Are you tired of feeling like you're paying too much for your mortgage? Negotiating your mortgage rate can seem daunting, but it's a powerful way to save money and secure a better deal for your financial future. With the right approach and a well-crafted letter, you can make a compelling case to your lender for a lower rate. So, whether you're a first-time buyer or looking to refinance, join us as we delve into essential tips and a handy template to help you navigate this process effectively.

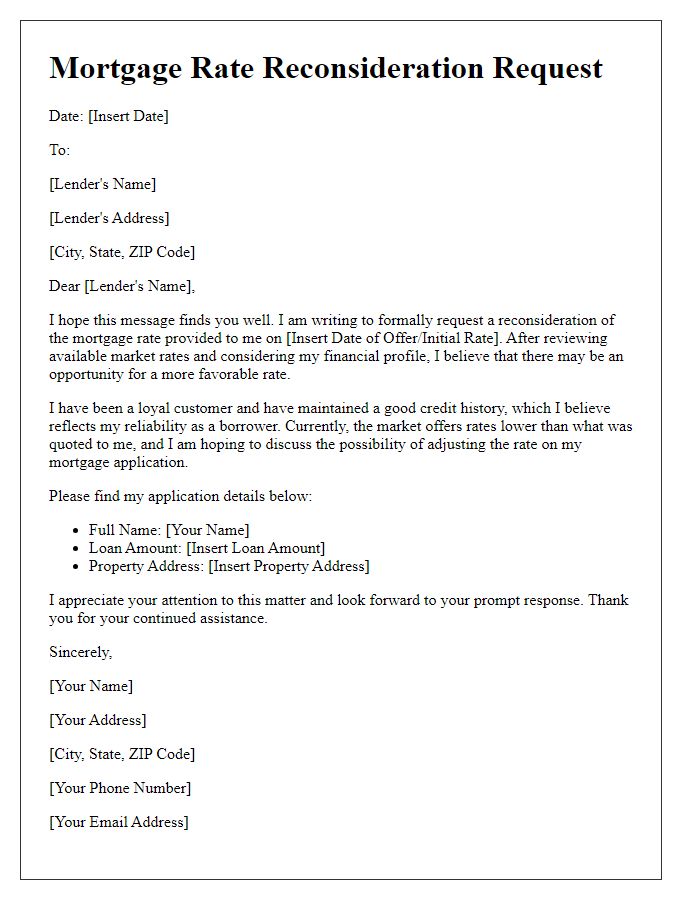

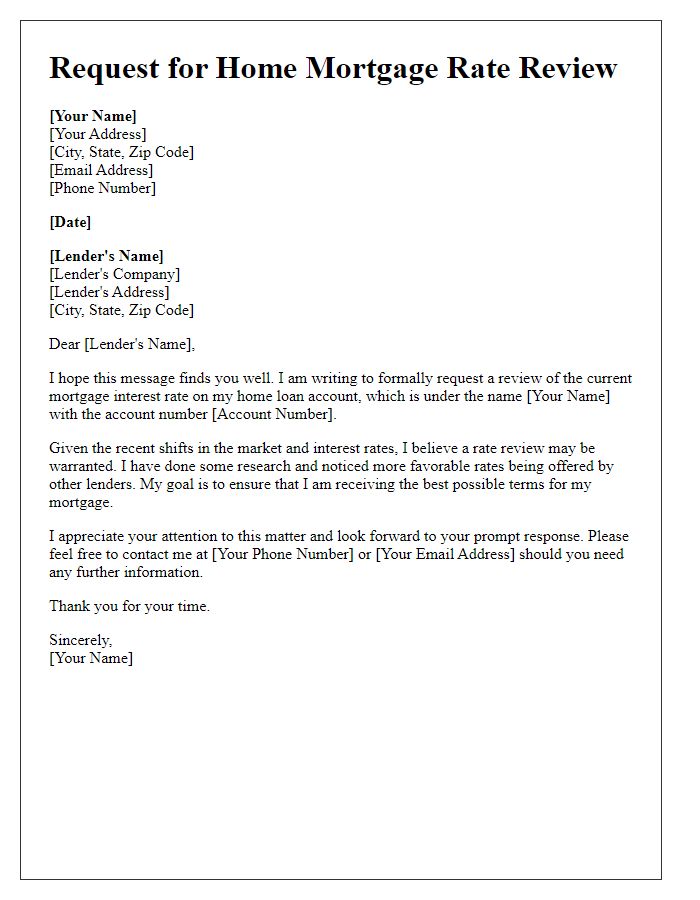

Clear Subject Line

Subject: Request for Mortgage Rate Negotiation Offer This mortgage negotiation request aims to reduce the current interest rate on the home loan from XYZ Bank for the property located at 1234 Elm Street, Springfield. The existing rate of 4.5% could significantly impact monthly payments of approximately $1,500 for a 30-year fixed mortgage, amounting to over $250,000 in total interest paid over the life of the loan. Comparative analysis shows that competing lenders offer rates as low as 3.8%, highlighting potential savings of $60 monthly, translating into $21,600 over 30 years. This negotiation is grounded in strong credit history (credit score exceeding 740) and consistent income verification, aiming to secure a more favorable rate that aligns with current market trends and financial goals.

