Are you feeling overwhelmed by the complexities of your mortgage agreement? You're not aloneâmany homeowners find themselves in a similar situation. In this article, we'll explore the essential steps for effectively canceling a standard mortgage agreement, ensuring you understand your rights and options. So, grab a cup of coffee, and let's dive deeper into the process together!

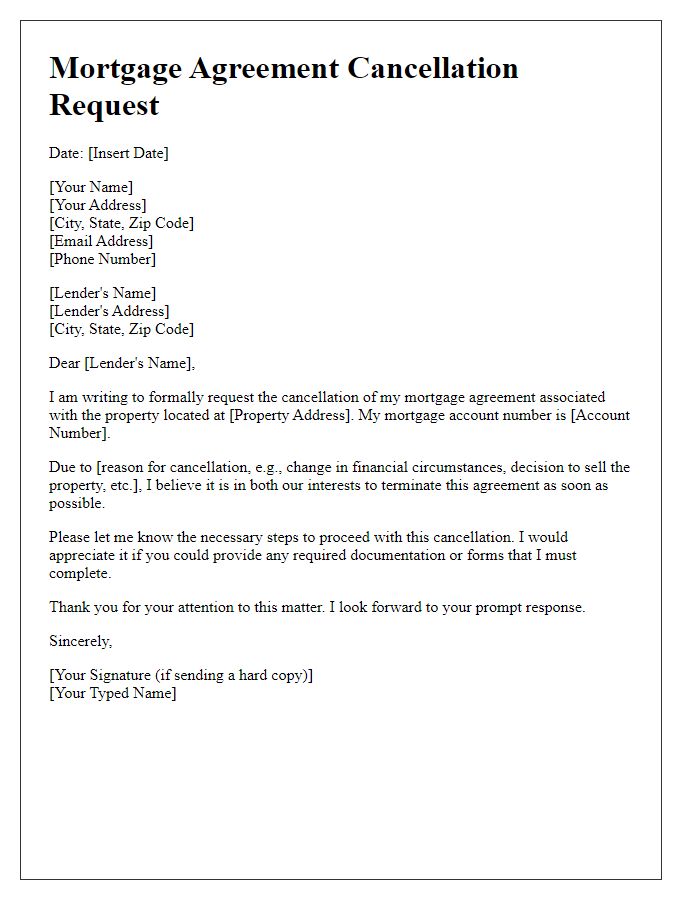

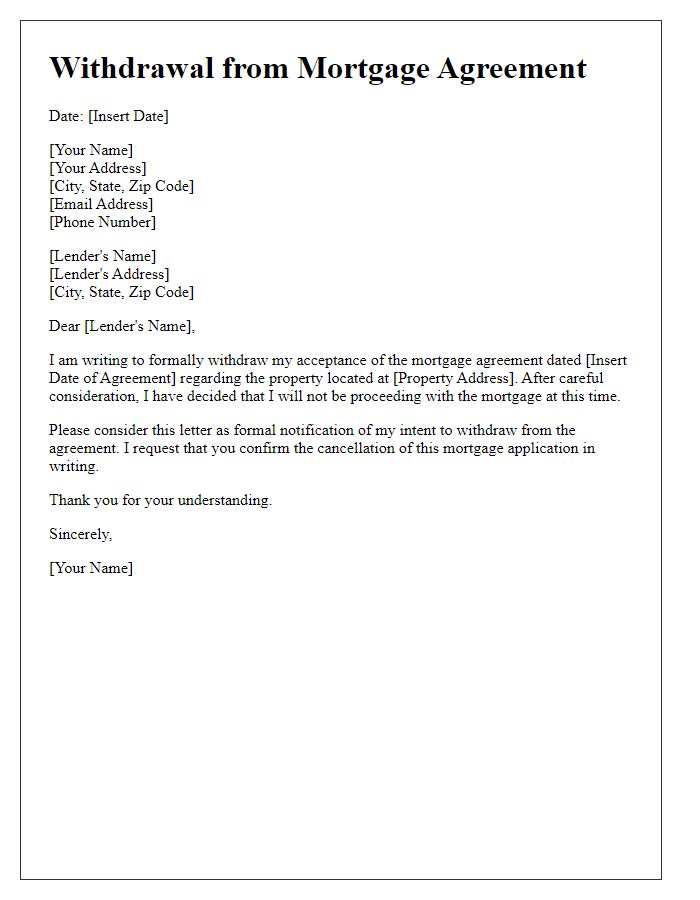

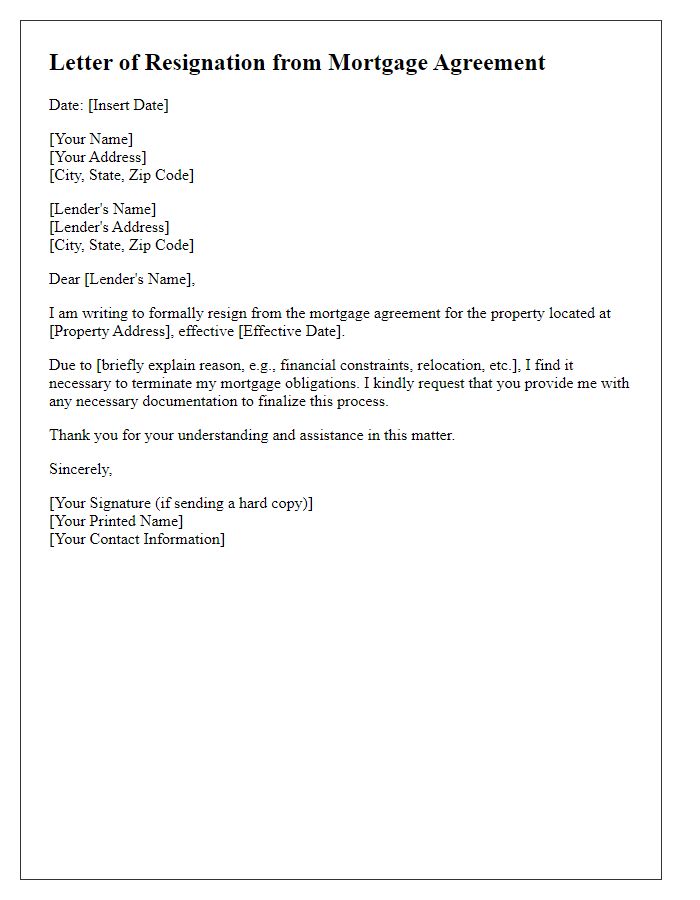

Borrower and lender contact information

The cancellation of a standard mortgage agreement involves key details regarding both the borrower and the lender. The borrower typically includes information such as full name, address (including zip code), and contact number, which facilitates effective communication during the cancellation process. The lender's details should comprise the institution's name, mailing address, and customer service phone number to address any potential inquiries. Additionally, referencing the mortgage account number, date of agreement, and loan amount is essential to accurately identify the specific loan being canceled. Including these details ensures a clear and efficient process for all parties involved.

