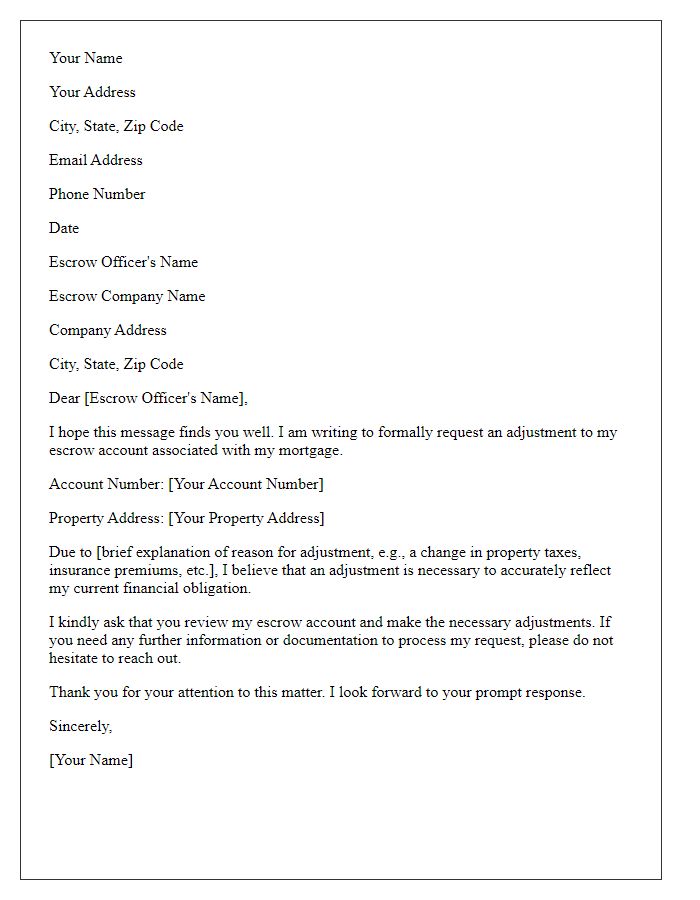

Are you navigating the complexities of an escrow account adjustment? Whether you're a homeowner or in real estate, understanding the ins and outs of this process can significantly impact your financial decisions. Adjustments can arise from changes in property taxes, insurance premiums, or even lender requirements, making it essential to stay informed. Dive in to learn more about how to effectively manage your escrow account and what steps you can take to ensure everything is in order!