Personal Greeting

Negotiating mortgage rates can lead to significant savings for homeowners, particularly in a fluctuating economy where interest rates impact monthly payments. In October 2023, the average mortgage rate for a 30-year fixed loan hovered around 7.5%, signaling an opportunity for negotiation. Potential homeowners can approach lenders, such as Wells Fargo or Bank of America, armed with competitive offers from other banks that may offer lower rates, sometimes as low as 6.8%. Highlighting factors such as strong credit scores, steady income, and a substantial down payment can strengthen a negotiation. Homeowners located in high-cost areas like San Francisco or New York, where property prices impact loan amounts, may benefit more from reduced rates, ultimately influencing their overall financial stability.

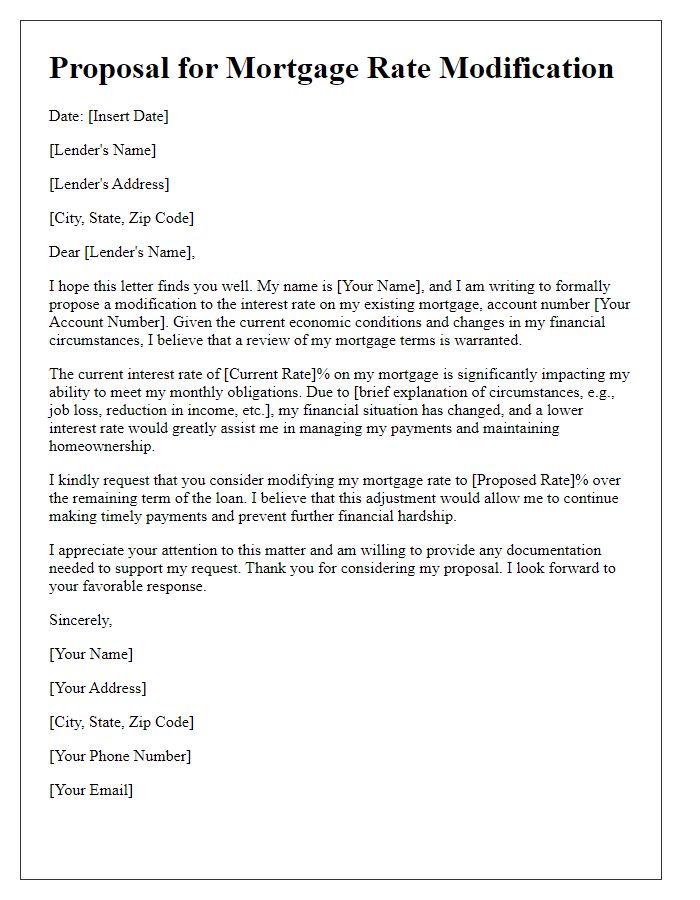

Current Mortgage Details

Current mortgage details often include the principal amount of $300,000, at an interest rate of 4.5% fixed, over a 30-year term. Monthly payments would typically amount to approximately $1,520. This mortgage is held with a prominent lender like Wells Fargo, under a loan number (123456789). The current market conditions in October 2023 indicate a decline in average mortgage rates, now nearing 3.75% for similar loans, prompting homeowners to explore negotiation options. Additionally, property values in neighborhoods such as Westwood have increased by 12% in the past year, enhancing equity and providing leverage for negotiations.