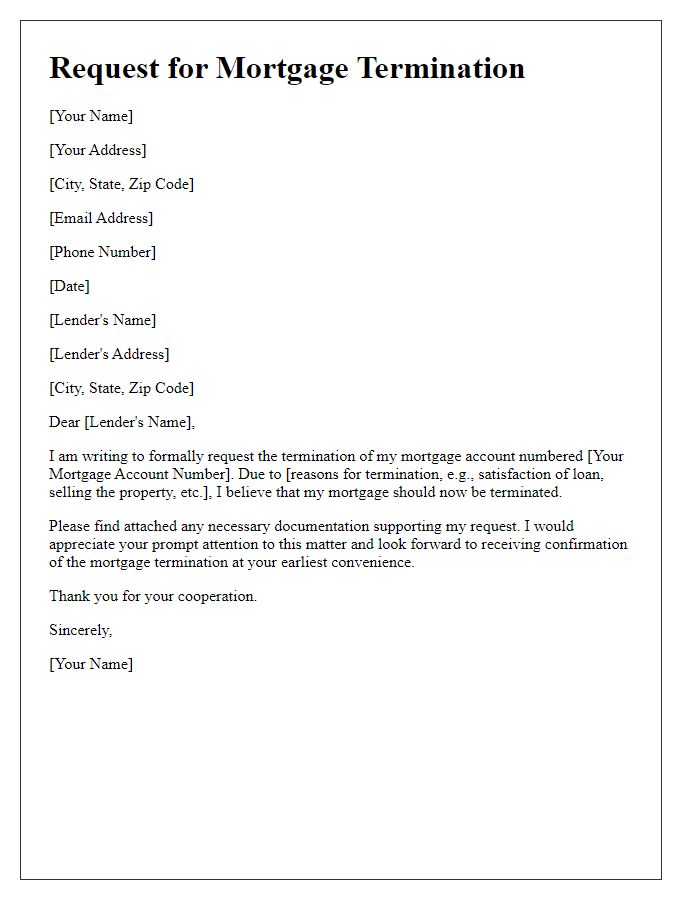

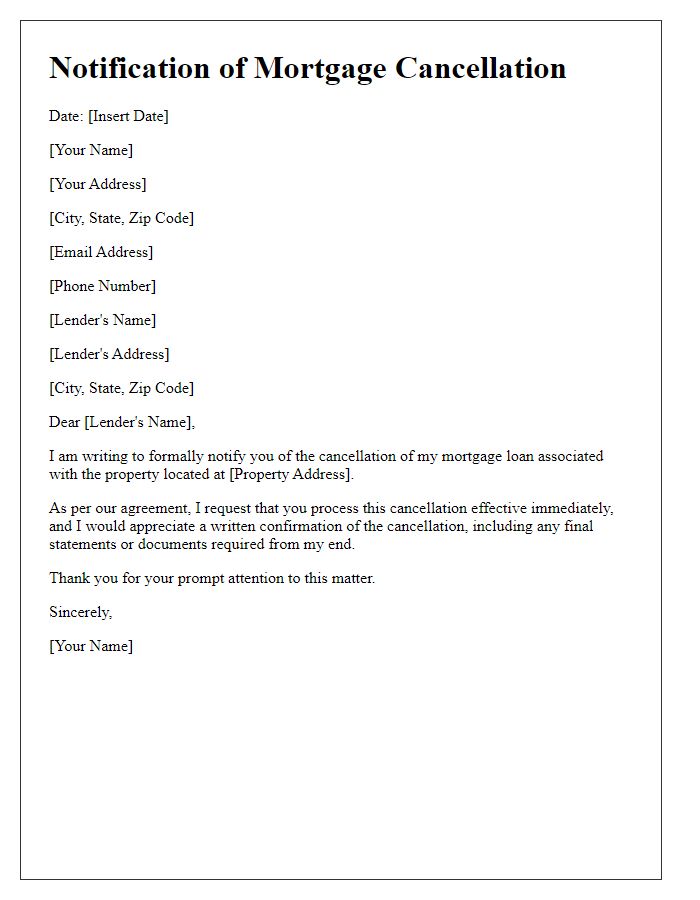

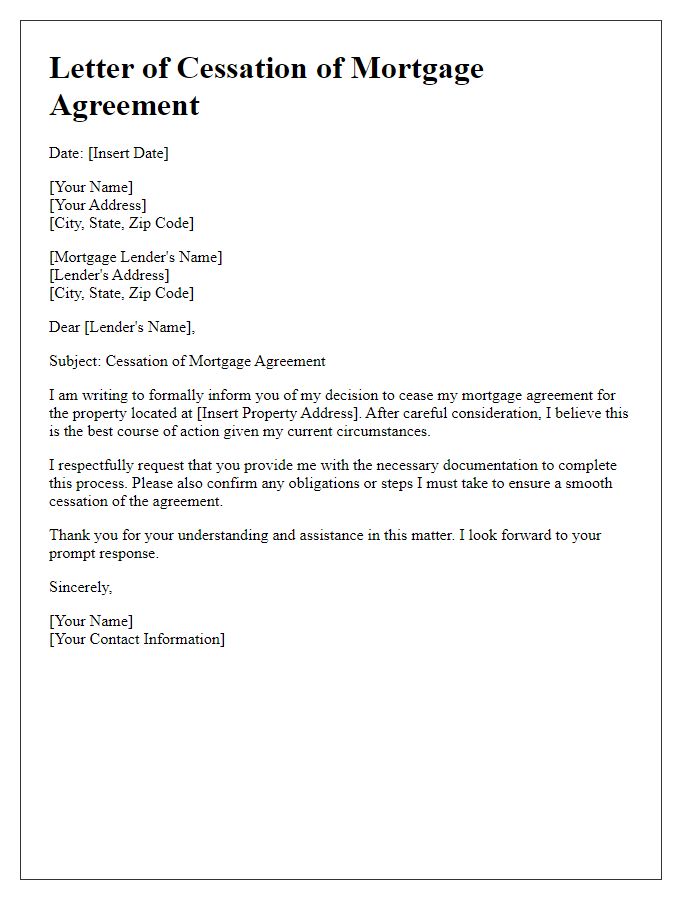

Effective cancellation date

Effective cancellation of a standard mortgage agreement typically requires acknowledgment of certain key terms and conditions. Borrowers must provide written notice to the lending institution, including the effective cancellation date, which is usually stipulated as a specific date or a period following the notice. Important details include the loan number, property address, and names of involved parties to ensure proper identification of the mortgage in question. Lenders may require additional documentation to finalize the cancellation process, including any necessary releases or agreements regarding outstanding balances or fees incurred before cancellation. This procedure ensures that both parties are in agreement about the termination of mortgage responsibilities.

