Are you looking for a straightforward and effective way to verify employment for a mortgage application? Writing a verification letter doesn't have to be complicated; it can be as simple as following a template that covers all the necessary details. This article will guide you through creating a clear and concise letter that will satisfy lenders and streamline the mortgage process. So, let's dive in and explore how to craft the perfect verification of mortgage employment letter!

Employee's full name and job title

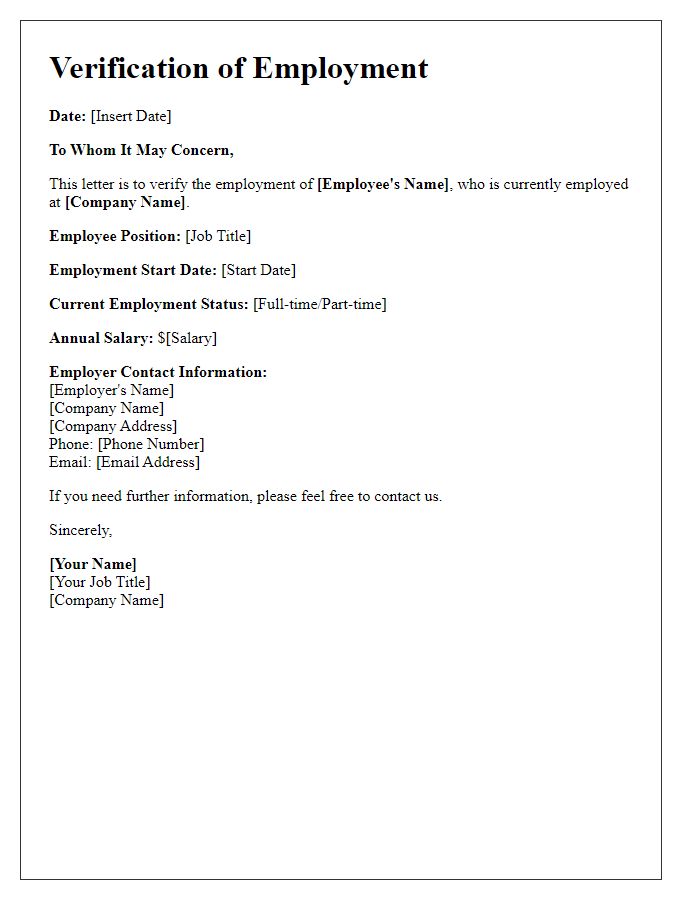

In the process of verifying mortgage employment, it is essential to confirm important details regarding the employee. Employee's full name, as listed on official records, and job title, which reflects their current position within the company, are critical elements. These details aid in establishing the employee's employment status and income, both necessary for mortgage approval. Accurate verification ensures that financial institutions can assess an applicant's ability to fulfill loan obligations and aids in maintaining the integrity of the mortgage process.

Employment status (full-time, part-time)

Mortgage employment verification is crucial in the loan process to establish an individual's current employment status. Full-time employees typically work 40 hours a week within a structured schedule, while part-time employees work fewer hours, often with flexible or variable shift patterns. Accurate verification confirms not only employment status but also income stability, vital for mortgage lenders to assess repayment capability. Many lenders might look for confirmation through official documents like pay stubs, W-2 forms, or direct inquiries with the employer for clarity on the applicant's role, duration of employment, and income status, ensuring all details align with lending requirements.