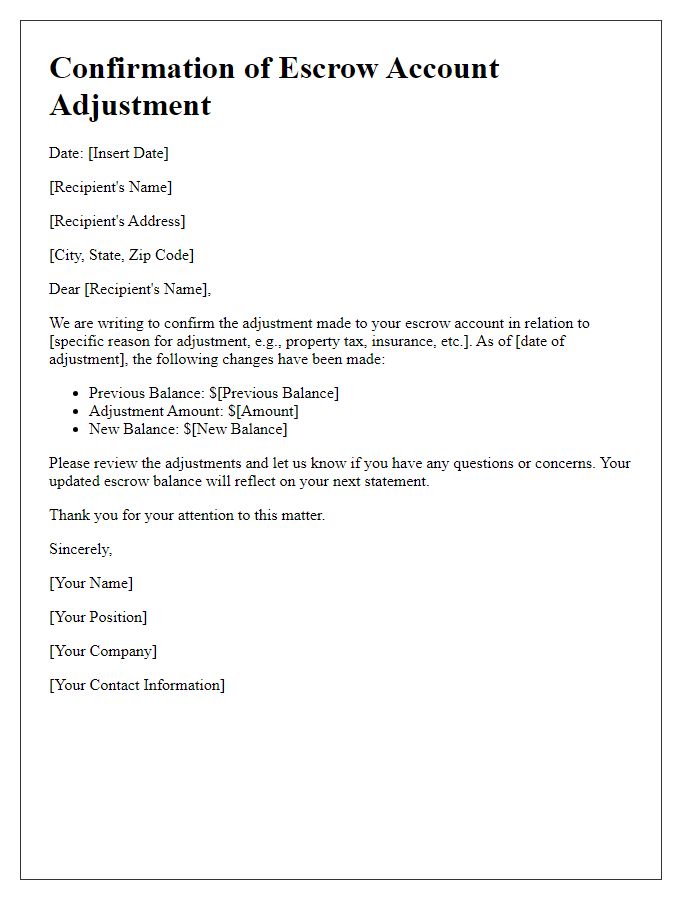

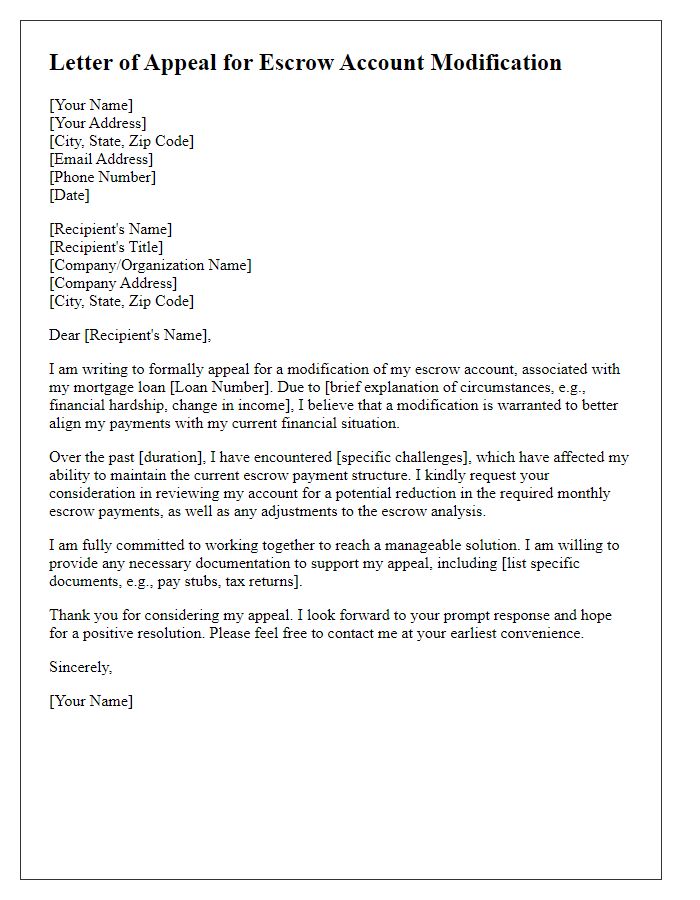

Clear subject line

Escrow Account Adjustment Request: Immediate Attention Required

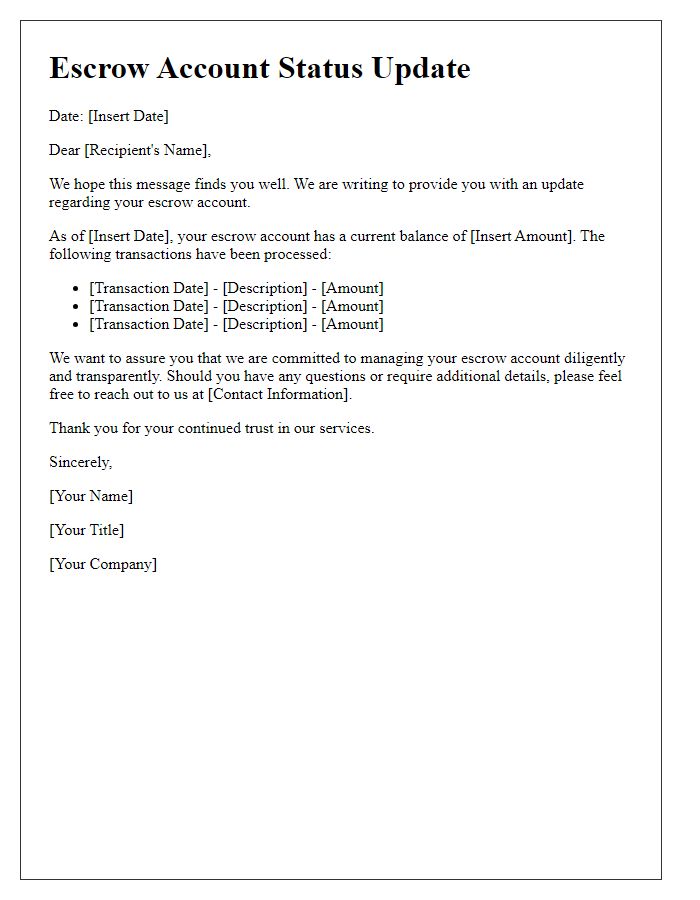

Account identification details

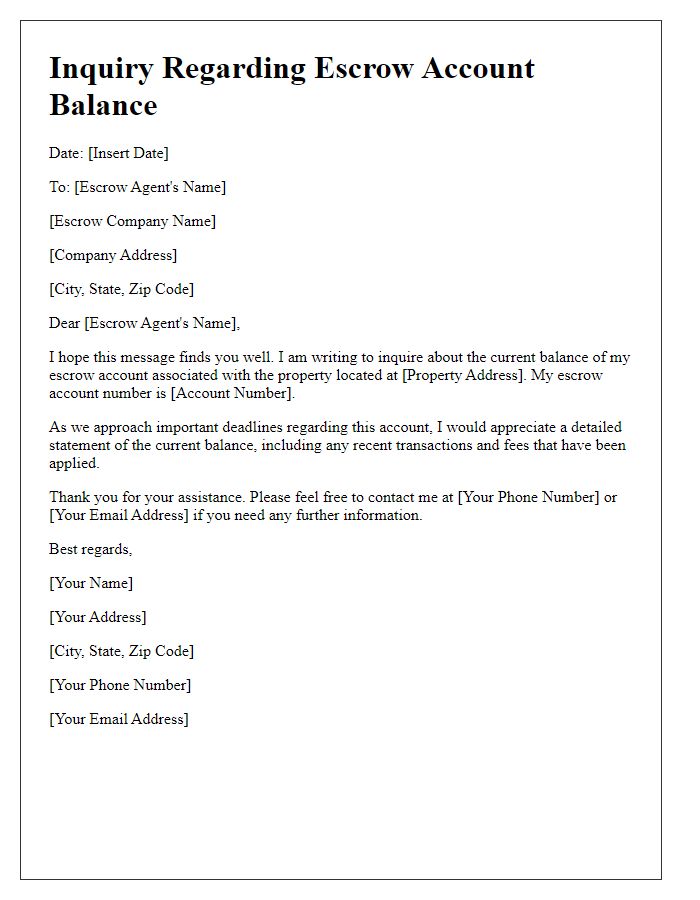

