Are you facing challenges with your mortgage payments and considering the need for mortgage default insurance? This type of insurance can provide you with essential financial protection, ensuring that you are covered in case of unforeseen circumstances. Navigating the process can seem daunting, but understanding your options is key to finding the right solution for your needs. Read on to discover how to effectively draft a request letter for mortgage default insurance that addresses your specific situation.

Borrower's personal information and contact details

Mortgage default insurance serves as a financial safety net for lenders, specifically protecting against potential losses when borrowers fail to meet repayment obligations. When seeking this insurance, essential borrower information includes full name, address (including city and postal code), date of birth, employment status, and contact details such as phone number and email address. Furthermore, financial details, such as annual income, outstanding debts, and current credit score, are critical for assessing eligibility. Providing comprehensive documentation, including proof of income and identification, can facilitate the approval process for this insurance, crucial for securing financing on homes valued at less than 20% equity, in locations such as Toronto or Vancouver, where housing prices are often exorbitantly high.

Loan and mortgage account details

Mortgage default insurance protects lenders against losses when borrowers default on their loans. In Canada, for example, the Canada Mortgage and Housing Corporation (CMHC) provides this type of insurance for high-ratio mortgages (typically those with down payments less than 20%). Essential loan details include the mortgage account number, which uniquely identifies the loan, as well as the total loan amount (often in the hundreds of thousands of dollars), and the interest rate percentage (usually ranging from 2% to 4% in recent years). Additionally, providing information about the property address enhances the context, indicating whether it is residential or commercial, which can impact insurance requirements.

Explanation of the reason for insurance request

Mortgage default insurance is typically required for borrowers who provide a down payment of less than 20% when purchasing residential properties in Canada. Lenders, such as banks or credit unions, mandate this insurance to protect themselves against potential losses if a borrower fails to make mortgage payments. This type of insurance ensures that financial institutions can recover outstanding amounts in the event of default, securing their investment even in fluctuating housing markets. The insurance premiums, calculated as a percentage of the mortgage amount, can significantly assist buyers in obtaining financing, allowing access to homeownership while minimizing the lender's risk. The implications of mortgage default insurance extend beyond individual borrowers, impacting overall mortgage lending guidelines and housing market stability in the region.

Supporting financial documentation

Requesting mortgage default insurance involves submitting supporting financial documentation to a lender. Essential documents include recent pay stubs (typically from the last 30 days), bank statements (covering the last three months for all accounts), and tax returns (for the previous two years). Additional information might include a credit report, which provides insight into payment history and outstanding debts. Important details such as the property address, loan amount, and borrower information should be clearly stated. Understanding the average processing time of 10 to 14 business days for mortgage insurance applications can streamline communication with the lender. Ensure all documentation adheres to the lender's specific requirements to avoid delays.

Desired coverage amount and terms

Mortgage default insurance serves as a safeguard for lenders in the event of borrower default within Canadian real estate transactions. Typically, borrowers must secure coverage when their down payment is less than 20% of the property's purchase price. The desired coverage amount often aligns with the mortgage value, potentially ranging from 80% to 95% of the home's appraised value. Terms of the insurance may include premium costs, which can be rolled into monthly mortgage payments, and specific eligibility criteria set by entities such as the Canada Mortgage and Housing Corporation (CMHC) or private insurers. Understanding these details is vital for ensuring adequate protection against financial risks associated with mortgage default.

