Are you struggling to keep up with your mortgage payments and feeling overwhelmed by arrears? You're not alone, as many homeowners face financial challenges at some point in their lives. Fortunately, there are effective ways to communicate with your lender and explore options for settling your mortgage arrears. Join us as we delve into a helpful letter template that can guide you in taking that important step toward financial stability.

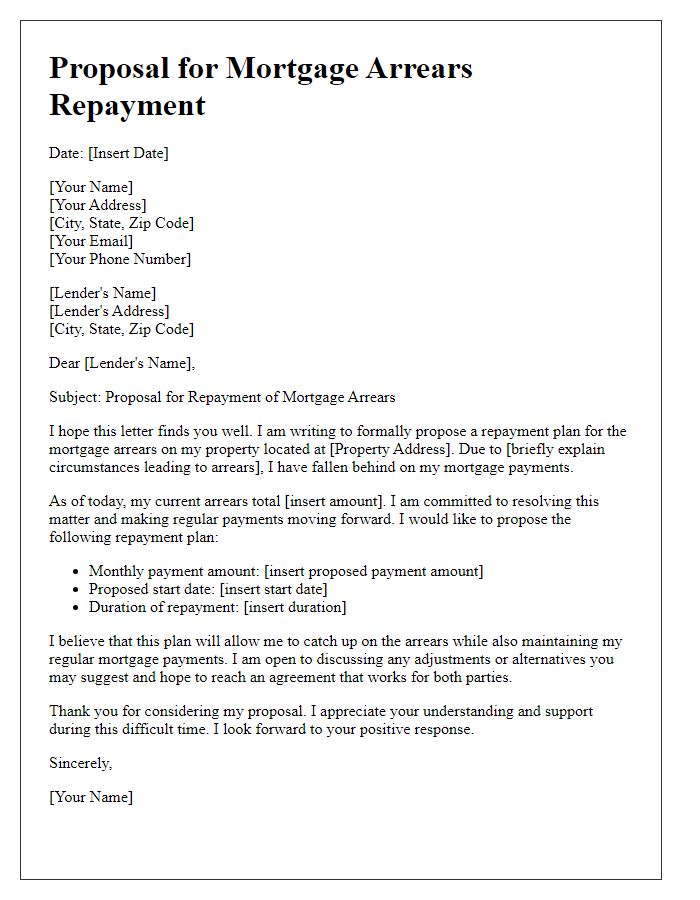

Borrower's Full Name and Address

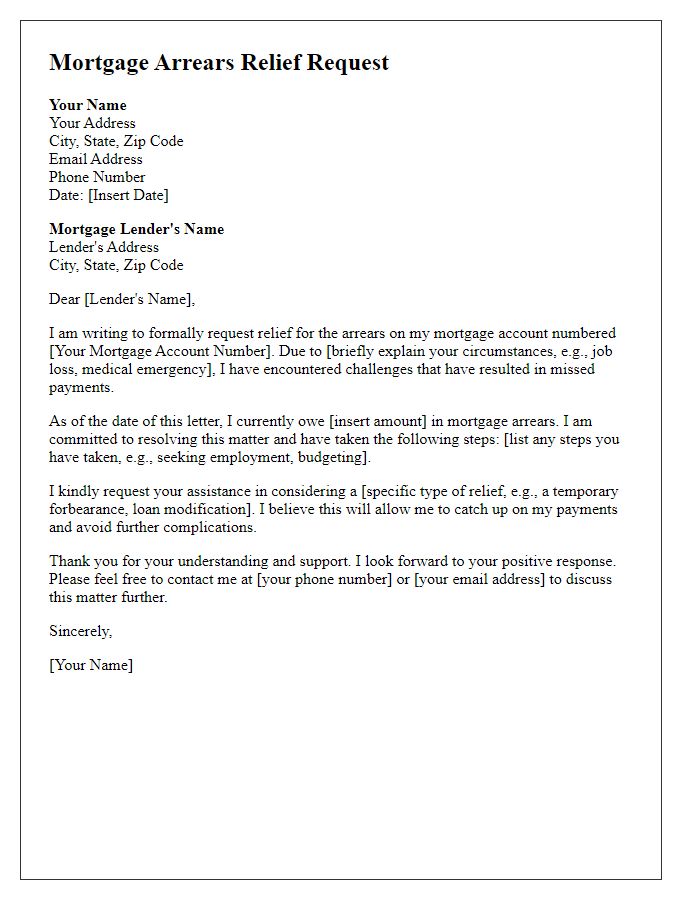

Mortgage arrears can significantly impact a borrower's financial stability and credit score. For instance, failing to make timely payments can lead to penalties of approximately 5% of the overdue amount, varying by lender. A housing loan, such as a 30-year fixed mortgage, frequently requires borrowers to adhere to a payment schedule to avoid delinquency. If the borrower resides in a major city like New York, the high cost of living compounds the urgency of resolving arrears, typically requiring communication with the mortgage servicer to negotiate a repayment plan. Additionally, understanding relevant local regulations and seeking advice from organizations like the National Foundation for Credit Counseling can provide borrowers with resources for effective debt management.