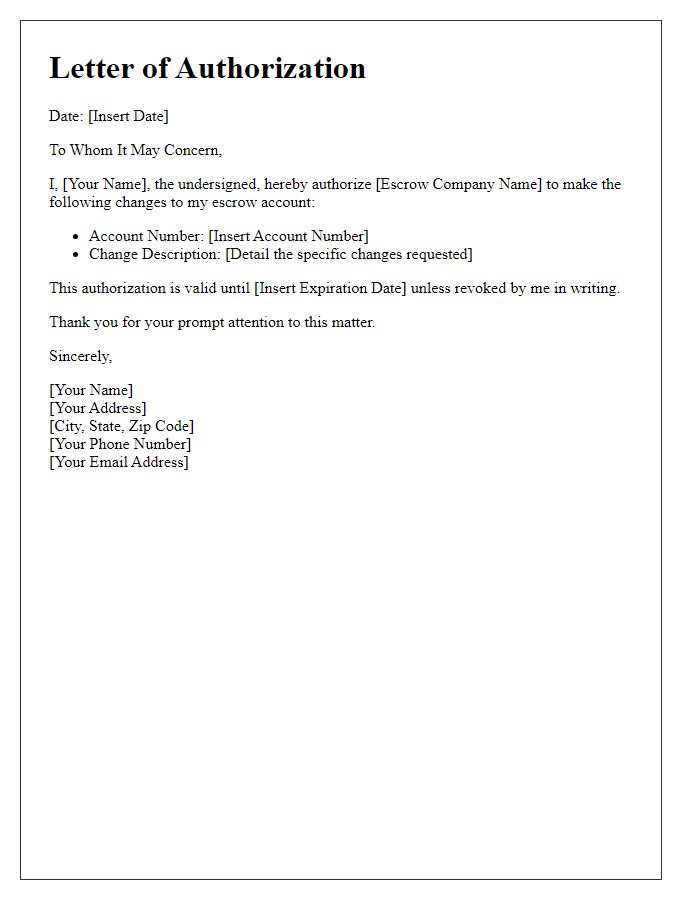

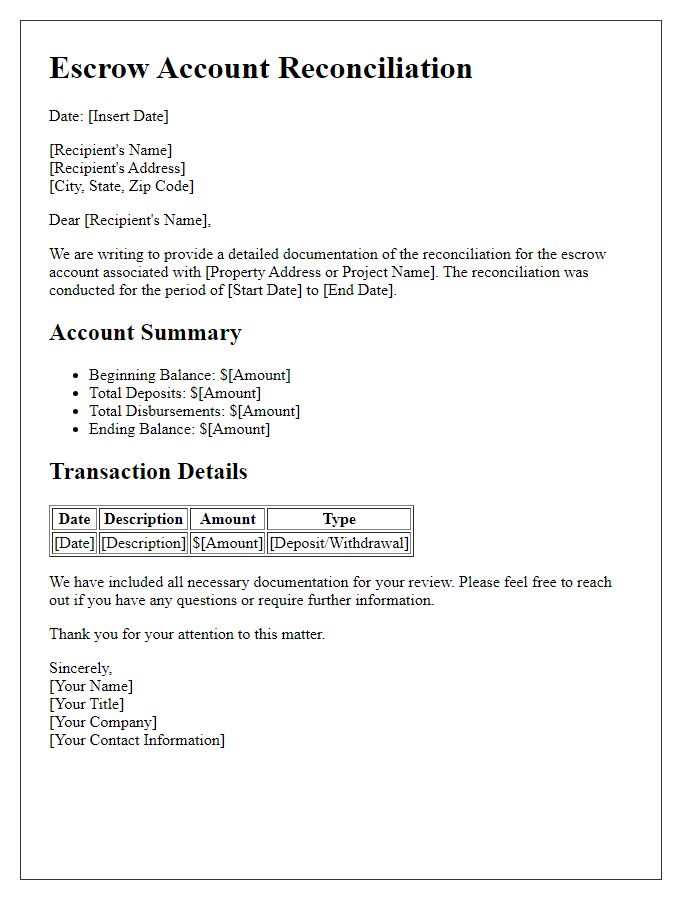

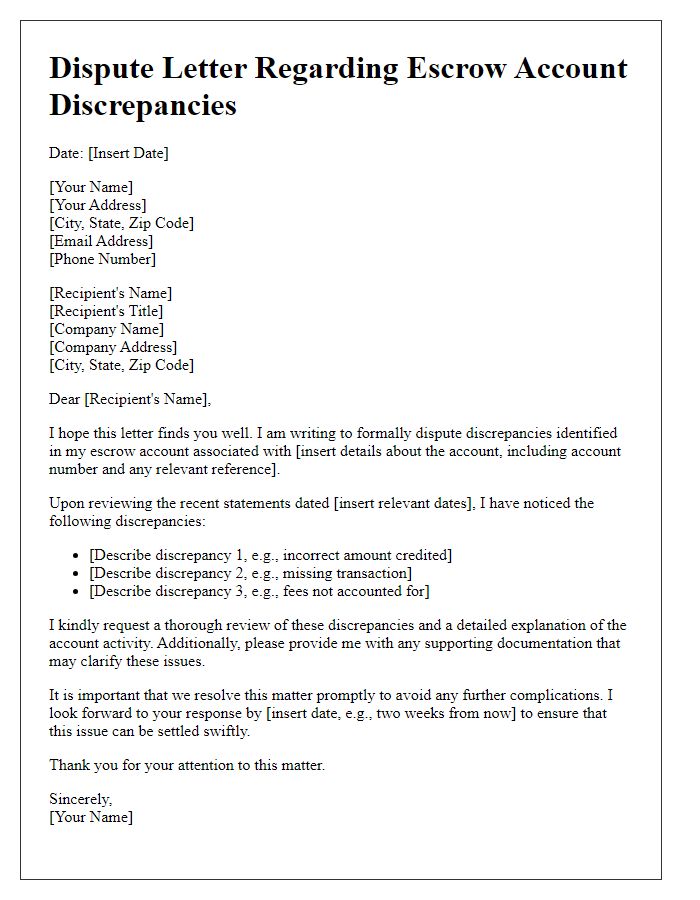

An escrow account adjustment is crucial for maintaining accurate financial records and ensuring compliance with contractual obligations. Proper identification details include the account number, which uniquely identifies the escrow account, and the property address linked to the transaction, such as 123 Main Street, Springfield. The parties involved in the escrow transaction, including the buyer and seller's names, are essential for transparency and clarity. Additional information may encompass the date of the adjustment, the specific reason for the adjustment, such as changes in closing costs or repairs, and the amount being adjusted. Overall, precise details in an escrow account adjustment facilitate effective communication between all stakeholders and help prevent future disputes.