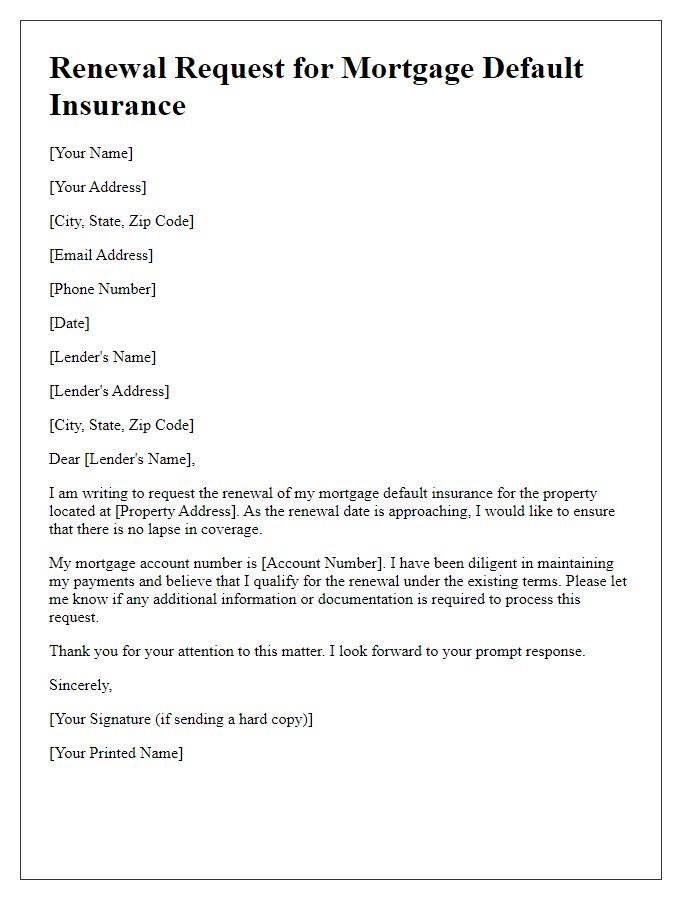

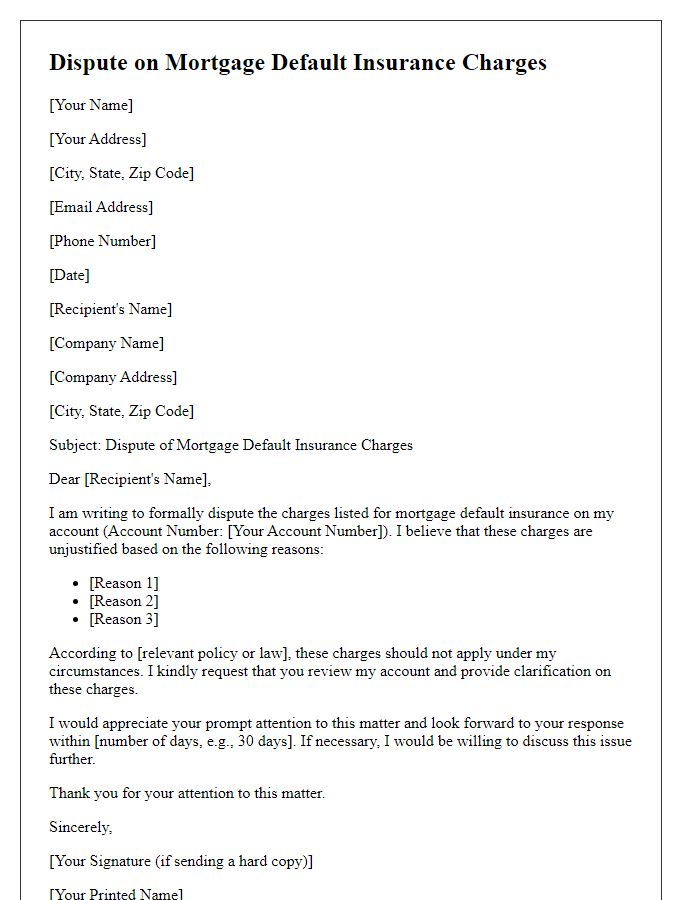

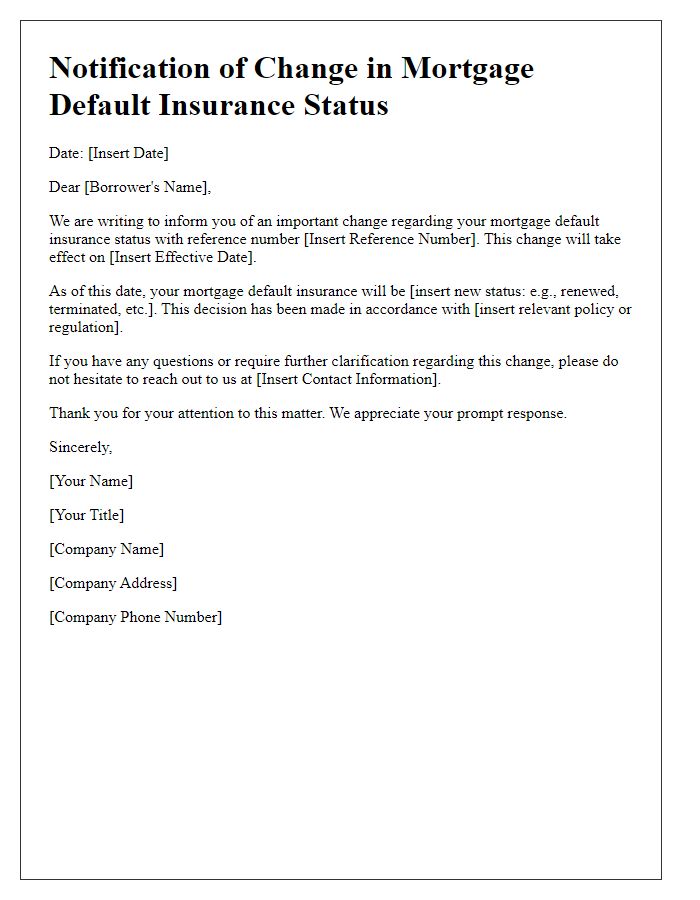

Letter Template For Request On Mortgage Default Insurance Samples

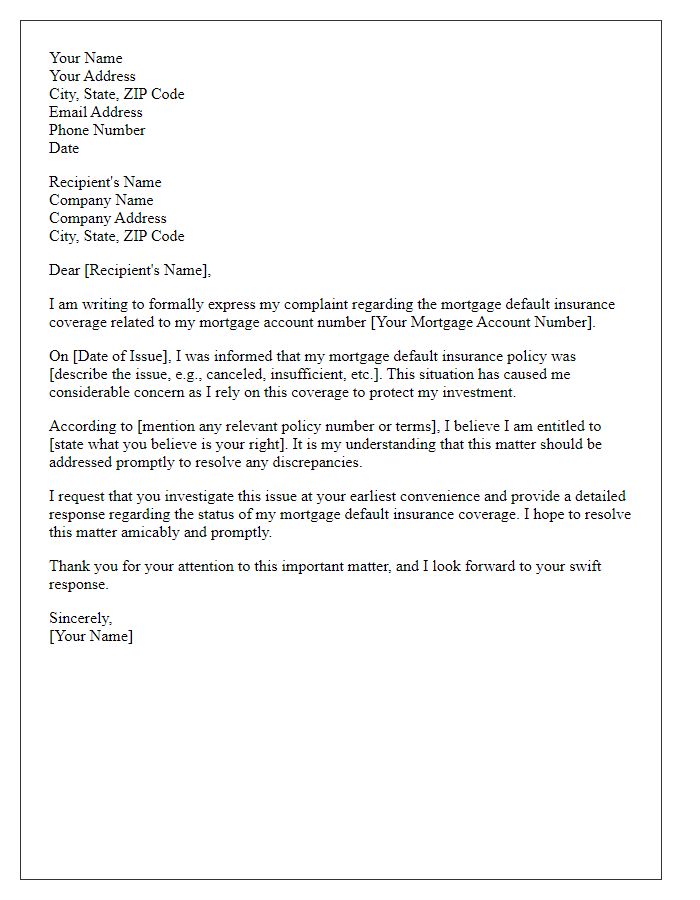

