Are you navigating the complexities of closing a mortgage escrow account? It can feel overwhelming, but understanding the process can make it much smoother. In this article, we'll break down the essential steps and provide a helpful letter template to guide you through the closing process. Join us as we unpack the details and equip you with the knowledge you need to feel confident moving forward!

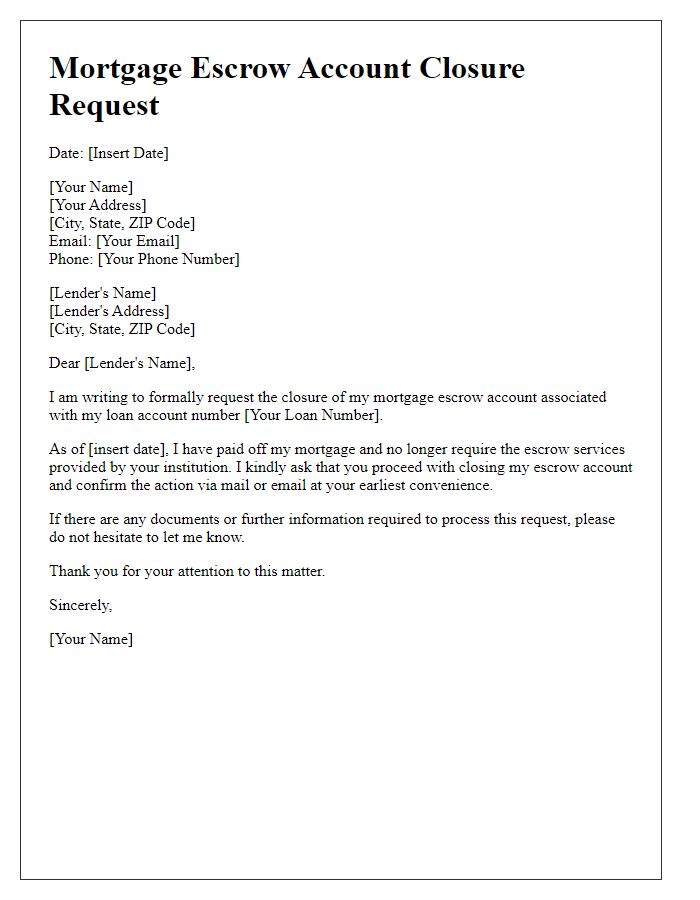

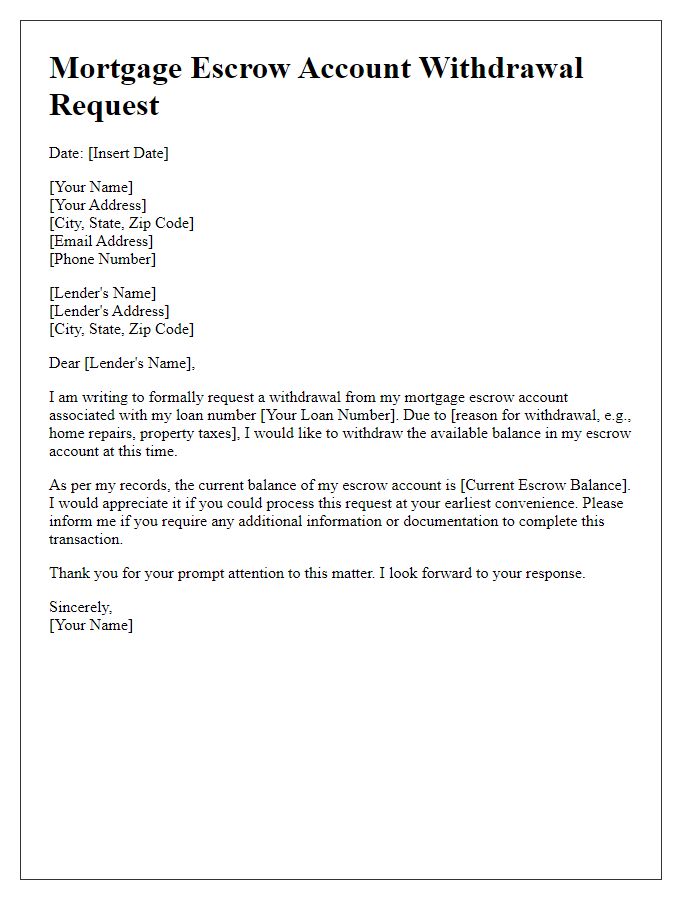

Account Holder Information

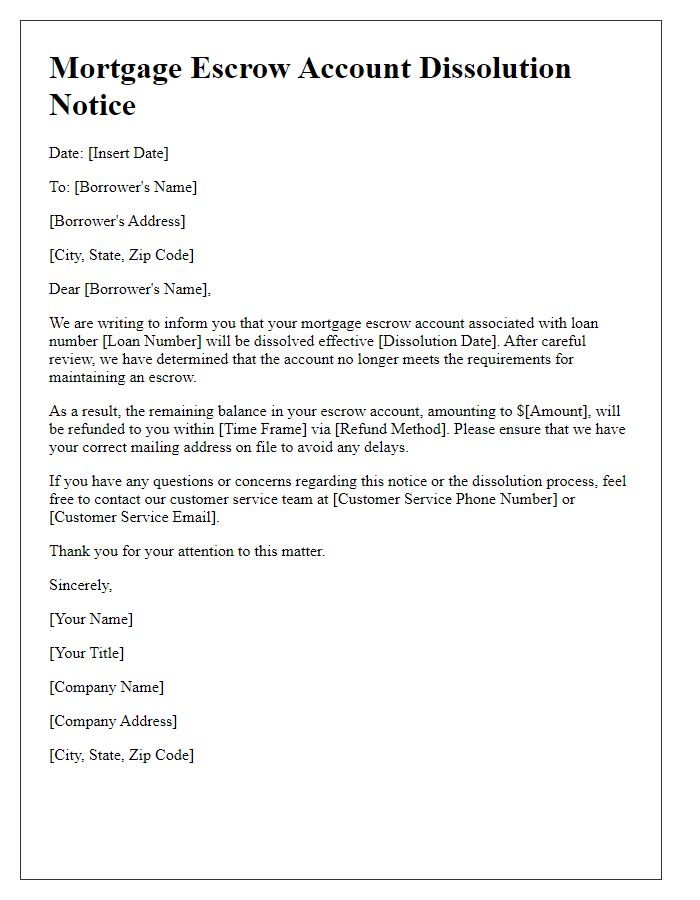

Mortgage escrow accounts are crucial for managing payments related to homeownership expenses, including property taxes and homeowners insurance. The account holder, typically the homeowner, oversees the financial aspect of these payments, ensuring timely and accurate disbursements. Closing an escrow account involves detailed documentation, including the account holder's name, address, and loan account number. This process may require coordination with the mortgage lender, such as a bank or credit union, and adherence to local regulations. Additionally, it is essential to determine any remaining balance in the escrow account and how it will be disbursed after closure, which may involve various financial protocols to ensure transparency and compliance.

