Are you feeling a bit overwhelmed by the responsibilities that come with your mortgage? You're not alone; many borrowers have questions about their rights and obligations when it comes to home loans. Understanding the ins and outs of mortgage responsibilities is crucial for making informed decisions. Stick around as we dive deeper into what you need to know to navigate your mortgage journey confidently!

Borrower's Contact Information

The mortgage responsibility of the borrower, identified by the borrower's contact information, which includes full name, phone number, and email address, is crucial for maintaining communication with the lender. These details support efficient processing of payments and queries regarding the mortgage agreement, a legal document outlining the terms of the loan for purchasing real estate, such as a house or condominium. Clarity in borrower responsibility ensures that the borrower remains informed about their obligations, such as timely monthly payments and adherence to interest rates, which can fluctuate based on market conditions. Accurate and updated contact information helps prevent misunderstandings regarding missed payments, which can lead to foreclosure or additional fees, thereby reinforcing the importance of responsible financial management throughout the mortgage term.

Lender's Contact Information

Lender's contact information is vital for establishing clear communication regarding mortgage responsibilities. This includes essential details such as the lender's full name, typically represented by a financial institution like Bank of America or Wells Fargo, and their physical address, which is crucial for documentation purposes. Phone numbers, often including a toll-free option for convenience, allow borrowers to seek immediate clarification on mortgage queries. Additionally, email addresses provide a digital means for submitting inquiries or formal communications. It's beneficial to include the lender's website URL for access to online resources, mortgage calculators, or customer service portals, further aiding borrowers in understanding their commitments and responsibilities related to their loans.

Loan Details and Terms

Mortgage agreements establish significant financial responsibilities for borrowers, typically outlined in detailed loan documents. Essential components include the principal amount, which might range from $100,000 to several million dollars depending on the property value and borrower qualifications. Interest rates, often variable or fixed, are crucial for understanding monthly payment obligations, with current average rates hovering around 3% to 4%. Loan terms typically span 15 to 30 years, dictating the duration of repayment and impacting overall interest paid. Borrowers must maintain homeowners insurance to protect their investment, and property taxes are also critical financial responsibilities that vary by location, sometimes reaching thousands annually. Furthermore, borrowers must adhere to all terms specified by the lender, including late fees and prepayment penalties, to avoid default. Understanding these elements is vital for financial planning and responsible homeownership.

Borrower's Obligations and Responsibilities

Mortgage borrowers must understand their obligations and responsibilities to ensure smooth loan servicing and avoid potential pitfalls. Monthly mortgage payments must be made timely (typically by the first of each month) to avoid late fees and damage to credit scores, measured by FICO scores. Maintaining the property (which includes ensuring structural integrity and appropriate zoning compliance) is crucial for preserving its value and adhering to lender requirements. Borrowers must also keep homeowners insurance active (usually a minimum coverage of $100,000), protecting both the property and the lender's investment. Communication with lenders is essential, especially in circumstances such as job loss, which can lead to financial distress and potential foreclosure (a legal process that can occur after several missed payments, often starting after 90 days). Lastly, understanding the terms of the mortgage agreement, including interest rates (fixed or variable), is vital as it affects overall financial obligations over the loan term.

Request for Clarification or Confirmation

Borrowers often face confusion regarding mortgage responsibilities, which involve terms like principal, interest, taxes, and insurance. A mortgage agreement, typically spanning 15 to 30 years, requires timely payments to avoid penalties. Missed payments may incur late fees and affect credit scores, often monitored by agencies like FICO. Specific obligations, such as property maintenance and adherence to lender policies, can vary by state, impacting overall financial liability. Understanding these responsibilities is crucial for effective financial planning and maintaining loan eligibility with lenders like Wells Fargo or Bank of America.