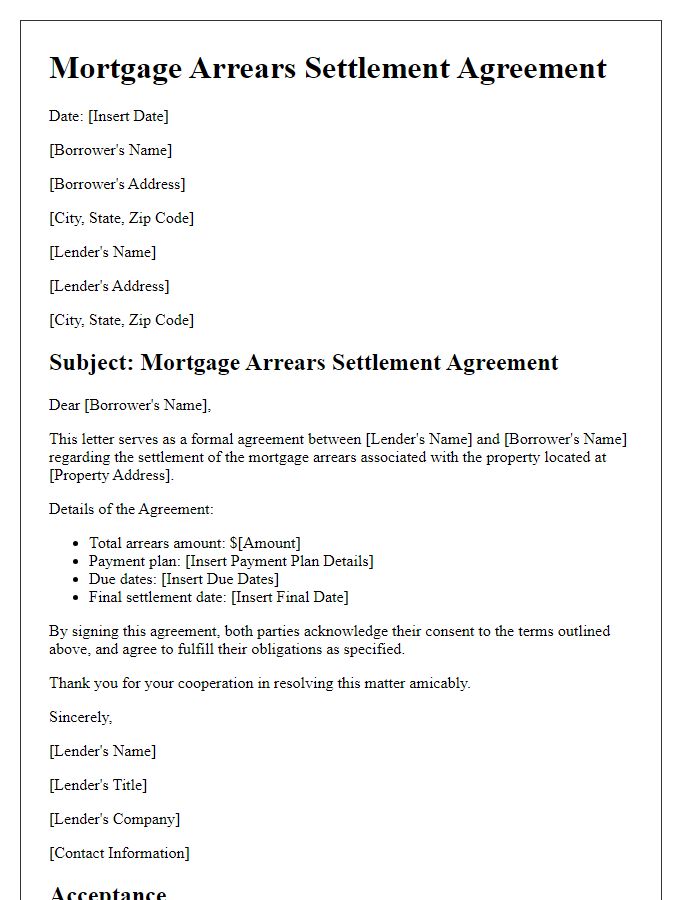

Lender's Full Name and Address

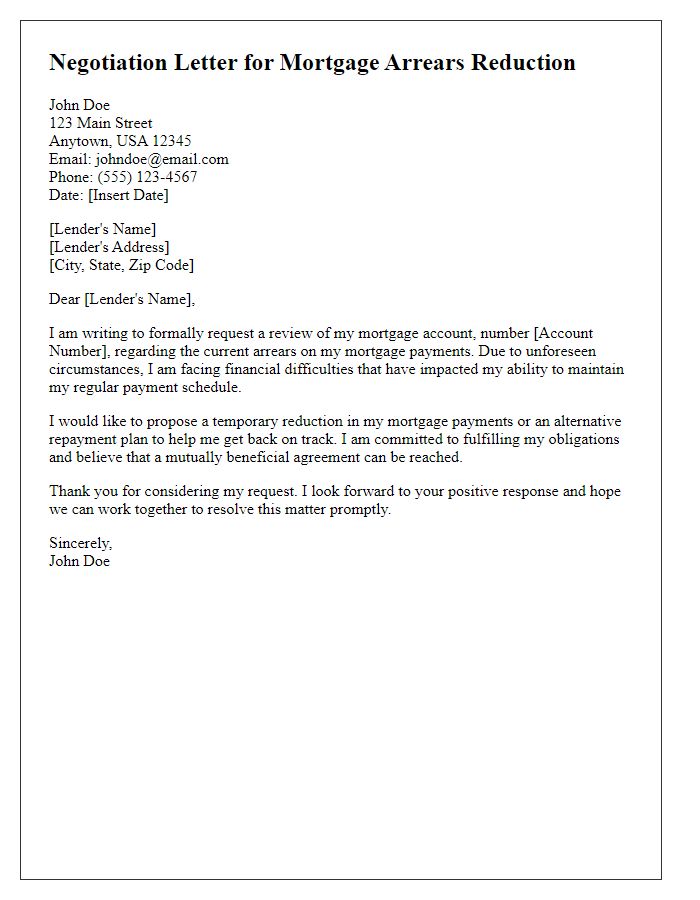

Mortgage arrears can significantly impact the financial stability of homeowners, leading to potential foreclosure actions by lenders such as banks or credit unions. In 2023, statistics from the Federal Housing Finance Agency indicated that approximately 3.9% of residential mortgages were in arrears, highlighting the importance of addressing these issues promptly. A mortgage arrear settlement often involves negotiations between the borrower and the lender, potentially leading to modified repayment plans or reduced principal amounts. Affected homeowners usually seek assistance from non-profit credit counseling agencies, which provide guidance and resources to navigate the complexities of outstanding debts. Legal protections, such as the Fair Debt Collection Practices Act, also play a critical role in ensuring fair treatment during these negotiations.