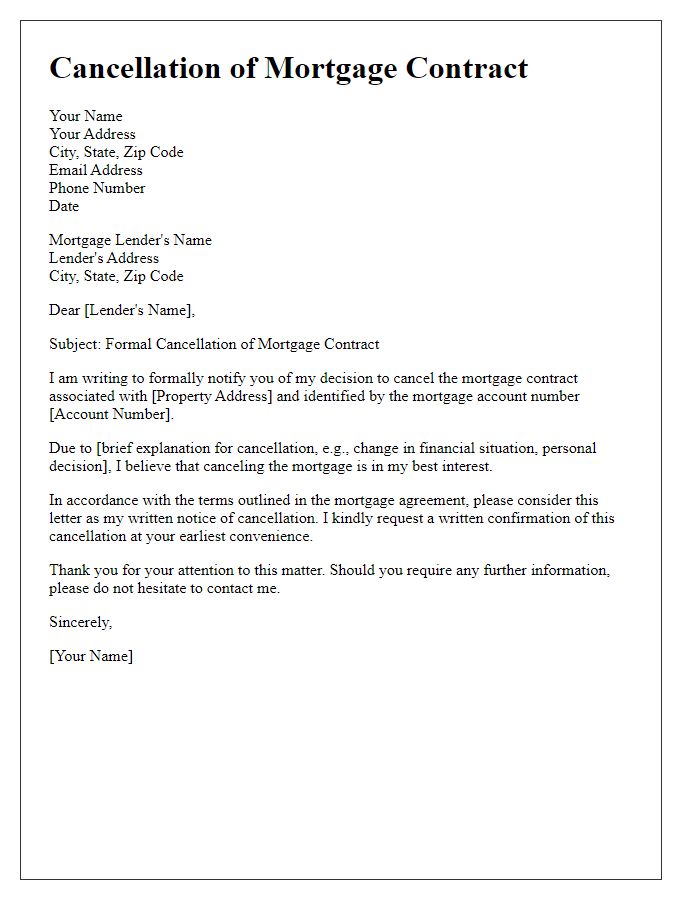

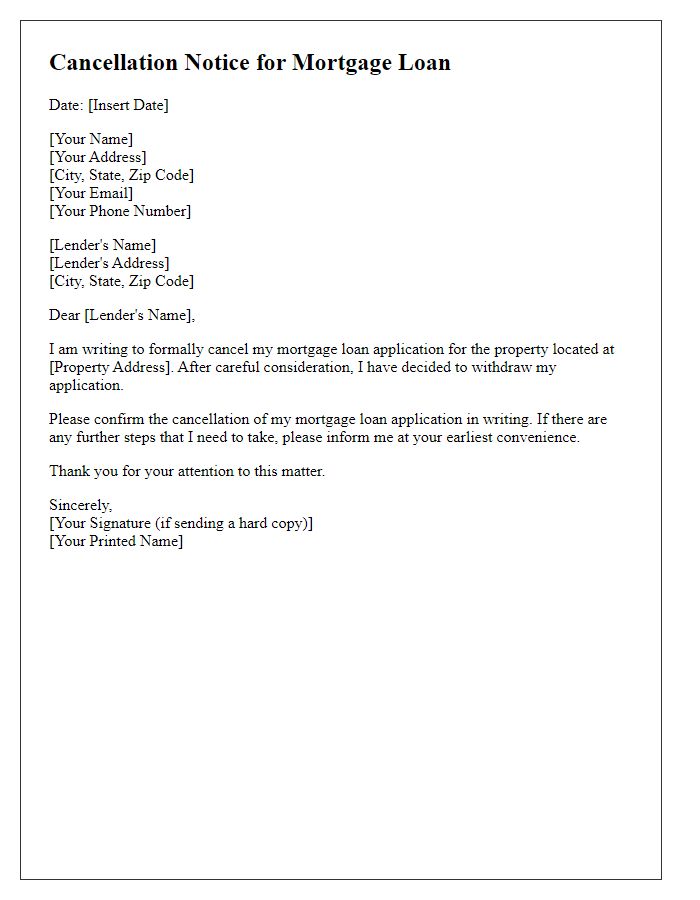

Mortgage loan details (account number, property address)

Mortgage loan cancellations may arise due to various reasons impacting homeownership. Standard cancellation procedures typically require a detailed account number, crucial for identifying the specific loan file. Property addresses serve as essential identifiers to ensure proper documentation of the associated real estate, which could involve single-family homes, condominiums, or townhouses. Timely submission of the cancellation request is vital; ideally, this should align with lender-specific guidelines and regulations that govern the mortgage agreement, reflecting changes in financial circumstances or market conditions. Lenders may also stipulate documentation regarding any outstanding payments to complete the cancellation process successfully.