Letter Template For Borrower Mortgage Responsibility Clarification Samples

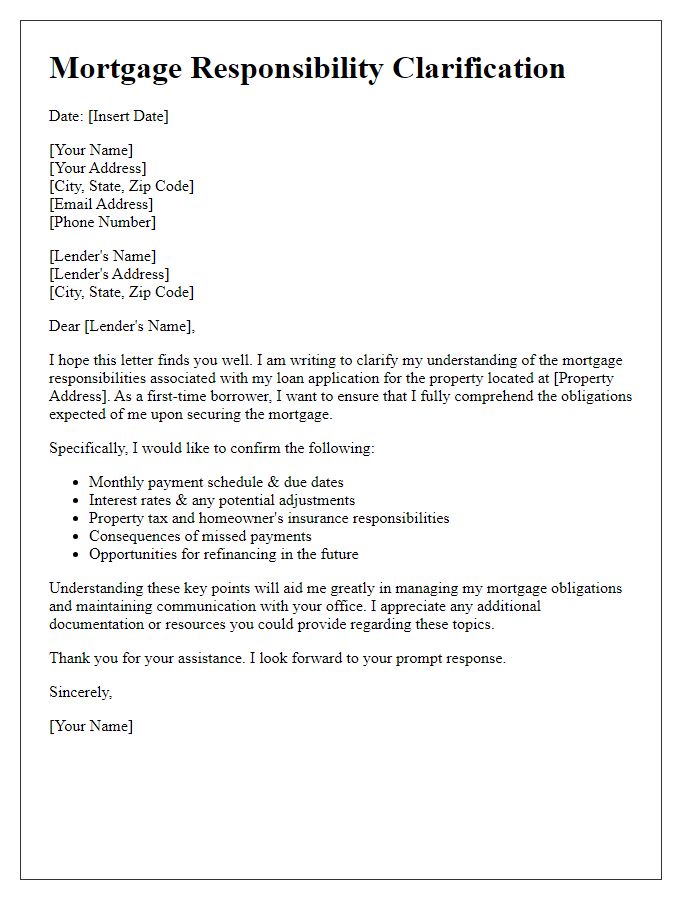

Letter template of mortgage responsibility clarification for first-time borrowers