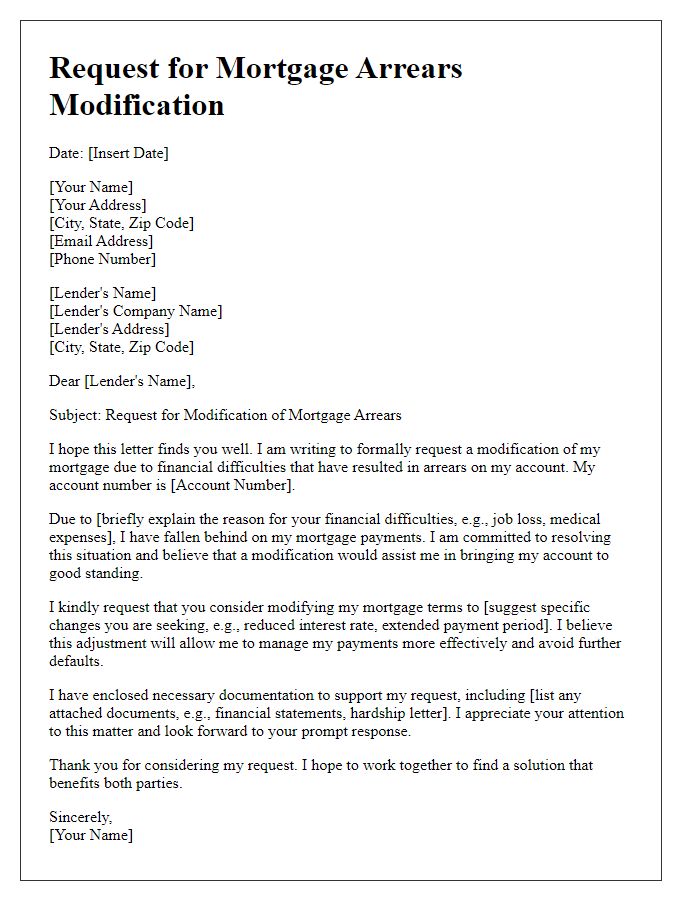

Account Number and Loan Details

Mortgage arrears can significantly impact financial stability, particularly for homeowners with outstanding payments on properties valued over $300,000. The account number associated with each mortgage, such as 00123456789, is crucial for identifying specific loans under a lending institution, such as Bank of America. Settlement discussions often revolve around the loan details, including principal amounts, interest rates (averaging around 4.5% for 30-year fixed loans), and payment timelines. Mortgages in arrears might lead to additional fees, potential foreclosure risks, and long-term credit score implications, stressing the importance of addressing these issues promptly. Utilizing a structured repayment plan can help alleviate stress and restore financial footing, benefiting homeowners significantly in stabilizing their circumstances.