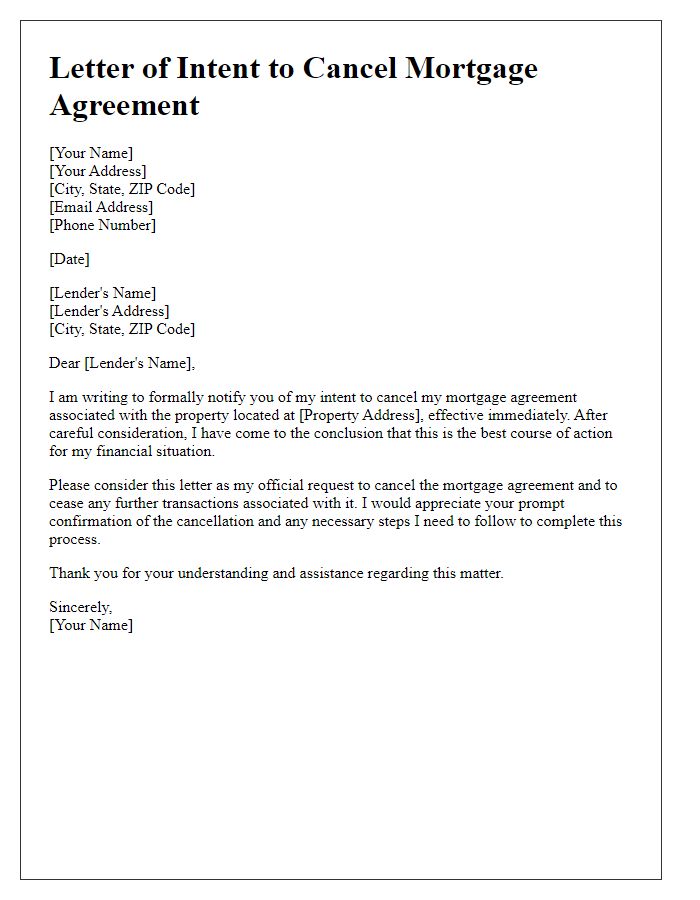

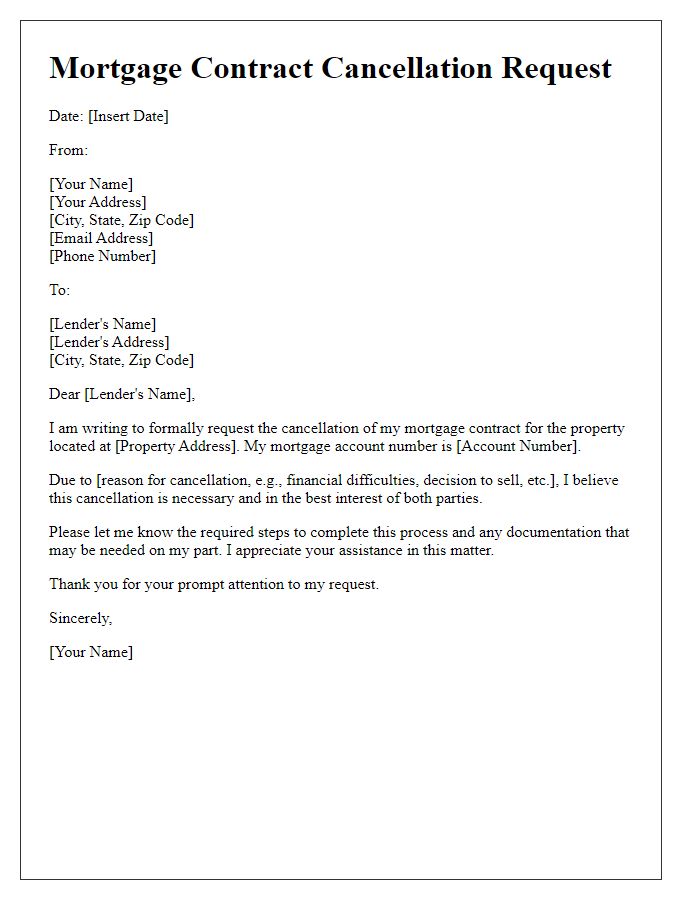

Reason for cancellation

Mortgage agreement cancellation may arise from various reasons, such as unforeseen changes in financial circumstances or dissatisfaction with loan terms. For instance, significant job loss leading to reduced income or discovering hidden fees and unfavorable interest rates that weren't clear during the signing process can prompt cancellation actions. Additionally, factors like changes in life events, such as divorce or relocation, may necessitate the cancellation of a mortgage agreement. Understanding specific laws and regulations related to mortgage cancellation in a particular region, such as the Truth in Lending Act (TILA) in the United States, is crucial for ensuring compliance during the cancellation process. Handling this matter promptly can also prevent additional financial burdens or penalties.

Statement of any remaining obligations or payments

A standard mortgage agreement cancellation may involve several remaining obligations, which can include outstanding payments on the principal balance, accrued interest, property taxes, and potential fees associated with the early termination of the loan. Borrowers should be aware of the specific timeline for payment settlement, typically indicated in the original loan documentation. Additionally, if any property was pledged as collateral, it may be necessary to complete a deed of reconveyance to release the lender's lien. Understanding state-specific laws and terms stipulated in the mortgage contract is essential to ensure compliance with the cancellation process.

Comments