Property and Loan Details

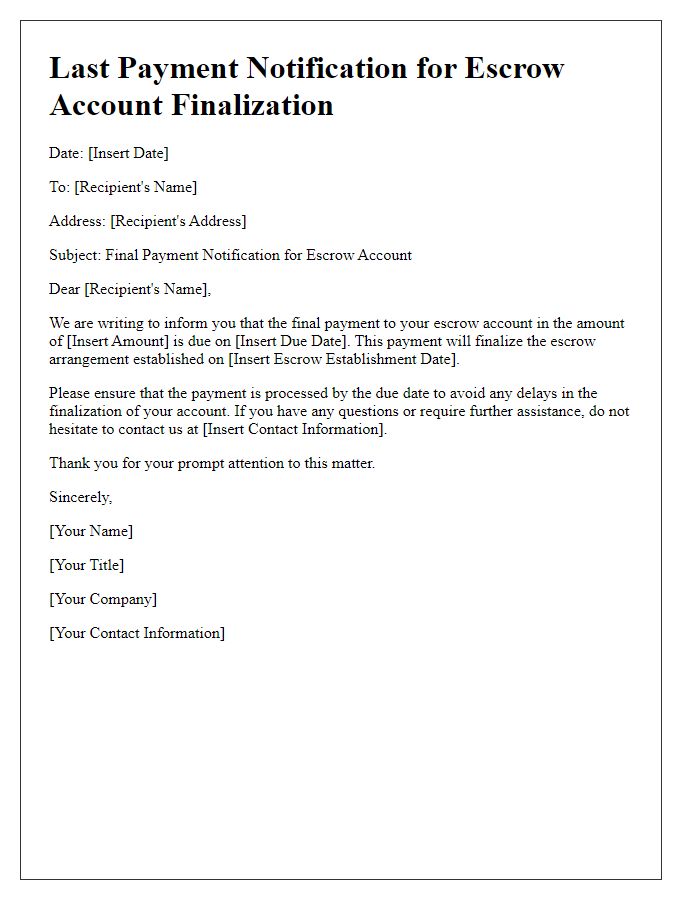

Mortgage escrow accounts, typically associated with residential properties in the United States, facilitate the management of property taxes and homeowners insurance premiums. These accounts ensure timely payments to third parties, safeguarding against potential financial penalties. For instance, an escrow account might handle payments for a single-family home located in Dallas, Texas, purchased for $300,000 with a 30-year fixed-rate mortgage at a 3.5% interest rate. The mortgage lender, such as Wells Fargo, may establish monthly escrow contributions to cover estimated annual property tax amounts of $4,200 and homeowners insurance costs of $1,500. Closing an escrow account may initiate after the mortgage reaches a predetermined status, typically after a series of successful payments, indicating sufficient funds remain to cover the remaining financial obligations related to the property.