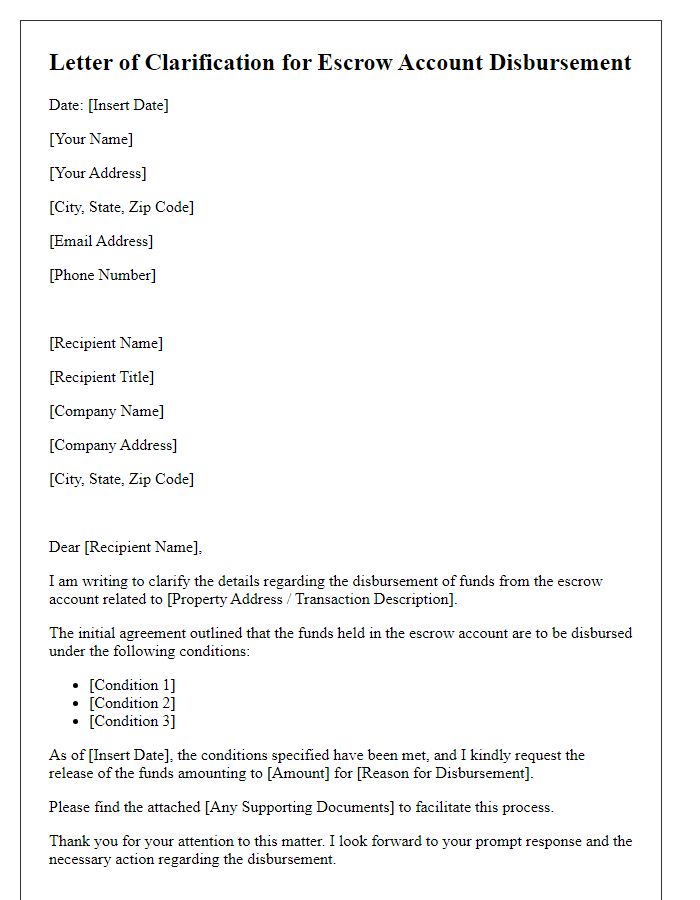

Specific adjustment request

When managing an escrow account, specific adjustment requests can arise during financial transactions, particularly in real estate closings or property management. For instance, a property sale in California may necessitate adjustments for property taxes, homeowners association (HOA) fees, or insurance premiums that have been prepaid by sellers. A detailed review of the closing statement is critical, ensuring clarity on prorated amounts, indicating the exact figures that need revision, such as a $2,000 discrepancy in property tax payment. Accurate adjustments ensure fair distribution of funds, reflecting the real-time balance and obligations of both buyers and sellers. Clear documentation of these adjustments aids in the seamless transfer of funds, maintaining transparency and compliance within the escrow's fiduciary obligations.

Justification for adjustment

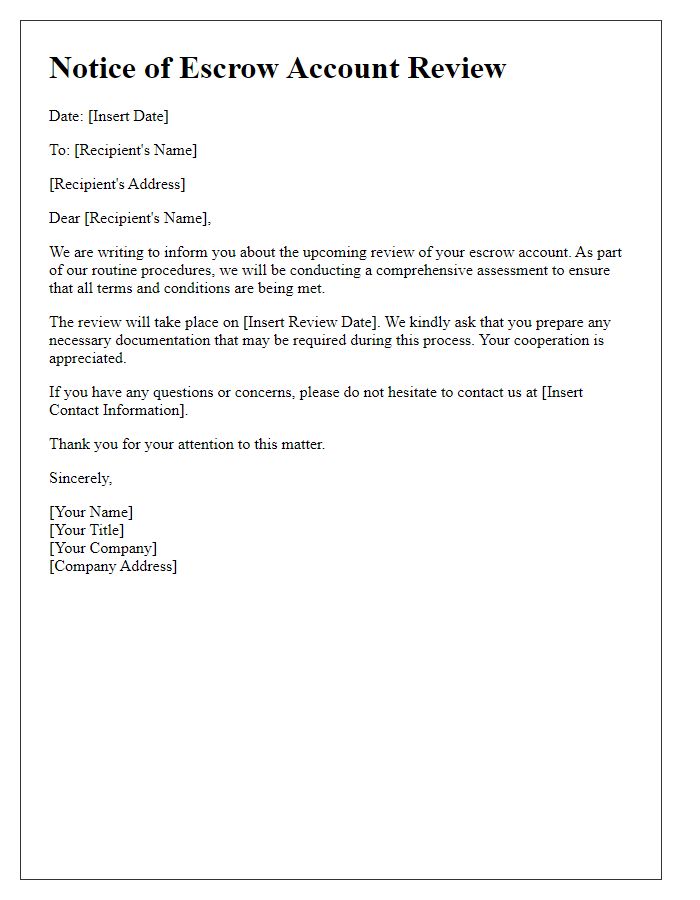

An escrow account adjustment, often related to real estate transactions, ensures proper management of funds allocated for property-related expenses. Changes in property taxes, homeowners insurance premiums, or unexpected repairs may necessitate adjustments. Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) mandate annual reviews of escrow accounts to ensure accuracy. An adjustment may be justified if property taxes have increased by over 10% or if insurance has risen significantly. Proper documentation, including tax assessments and insurance policy updates, should substantiate the adjustment. Transparency in this process protects both the lender and borrower, ensuring that sufficient funds are available for upcoming payments.

Contact information for follow-up

Escrow accounts are financial arrangements held by a third party, commonly used in real estate transactions to ensure secure handling of funds. Adjustments to escrow accounts may occur due to various factors, such as changes in closing costs or property taxes. Necessary contact information includes the escrow officer's name, phone number, and email address, typically provided by the escrow company, which may be located in cities like Los Angeles, Denver, or Miami. Follow-up on adjustments is crucial, as discrepancies can lead to delays in closing transactions, impacting both sellers and buyers. Accurate communication ensures transparency and smooth financial management throughout the escrow process.

Comments