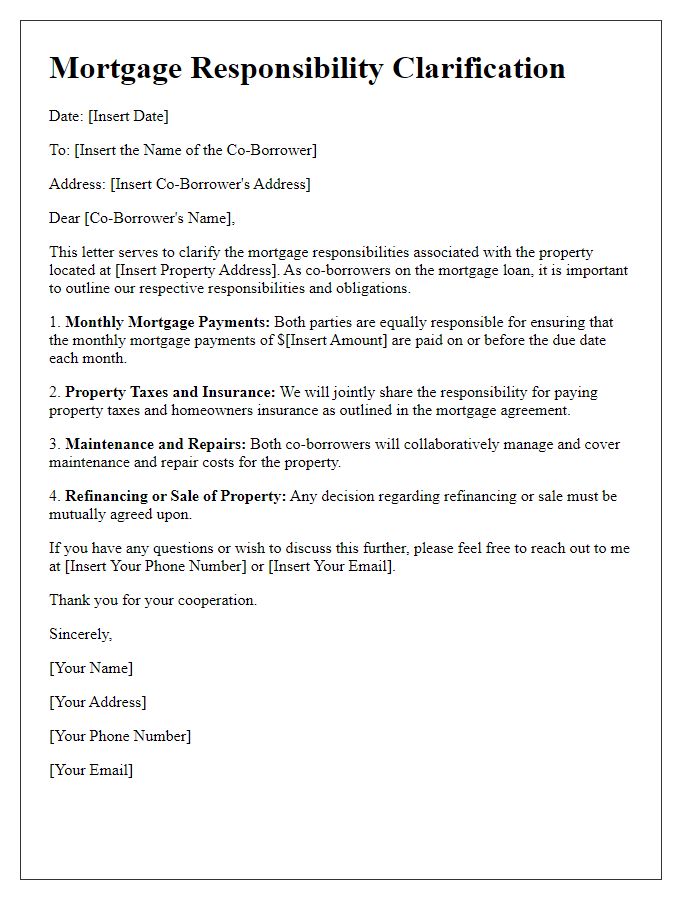

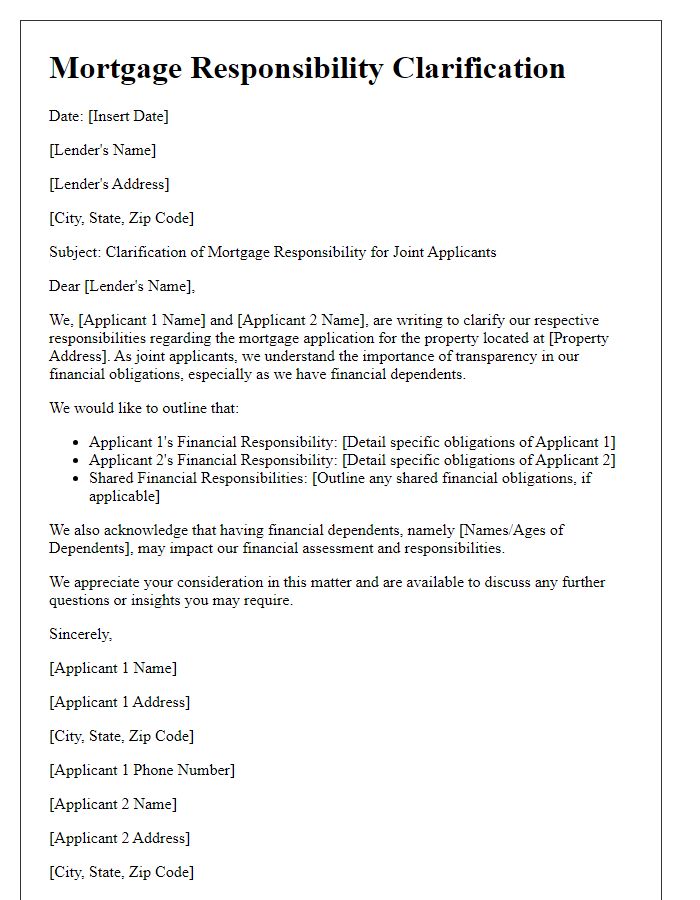

Letter template of mortgage responsibility clarification for co-borrowers

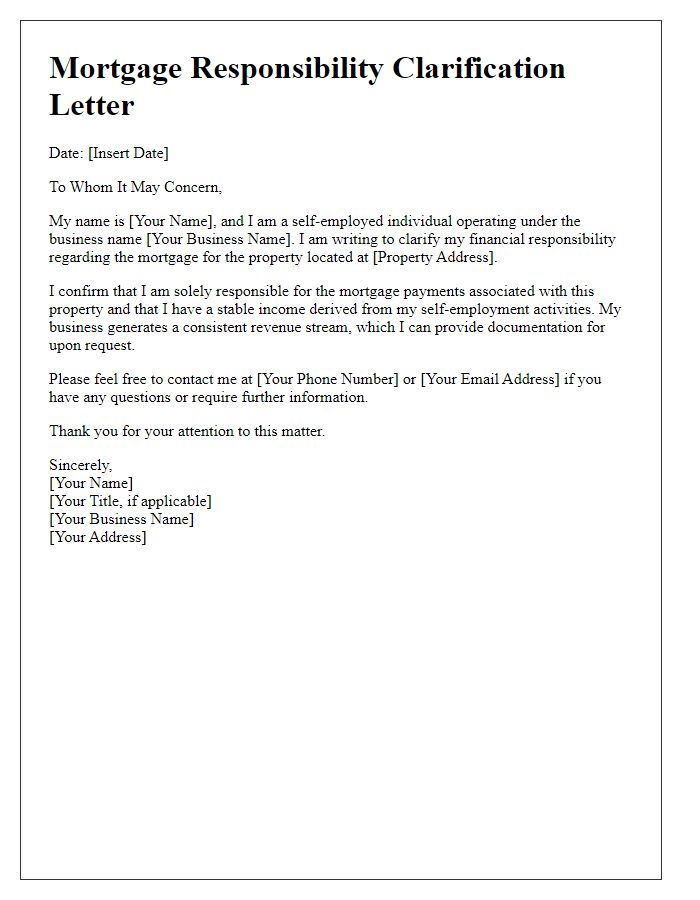

Letter template of mortgage responsibility clarification for self-employed individuals

Letter template of mortgage responsibility clarification for repeated applicants

Letter template of mortgage responsibility clarification for real estate investment properties

Letter template of mortgage responsibility clarification for low-income applicants

Letter template of mortgage responsibility clarification for refinanced mortgages

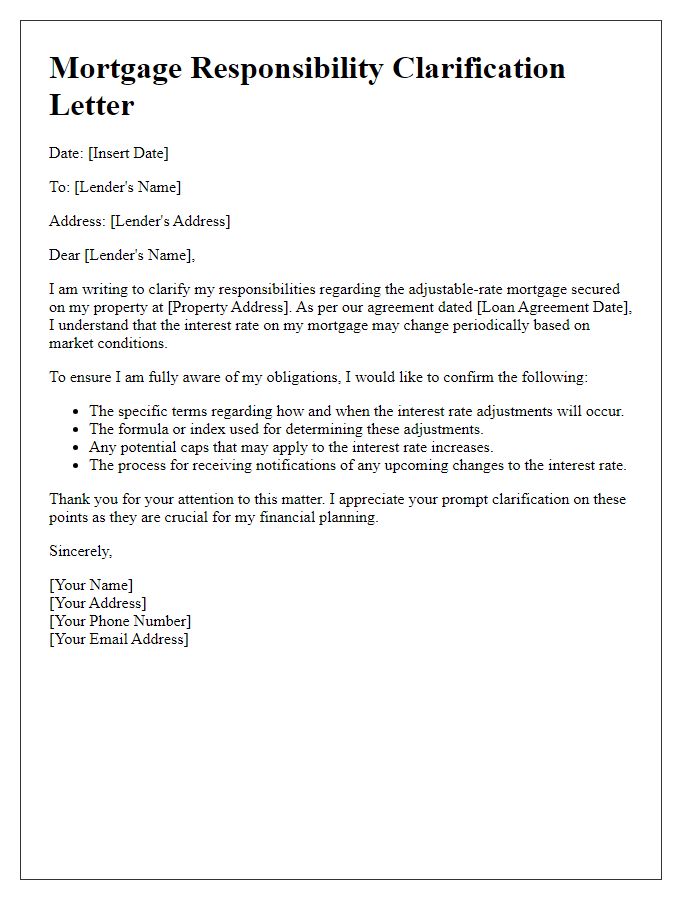

Letter template of mortgage responsibility clarification for adjustable-rate mortgages

Comments