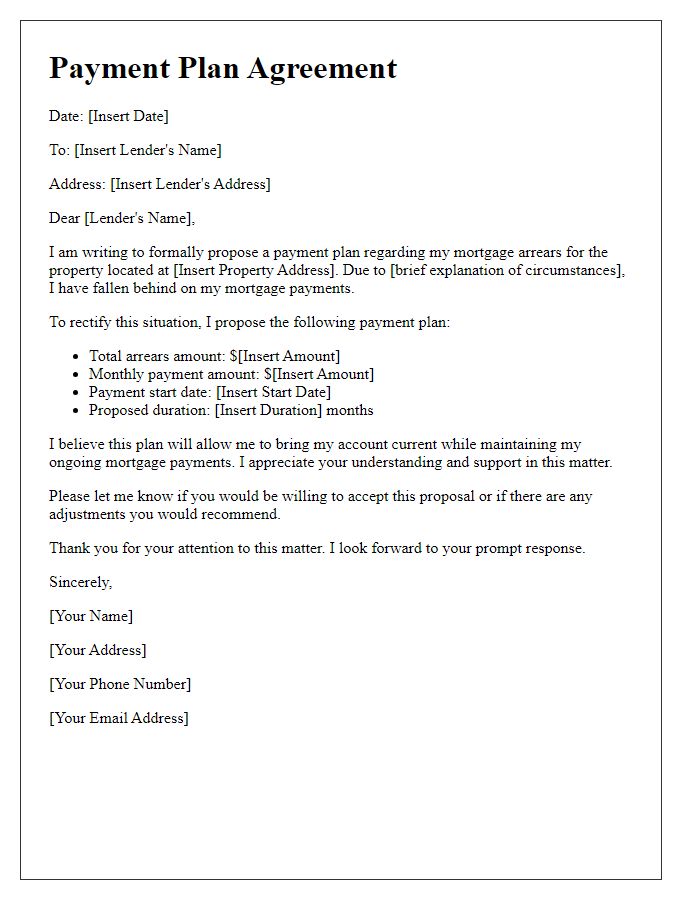

Proposed Payment Plan and Terms

Proposed payment plans can help individuals address mortgage arrears effectively. Typically, lenders like banks or credit unions offer these plans to assist borrowers in managing overdue payments. For instance, a borrower may propose a payment plan that includes a specified monthly payment amount, such as $500, over a set duration, like 12 months, to repay outstanding arrears. Important terms can include interest rates, potentially decreased during the repayment phase, and conditions under which the borrower must adhere to scheduled payments. Additionally, detailed considerations regarding any fees for late payments or the impact on the borrower's credit score can greatly influence the acceptance of the proposed plan. Clear documentation of these terms ensures both parties understand their responsibilities and expectations, fostering effective communication throughout the repayment process.