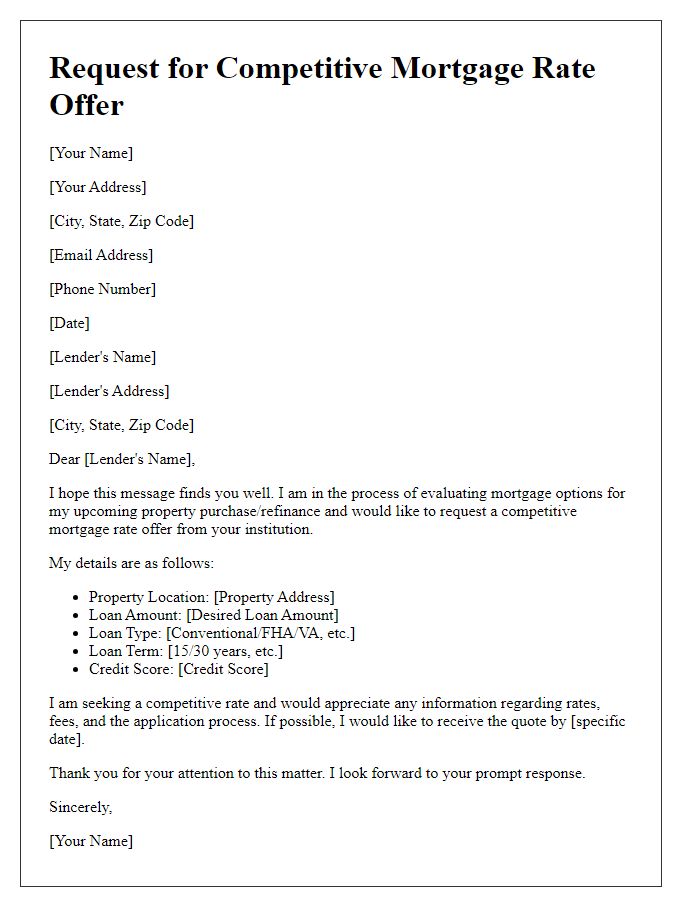

Proposed Rate and Terms

Negotiating a mortgage rate can significantly impact long-term financial commitments. A proposed interest rate of 3.25% can provide substantial savings compared to current market rates averaging around 4.5% as of October 2023. Requesting a 30-year fixed mortgage term ensures consistent monthly payments, ideal for homeowners in areas with fluctuating property values, such as California's real estate market. Additionally, suggesting lower closing costs around $2,000 instead of the typical $3,500 can enhance affordability. Highlighting a strong credit score, exceeding 750, and a stable income history can further strengthen the negotiation position, making lenders more likely to consider favorable adjustments in the proposed rate and terms.

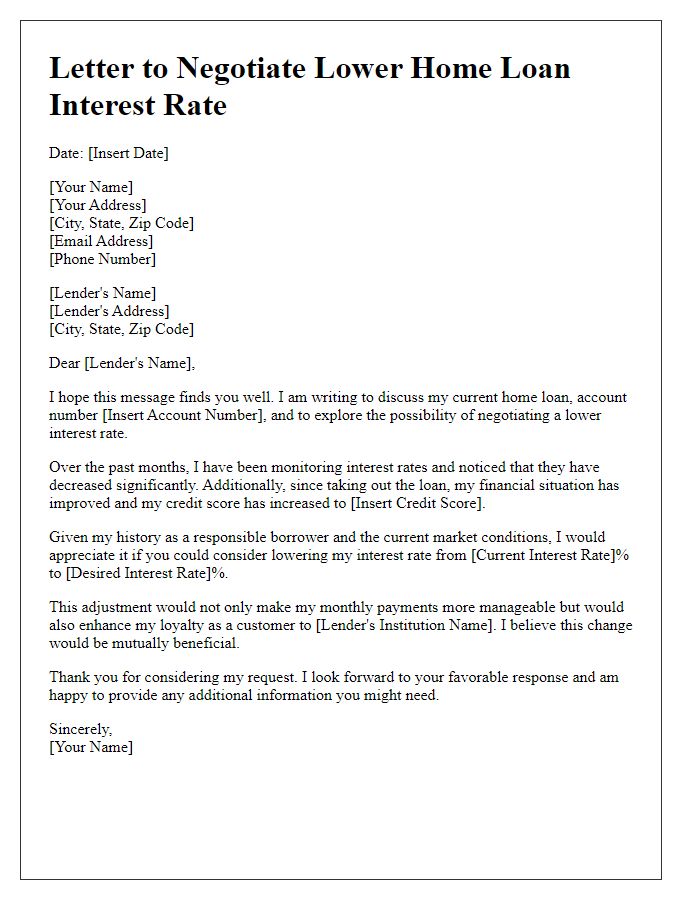

Call to Action

Mortgage rate negotiations can significantly impact long-term financial commitments, especially for homeowners seeking favorable terms. Numerous lenders, including traditional banks and credit unions, offer varying interest rates influenced by market trends. For example, a 30-year fixed mortgage can have rates fluctuating between 3% and 5% over a year, depending on economic conditions. By initiating negotiations, homeowners can explore potential savings of thousands of dollars, especially when evaluating the total cost of the loan, including interest accrued over time. Engaging a mortgage broker may also enhance negotiation leverage, providing insights into current offers and helping homeowners secure the best possible deal.

Comments