Duration of employment

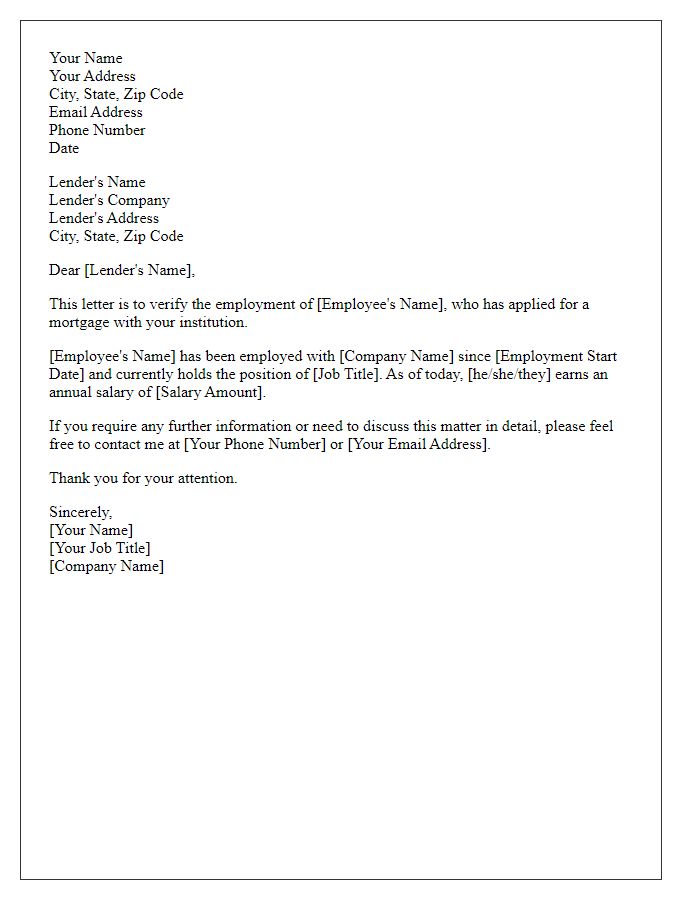

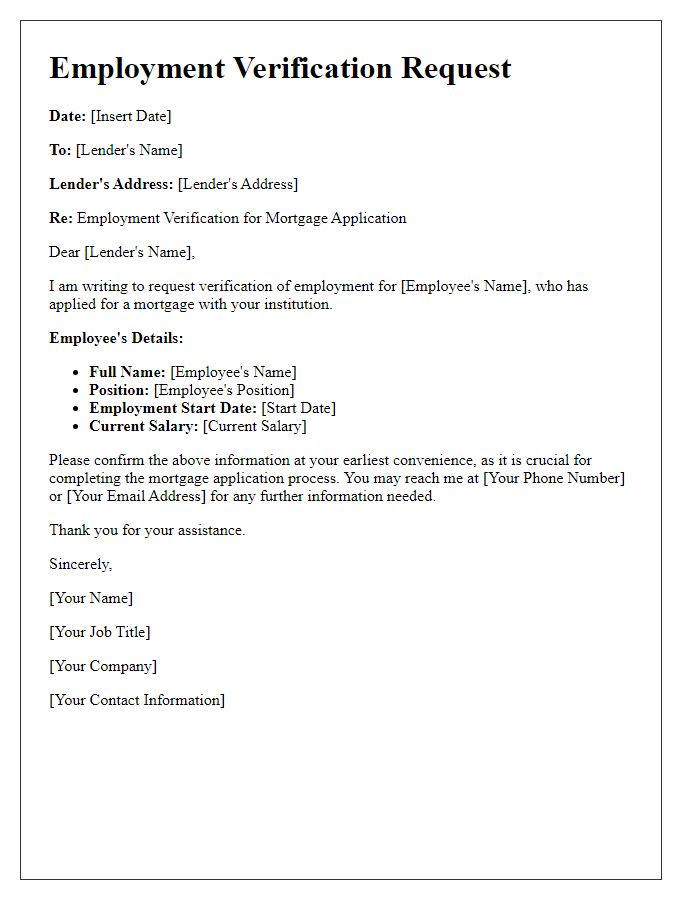

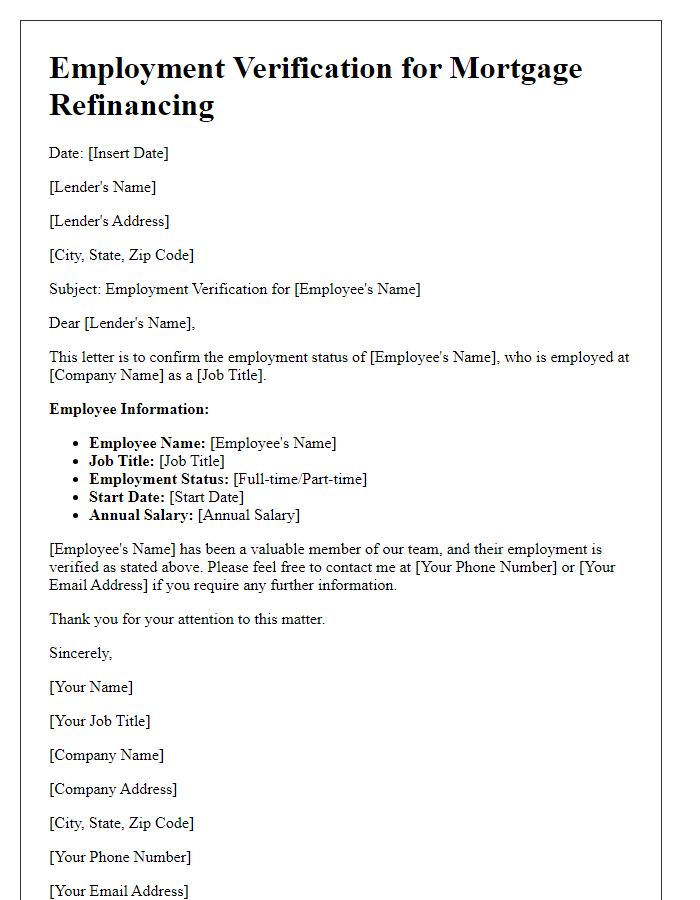

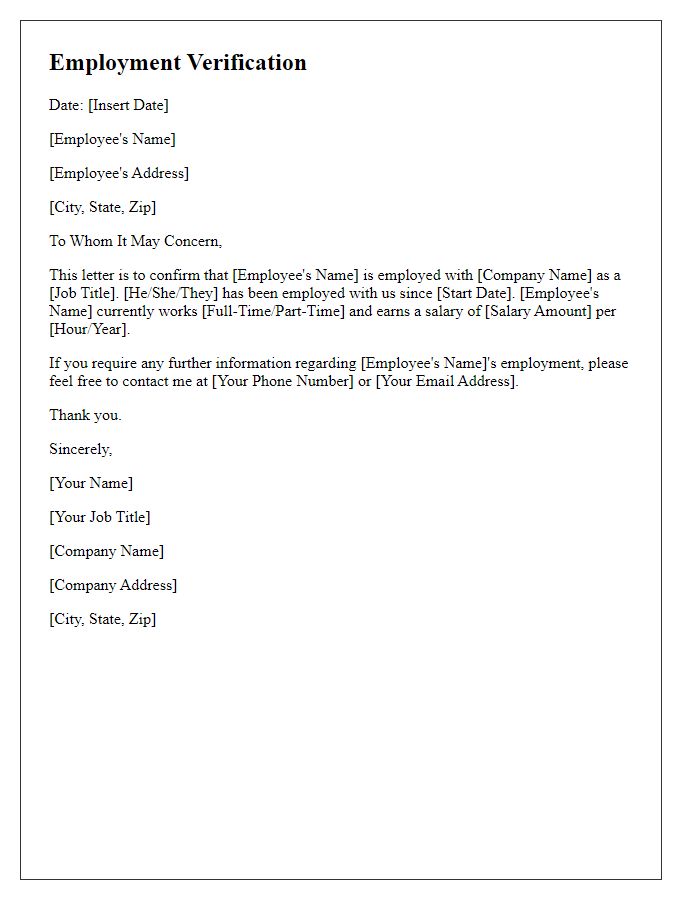

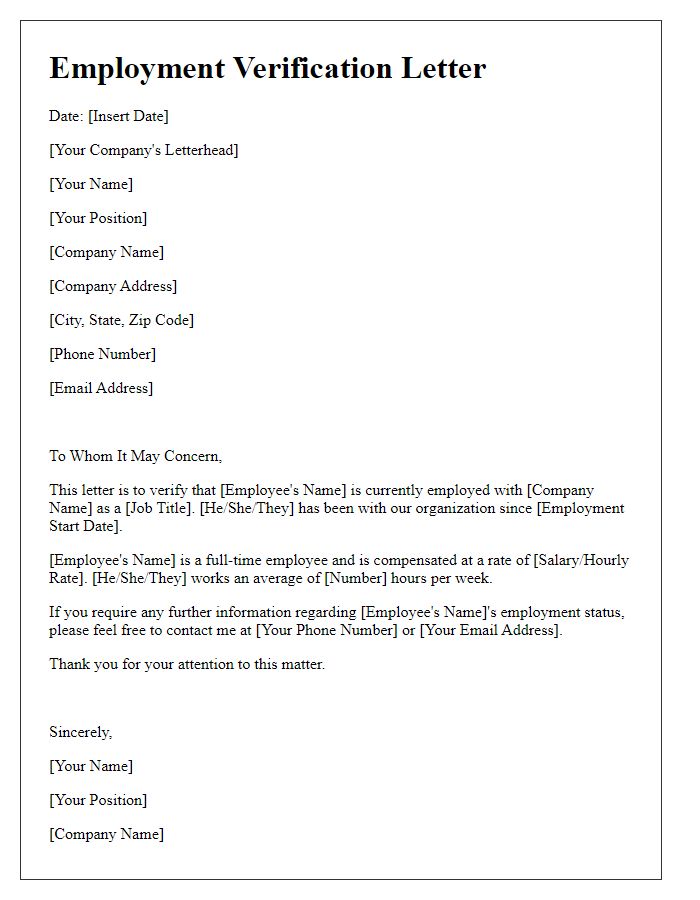

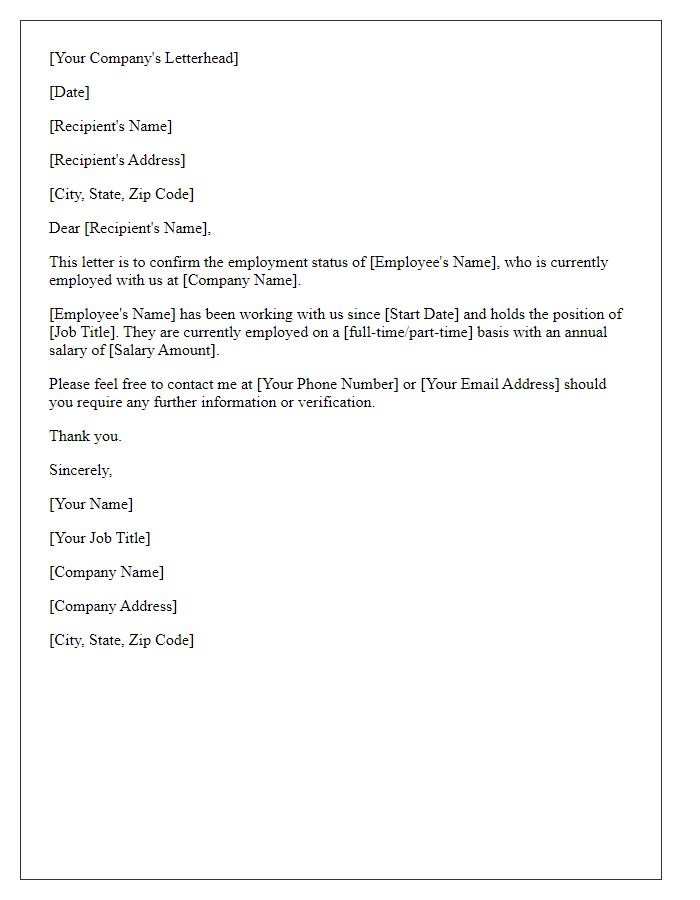

A verification of mortgage employment letter serves as an official document that confirms an individual's employment status, duration of employment, and salary details for the purpose of securing a mortgage. This letter typically includes crucial information such as the employee's full name, the company's name (where the employee is currently working), and the specific duration of employment--often detailed in months or years. For example, if an employee has been with the company since June 2019, the letter would state the start date, emphasizing a continuous employment period of over four years as of October 2023. Additionally, details about the employee's job title, work responsibilities, and whether the position is full-time or part-time may also be included to provide further clarity to the mortgage lender. This letter, signed by an authorized representative from the employer's human resources or payroll department, serves as a testament to the stability and reliability of the borrower's income, which is essential for the mortgage approval process.

