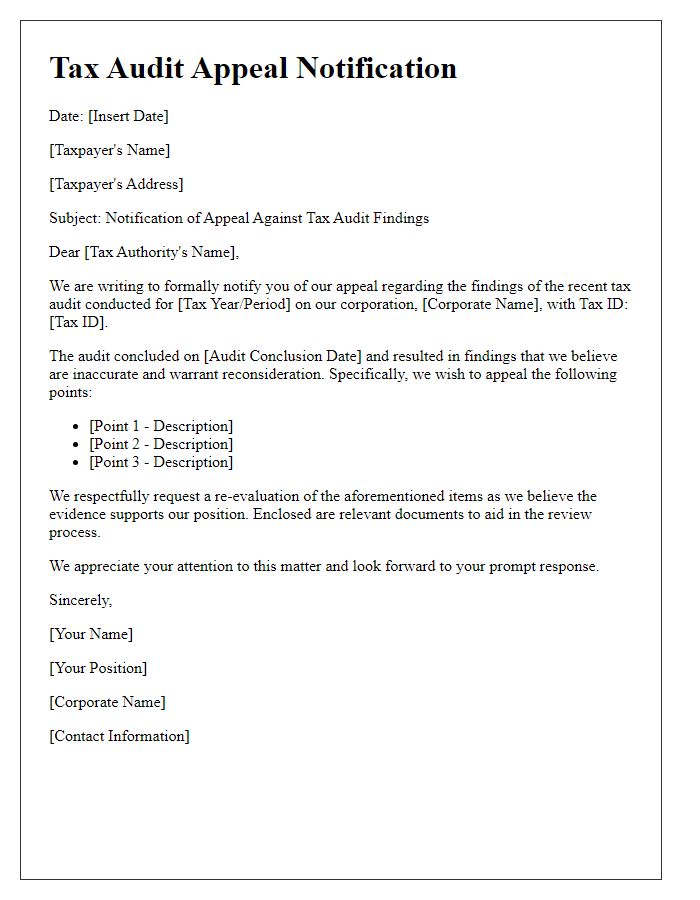

Letter template of tax audit appeal notification for corporate taxpayers

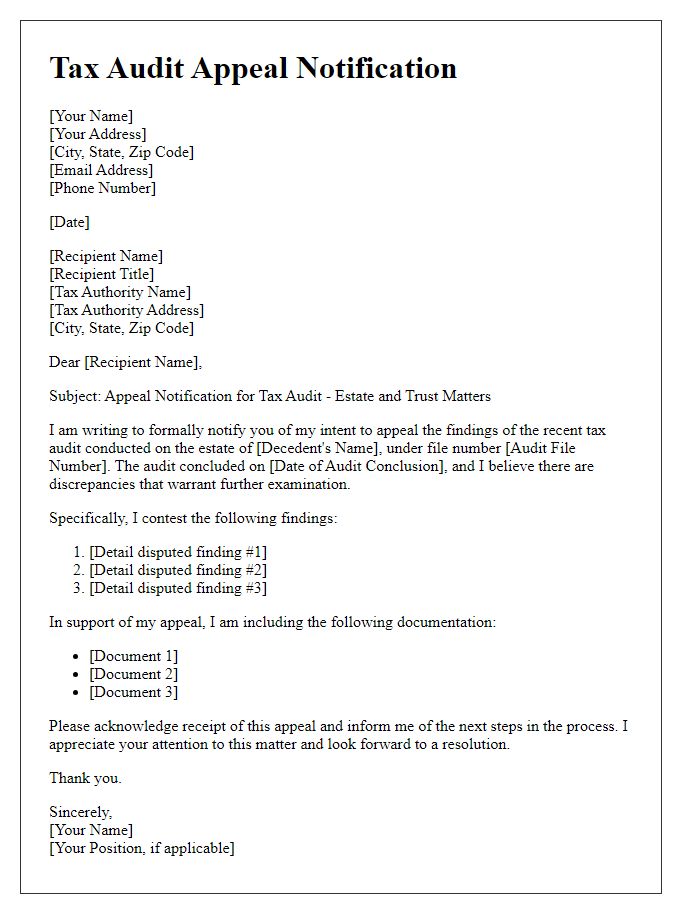

Letter template of tax audit appeal notification for estate and trust matters

Comments