Letter template of complaint regarding mortgage default insurance coverage

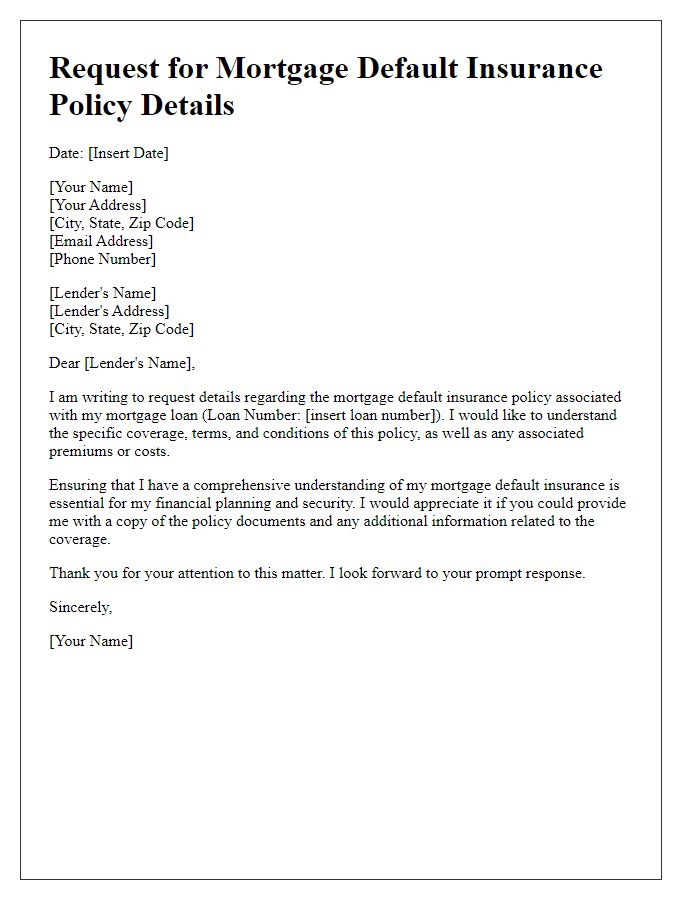

Letter template of request for mortgage default insurance policy details

Comments