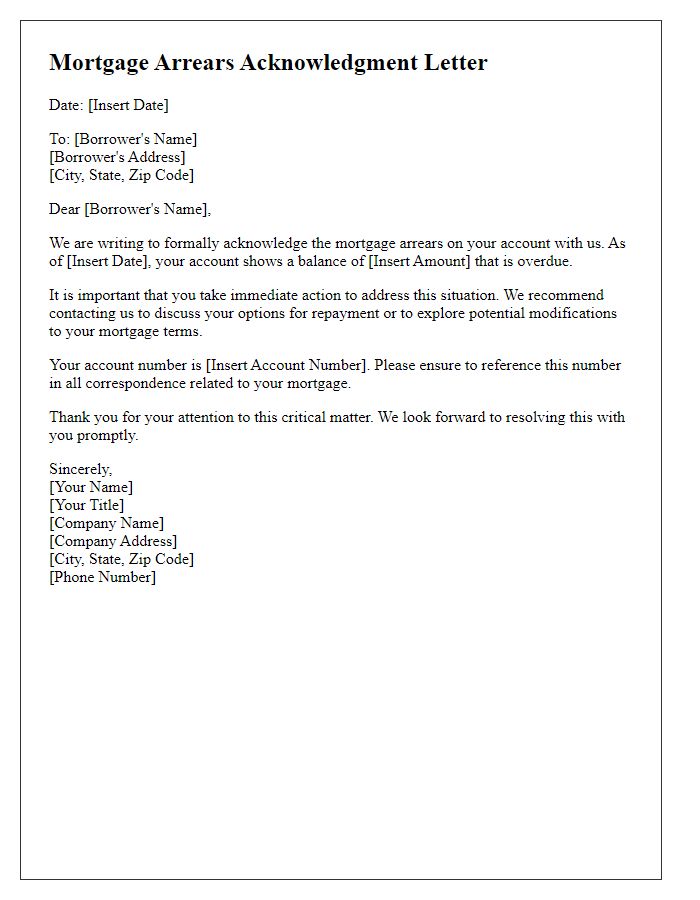

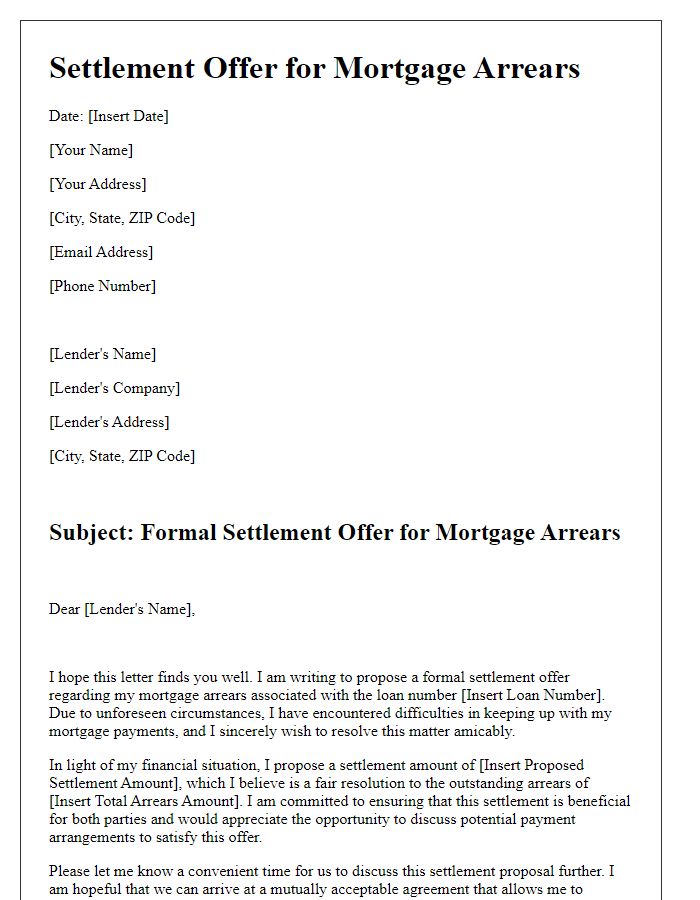

Contact Information for Further Communication

In mortgage arrears situations, establishing effective communication channels is crucial for resolution. Homeowners should gather essential contact information, including the mortgage lender's customer service hotline, typically available at 1-800-XXX-XXXX. Additionally, homeowners may benefit from reaching out to a designated loan officer or account manager, whose direct email address may be provided in prior correspondence. It is also advisable to note down local branch addresses for face-to-face discussions, especially if the lender is a prominent institution like Wells Fargo or Bank of America. Homeowners should keep track of any reference numbers associated with their mortgage account for smoother communication during negotiations. Furthermore, obtaining contact details for financial counseling organizations, such as the National Foundation for Credit Counseling, can provide valuable support and guidance throughout the settlement process.

Comments