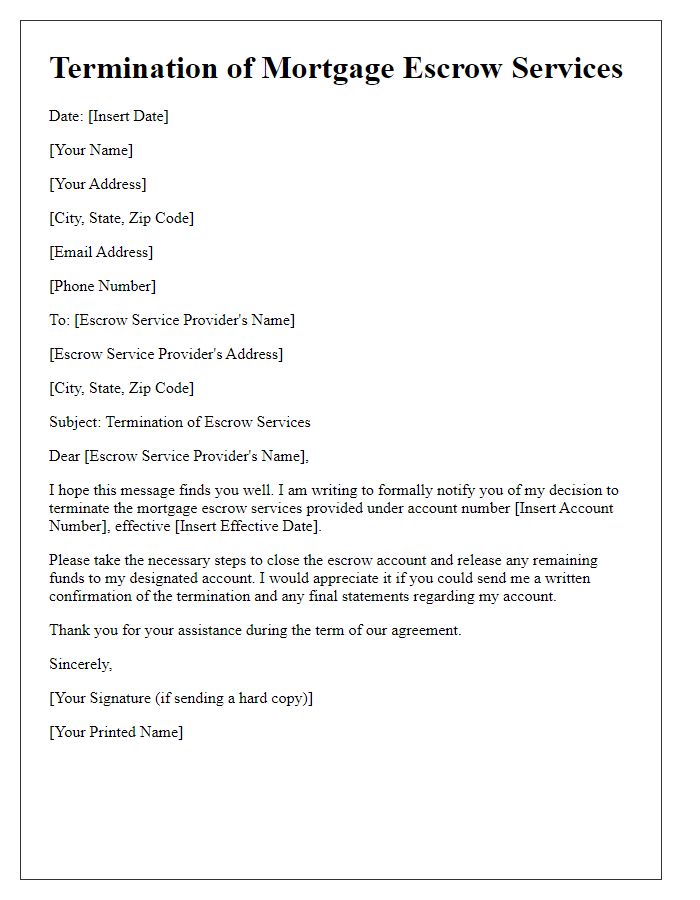

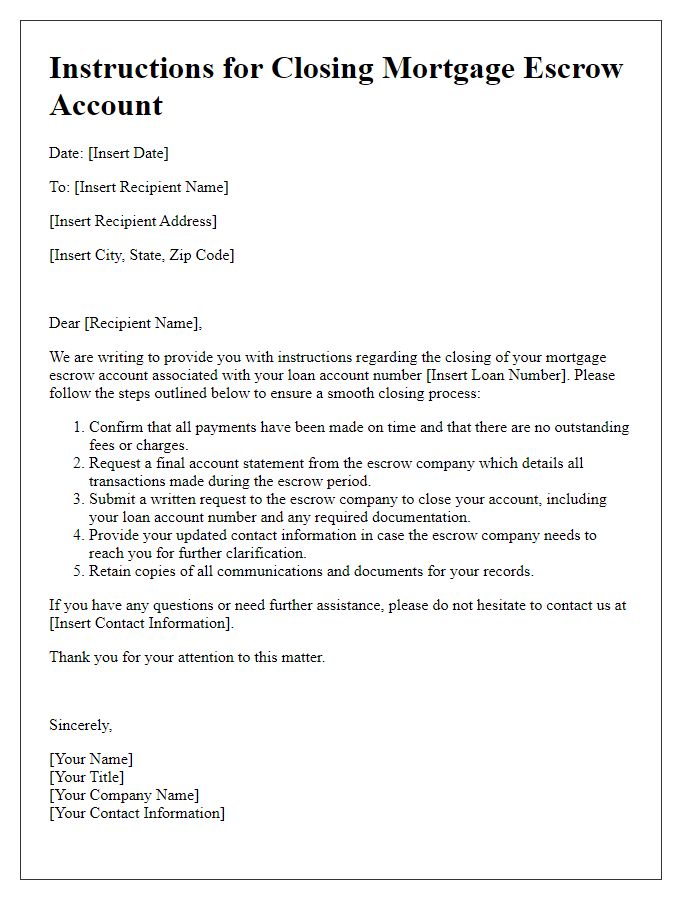

Reason for Closing Request

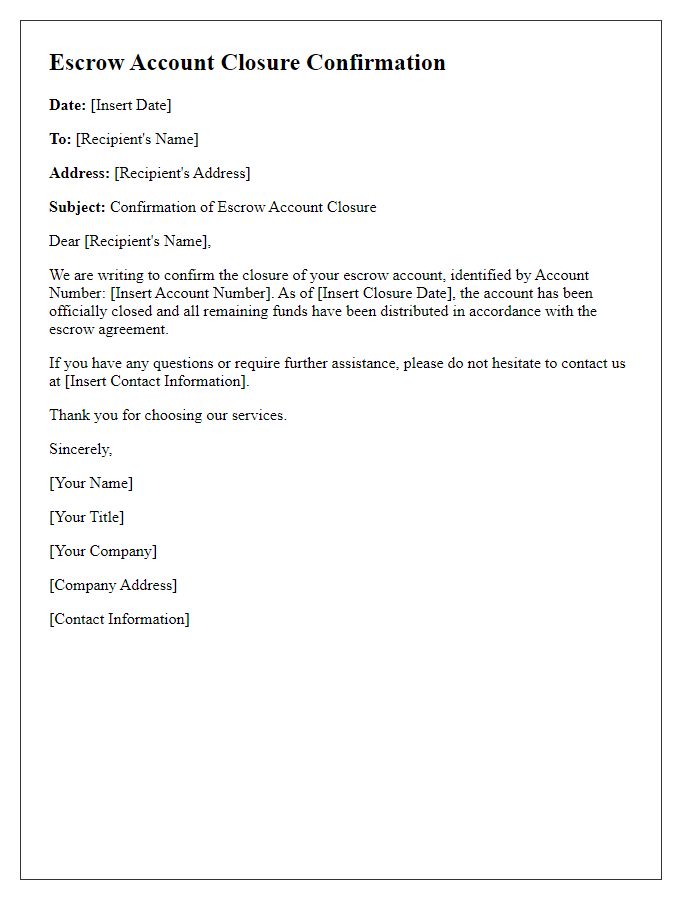

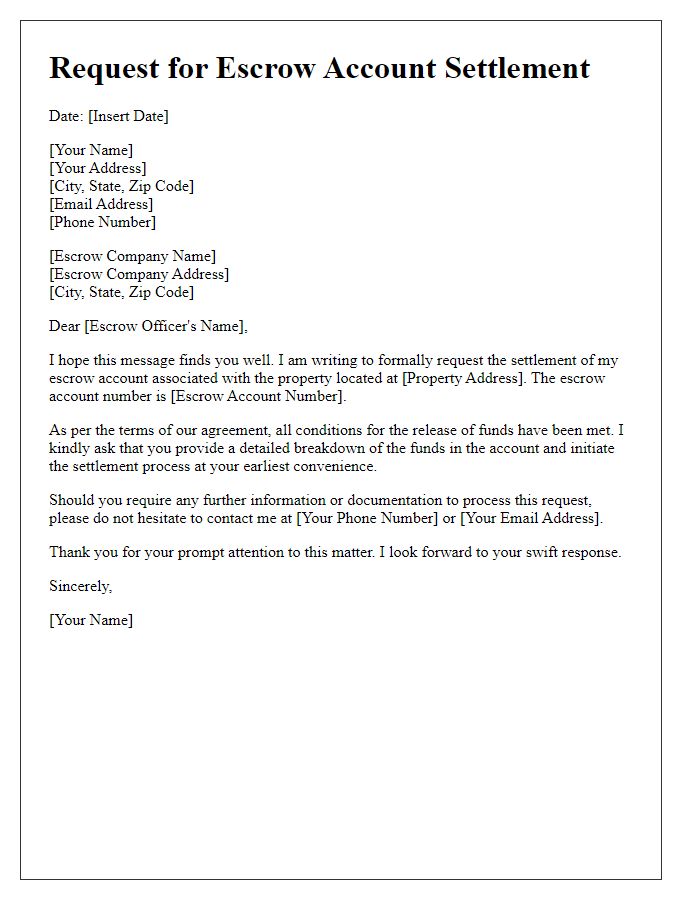

Homeowners often seek to close their mortgage escrow accounts due to various reasons such as changes in property taxes, reassessment of insurance premiums, or a desire for increased control over personal finances. When the escrow account, typically managed by lending institutions like banks or credit unions, is closed, they can redirect funds for property tax payments and homeowners insurance directly to the respective agencies and providers, eliminating the intermediary process. The closure process may involve submitting a formal request including documentation, and homeowners should be aware that some lenders may impose fees or require specific conditions to facilitate the account closure.