Annual or monthly salary details

Mortgage employment verification is a crucial step for lenders assessing potential borrowers. Accurate confirmation of annual or monthly salary details is vital. Employers typically provide verification letters detailing the employee's position, salary, and employment status, ensuring lenders have reliable data. These letters must include specific information, such as gross salary figures, date of employment commencement, and full-time or part-time status, to meet lender requirements. Clear documentation expedites the mortgage approval process, fostering trust between the lender and borrower while ensuring compliance with financial regulations. Verification letters play a pivotal role, safeguarding against fraud and misrepresentation in mortgage applications.

Contact information for employer verification

Employers play a crucial role in the verification of mortgage employment for potential homebuyers in the United States. Accurate contact information is essential for lenders to confirm employment status and income details. Commonly requested details include the employer's name, physical address, phone number, and the name of the human resources or payroll department representative. Verification typically involves a review of the employment letter, pay stubs, or W-2 forms from the past two years to ensure consistent income levels. Effective communication is vital, as lenders often require immediate response to expedite the mortgage approval process, influencing timelines to secure favorable interest rates.

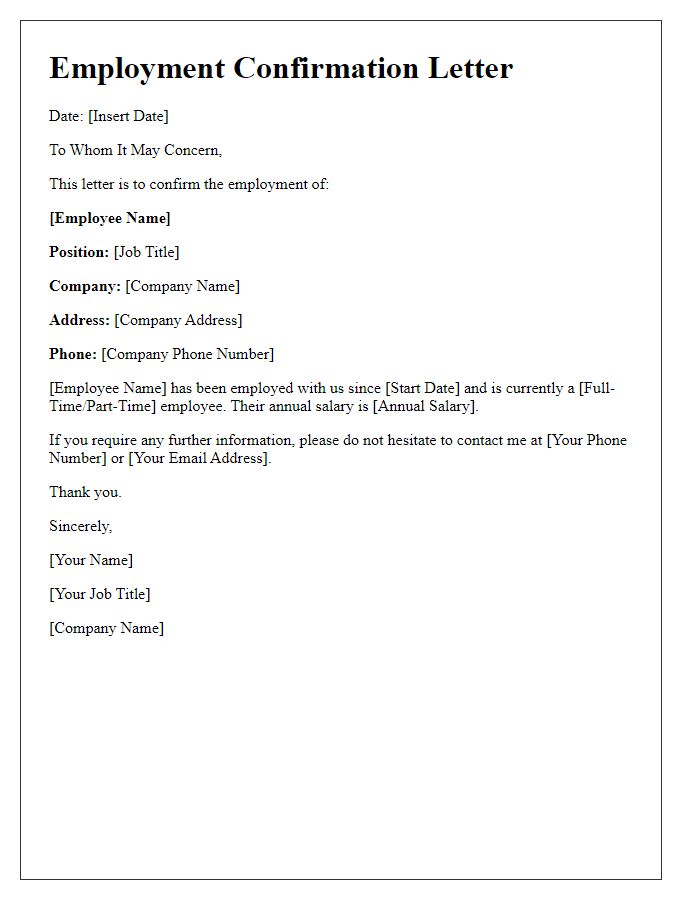

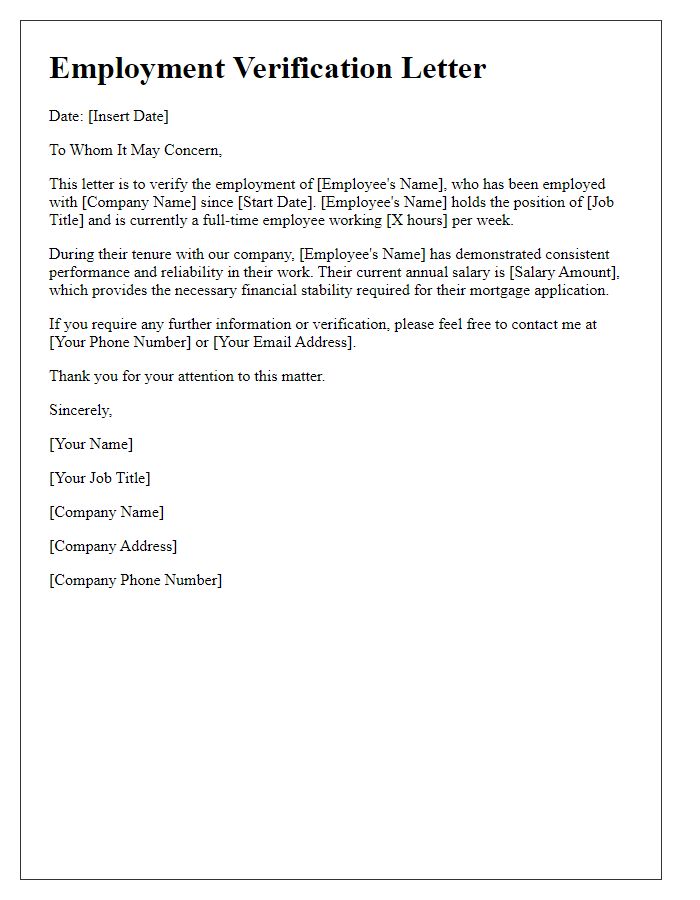

Letter Template For Verification Of Mortgage Employment Samples

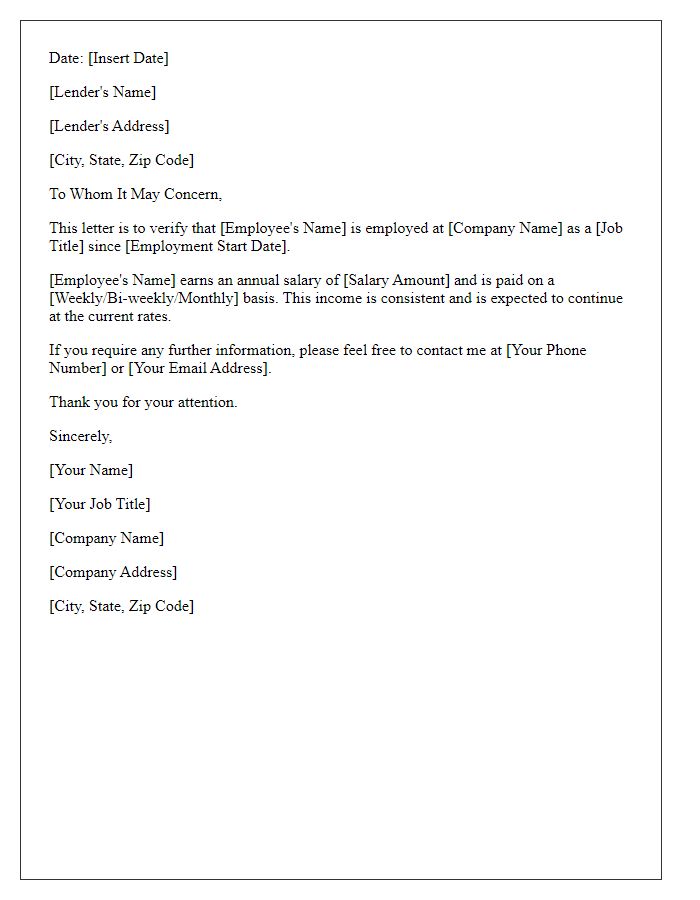

Letter template of mortgage employment verification for loan application

Comments