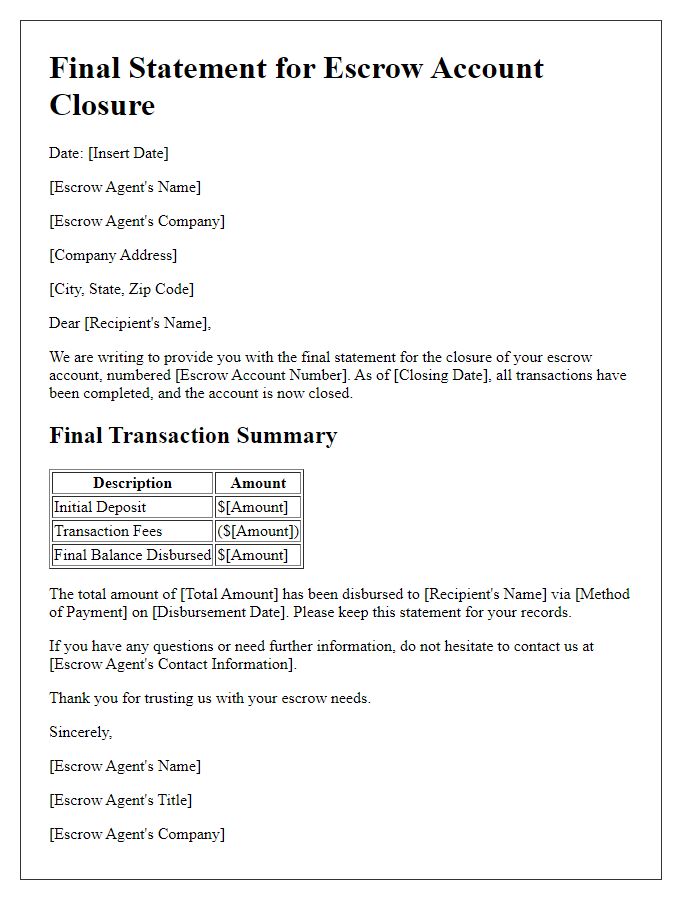

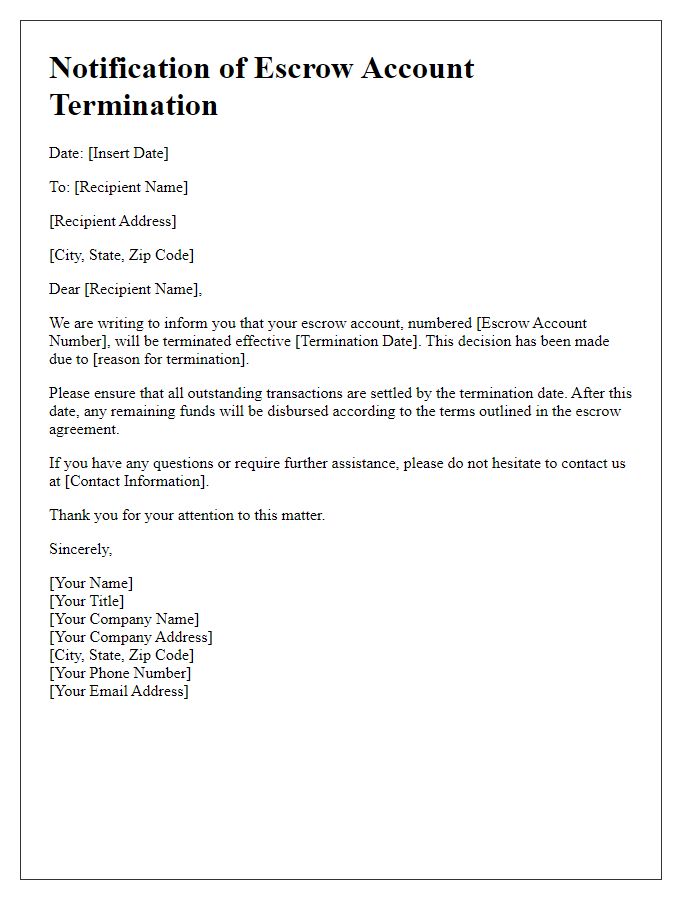

Instructions for Disbursement

Mortgage escrow accounts facilitate the management of payments like property taxes and homeowners insurance. Upon closing, detailed instructions for disbursement are critical to ensure timely payment. The closing process typically involves reviewing the final closing statement, which outlines the escrow balance and designated payments. Specific amounts, such as the property tax payment of $2,500 due by December 1st or the homeowner's insurance premium of $1,200, should be clearly identified. A reliable lender, such as Wells Fargo or Bank of America, usually manages these funds. Ensuring that details such as the correct disbursement date, usually within 30 days post-closing, and any required signatures from involved parties, including the homeowner or closing agent, are clearly outlined helps streamline the final steps of the mortgage process.

Contact Information for Further Communication

Mortgage escrow accounts are vital in ensuring timely payment of property taxes and homeowners insurance. Upon closing, detailed account statements will be provided, outlining the final balance and disbursement of funds. Homeowners should ensure to update their contact information, including email addresses and phone numbers, to facilitate clear communication. Important notifications from the mortgage lender, such as tax assessments or insurance renewal dates, will be processed through these channels. Timely responses are crucial to avoid lapses in insurance coverage or property tax payments, thus safeguarding the homeowner's investment and credit score. Establishing a proactive communication line with the mortgage servicer is imperative for maintaining the integrity of the escrow account post-closing.

Comments